Thread

These are 10 heuristics/ideas that have served me well and I lean on them whenever considering a decision or making an investment.

Benefited hugely from the ideas and wisdom of Charlie Munger, Howard Marks, @jposhaughnessy @morganhousel and @nntaleb.

These are 10 heuristics/ideas that have served me well and I lean on them whenever considering a decision or making an investment.

Benefited hugely from the ideas and wisdom of Charlie Munger, Howard Marks, @jposhaughnessy @morganhousel and @nntaleb.

1. Incentives

“Show me the incentives and I will show you the outcome.” - Charlie Munger

Ensuring incentives are aligned positions you for better outcomes.

At the minimum know what everyone's incentives are before entering any deal/investment.

“Show me the incentives and I will show you the outcome.” - Charlie Munger

Ensuring incentives are aligned positions you for better outcomes.

At the minimum know what everyone's incentives are before entering any deal/investment.

2. Asymmetry

Position for ideally large (unknown) upside and small (known) downside

"If you ‘have optionality,’ you don’t have much need for what is commonly called intelligence, knowledge, insight, skills and these complicated things that take place in our brain cells"-N Taleb

Position for ideally large (unknown) upside and small (known) downside

"If you ‘have optionality,’ you don’t have much need for what is commonly called intelligence, knowledge, insight, skills and these complicated things that take place in our brain cells"-N Taleb

3. Resulting

"We have a tendency to equate the quality of a decision with the quality of its outcome." -

@AnnieDuke

You need to have conviction and stick to your process, don't change your strategy just because a few trades didn’t turn out well in the short run.

"We have a tendency to equate the quality of a decision with the quality of its outcome." -

@AnnieDuke

You need to have conviction and stick to your process, don't change your strategy just because a few trades didn’t turn out well in the short run.

4. The opportunity cost of not being there

This never gets discussed but there is a very real cost of passing on a great opportunity or trade that goes parabolic

If you think there is asymmetry there then consider taking a tiny position(an amount it won’t hurt to lose)

This never gets discussed but there is a very real cost of passing on a great opportunity or trade that goes parabolic

If you think there is asymmetry there then consider taking a tiny position(an amount it won’t hurt to lose)

5. Scaling

If you have a choice don't do everything at once.

Take selling a position; see the company all over the media sell 10%, its mentioned at BBQ another 10%

This helps insulate you from hindsight bias.

Wrote about this on my blog here: traderferg.com/avoiding-the-m…

If you have a choice don't do everything at once.

Take selling a position; see the company all over the media sell 10%, its mentioned at BBQ another 10%

This helps insulate you from hindsight bias.

Wrote about this on my blog here: traderferg.com/avoiding-the-m…

6. Lasting Edges

The market is consistently evolving so make sure you evolve with it or pick something lasting to exploit

"Arbitrage human nature. It's not going change anytime soon" -

@jposhaughnessy

The market is consistently evolving so make sure you evolve with it or pick something lasting to exploit

"Arbitrage human nature. It's not going change anytime soon" -

@jposhaughnessy

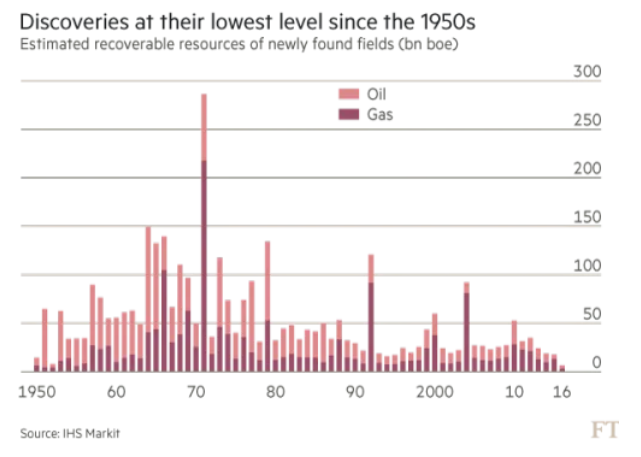

7. Position yourself to get lucky

You can achieve an awful lot by simply avoiding the standard traps in life (excessive debt & excessive leverage)

And positioning yourself on a trend early

Let luck take care of the rest

You can achieve an awful lot by simply avoiding the standard traps in life (excessive debt & excessive leverage)

And positioning yourself on a trend early

Let luck take care of the rest

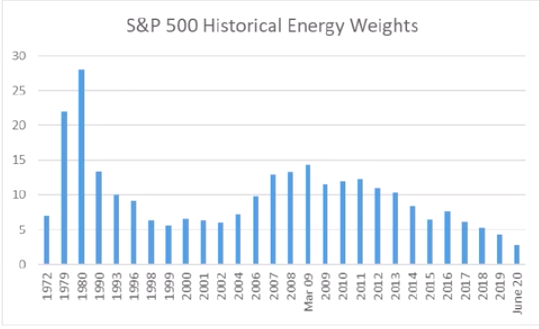

8. Mean reversion

"Regression to the mean is the most powerful law in financial physics" -

@jasonzweigwsj

Excessive outperformance is usually matched by equal or greater underperformance

Try to be on the right side of mean reversion

"Regression to the mean is the most powerful law in financial physics" -

@jasonzweigwsj

Excessive outperformance is usually matched by equal or greater underperformance

Try to be on the right side of mean reversion

9. Does it work in practice

"In theory, there is no difference between theory and practice. In practice there is." - Yogi Berra

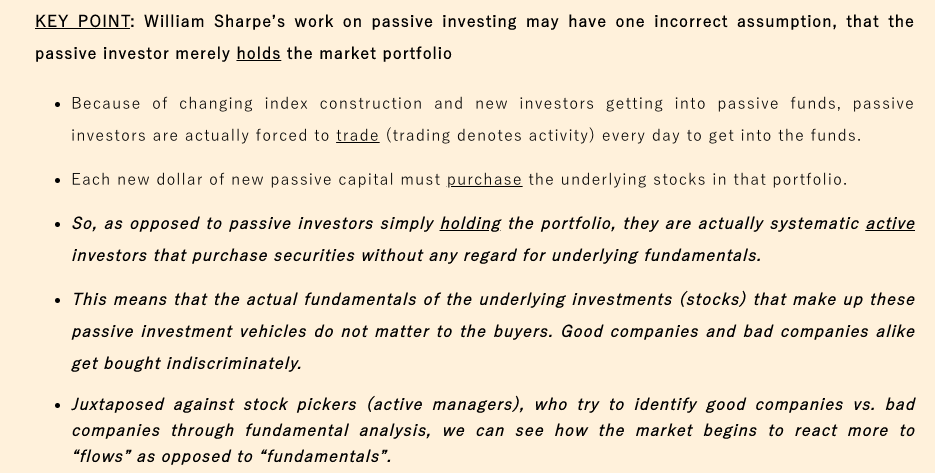

Look at the real outcome occurring in the world not what the academics or their models are showing.

"In theory, there is no difference between theory and practice. In practice there is." - Yogi Berra

Look at the real outcome occurring in the world not what the academics or their models are showing.

10. Cultivate the skill of sitting on your hands

“Approximately 99% of the time, the single most important thing investors should do is absolutely nothing”

@jasonzweigwsj

Yet our monkey minds find this harder than ever with smartphones with notifications and social media now

“Approximately 99% of the time, the single most important thing investors should do is absolutely nothing”

@jasonzweigwsj

Yet our monkey minds find this harder than ever with smartphones with notifications and social media now

• • •

Missing some Tweet in this thread? You can try to

force a refresh