Time to get paid! #PayYourself

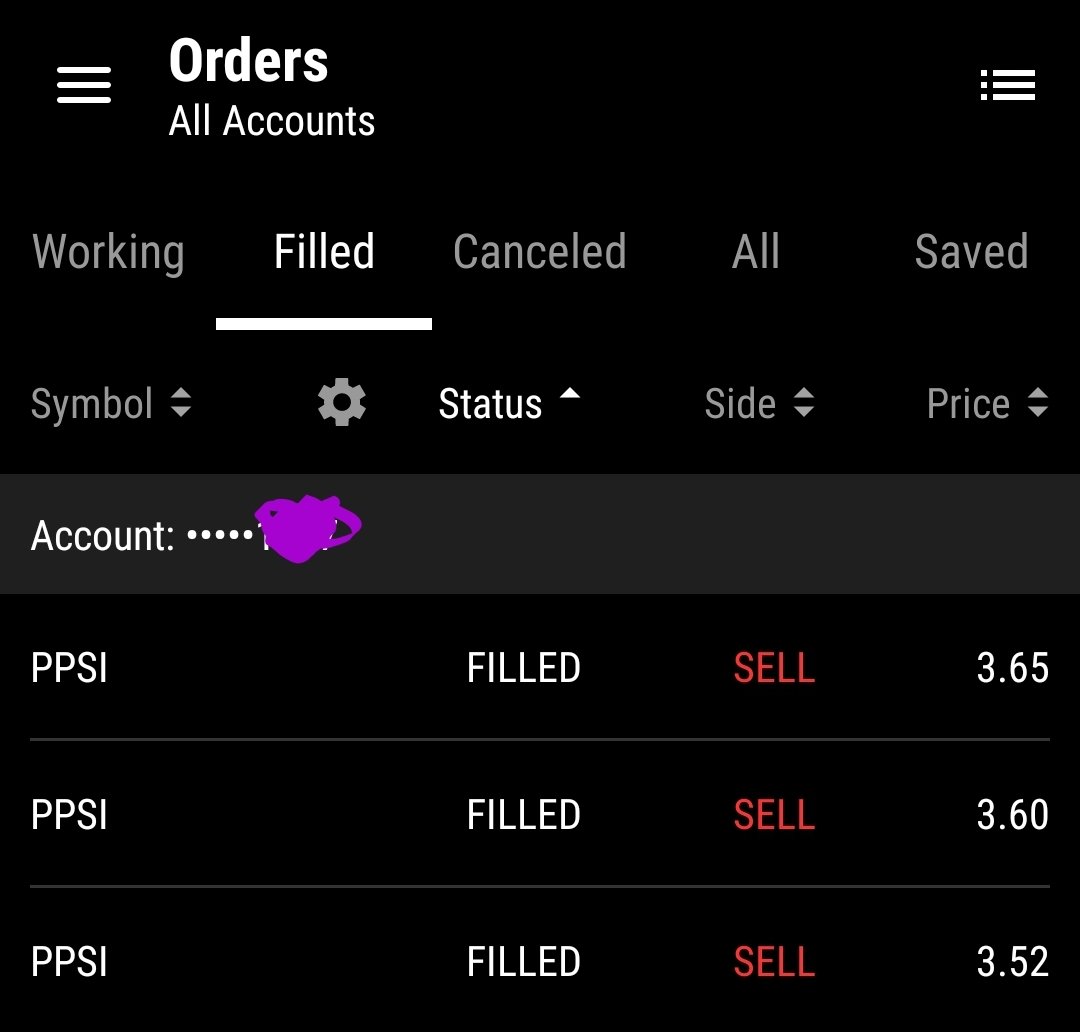

Sold 80% of my position here, leaving just a small batch to ride with a trail stop ✅🙂

Offer out at $3.97

Sold 80% of my position here, leaving just a small batch to ride with a trail stop ✅🙂

