Fair summary of the data on the impact of Trump's China tariffs by @bobdavis187 and @JoshZumbrun.

1/x

wsj.com/articles/china…

1/x

wsj.com/articles/china…

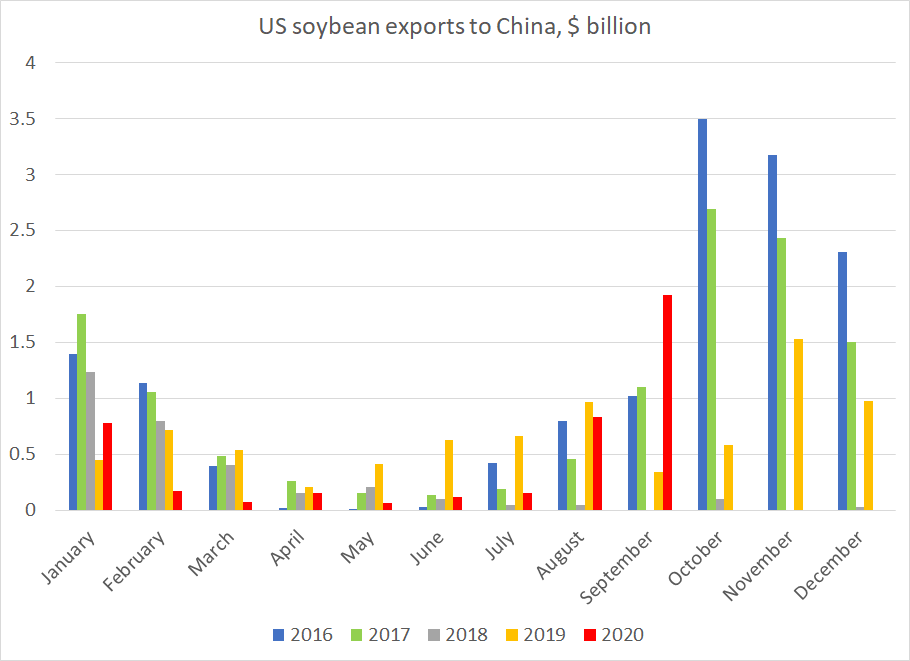

Has some interesting color on polysilicon (used in solar PVs) as well. Apparently the Chinese tariff on polysilicon wasn't lifted in the phase one deal.

And, well, China is hard market once China targets a given sector

2/x

And, well, China is hard market once China targets a given sector

2/x

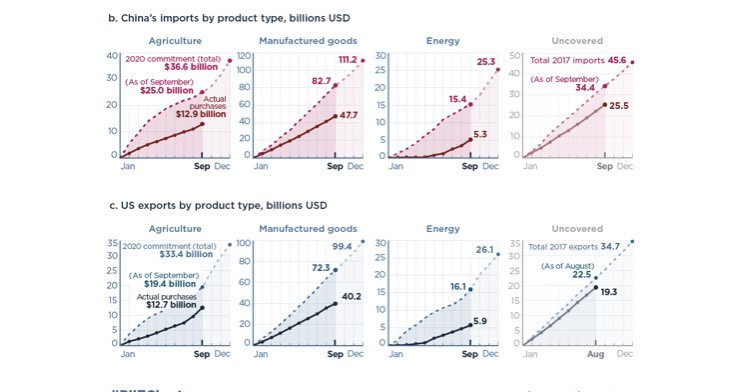

There are some measures on the agricultural side that if sustained should raise US exports (approval of pork and beef exports, rolling back retaliatory tariffs on chicken parts). But always has a bit unclear (imo) how the phase one deal would raise exports of manufactures

3/x

3/x

And there are a couple of data angles that a story like this couldn't really get into --

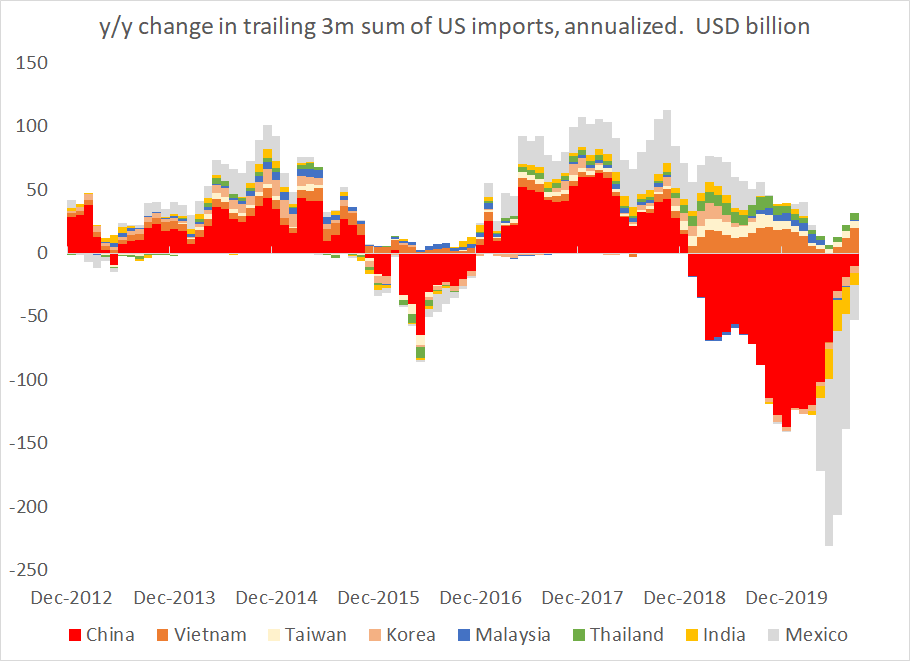

For example, one surprise, at least to me, is that the tariffs on China didn't do more to help Mexico's exports

4/x

For example, one surprise, at least to me, is that the tariffs on China didn't do more to help Mexico's exports

4/x

Another interesting story line is how the US and the Chinese bilateral trade data have diverged.

In the US data, the monthly trade deficit with China has been about at its 2016 level in the last 4ms (a bit higher in July, a bit lower in August) & well down from 2018

5/x

In the US data, the monthly trade deficit with China has been about at its 2016 level in the last 4ms (a bit higher in July, a bit lower in August) & well down from 2018

5/x

In the Chinese data, by contrast, the monthly surplus with the US has been equal to or above the 2018 peak levels in most recent months (September was a modest exception), and well over 2016 levels

6/x

6/x

So in the Chinese data, China's YTD surplus with the US is more or less back at all time highs (even with a weak q1 for obvious reasons, and even with the tariffs)

7/x

7/x

This is because China's reported exports to the US are now running about 10% above reported US imports from China, while historically Chinese exports to the US tended to be ~ 15% below US imports from China.

8/x

8/x

Tis of course far too technical for the WSJ story (which given that it was focused on the US needed to be based on US data). But increasingly estimates of the impact of the tariffs on bilateral trade do depend on whether or not you look at the US or the Chinese data ...

9/9

9/9

• • •

Missing some Tweet in this thread? You can try to

force a refresh