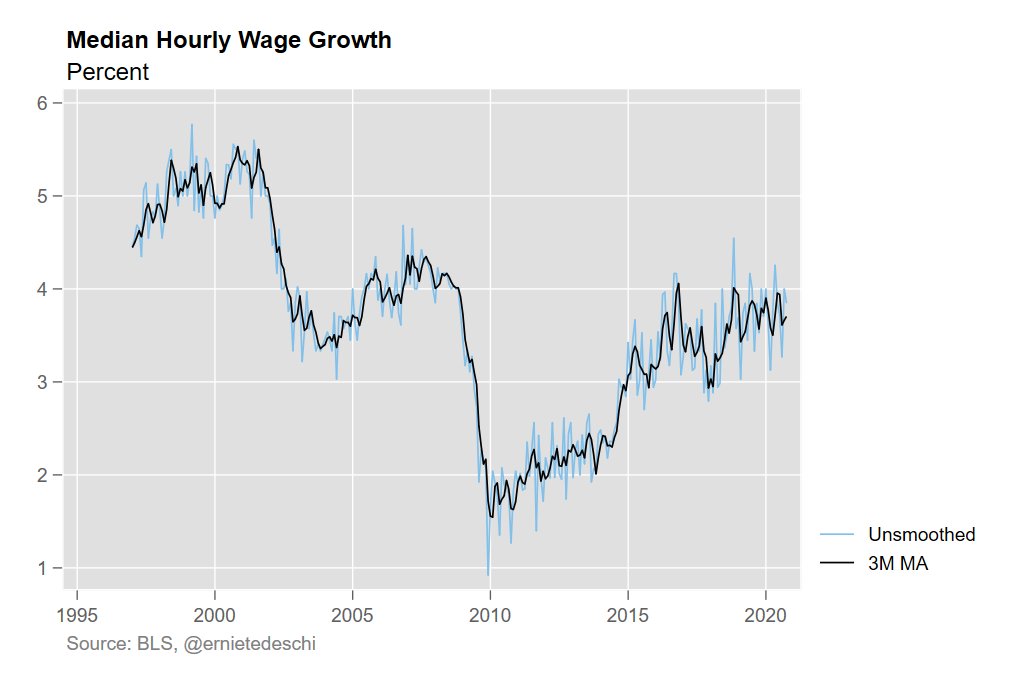

On the one hand, the US recovery so far has been durably positive & modest

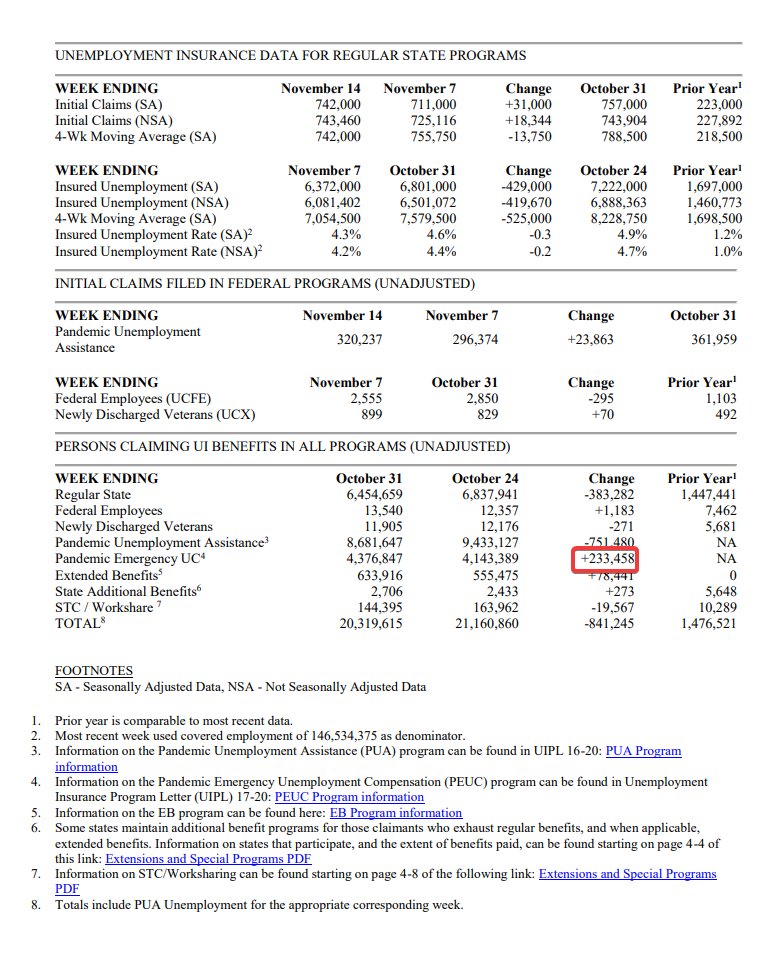

On the other hand, b/t the COVID surge, the cold winter weather, exhausted household savings, the end of moratoria on student loans/foreclosures/evictions, & UI expirations, we're piling on a lot of risks

