Phil Fisher's Common Stocks and Uncommon Profits is widely regarded as one of the best investment books of all time. Warren Buffett once said, "I am an eager reader of whatever Phil has to say, and I recommend him to you."

Here are some of Fisher's most valuable investment tips

Here are some of Fisher's most valuable investment tips

1. "The stock market is filled with individuals who know the price of everything, but the value of nothing."

Price and value are two very different things. Recognizing this fact is the first step to investing success.

2. "It is often easier to tell what will happen to the price of a stock than how much time will elapse before it happens."

Even if we're confident that a stock will appreciate in value, we can never be certain when that will happen. Thus, we should factor that reality into our investment strategies — and give ourselves time to be proved correct.

3. "The only true test of whether a stock is "cheap" or "high" is not its current price in relation to some former price, no matter how accustomed we may have become to that former price...

but whether the company's fundamentals are significantly more or less favorable than the current financial-community appraisal of that stock."

The market doesn't care what price you paid for a stock. You shouldn't, either. It's natural to anchor to your purchase price, but it's far more important to value a stock based on the underlying business' future growth prospects.

If your estimate of the stock's value is more than the market's view, you should probably continue to hold it. But if the opposite is true, you'll likely be best served by selling the stock, even if it's below the price you paid.

4. "If the growth rate is so good that in another 10 years the company might well have quadrupled, is it really of such great concern whether at the moment the stock might or might not be 35% overpriced?"

The best growth stocks almost always seem expensive — except in the rearview mirror. Value-focused investors often miss out on them for that reason, much to their detriment.

Being willing to pay a premium for companies with excellent growth prospects can help you generate market-crushing returns over time.

5. "It is my observation that those who sell such stocks to wait for a more suitable time to buy back these same shares seldom attain their objective. They usually wait for a decline to be bigger than it actually turns out to be."

Attempting to time the market is typically a fool's errand. As Fisher explains, it's often quite difficult to buy back stocks during market downturns, as these pessimistic times tend to make investors believe that things will continue to get worse.

And when the market eventually rebounds, it climbs a "wall of worry," with investors fearing that numerous risks will cause stocks to fall the entire time.

The market doesn't give clear buy and sell signals, so it's often best to simply ride out the volatility to benefit fully from its long-term gains.

6. "More money has probably been lost by investors holding a stock they really did not want until they could 'at least come out even' than from any other single reason."

"...If these actual losses are added to the profits that might have been made through the proper reinvestment of these funds if such reinvestment had been made when the mistake was first realized, the cost of self-indulgence becomes truly tremendous."

The opportunity cost of forgoing a superior investment can be much greater than the losses you incur on an underperforming stock.

Don't make the mistake of holding on to subpar investments in hopes of getting back to even. Instead, seek to optimize your portfolio with the best businesses you can find.

7. "Investors have been so oversold on diversification that fear of having too many eggs in one basket has caused them to put far too little into companies they thoroughly know and far too much in others which they know nothing about."

Diversification through tools such as index funds can serve most investors well. But for investors willing to put in the time and effort to study individual stocks, too much diversification can dampen results.

A more concentrated portfolio of carefully chosen stocks can help a skilled investor outperform the market.

8. "In the field of common stocks, a little bit of a great many can never be more than a poor substitute for a few of the outstanding."

Well-run, competitively advantaged businesses with strong growth prospects are not always easy to find. Fortunately, you'll only need to identify a handful of them for a lifetime of investing success.

9. "If the job has been correctly done when a common stock is purchased, the time to sell it is — almost never."

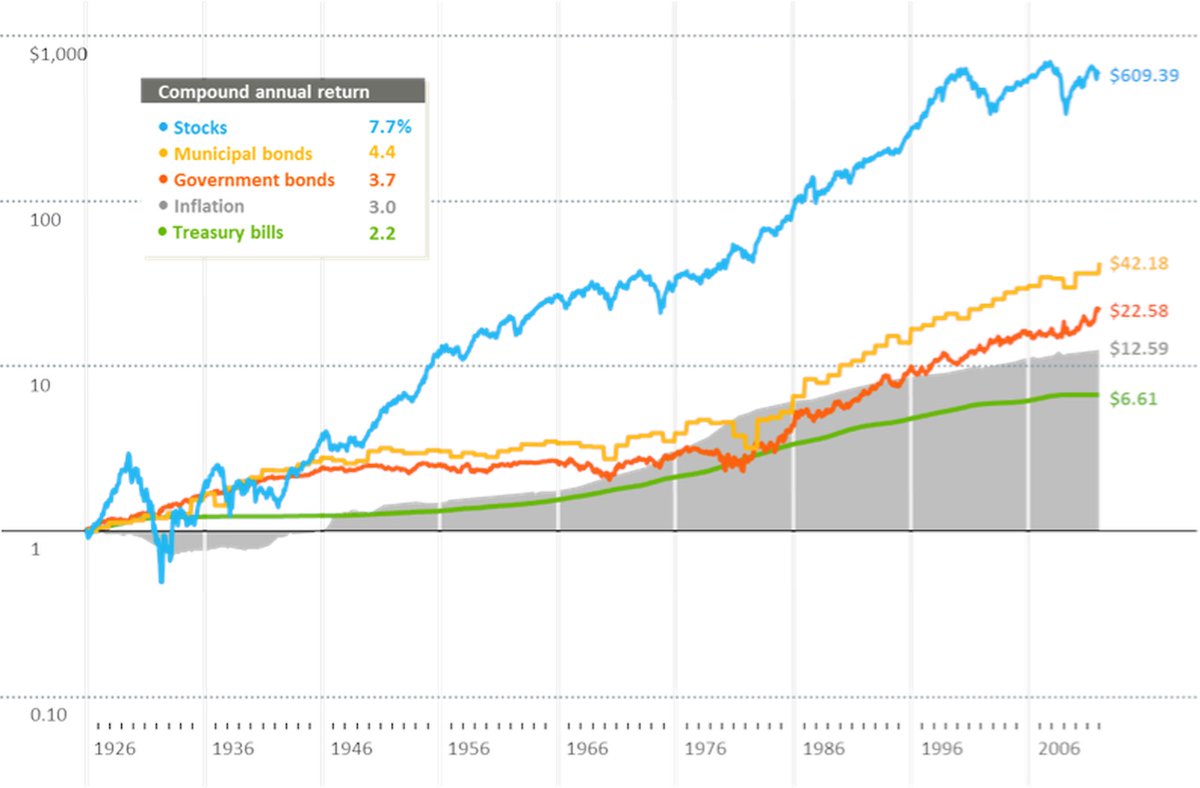

When you do find a great business, resist the urge to sell. The desire to lock in gains can be powerful, but the truly life-changing returns only come from holding stocks for long periods.

10. "I had made what I believe was one of the more valuable decisions of my business life. This was to confine all efforts solely to making major gains in the long run."

The financial media will attempt to grab your attention with seemingly important, but ultimately, short-term concerns. Keep your focus on the long-term fundamentals of your investments, and you'll maximize your returns and build lasting wealth.

• • •

Missing some Tweet in this thread? You can try to

force a refresh