The United States

(1/4)

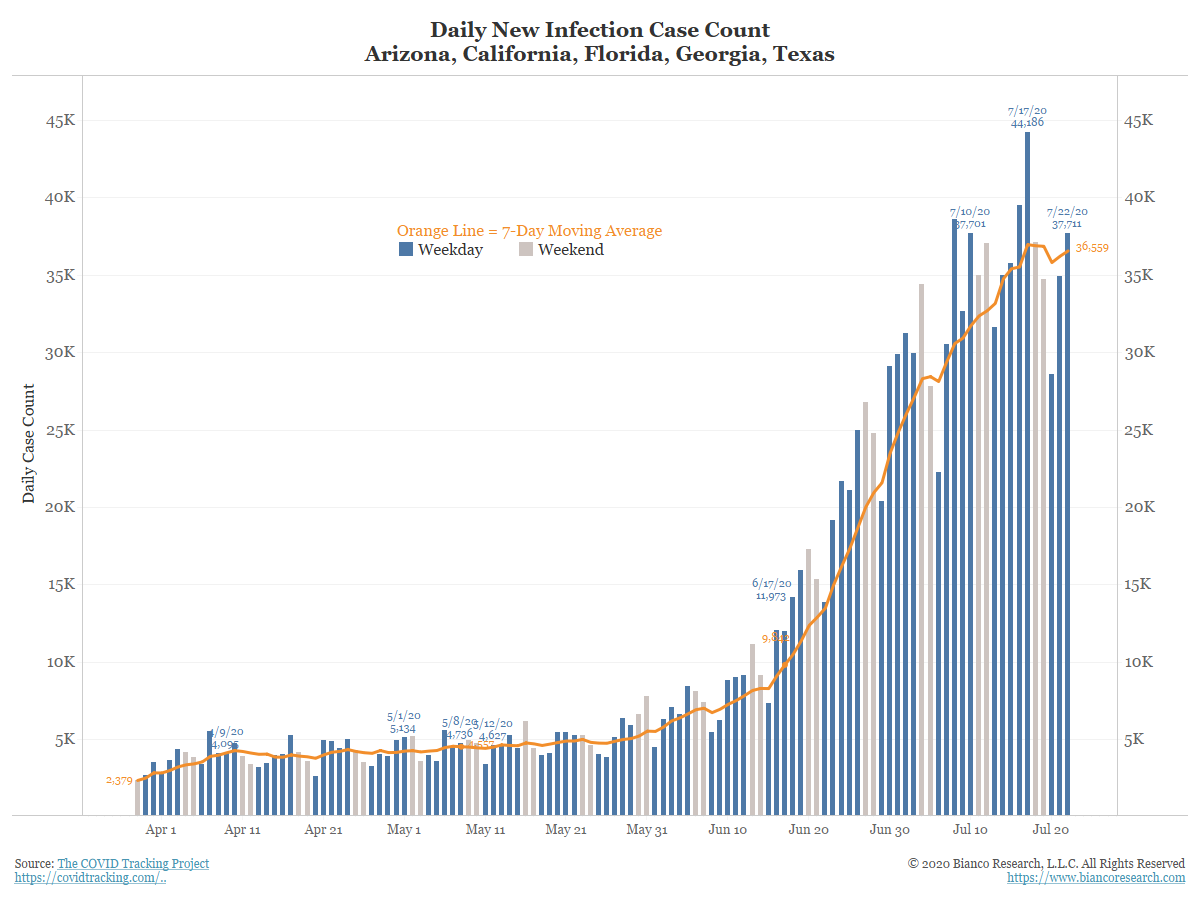

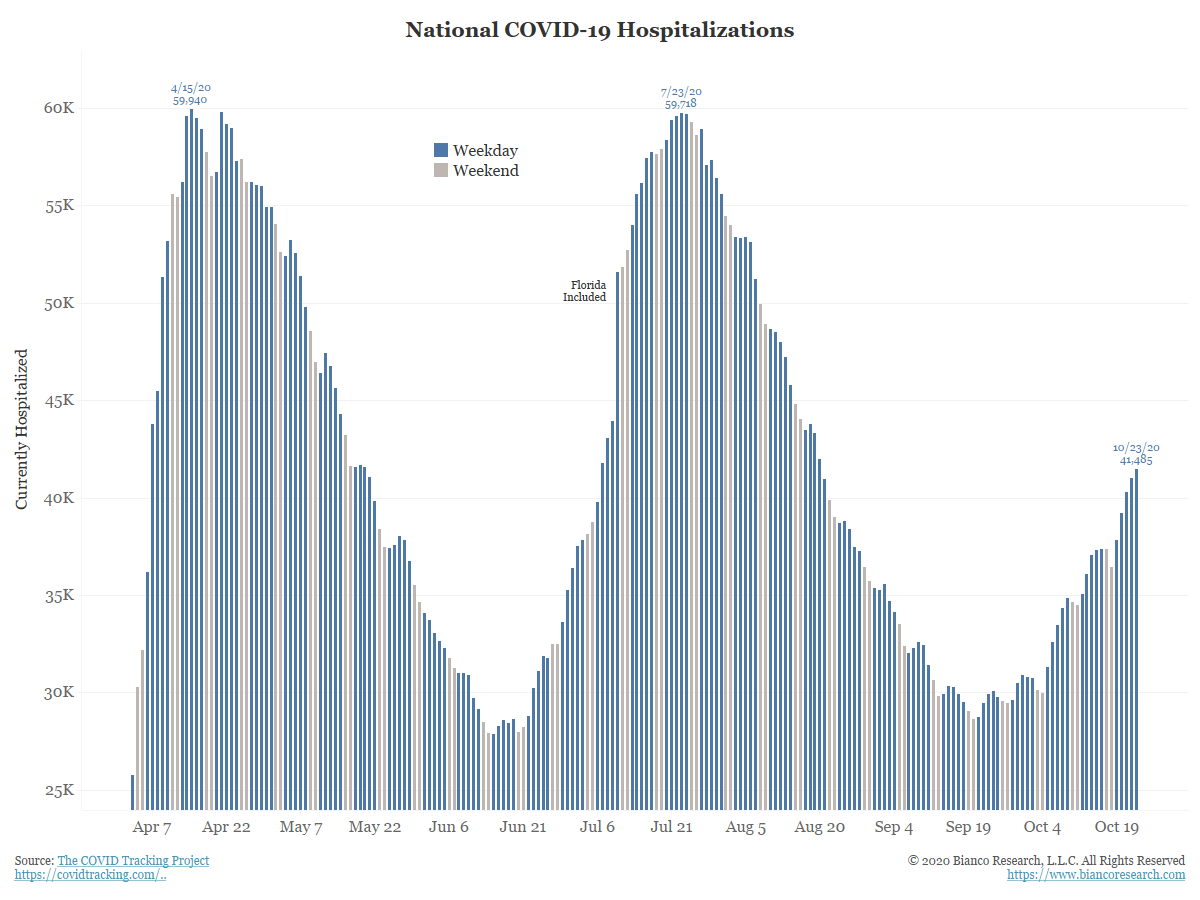

Deaths, survival, and hospitalizations, are important but they do not drive behavior and policy. The "reaction function" is case counts.

When does this rise stop? What should the US do?

@ErikSTownsend @ttmygh @EpsilonTheory @chrismartenson @MishGEA

(1/4)

Deaths, survival, and hospitalizations, are important but they do not drive behavior and policy. The "reaction function" is case counts.

When does this rise stop? What should the US do?

