The U.S. and U.K. moved this week to make climate-related financial risks the norm. All businesses everywhere should get ready to do the same.

THREAD: bloomberg.com/news/articles/…

THREAD: bloomberg.com/news/articles/…

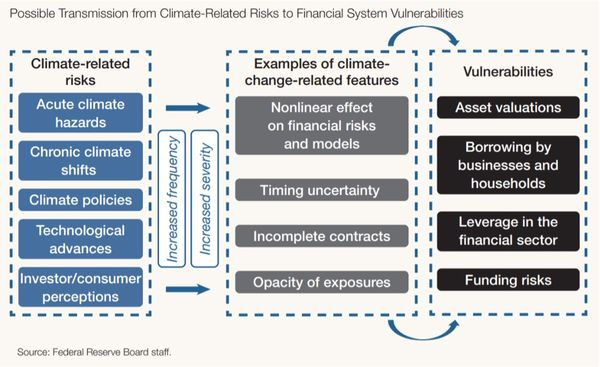

1/ In its latest Financial Stability Report, the @federalreserve specifically calls out climate change as a near-term risk to the financial system. bloomberg.com/news/articles/…

2/ Climate change, it concludes, “increases the likelihood of dislocations and disruptions in the economy” and “is likely to increase financial shocks and financial system vulnerabilities that could further amplify these shocks.” bloomberg.com/news/articles/…

3/ Acute hazards like “storms, floods, droughts, or wildfires, can quickly alter, or reveal new information about, future economic conditions or the value of real or financial assets". Here's the @federalreserve diagram: bloomberg.com/news/articles/…

4/ Chronic hazards, like slowly rising sea levels, seem at first to be easier to price—but “in the presence of rapid shifts in public perceptions of risk,” chronic hazards “have the potential to produce similar abrupt repricing events.” Diagram, again: bloomberg.com/news/articles/…

5/ The Fed concludes by saying that it expects banks “have systems in place that appropriately identify, measure, control, and monitor all of their material risks, which for many banks are likely to extend to climate risks.”

The U.K. goes much further. bloomberg.com/news/articles/…

The U.K. goes much further. bloomberg.com/news/articles/…

6/ Chancellor of the Exchequer Rishi Sunak, took that one giant step further by, among other things, mandating that all major U.K. companies and financial institutions disclose their climate risk by 2025. bloomberg.com/news/articles/…

7/ That disclosure needs to align with the guidance set by the Taskforce on Climate-Related Financial Disclosures by 2025 @FSB_TCFD bloomberg.com/news/articles/…

8/ By 2022, the U.K. expects 100% of “premium listed companies” such as BP Plc and Royal Dutch Shell, to have TCFD-aligned climate risk disclosures. By 2022, it expects 94% disclosure from bank and building societies, and 89% disclosure from insurers. assets.publishing.service.gov.uk/government/upl…

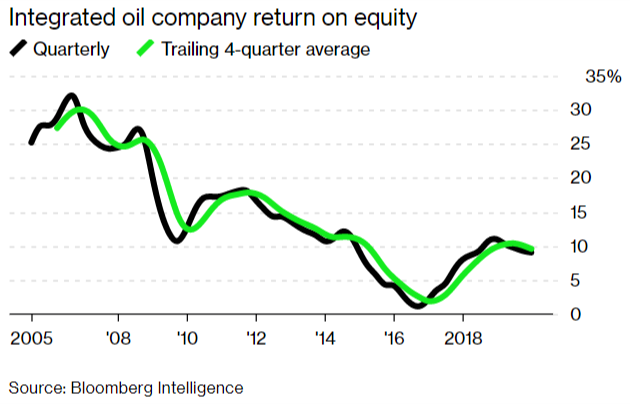

9/ Climate risk disclosure might seem like a somewhat distant and certainly very technical subset of financial market regulation. But as the Fed suggests, climate risk is both here and now, and it has present-day implications for business. bloomberg.com/news/articles/…

10/ There’s a real upside to better understanding climate risk, as this chart by my colleagues at @BloombergNEF (adapted from @FSB_TCFD ) shows: bloomberg.com/news/articles/…

11/ @hmtreasury is taking the product of measuring and understanding climate risk and making it a requirement for the U.K.'s most important businesses and financial institutions. Could the U.S. do the same? bloomberg.com/news/articles/…

12/ The incoming administration can take a whole-government approach, even if it may not have the Senate control to pass its climate measures into law. bloomberg.com/news/articles/…

13/ That approach could include following the U.K.'s lead, with the Securities and Exchange Commission requiring disclosure of climate risks. That, and the Fed's guidance, could lead to less risky, climate-positive business and investment strategies. bloomberg.com/news/articles/… /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh