Thread:

Dollars, gold, #Bitcoin - which is the best for storing your hard earned money?

----

All forms of money grow in total value as the global economy grows. What differs is how they do it.

The U.S. prints as many dollars as needed to achieve 2% inflation.

Dollars, gold, #Bitcoin - which is the best for storing your hard earned money?

----

All forms of money grow in total value as the global economy grows. What differs is how they do it.

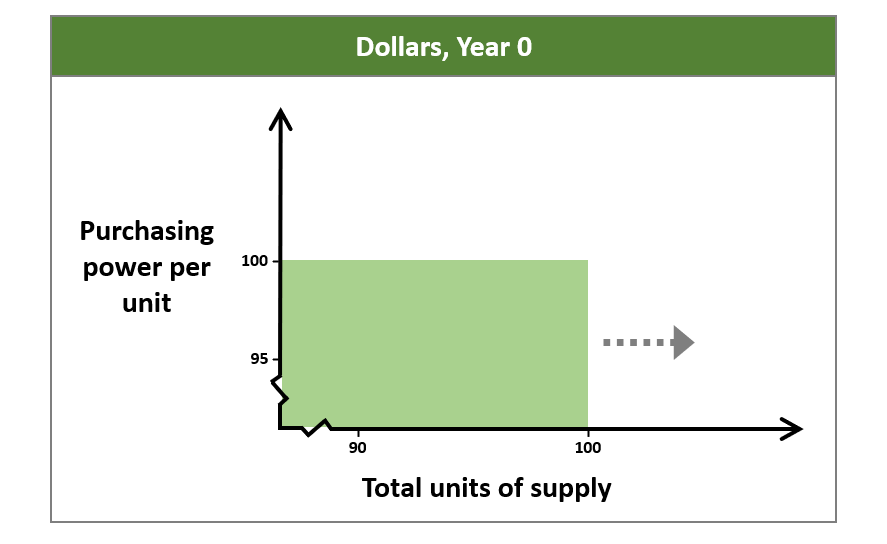

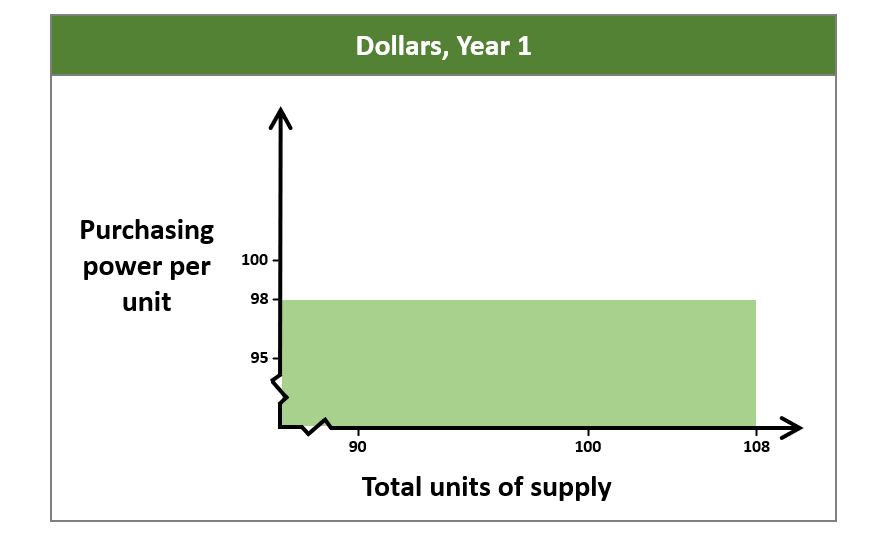

The U.S. prints as many dollars as needed to achieve 2% inflation.

The only way to do this is to pull supply out to the right far enough that it deflates the purchasing power of all existing dollars by ~2%. (For your own good!)

Since 2010, this has meant an average supply increase of ~8% per year. Source: fred.stlouisfed.org/series/M2

Since 2010, this has meant an average supply increase of ~8% per year. Source: fred.stlouisfed.org/series/M2