@ErikSTownsend @ttmygh @EpsilonTheory @chrismartenson @MishGEA

The Midwest

(2/4)

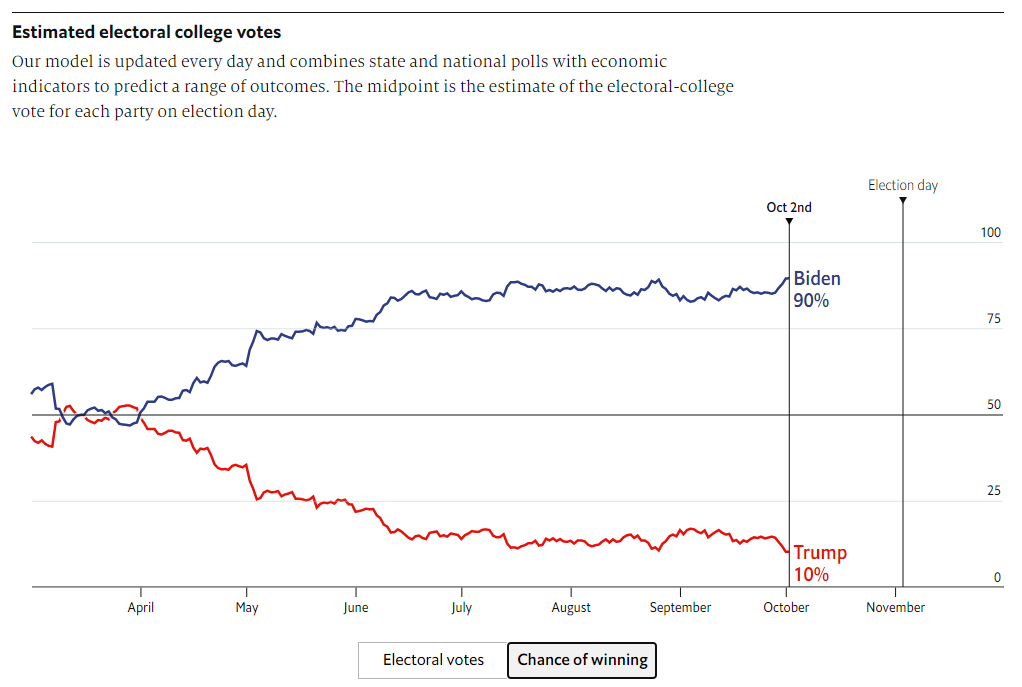

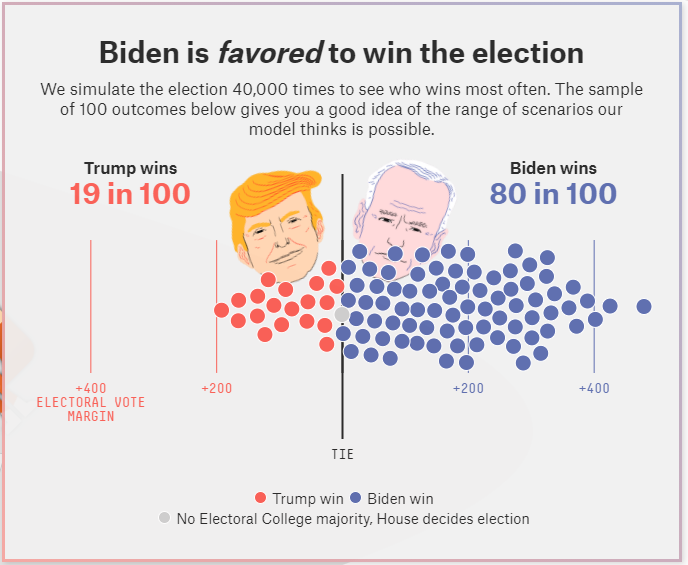

WI and OH are swing states? How does this impact them?

1. Blame Trump?

2. Republicans will vote, Democrats will stay home?

(2/4)

WI and OH are swing states? How does this impact them?

