Timeline: 1-2 Decades

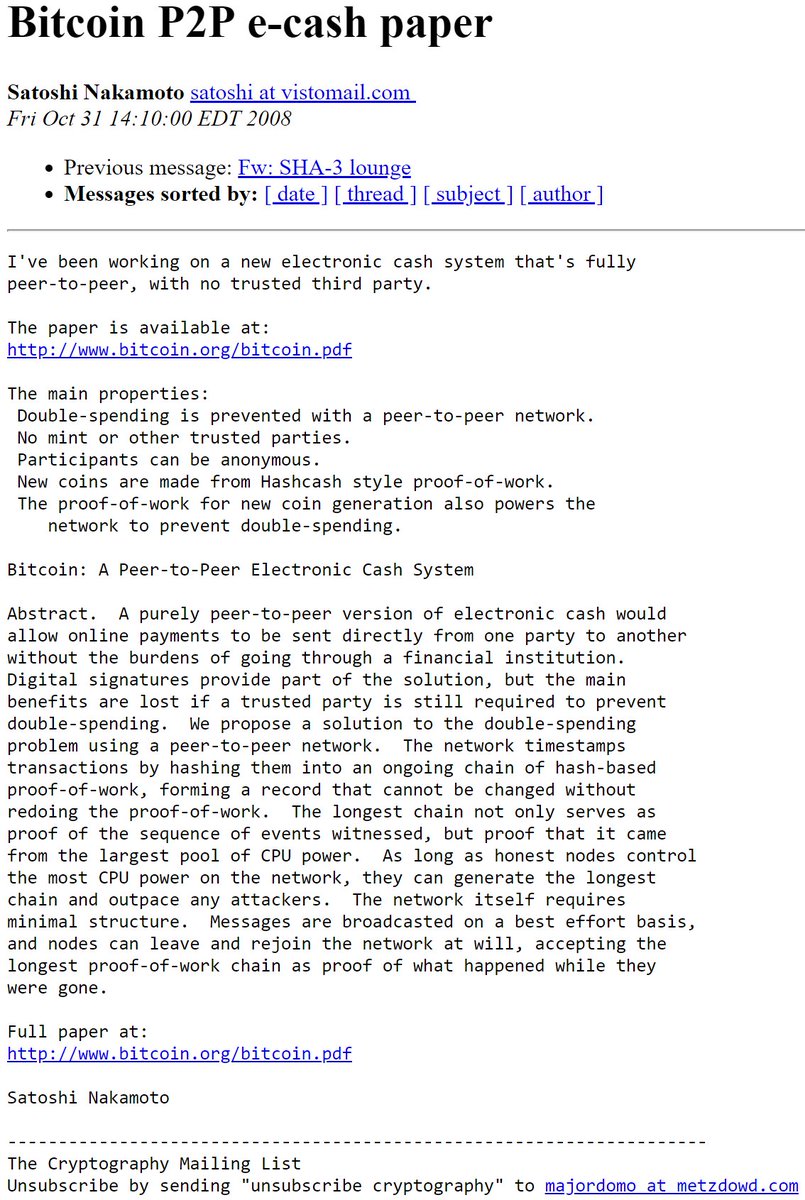

Bitcoin is software that transfers value using a currency protected from unexpected inflation without relying on your government or bank.

The bear markets drive out all those that still do not understand bitcoin, pushing the prices down for others to accumulate more.

1) Someone speculates that Bitcoin will be worth more in the future.

2) This takes Bitcoin off the market and drives up the price.

3) The price goes up, which attracts more speculators.

1) Someone deciding to sell bitcoin.

2) Bitcoin miners selling Bitcoin to pay for electricity.

3) Price falls, which scares away buyers, and brings more sellers.

There is a group of people who are considered the Bitcoin Holders of Last Resort.

Holders of Last Resort recognize the significance of Bitcoin and are able to profit off its inevitable global adoption.

Now, how do we get the $98 Million mark?

$294 TRILLION Dollars will flood into Bitcoin, the new global unit of account.

That’s $98 Million / Bitcoin.

If you want access to the Moon Capital newsletter, subscribe and get it in your inbox every Friday morning.

mailchi.mp/f0739c194b57/m…