#options #notes

The days of relatively higher implied volatility seems to have come to an end now.

Bank nifty historical IV is now in 30s. IVP is now in the 50s.

Nifty is even lower. Historical IV around 20. IVP in 40s.

It’s like the days of Iron Vertical spreads and IB are on.

The days of relatively higher implied volatility seems to have come to an end now.

Bank nifty historical IV is now in 30s. IVP is now in the 50s.

Nifty is even lower. Historical IV around 20. IVP in 40s.

It’s like the days of Iron Vertical spreads and IB are on.

#options #notes

SBIN is at IV of late 40s. IVP around 50.

ITC is at IV late 30s. IVP just above 60.

NTPC is at IV 40s. IVP in 60s.

COALINDIA IV 40s IVP around 60.

Reliance IV around 40 IVP around 60.

LT IV 30s.

NMDC IV 50s, but it’s very illiquid.

SBIN is at IV of late 40s. IVP around 50.

ITC is at IV late 30s. IVP just above 60.

NTPC is at IV 40s. IVP in 60s.

COALINDIA IV 40s IVP around 60.

Reliance IV around 40 IVP around 60.

LT IV 30s.

NMDC IV 50s, but it’s very illiquid.

#options #notes

The thing is that 45 day trades are becoming very tough now.

With US elections possibly going to have an impact, indices are not that safe and stock options (the few ones that are liquid enough) are not that good for a 45 day duration.

The thing is that 45 day trades are becoming very tough now.

With US elections possibly going to have an impact, indices are not that safe and stock options (the few ones that are liquid enough) are not that good for a 45 day duration.

#options #notes

Volatility, whether implied or historical, captures the sense of the market.

It’s not your friend nor your enemy, like road traffic is not there to harm you or sud you. It’s just there.

You have to find your own way through it.

Volatility, whether implied or historical, captures the sense of the market.

It’s not your friend nor your enemy, like road traffic is not there to harm you or sud you. It’s just there.

You have to find your own way through it.

#options #notes

Volatility is about what the market expects. A lot of expectations is based on our past experiences. We see sudden moves, we fear how much more things can go wrong. We see calm markets, we fear how long this peace will last.

Volatility is about what the market expects. A lot of expectations is based on our past experiences. We see sudden moves, we fear how much more things can go wrong. We see calm markets, we fear how long this peace will last.

#options #notes

The market also has a sense of where it would like to be.

In general, we believe that future is going to be better than the present. Companies will do well and its stock price will appreciate.

A composite index will go up because the economy is bound to improve.

The market also has a sense of where it would like to be.

In general, we believe that future is going to be better than the present. Companies will do well and its stock price will appreciate.

A composite index will go up because the economy is bound to improve.

#options #notes

We also know that markets are like drunkards. They will reach the destination, but they will never walk straight.

Volatility captures how straight the drunkard is walking. It’s not about destination.

We also know that markets are like drunkards. They will reach the destination, but they will never walk straight.

Volatility captures how straight the drunkard is walking. It’s not about destination.

#options #notes

When we assess a stock or a group of stocks (index), we should have a general sense of where the market is headed. The drunkard May reach his building but may knock on the wrong door. We don’t know. The drunkard himself doesn’t know.

Uncertainty drives volatility.

When we assess a stock or a group of stocks (index), we should have a general sense of where the market is headed. The drunkard May reach his building but may knock on the wrong door. We don’t know. The drunkard himself doesn’t know.

Uncertainty drives volatility.

#options #notes

Mathematically, historical volatility captures expected move based on past experience. Implied volatility captures how options traders are expecting the future to look like.

The past may decide today’s values to a fair degree, to some extent the future values.

Mathematically, historical volatility captures expected move based on past experience. Implied volatility captures how options traders are expecting the future to look like.

The past may decide today’s values to a fair degree, to some extent the future values.

#options #notes

Today’s prices is a reflection of how much a trader is willing to pay for the risks attached.

A 40% IV means that the price one year down the line has a high probability to be within +/-40% of current price.

Today’s prices is a reflection of how much a trader is willing to pay for the risks attached.

A 40% IV means that the price one year down the line has a high probability to be within +/-40% of current price.

#options #notes

When we say Nifty has an IV of 20 and nifty is at around 11750(ATM strike), what we mean is that after 1 year, we expect nifty to be about 9,400-14,100 with a high probability of 68%.

+/- Price*IV*sqrt(fraction of time left in the year) captures the price range.

When we say Nifty has an IV of 20 and nifty is at around 11750(ATM strike), what we mean is that after 1 year, we expect nifty to be about 9,400-14,100 with a high probability of 68%.

+/- Price*IV*sqrt(fraction of time left in the year) captures the price range.

#options #notes

After 6 months, nifty at 11750 and IV 20 will be in the range: 11750*20%*sqrt(6 months/12 months)=> 11750+/-1661 or 10,500-13,500.(rounded to next multiple of 500).

For 2 weeks, it’s 11750*.2*sqrt(2/52)=> 11,250-12,250.

Reference: optionsanimal.com/using-implied-…

After 6 months, nifty at 11750 and IV 20 will be in the range: 11750*20%*sqrt(6 months/12 months)=> 11750+/-1661 or 10,500-13,500.(rounded to next multiple of 500).