1. Blame Trump?

2. Republicans will vote, Democrats will stay home?

Western Europe

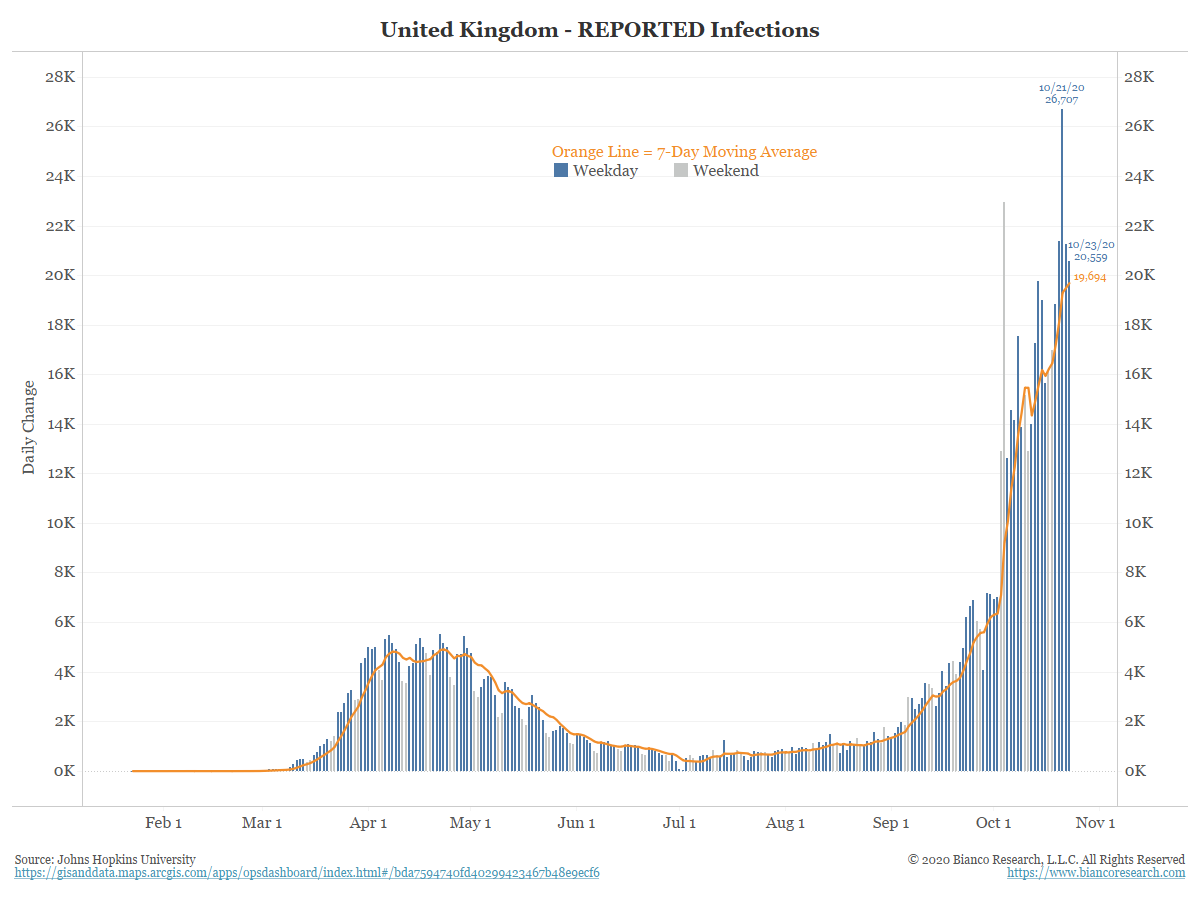

Does this vertical rise stop double again in the next few weeks? Double after that? Or is it peaking now?

When does it stop? What should Europe do?

(3/4)

Does this vertical rise stop double again in the next few weeks? Double after that? Or is it peaking now?

When does it stop? What should Europe do?

(3/4)

The World (4/4)

The world never stopped its first wave. Now winter is returning to the northern hemisphere. What next?

The world never stopped its first wave. Now winter is returning to the northern hemisphere. What next?

• • •

Missing some Tweet in this thread? You can try to

force a refresh