In 1637, the Dutch Republic erupted into a speculative fever over an unlikely item...the tulip.

Tulip Mania has become a legend synonymous with market euphoria and bubbles. But is this tale all it's cracked up to be?

Who's up for a story?

👇👇👇

Tulip Mania has become a legend synonymous with market euphoria and bubbles. But is this tale all it's cracked up to be?

Who's up for a story?

👇👇👇

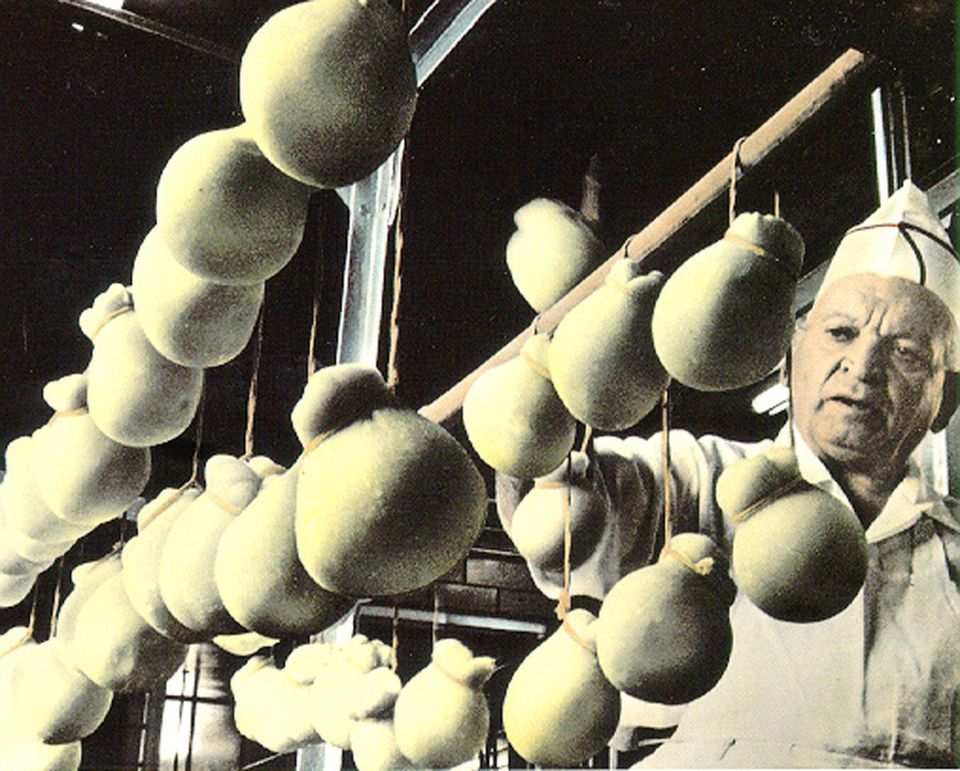

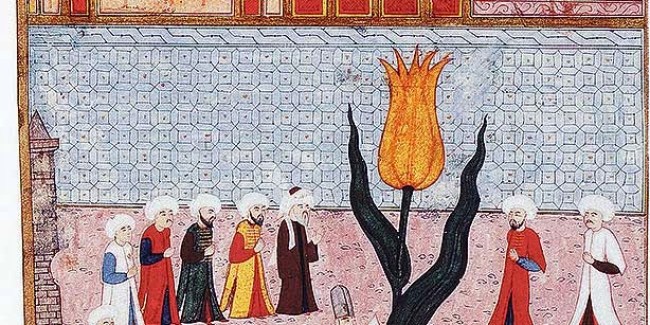

1/ The tulip is a spring-blooming flower native to the valleys of the Tien Shan Mountains in Central Asia.

It is believed to have been introduced to Europe in 1554, when an ambassador of the Holy Roman Emperor sent tulip bulbs and seeds to Vienna from the Ottoman Empire.

It is believed to have been introduced to Europe in 1554, when an ambassador of the Holy Roman Emperor sent tulip bulbs and seeds to Vienna from the Ottoman Empire.

2/ Tulips gained in popularity as people were attracted to their rich color and ability to grow in sub-optimal conditions.

They soon became a coveted status symbol for the wealthy.

The Semper Augustus, with its colorful, flame-like streaks, was the most desired of them all.

