The vast majority of people think they can beat the crypto markets even though they're something like a full-time dentist and they play squash twice a week and they have two kids and a wife and they get about 30 minutes a day to study crypto

More 👇

More 👇

2/

But sure, they've read @benmezrich's Bitcoin Billionaries. They listen to @APompliano's podcast. They understand blockchain

That means they can compete with the OG 🐳s who've owned $BTC since Gox died + still spend 12 hrs a day reading, learning + experimenting in crypto

But sure, they've read @benmezrich's Bitcoin Billionaries. They listen to @APompliano's podcast. They understand blockchain

That means they can compete with the OG 🐳s who've owned $BTC since Gox died + still spend 12 hrs a day reading, learning + experimenting in crypto

3/

It's especially laughable when that sort of person thinks they can short-term trade. Like the right entry and exit points are always between 9 p.m. and 10 p.m. on Thursdays when they actually have a minute to look at the markets lol

It's especially laughable when that sort of person thinks they can short-term trade. Like the right entry and exit points are always between 9 p.m. and 10 p.m. on Thursdays when they actually have a minute to look at the markets lol

4/

So if you're not:

- a full-time trader

- someone who has 10+ hours a week to burn on research

- someone with a technical trading background

You should throw short-term trading out the window. You'll get f'ing roasted by the whales and pros

So if you're not:

- a full-time trader

- someone who has 10+ hours a week to burn on research

- someone with a technical trading background

You should throw short-term trading out the window. You'll get f'ing roasted by the whales and pros

5/

I can assure you that isn't fake news. It's temporal reality. You simply won't have enough time to know what's good, what's utter horseshit and/or when a project has materially changed

So ser, how can I pick the right tokens to invest in?

I can assure you that isn't fake news. It's temporal reality. You simply won't have enough time to know what's good, what's utter horseshit and/or when a project has materially changed

So ser, how can I pick the right tokens to invest in?

6/

Well, I'm a 🤡 fren... I don't give investment advice. But if I did, I'd probably say something like "it's pretty fucking obvious that you need to own $BTC and $ETH, right?"

Well, I'm a 🤡 fren... I don't give investment advice. But if I did, I'd probably say something like "it's pretty fucking obvious that you need to own $BTC and $ETH, right?"

7/

They should make up half or more of your holdings. They're our godfathers after all. They are the golden calves before which we bow. And we bow before them not just bc of what they are, but bc of where they're going. They've not reached anything close to their potential yet

They should make up half or more of your holdings. They're our godfathers after all. They are the golden calves before which we bow. And we bow before them not just bc of what they are, but bc of where they're going. They've not reached anything close to their potential yet

8/

If you're not long AF $BTC + $ETH, let me say there's such a thing as being TOO contrarian. I know you want to feel cute + clever + "in the know," but it ain't hard. BUY THE BIG DOGS. Don't put 100% into a 2-man project that sprung up 4 days ago that you read about on Reddit

If you're not long AF $BTC + $ETH, let me say there's such a thing as being TOO contrarian. I know you want to feel cute + clever + "in the know," but it ain't hard. BUY THE BIG DOGS. Don't put 100% into a 2-man project that sprung up 4 days ago that you read about on Reddit

9/

Ok ser, if I put 50% into $BTC and $ETH, ser, what to do with the other half of the monies?

Maybe 30-40% into category leaders

What does that mean ser?

Means there are verticals + there are projects that any green frog can tell you are leading those verticals

Ok ser, if I put 50% into $BTC and $ETH, ser, what to do with the other half of the monies?

Maybe 30-40% into category leaders

What does that mean ser?

Means there are verticals + there are projects that any green frog can tell you are leading those verticals

10/

Examples, ser?

Oracles = $LINK

Borrowing/lending = $AAVE

Yield aggregators = $YFI

Derivatives = $SNX

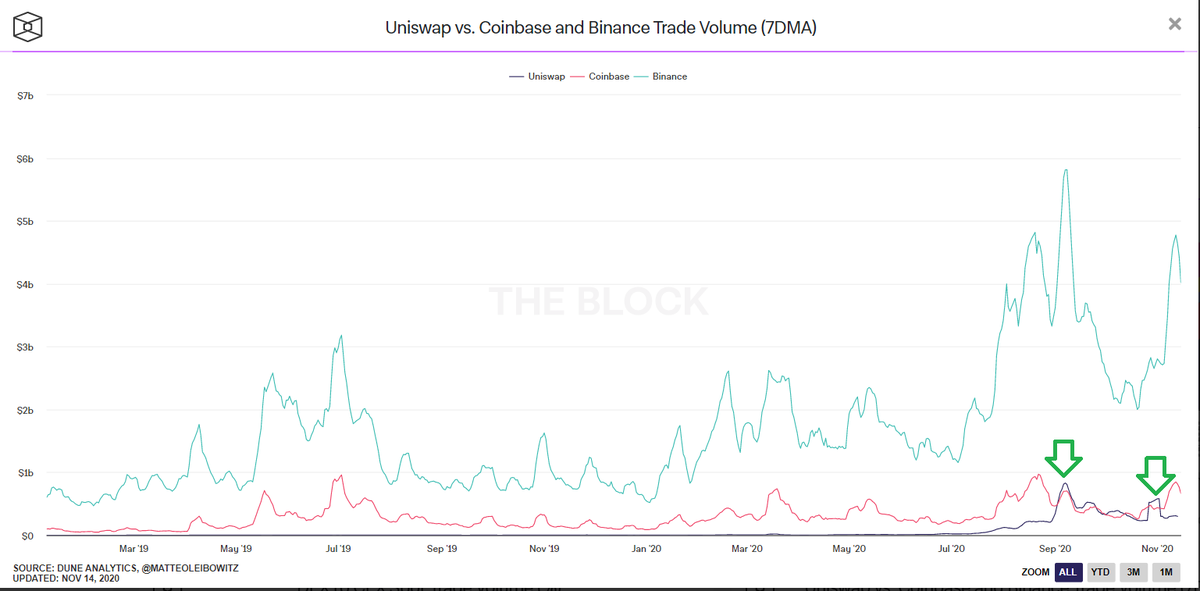

DEXes = $UNI $RUNE

Read about them. USE THEM. See which ones you believe in most... which ones you think have the most potential to change the world, and buy and hold.

Examples, ser?

Oracles = $LINK

Borrowing/lending = $AAVE

Yield aggregators = $YFI

Derivatives = $SNX

DEXes = $UNI $RUNE

Read about them. USE THEM. See which ones you believe in most... which ones you think have the most potential to change the world, and buy and hold.

11/

Hold.

Hold.

Hold.

Do that fren, and you'll be just fine. The whales will have nothing on you

You and I will be holding the good stuff side by side... and letting time and adoption do their jobs

Hold.

Hold.

Hold.

Do that fren, and you'll be just fine. The whales will have nothing on you

You and I will be holding the good stuff side by side... and letting time and adoption do their jobs

12/

For that last 10-20%, that's where u can get your jollies. Put it into that weird shiz like "Elongated Earl's Magical Chainlink Killer" or "14-Year-Old Boy's Compound Fork with a Reverse Cowboy Integration of Mimblewimble"

Sure. Gamble responsibly. You earned it

🤡 out

For that last 10-20%, that's where u can get your jollies. Put it into that weird shiz like "Elongated Earl's Magical Chainlink Killer" or "14-Year-Old Boy's Compound Fork with a Reverse Cowboy Integration of Mimblewimble"

Sure. Gamble responsibly. You earned it

🤡 out

• • •

Missing some Tweet in this thread? You can try to

force a refresh