For 2 weeks, it’s 11750*.2*sqrt(2/52)=> 11,250-12,250.

Reference: optionsanimal.com/using-implied-…

#options #notes

This view is based on how the prices have moved on the past.

Now, let’s get practical. At Friday(16/10/2020) close, oct nifty monthly(29th October) is 13 days away.

So, 11762.45*.19*sqrt(13/365)=> +/-422. 11,300-12,200.

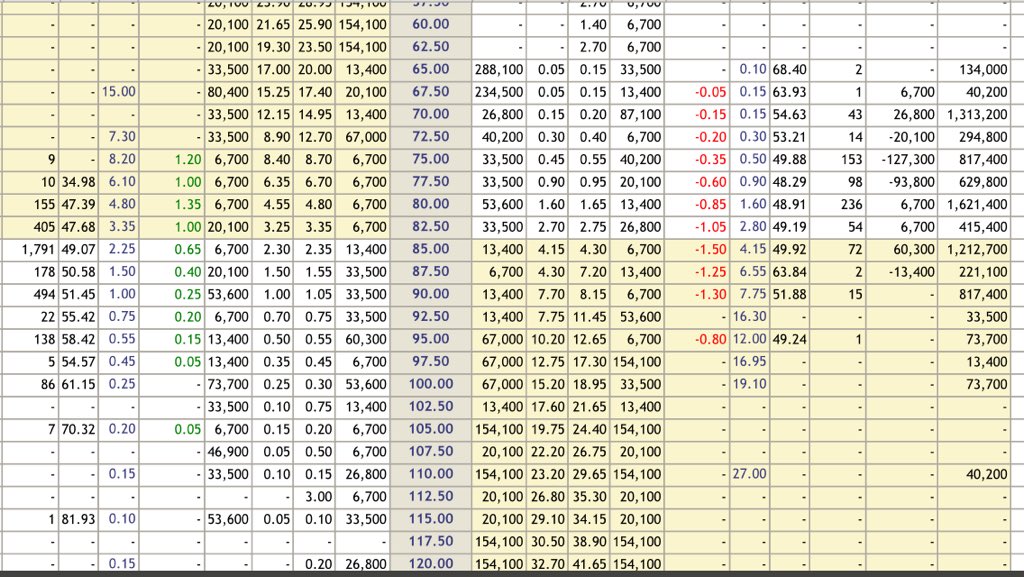

Premiums:

11300 put->40.4

12200 call->21.0

This view is based on how the prices have moved on the past.

Now, let’s get practical. At Friday(16/10/2020) close, oct nifty monthly(29th October) is 13 days away.

So, 11762.45*.19*sqrt(13/365)=> +/-422. 11,300-12,200.

Premiums:

11300 put->40.4

12200 call->21.0

#options #notes

As the premiums show, people are willing to pay 40.4 for a move down and only 21 for a move up.

40.4 caputures the willingness to pay 20 extra to protect a move below 11300.

Or, people don’t mind nifty to move above 12200 and are willing to only pay 21 for that.

As the premiums show, people are willing to pay 40.4 for a move down and only 21 for a move up.

40.4 caputures the willingness to pay 20 extra to protect a move below 11300.

Or, people don’t mind nifty to move above 12200 and are willing to only pay 21 for that.

#options #notes

In an ideal world, the premia at 11300 and 12200 should be roughly the same. This huge difference is what we call the skew.

Generally, since the fear is for the underlying nifty to fall down, premium is higher in the put side.

In an ideal world, the premia at 11300 and 12200 should be roughly the same. This huge difference is what we call the skew.

Generally, since the fear is for the underlying nifty to fall down, premium is higher in the put side.

#options #notes

If the fear (or strong expectation) is for an upside move, the call premiums will be higher.

Example: NMDC.

Price is 82.95. IV is about 49. Same formula says +/-7.67 or a 75-92.5 range.

75 put is at 0.5

92.5 call is at 0.75

(Lot size 6700)

Or ₹3350 and ₹5025

If the fear (or strong expectation) is for an upside move, the call premiums will be higher.

Example: NMDC.

Price is 82.95. IV is about 49. Same formula says +/-7.67 or a 75-92.5 range.

75 put is at 0.5

92.5 call is at 0.75

(Lot size 6700)

Or ₹3350 and ₹5025

#options #notes

The put-call ratio(PCR) is a good approximation for the skew.

If price is expected to stay same, equal number of people will sell on both put side(downside) and call side(upside).

For the nifty example, PCR>1.(more puts)

For the NMDC example, PCR<1.(more calls)

The put-call ratio(PCR) is a good approximation for the skew.

If price is expected to stay same, equal number of people will sell on both put side(downside) and call side(upside).

For the nifty example, PCR>1.(more puts)

For the NMDC example, PCR<1.(more calls)

#options #notes

In general, when volatility is higher, a premium seller will be able to earn more and at a farther away strike than when volatility is lower.

Other factors that matter: liquidity(difference between bid price and ask price)

Volume/open interest.(ppl are buying it)

In general, when volatility is higher, a premium seller will be able to earn more and at a farther away strike than when volatility is lower.

Other factors that matter: liquidity(difference between bid price and ask price)

Volume/open interest.(ppl are buying it)

@threadreaderapp thread unroll please

• • •

Missing some Tweet in this thread? You can try to

force a refresh