As time goes on and Bitcoin's network effect grows, educational content gets better, UX/UI of onramps and services get simpler, it gets easier for people to "get it"

Just like with the Internet in the 90s, social media, mobile, etc.

Same chart, now not in log format

Just like with the Internet in the 90s, social media, mobile, etc.

Same chart, now not in log format

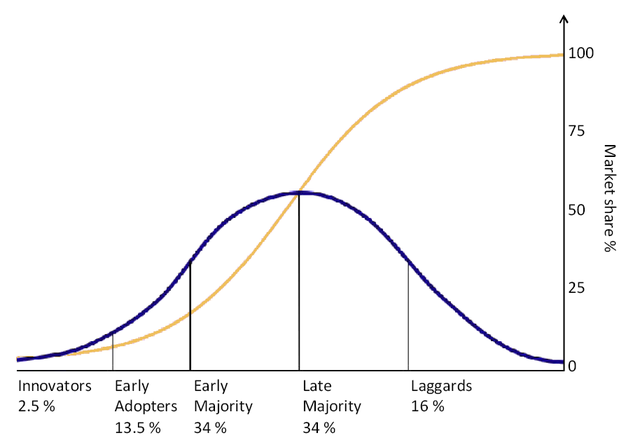

If we think about how equipped everyone in the world is to understand that Bitcoin is on a trajectory to become the world's preferred money / dominant SoV... we would have a bell curve distribution, shown here

The people who have understood Bitcoin to-date are part of the extreme edges of the normal distribution of humanity, for various reasons (e.g., software engineering, previous study of Austrian economics or libertarianism, life experiences, distrust of authority, curiosity, luck)

The implication here is two-fold:

1. It will get easier and easier for everyone to understand and see the value of Bitcoin as a primary unit of account

2. We have not yet reached the bulk of the bell curve, but it is fast approaching

1. It will get easier and easier for everyone to understand and see the value of Bitcoin as a primary unit of account

2. We have not yet reached the bulk of the bell curve, but it is fast approaching

@halfin @real_vijay @vijay_follower_ @TuurDemeester @pierre_rochard @saifedean @parkeralewis @Breedlove22 @michael_saylor

@PrestonPysh @nic__carter @MartyBent @matt_odell @stephanlivera @johnkvallis @CitizenBitcoin @princey1976 @nlw @ck_SNARKs @TheCryptoconomy @HODLAMERICAN615 @hodlonaut @bitstein @SwanBitcoin @coryklippsten @BVBTC @skwp @maxkeiser @edstromandrew @sthenc @LynAldenContact

• • •

Missing some Tweet in this thread? You can try to

force a refresh