September's FX settlement data (settlement includes the PBOC and the state banks) provides the first obvious sign of renewed intervention -- settlement, adjusted for forwards, jumped $10b in September

1/x

1/x

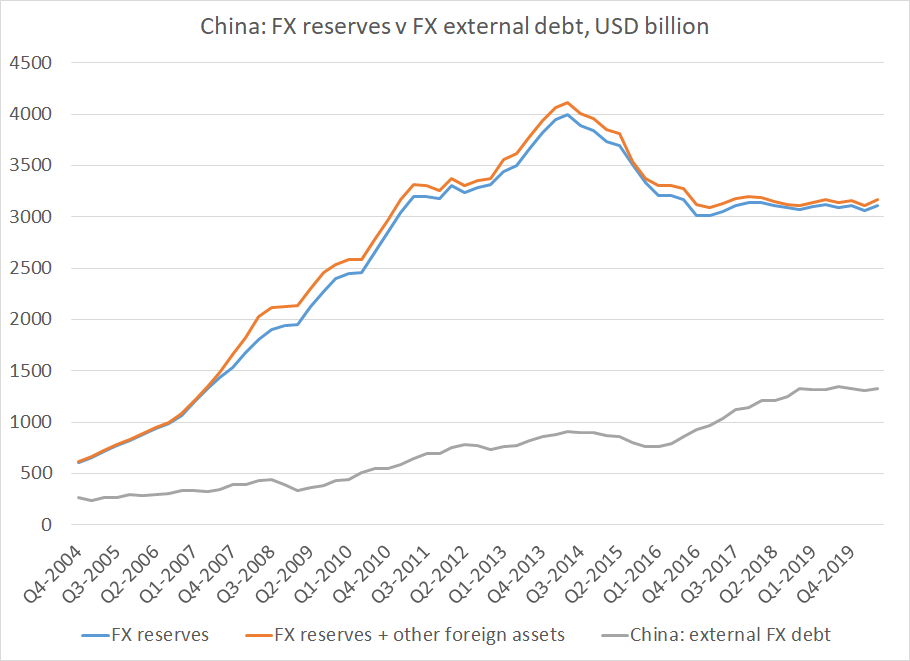

A reminder -- China historically has needed to intervene more when the yuan is appreciating than when it is stable or falling (as controlling the pace of appreciation takes the PBOC's balance sheet)

2/x

2/x

To be sure the $10b in purchases in the settlement data in September is only visible purchase in the traditional intervention proxies in the last 3ms, and it remains is modest v the $150b plus trade and bond inflow -- there is more going on

3/x

3/x

As @M_C_Klein highlighted in Barrons there has been rapid growth in the net foreign assets of the state banks over the last 5ms of data (roughly $20b a month in q3).

More here --

cfr.org/blog/chasing-s…

4/4

More here --

cfr.org/blog/chasing-s…

4/4

• • •

Missing some Tweet in this thread? You can try to

force a refresh