Italy & Coffee

Italy is the spiritual home of coffee.

The vocabulary of coffee (espresso/cappuccino/barista/macchiato/latte) is Italian.

1/

Italy is the spiritual home of coffee.

The vocabulary of coffee (espresso/cappuccino/barista/macchiato/latte) is Italian.

1/

Coffee was introduced to Italy by Arabic travellers in 15th/16th century.

Wine sellers threatened by its popularity made an appeal to Pope Clement VIII to banish it.

Pope after tasting the coffee declared it to be delicious & quipped that it should be baptised.

2/

Wine sellers threatened by its popularity made an appeal to Pope Clement VIII to banish it.

Pope after tasting the coffee declared it to be delicious & quipped that it should be baptised.

2/

After the Papal blessing cafes proliferated across Europe.

The 2nd oldest cafe in Italy today, Caffè Greco was opened in 1760. It was frequented by Byron/Keats/Shelly/Goethe/Wagner among others.

It still has the couch of Christian Anderson who lived upstairs for a while.

3/

The 2nd oldest cafe in Italy today, Caffè Greco was opened in 1760. It was frequented by Byron/Keats/Shelly/Goethe/Wagner among others.

It still has the couch of Christian Anderson who lived upstairs for a while.

3/

The Espresso machine was discovered in Italy. Secret of a good espresso are the 5 Ms.

Miscela — Blend

Macchina — Machine

Macinino — Grinder

Manutenzione — Machine Maintenance

Mano — Skill of the Barista

Preparing & serving a good espresso is a science.

4/

Miscela — Blend

Macchina — Machine

Macinino — Grinder

Manutenzione — Machine Maintenance

Mano — Skill of the Barista

Preparing & serving a good espresso is a science.

4/

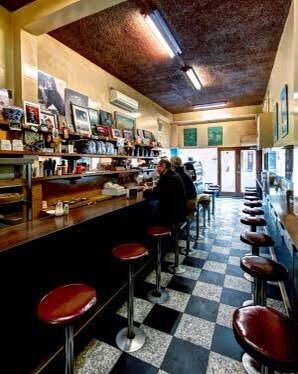

There are rules & rituals around drinking coffee.

Cappuccino is a breakfast beverage.

Coffee break is known as “una pausa” (a pause).

Take away is frowned upon. Most Italians drink coffee standing at the bar.

It’s priced cheap(er). As everybody deserves good coffee.

5/

Cappuccino is a breakfast beverage.

Coffee break is known as “una pausa” (a pause).

Take away is frowned upon. Most Italians drink coffee standing at the bar.

It’s priced cheap(er). As everybody deserves good coffee.

5/

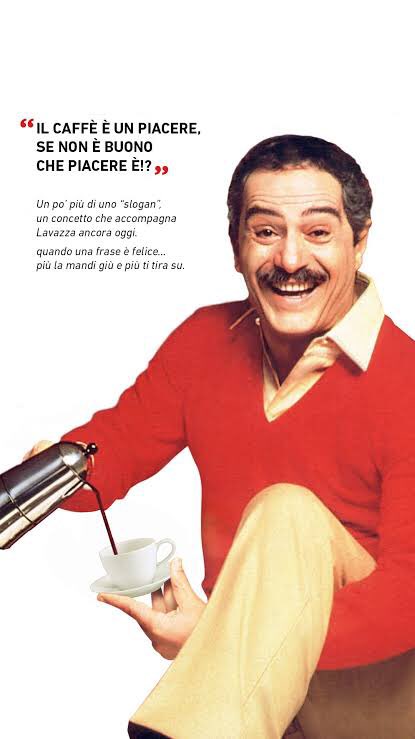

Lavazza is a 125 year old brand from Turin, Italy.

One of its ad slogans is:

Coffee is a pleasure. If it’s not good, what pleasure is it?

6/

One of its ad slogans is:

Coffee is a pleasure. If it’s not good, what pleasure is it?

6/

Attempts to embellish coffee with milkshakes & frappuccinos are treated as sacrilege.

Starbucks dared to open its first store in Italy only in 2018.

It still has only 9 stores in the country.

7/

Starbucks dared to open its first store in Italy only in 2018.

It still has only 9 stores in the country.

7/

https://twitter.com/simongerman600/status/1309252027843833856

• • •

Missing some Tweet in this thread? You can try to

force a refresh