1. New Traders:

It's natural to focus on "how much money you're going to make"

Which trade is going to make you that gain $$$

The money money money 💰💰

But your gains are burried in your losses

Let's approach this from the losing side

(THREAD) 👇

It's natural to focus on "how much money you're going to make"

Which trade is going to make you that gain $$$

The money money money 💰💰

But your gains are burried in your losses

Let's approach this from the losing side

(THREAD) 👇

2. Our brain is naturally not wired for Stock Trading, so it takes time to rewire

Ever held to a losing trade and just couldn't let go till got worse?

Ever sell a stock too soon for fear that it may come back?

Ever turn a winning trade in to a losing trade?

These are FEARS

Ever held to a losing trade and just couldn't let go till got worse?

Ever sell a stock too soon for fear that it may come back?

Ever turn a winning trade in to a losing trade?

These are FEARS

3.

-Fear of the unknown

-Fear coming from previous experiences

-Fear of missing out

That profit you took only to watch it go even higher after u sold

That stop loss you took only to watch it reverse

That big loss you were holding that reversed and u got bailed out

-Fear of the unknown

-Fear coming from previous experiences

-Fear of missing out

That profit you took only to watch it go even higher after u sold

That stop loss you took only to watch it reverse

That big loss you were holding that reversed and u got bailed out

4. What you need to come to terms with and accept, is that Money in Trading is not made on any one individual trade

But rather a series of trades 20 30 50 100 ect..

Each individual trade will have it's own UNIQUE outcome

What really matters is the result after many many trades

But rather a series of trades 20 30 50 100 ect..

