"I don’t believe in edge. I think it’s a fairy tale. The world is too competitive. Going back to AI, investing is where chess was in 1996... "~@GavinSBaker

This is a killer interview with Gavin on how to think about edge in investing. Some thoughts👇 /1

themarket.ch/interview/semi…

This is a killer interview with Gavin on how to think about edge in investing. Some thoughts👇 /1

themarket.ch/interview/semi…

2/ At MO, we often write about how anything that can be quantified will be arbitraged by machines. A world of alt data, satellites giving coverage of consumer traffic, drones beaming infrared signal at oil-storage to gauge inventory, etc = The mrkt becoming hyper-efficient.

3/ This is why discretionary investors need to extend their analysis timeframe. Gavin says that "all alpha comes from insights. An insight is a kind of a differentiated long-term viewpoint about a stock. It's a differentiated view about the long-term state of the world."

4/ This isn't a new idea, it's just perhaps more true today than before. "Market Wizard" Michael Steinhardt was playing this game over 40yrs ago and wrote about the importance of forming a long-term variant perception in his book "No Bull".

5/ Here's what this looks like:

- Market is extremely efficient in near-term (0-12m)

- Further out, it tends to just extrapolate into the future

- Betting on trend growth continuation and reversion around that trend is statistically a good bet, but...

- Market is extremely efficient in near-term (0-12m)

- Further out, it tends to just extrapolate into the future

- Betting on trend growth continuation and reversion around that trend is statistically a good bet, but...

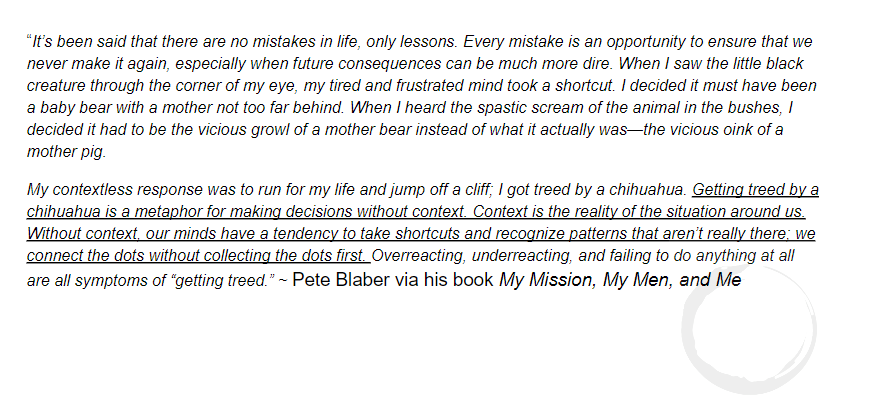

6/ Occasionally we see wildly divergent non-consensus outcomes = opportunity, a mispricing of the future. These instances occur due to a number of reasons, a few of them being...

7/

1. Market is slow to recognize competitive advantages + it tends to underappreciate their impact on future value creation