On the other hand, b/t the COVID surge, the cold winter weather, exhausted household savings, the end of moratoria on student loans/foreclosures/evictions, & UI expirations, we're piling on a lot of risks

https://twitter.com/ernietedeschi/status/1329050007358599170

And add on the risks of business closures & state/local cuts. There's a lot that can hurt us economically between now and wide vaccine distribution.

The wrong question to ask is whether the recovery is "self-sustaining" without further fiscal support. I am less confident in this assessment now, but it's still quite possible that if we got no fiscal package most economic data would continue coming in north of zero.

Instead...

Instead...

...the better question is how can further economic assistance 1) sustain families going through hardship now, especially the ones on the cusp of losing *all* their jobless benefits after Dec 31, and 2) shorten the time it takes to recover by supporting demand & healing supply.

Illustratively, even if we kept up October's jobs pace, it'd take another year-and-a-half just to crawl back to February levels, and another two-and-a-half years to get to where we'd plausibly have been otherwise.

That's already a long recovery. Even longer if growth slows.

That's already a long recovery. Even longer if growth slows.

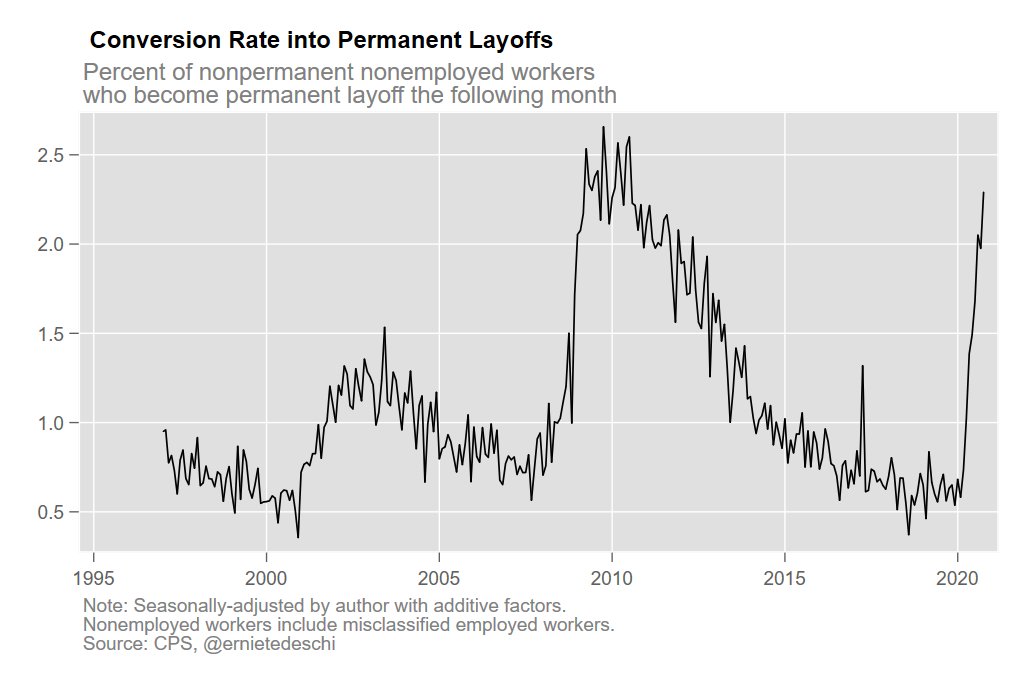

The recovery from the Great Recession was painfully long; we want to avoid that.

At this point, the risks of doing too much are far outweighed by the risks of doing too little.

At this point, the risks of doing too much are far outweighed by the risks of doing too little.

The economy is dynamic: we might do a lot and discover later that we underestimated our economy's capacity for self-healing in the face of a pandemic shock.

I'd much rather us make that happy error than discover that we made matters worse by prematurely declaring victory.

I'd much rather us make that happy error than discover that we made matters worse by prematurely declaring victory.

In short, America going into the winter months without more economic support is like a young runner with a serious injury competing in a rugged 10K after a week of good therapy because she can't feel the pain.

*Maybe* she'll be fine. But the risks are alarming.

*Maybe* she'll be fine. But the risks are alarming.

• • •

Missing some Tweet in this thread? You can try to

force a refresh