They soon became a coveted status symbol for the wealthy.

The Semper Augustus, with its colorful, flame-like streaks, was the most desired of them all.

3/ By the early 1600s, the Dutch Republic was entering a golden age.

Many financial innovations popped up during this time - the first stock exchange, for example.

But it was another financial innovation that would propel tulips into historical lore: the futures contract.

Many financial innovations popped up during this time - the first stock exchange, for example.

But it was another financial innovation that would propel tulips into historical lore: the futures contract.

4/ As tulips grow slowly and may take several years to bloom, paper contracts were written that entitled the buyer to the future tulips.

These contracts were freely-traded.

So in addition to the physical market for tulip bulbs, a thriving paper market was established.

These contracts were freely-traded.

So in addition to the physical market for tulip bulbs, a thriving paper market was established.

5/ By 1634, the prices of tulip bulbs were rising sharply.

Traders would meet in special taverns. In these taverns, no bulbs ever changed hands, just the paper contracts.

Speculative buying (buying on the expectation of further price increases) took hold.

The frenzy was on.

Traders would meet in special taverns. In these taverns, no bulbs ever changed hands, just the paper contracts.

Speculative buying (buying on the expectation of further price increases) took hold.

The frenzy was on.

6/ Companies were established to buy and sell tulips.

As with all financial bubbles, tulip mania became a self-fulfilling prophecy.

Rising prices beckoned new speculative traders into the market, which further drove up prices.

Prices continued to skyrocket through early 1637.

As with all financial bubbles, tulip mania became a self-fulfilling prophecy.

Rising prices beckoned new speculative traders into the market, which further drove up prices.

Prices continued to skyrocket through early 1637.

7/ At the peak, one tulip bulb sold for ~5,000 guilders, roughly the price of a nice house in the Dutch Republic at the time.

But as is common in speculative bubbles, the burst came suddenly.

When no buyers arrived at one trading session, the price of tulips fell precipitously.

But as is common in speculative bubbles, the burst came suddenly.

When no buyers arrived at one trading session, the price of tulips fell precipitously.

8/ Traders who had paid exorbitant prices for tulip contracts were left with worthless pieces of paper.

Many refused to pay, arguing the paper contracts were unenforceable, leading to further panic selling and further price declines.

Tulip mania was officially over.

Many refused to pay, arguing the paper contracts were unenforceable, leading to further panic selling and further price declines.

Tulip mania was officially over.

9/ The event was made popular by Scottish journalist Charles Mackay in his book, entitled Extraordinary Popular Delusions and the Madness of Crowds.

But many of his claims, including the devastating impact of the bubble on the Dutch economy, have been questioned or disproven.

But many of his claims, including the devastating impact of the bubble on the Dutch economy, have been questioned or disproven.

10/ Historian @anne_goldgar conducted extensive primary research on the incident, finding no evidence of a widespread financial impact from the bubble.

In fact, she found only ~40 cases of people paying more than 300 guilders for a tulip bulb.amazon.com/gp/product/022…

In fact, she found only ~40 cases of people paying more than 300 guilders for a tulip bulb.amazon.com/gp/product/022…

11/ Importantly, Goldgar found no evidence that working class people went bankrupt betting on tulips.

The Dutch Republic was not broken by the incident and very few people were truly impacted by it.

A fascinating historical incident, yes.

As sensational as the legend, no.

The Dutch Republic was not broken by the incident and very few people were truly impacted by it.

A fascinating historical incident, yes.

As sensational as the legend, no.

12/ This is the story of the facts and fiction of tulip mania.

So as bitcoin continues its rise and the inevitable calls of "tulip mania" commence their lazy refrain, keep calm and carry on!

In the words of @PrestonPysh, "There go those tulips again..." smithsonianmag.com/history/there-…

So as bitcoin continues its rise and the inevitable calls of "tulip mania" commence their lazy refrain, keep calm and carry on!

In the words of @PrestonPysh, "There go those tulips again..." smithsonianmag.com/history/there-…

13/ For more educational threads on money, business, and finance, check out my meta-thread below.

And turn on post notifications so you never miss a thread!

And turn on post notifications so you never miss a thread!

https://twitter.com/SahilBloom/status/1284583099775324161

• • •

Missing some Tweet in this thread? You can try to

force a refresh