Today I will explain how this is rational.

$1+ Million Bitcoin is inevitable.

Goods that are well suited to be used as money have the following properties: durable, divisible, transactable, fungible, portable, and SCARCE.

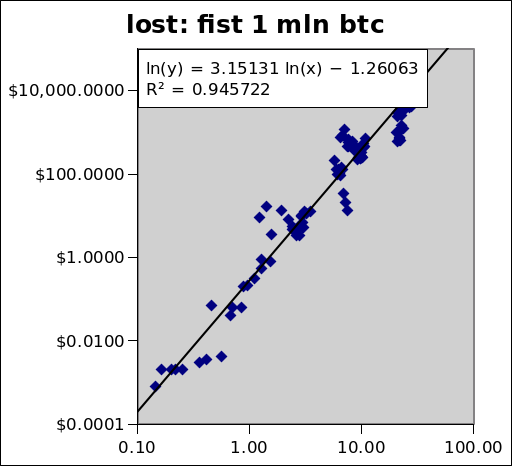

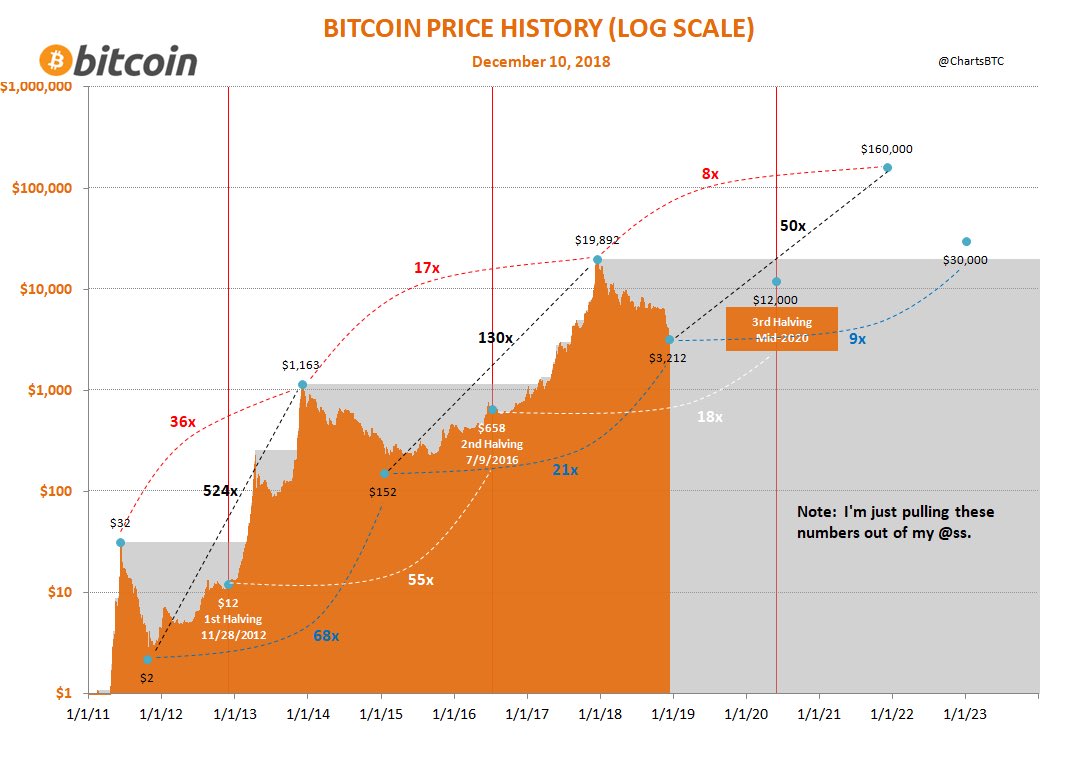

Bitcoin’s SCARCITY is increasing due to the 4 year halving, difficulty adjustment, and growing decentralization.

Currently thousands of people around the world are attempting to “front run” the halving. You’re stacking, I’m stacking, and many others are stacking.

The KEY driver to the price of bitcoin is SCARCITY.