If I had to name the most important event in crypto in 2020, it would hands-down be the triumphant climb of Uniswap to the peak of Mount Olympus

What a fucking demigod

$14 million locked 1 year ago. $2.88 billion locked today. Growth of 20,000% (@defipulse)

More below 👇

What a fucking demigod

$14 million locked 1 year ago. $2.88 billion locked today. Growth of 20,000% (@defipulse)

More below 👇

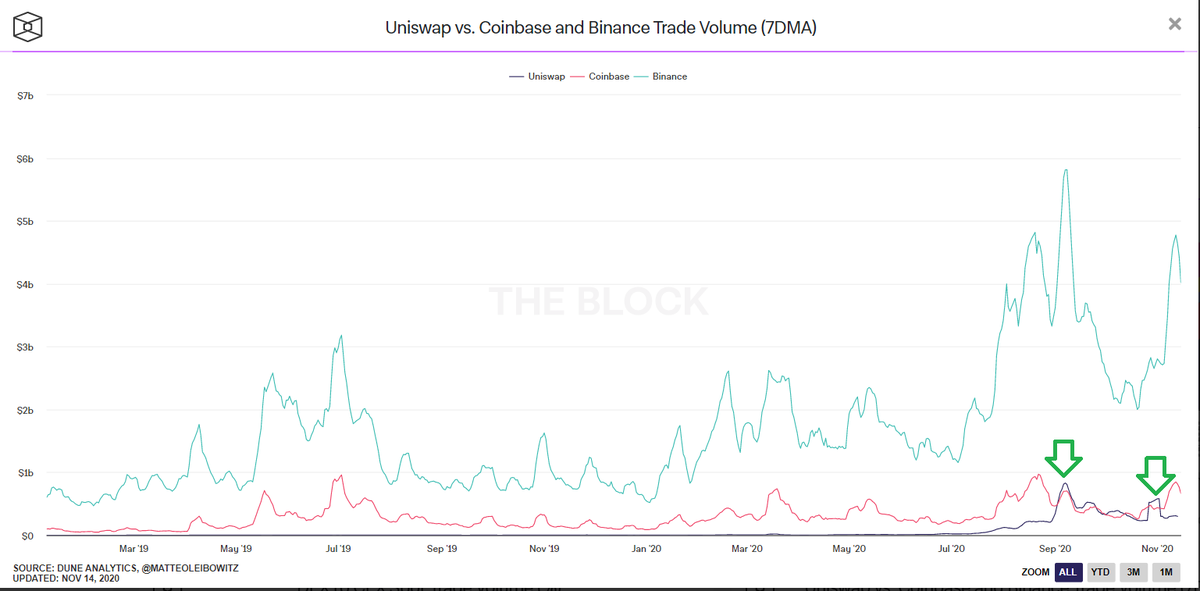

$UNI trading volumes have outpaced Coinbase some days... and Binance ain't all that far away

@TheBlock__

3/x

@TheBlock__

3/x

Hulk mode engaged. Changes to $UNI incentives are upon us now, but stepping back, here are a few takeaways from $UNI's growth as well as a prediction for 2021:

4/x

4/x

1) $UNI could be labeled a must-own. If you're a short-term trader, you might get it cheaper over the next few months (esp if there's a macro selloff). Remember, just 21% of the supply is in circ., so dilution will happen....

5/x

5/x

... If you're a long-term trader, I couldn't fault you for longing $UNI here (note I'm not long. I do have one wallet w 400 tokies that I haven't touched, but that's mostly out of laziness more than anything...)

6/x

6/x

2) Uniswap's got an Achilles heel: it only supports ERC20s and pegged assets. Maybe that's good enough to dominate for years to come. But native cross-chain trading just has benefits you can get with pegged tokens....

7/x

7/x

Uniswap showed us the way. But now, I feel like there's pressure building behind the dam... traders want Uniswap-like functionality for all blockchains. They want one place to go to trade any asset on any chain, and that's what $RUNE and @thorchain_org is building....

8/x

8/x

... So just as 2020 was the year of Uniswap, 2021 could be the year of Thorchain's Asgardex... especially since other chains are finally poking their heads above ground. (note I'm long $RUNE)

9/x

9/x

5) In fact, Thorchain could be the catalyst that accelerates adoption of other chains. If I were building on another blockchain (hey $DOT, $XTZ, $ADA, $XHV, $XRP, $TRX), one of my top priorities right now would be prepping to get my chain on Asgardex ASAP....

10/x

10/x

... I know you're focused on building your own cute little Uniswap clone on your blockchain... but what if you're missing the forest for the trees? What if you skip that step (leave it to other devs) and go cross-chain? Spin up a Thorchain node.

11/x

11/x

Get your tokens listed on Asgardex as soon as you're able. Get the tokens that are released on top of your chain listed, too. Don't watch from the sidelines while $RUNE starts climbing the mountain.

12/x

12/x

6) Back to Uniswap. Their volume seems insane, but we ain't seen nothing yet. We're going to see more unusual tokens trading on it.... things like $yTRUMP and $nTRUMP from those badasses at @catnip_exchange and $NFT indexes like the one my boy @alexgausman is building.

13/x

13/x

But most importantly, we're going to see derivatives trading on $UNI. We're going to have leveraged tokens targeting daytraders who will ramp up fee income exponentially. It's going to be utter madness. And I can't fucking wait

14/x

14/x

7) Uniswap melted the faces of centralized crypto exchanges this year. Next year, it'll rip hair off the chest of the tradfi establishment as it poaches market share of other assets (things like Synthetix's $SNX synthetic oil derivative, $sOIL, forex, stocks, options, etc).

15/x

15/x

8) In my mind, Uniswap represents a form of freedom. It's trading without needing permission from a bureaucrat and without having to trust my crypto to someone else

9) What's the takeaway, huh? I guess it's buckle tf up. We've started the engine, boys, and now, it's time to move

9) What's the takeaway, huh? I guess it's buckle tf up. We've started the engine, boys, and now, it's time to move

• • •

Missing some Tweet in this thread? You can try to

force a refresh