MMT is a lie. #Bitcoin is the truth.

An honest thread about a dishonest thread from @StephanieKelton

An honest thread about a dishonest thread from @StephanieKelton

https://twitter.com/StephanieKelton/status/1321180774675238912?s=20

A deficit occurs when any organization—a family, a company, or a government—generates expenses that exceeds its revenues.

Most call this a "net loss," but for governments it is typically called a deficit.

But how can the US government continually spend more than it earns?

Most call this a "net loss," but for governments it is typically called a deficit.

But how can the US government continually spend more than it earns?

Simple: the US government can print more US dollars ("points" as she calls them) to cover its deficit.

US dollars (and all fiat currencies) are simply a claim on the savings of society—redemption certificates for the goods, services, and knowledge generated by productive people.

US dollars (and all fiat currencies) are simply a claim on the savings of society—redemption certificates for the goods, services, and knowledge generated by productive people.

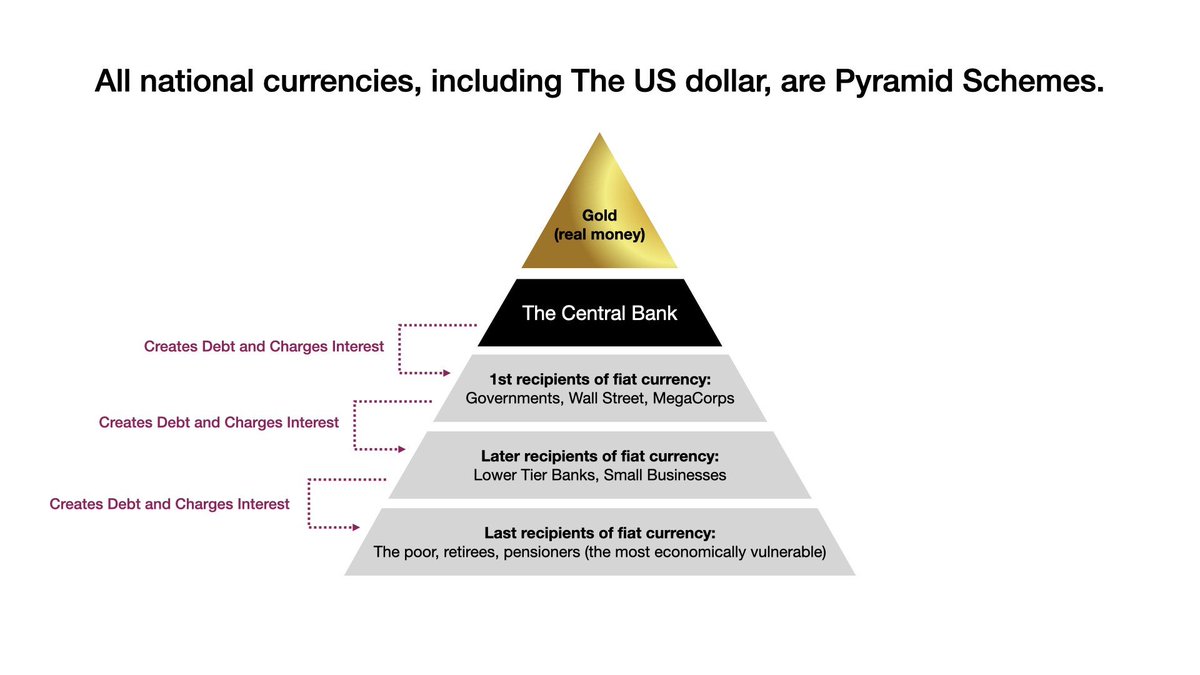

When the US government "awards points," it is reallocating claims on savings from those holding US dollars to those who receive newly produced US dollars first (google "the Cantillon Effect").

Politicians that makes these decisions produce no value, they survive by stealing.

Politicians that makes these decisions produce no value, they survive by stealing.

Contrary to @StephanieKelton's assertion, the US government is not "the scorekeeper that sits outside of the game." Like any organization, the US government is a social institution that operates in its own best interest. And its prime interest is protecting its central bank...

If the US government is a benevolent and neutral "scorekeeper that neither has nor needs points", then why does it protect The Federal Reserve's monopoly on money, which yields a 6% annual dividend (payable in US dollar "points) to a group of undisclosed, private shareholders?

Apparently, our benign scorekeeper—like all social institutions run by corruptible people—is itself a bit corrupt.

Follow the incentives and find the outcome. With no exposure to the downside of their decision making—no skin in the game—politicians always resort to printing.

Follow the incentives and find the outcome. With no exposure to the downside of their decision making—no skin in the game—politicians always resort to printing.

This is why #Bitcoin matters—it is a "game" with rules that cannot be bent or broken.

Bitcoin is antithetical to the deception of MMT—an attempted justification for the US government to continue harvesting the surplus of productive people through US dollar supply inflation.

Bitcoin is antithetical to the deception of MMT—an attempted justification for the US government to continue harvesting the surplus of productive people through US dollar supply inflation.

To assert that the US government can improve the "game of life" for productive people by corrupting their money is either ignorant or malevolent...

I can't tell if @StephanieKelton believes what she says, or is intentionally deceiving people, but either way, MMT is a lie.

I can't tell if @StephanieKelton believes what she says, or is intentionally deceiving people, but either way, MMT is a lie.

Imagine believing that a game could be better played by constantly and unpredictably changing the rules of the game...

That is exactly what MMT asserts: that the (apparently omnipotent) US government can change the rules as necessary to "contribute points to scorecards"

That is exactly what MMT asserts: that the (apparently omnipotent) US government can change the rules as necessary to "contribute points to scorecards"

Fortunately for players in of this rigged game in the 21st century, there is a new game in town: a firmly fixed supply of 21 million #Bitcoin.

The rules? No inflation. No counterfeiting. No stealing.

Just unstoppable, incorruptible, honest money.

The rules? No inflation. No counterfeiting. No stealing.

Just unstoppable, incorruptible, honest money.

For a deeper dive on the truth of fiat currency, and how it is the largest pyramid scheme in human history, check out recent piece "Masters and Slaves of Money"

medium.com/@breedlove22/m…

medium.com/@breedlove22/m…

• • •

Missing some Tweet in this thread? You can try to

force a refresh