1/ “BUT THEY WILL BAN BITCOIN.”

Let me quickly explain why this threat is HIGHLY overestimated and why it is NOT possible or even reasonable.

$1,000,000+ #Bitcoin is nearly inevitable.

Let me quickly explain why this threat is HIGHLY overestimated and why it is NOT possible or even reasonable.

$1,000,000+ #Bitcoin is nearly inevitable.

2/ First, if someone is presenting this argument, they've conceded that Bitcoin is the world's most valuable monetary good ever discovered.

They understand that Bitcoin will become so incredibly valuable that it may threaten government itself.

They understand that Bitcoin will become so incredibly valuable that it may threaten government itself.

3/ Many reference that private gold ownership was banned in the US in 1933.

BUT, people forget that the reason private gold ownership was banned is because the USD was redeemable for a fixed amount of gold. They needed to break the peg to expand credit (to stimulate).

BUT, people forget that the reason private gold ownership was banned is because the USD was redeemable for a fixed amount of gold. They needed to break the peg to expand credit (to stimulate).

4/ In order to stimulate the economy today, the Fed and the US government have a currency that is NOT pegged to gold OR bitcoin. Meaning they can stimulate as much as they want!

They don’t need to ban Bitcoin ownership to prevent a run on the dollar (like 1933).

They don’t need to ban Bitcoin ownership to prevent a run on the dollar (like 1933).

5/ But even if you are still worried they will find a different reason to ban bitcoin, listen to @parkeralewis

“When the US made gold illegal in 1933, gold did not lose its value. It actually increased in value relative to the dollar, and thirty years later, the ban was lifted.”

“When the US made gold illegal in 1933, gold did not lose its value. It actually increased in value relative to the dollar, and thirty years later, the ban was lifted.”

6/ Additionally, Bitcoin is a decentralized global network.

Banning Bitcoin wouldn’t kill bitcoin.

You’d have to physically find every Bitcoiner and destroy their computer(s) to kill Bitcoin.

Banning Bitcoin wouldn’t kill bitcoin.

You’d have to physically find every Bitcoiner and destroy their computer(s) to kill Bitcoin.

7/ If governments have been unsuccessful at banning drugs, weapons, alcohol, and gold how are they going to be successful at banning something that doesn’t even PHYSICALLY EXIST?

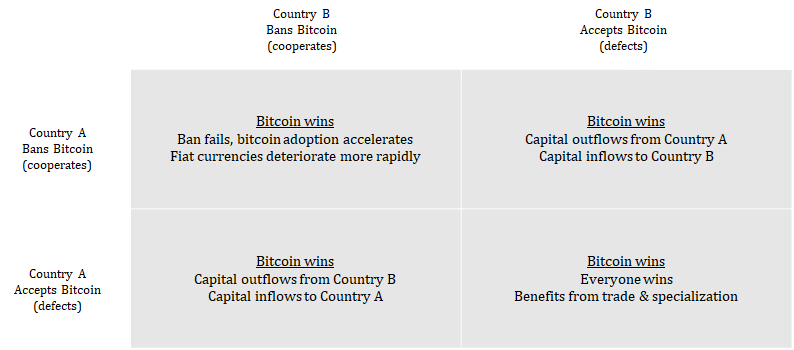

8/ Banning Bitcoin is a loser’s game.

Game theoretically, if you are reasonable and evaluating the potential outcomes, you will embrace and stack Bitcoin as soon as possible.

Game theoretically, if you are reasonable and evaluating the potential outcomes, you will embrace and stack Bitcoin as soon as possible.

9/ Like @PrestonPysh puts it, a country banning bitcoin would be like..

https://twitter.com/PrestonPysh/status/1326600292692070403?s=20

10/ Last, the legal precedent for Bitcoin certainly appears to be going in the exact opposite direction of a ban. Bitcoin senators (@CynthiaMLummis) are being elected and states like Texas and Wyoming are passing legislation to protect it.

11/ If you're not holding Bitcoin because you think it will get banned, you're in for a rough ride.

• • •

Missing some Tweet in this thread? You can try to

force a refresh