Offer out at $3.97

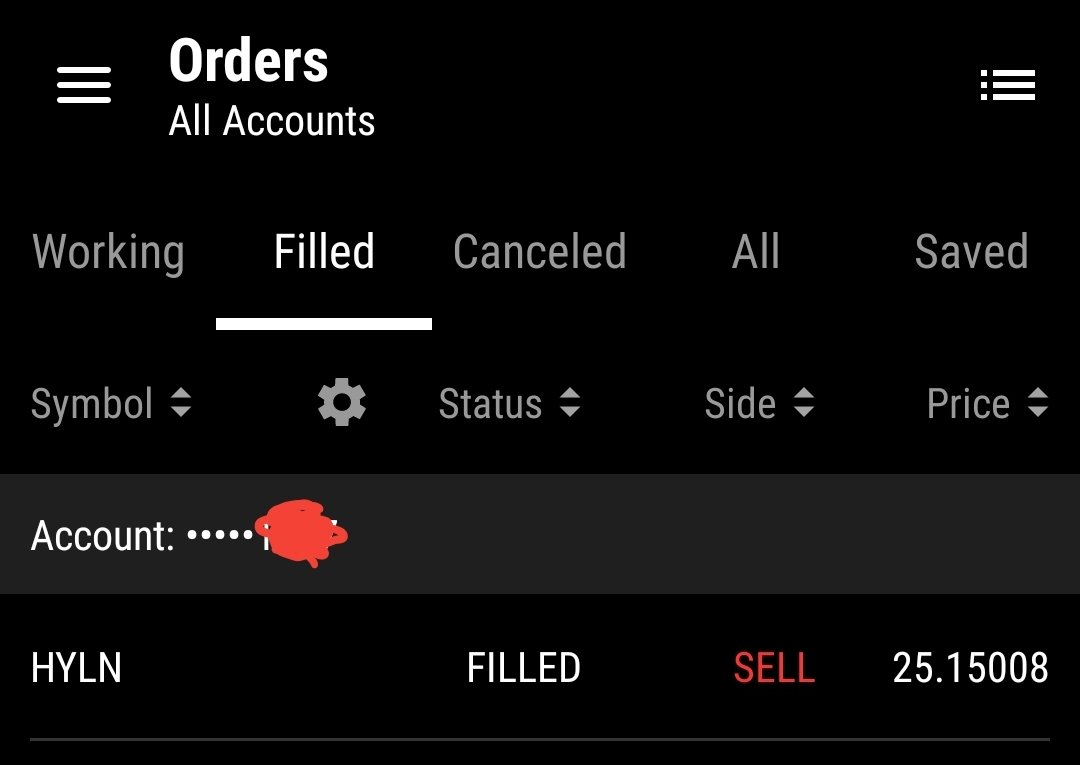

All out for a nice fat profit 💰

$PPSI

This one may continue to squeeze, but my job here is done unless another setup presents itself

#PayYourself

$PPSI

This one may continue to squeeze, but my job here is done unless another setup presents itself

#PayYourself

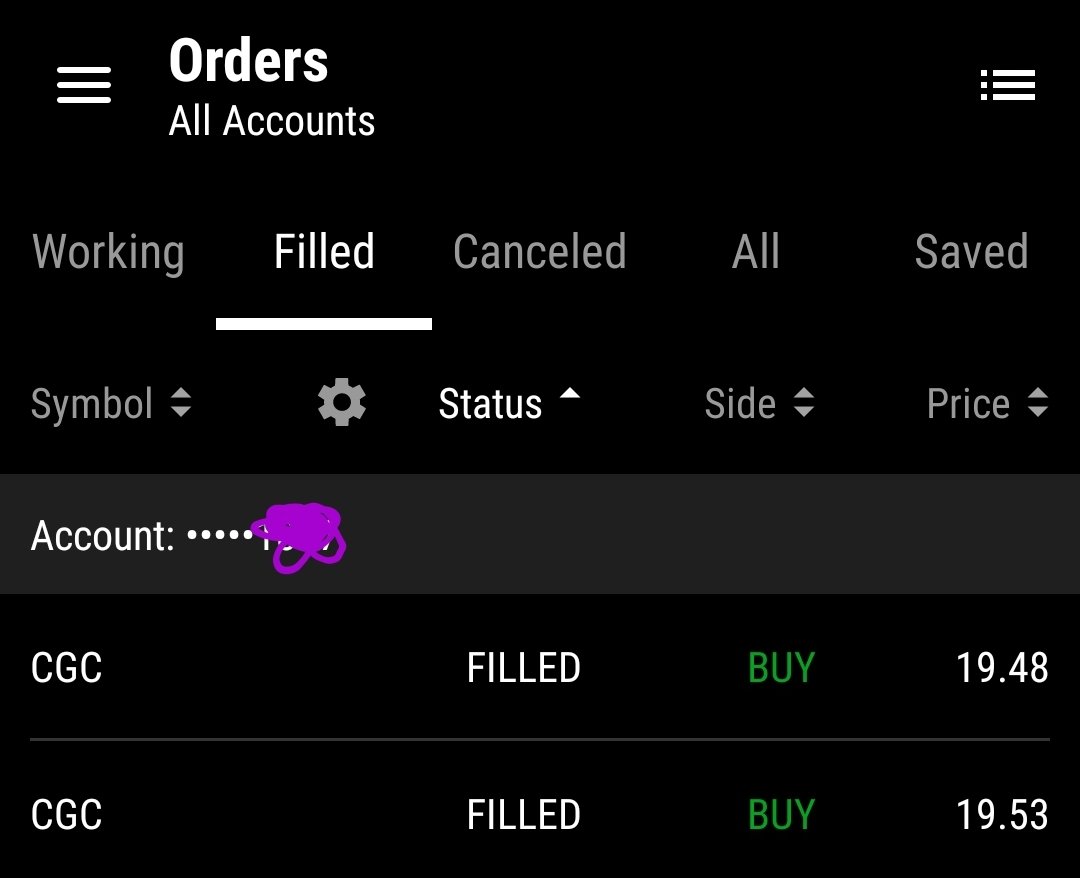

Bidding $3.03 for a possible quick flip in to the buy zone ✅

Smaller size this time, this stock has no catalyst it seems, the move was basically a short squeeze

Smaller size this time, this stock has no catalyst it seems, the move was basically a short squeeze

• • •

Missing some Tweet in this thread? You can try to

force a refresh