Each individual trade will have it's own UNIQUE outcome

What really matters is the result after many many trades

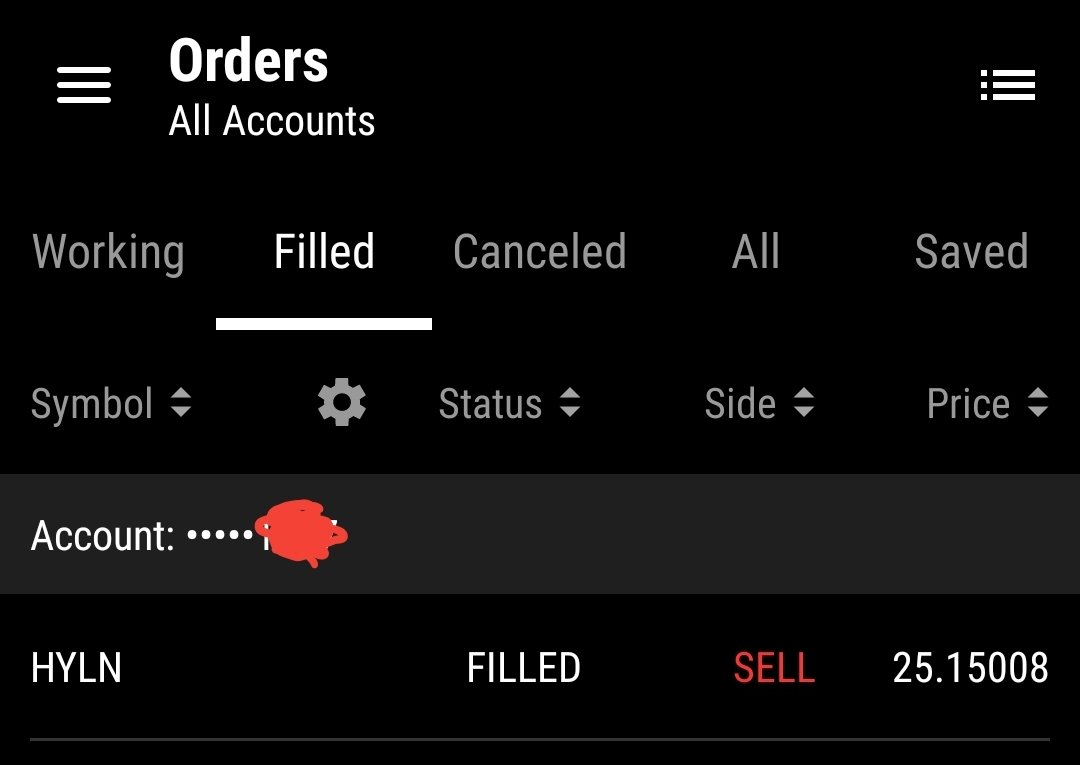

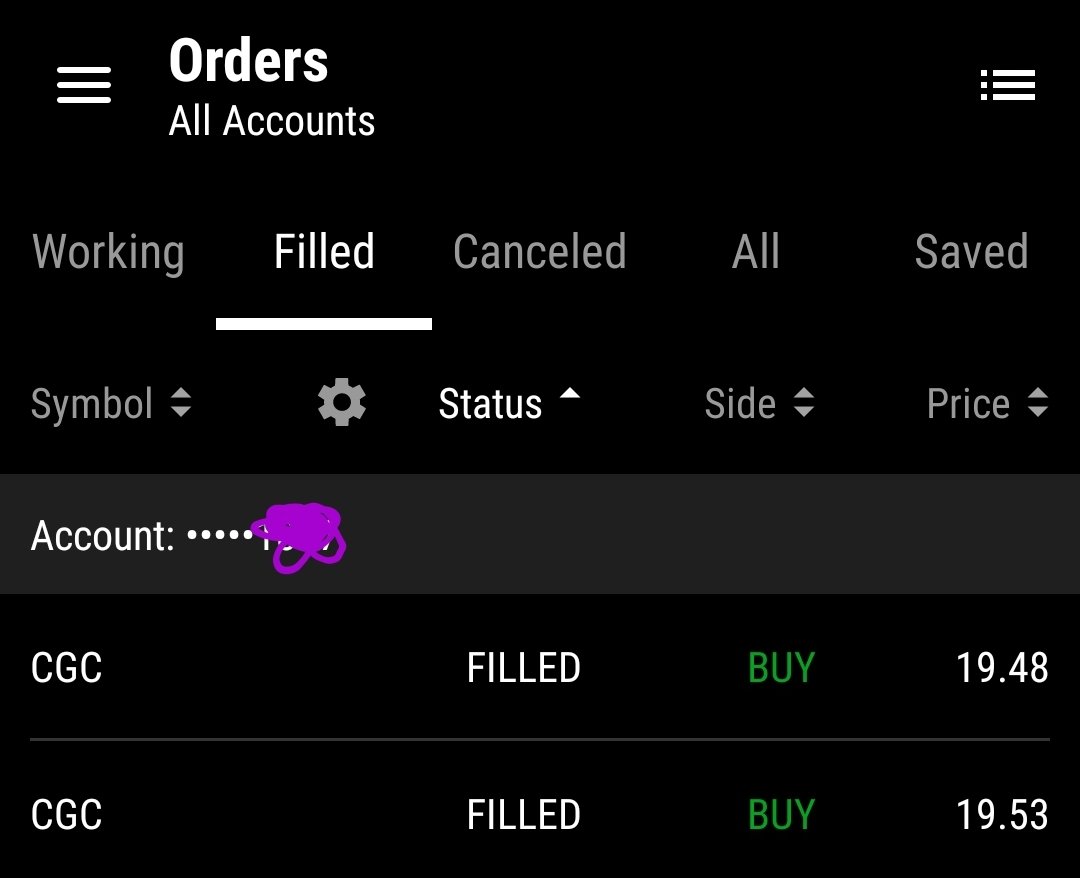

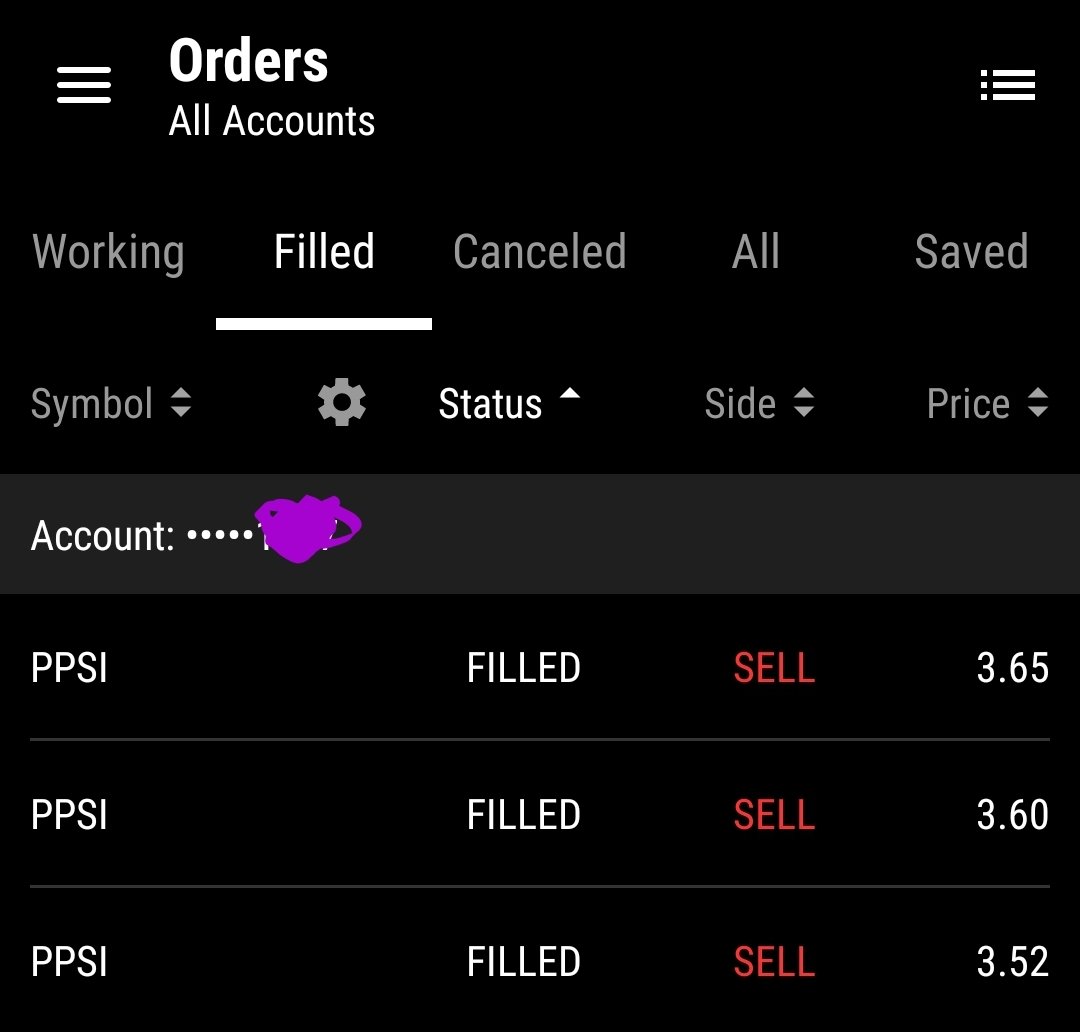

Take your favorite setup without any expectations

🟢Setup presents itself

🟢Take setup when it triggers no questions asked

🟢Know your stop loss and execute without hesitation

🟢Pay yourself as price rises

🟢On to the next setup

Forget the trade Win or Lose

Keep working

🟢Setup presents itself

🟢Take setup when it triggers no questions asked

🟢Know your stop loss and execute without hesitation

🟢Pay yourself as price rises

🟢On to the next setup

Forget the trade Win or Lose

Keep working

Once you develop the ability to grow capital, your confidence grows

Then it just becomes business as usual

Keep at it, believe you can do it, and continue to work on yourself

This game is 100% mental, so profitability comes down to you and only you.

Then it just becomes business as usual

Keep at it, believe you can do it, and continue to work on yourself

This game is 100% mental, so profitability comes down to you and only you.

• • •

Missing some Tweet in this thread? You can try to

force a refresh