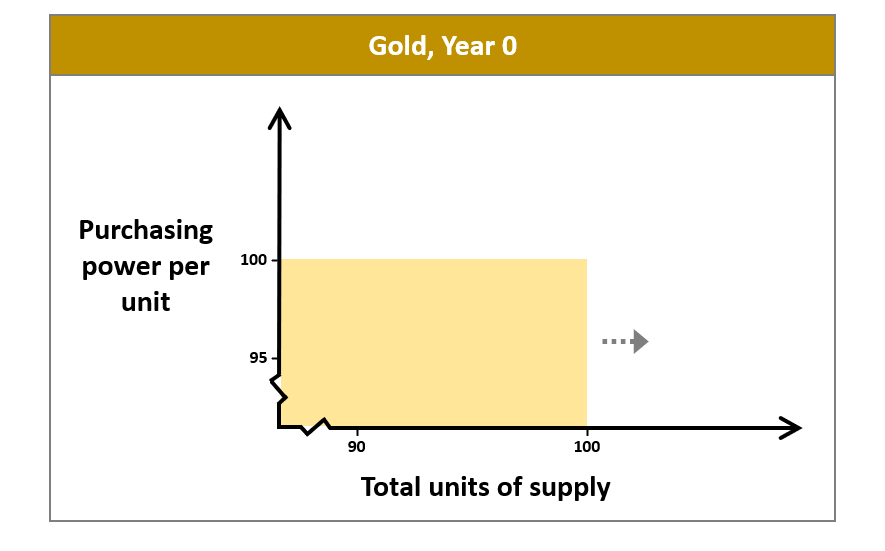

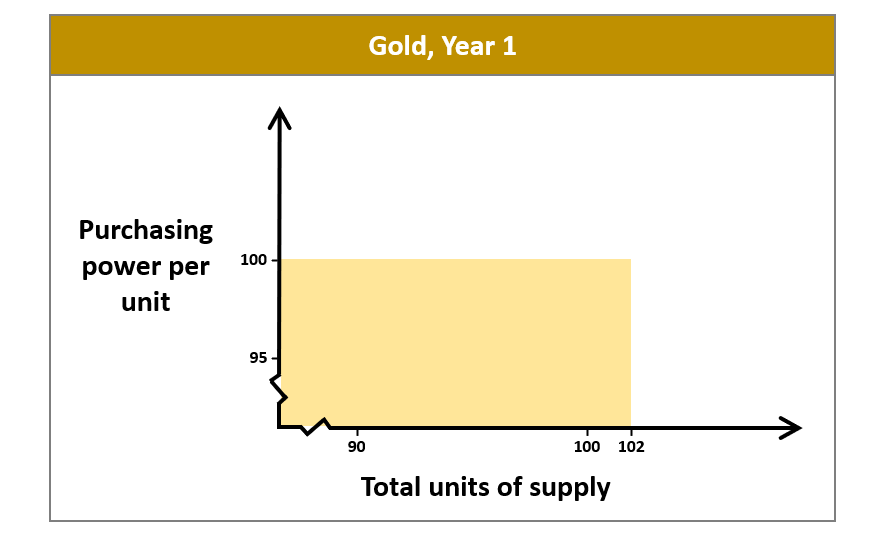

Gold's supply is not actively managed. However, the free market efforts of gold mining adds ~2% to total supply every year.

Since the global GDP also increases by ~2% every year, this means the purchasing power of one unit of gold is unchanged.

This makes it a better store of value than dollars.

Source: macrotrends.net/countries/WLD/…

This makes it a better store of value than dollars.

Source: macrotrends.net/countries/WLD/…

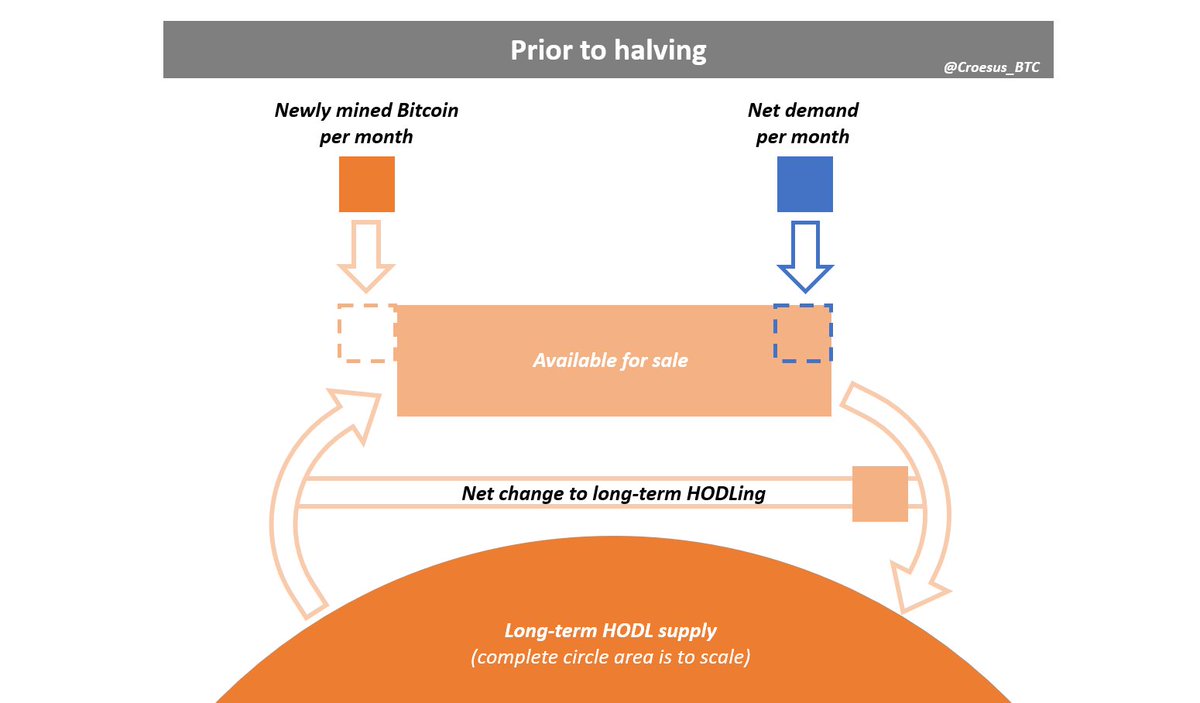

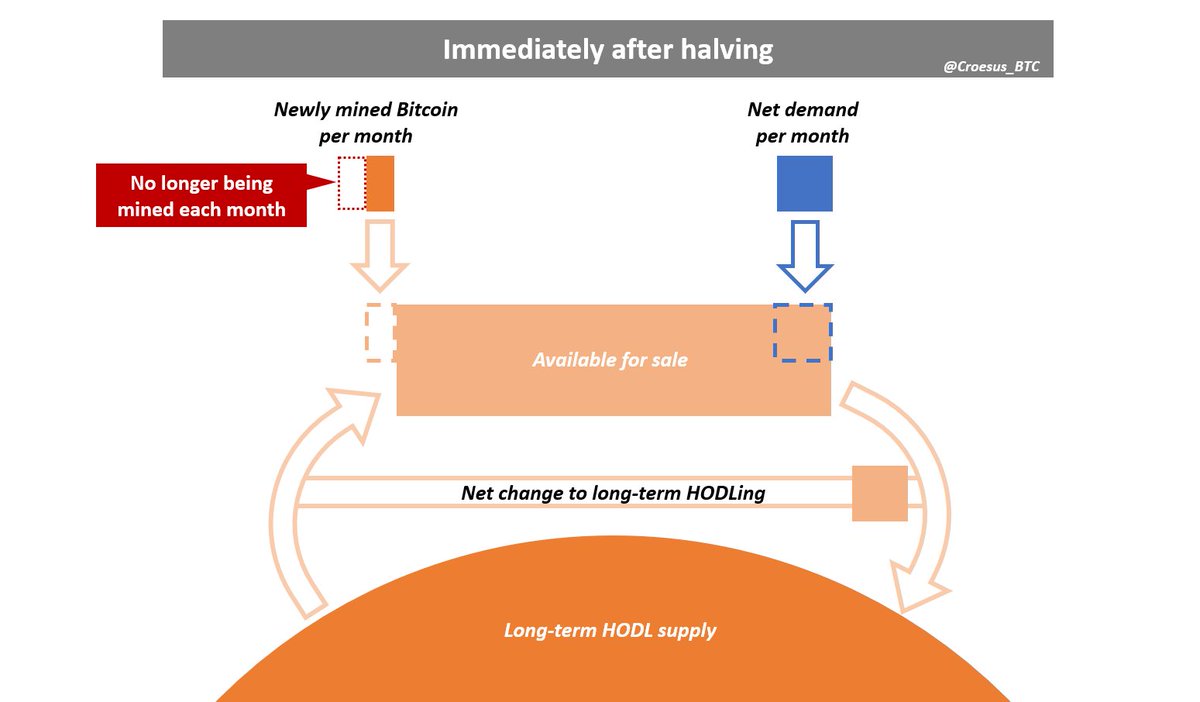

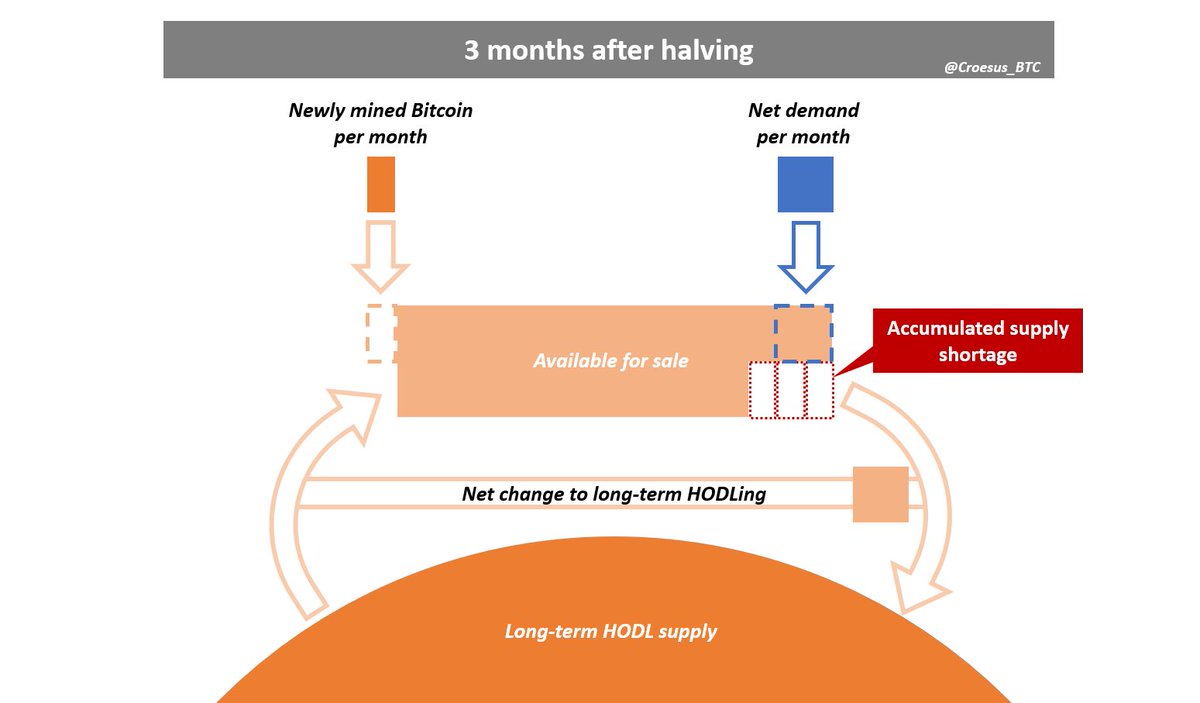

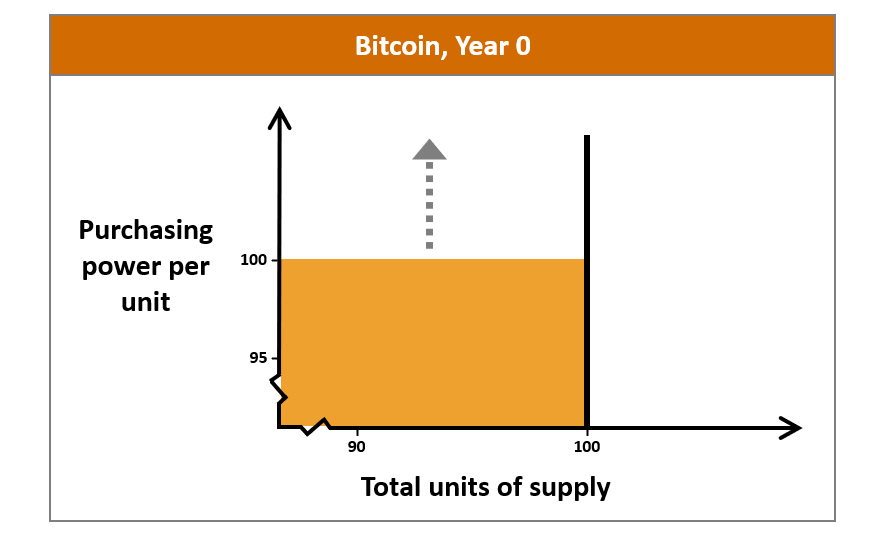

Bitcoin takes a different approach. For the first time in history, there is a money whose total supply is fixed. In contrast to dollars and gold, there is only one direction by which Bitcoin can grow.

Which form of money is best for storing your savings in Year 0?

Which form of money is best for storing your savings in Year 0?

• • •

Missing some Tweet in this thread? You can try to

force a refresh