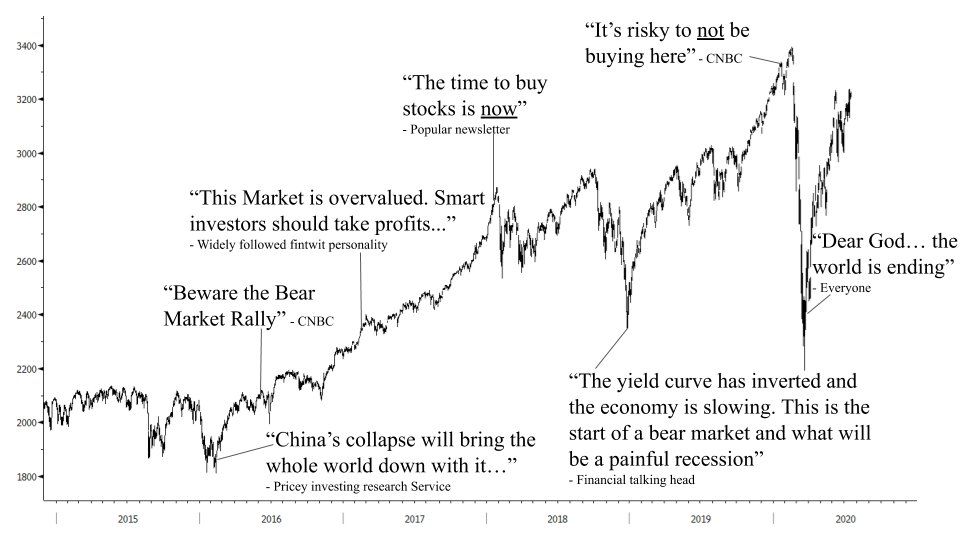

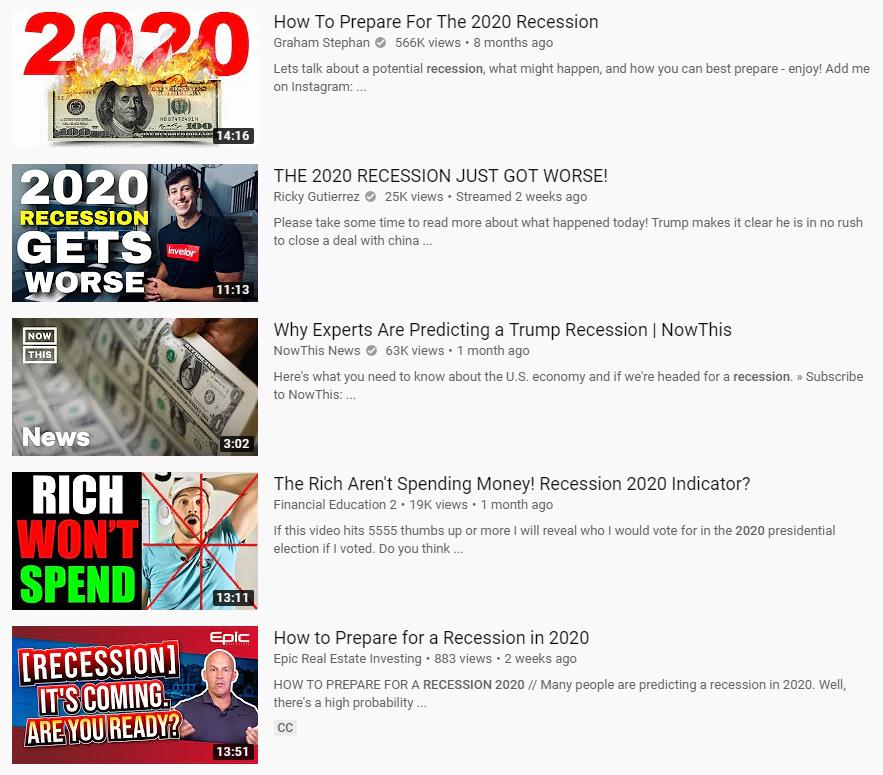

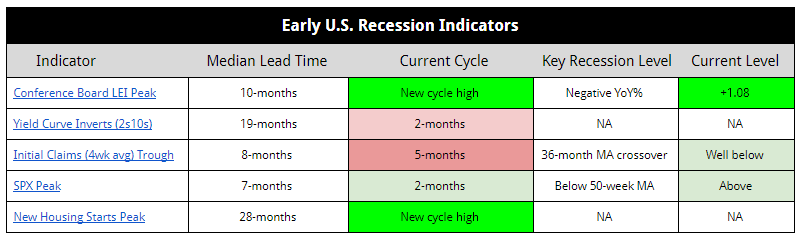

2. Market tends to underweight the impact of secular macro shifts and overweight cyclical ones

3. Market is inefficient at pricing anything exponential

1. Market is slow to recognize competitive advantages + it tends to underappreciate their impact on future value creation

2. Market tends to underweight the impact of secular macro shifts and overweight cyclical ones

3. Market is inefficient at pricing anything exponential

9/ @modestproposal1 talked about this in his recent interview w/ @patrick_oshag where he refers to it as "Two Different Theories for Investing: Underwriting the past versus underwriting the future."

10/ Where Underwriting the future is "more qualitatively focused and requires an investor to be comfortable with uncertainty as they build a view on the future of a company through strategic analysis. The best performing investors over the past 20 years belong to this group."

11/ Again, Greenblatt "Explain the big picture. Your predecessors (MBAs) failed over a long period of time. It has nothing to do about their ability to do a spreadsheet. It has more to do with the big picture. I focus on the big picture. Think of the logic, not just the formula"

12/ Extend timeframe. Understand consensus. Positive EV bets come from mrkt's failure to price competitive adv, secular macro shifts, exponential growth. You find these by looking out past the near-term, peering past the veil of the future, and forming differentiated insights...

13/ The robots own the near-term. Stop playing chess with Deep Blue. Use your creative faculties and work to underwrite the future.

You can read more here macro-ops.com/underwriting-t… /fin

You can read more here macro-ops.com/underwriting-t… /fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh