1/

Why, ser, are you so bullish on decentralized derivatives?

Well, for one, I'm an American. I can buy assault rifles + shoot myself up with heroin, but JFC, the boot will be on my neck if I say I'd like to trade some crypto derivatives

DeFi does not ask to see "my papers"

Why, ser, are you so bullish on decentralized derivatives?

Well, for one, I'm an American. I can buy assault rifles + shoot myself up with heroin, but JFC, the boot will be on my neck if I say I'd like to trade some crypto derivatives

DeFi does not ask to see "my papers"

2/

For two, I think most investors are underexposed to decentralized derivatives (with the possible exception of $SNX). That coupled with the fact that they're finally getting useful AF is why they currently make up about 50% of my crypto portfolio

For two, I think most investors are underexposed to decentralized derivatives (with the possible exception of $SNX). That coupled with the fact that they're finally getting useful AF is why they currently make up about 50% of my crypto portfolio

3/

One helpful way to allocate your portfolio is to consider the size of tradfi markets. For bitcoin, you can do something like this:

Store of value in the real world (gold): $7.5 trillion

Store of value in digital world ($BTC): $300 billion

One helpful way to allocate your portfolio is to consider the size of tradfi markets. For bitcoin, you can do something like this:

Store of value in the real world (gold): $7.5 trillion

Store of value in digital world ($BTC): $300 billion

4/

Huge opportunity there + I'm sure as hell not calling $7.5t an upper bound for bitcoin. #Bitcoin could also be base money. It could replace the $32 trillion that's tied up in offshore banking. We could even see some of the $BTC smart contract platforms gain traction and...

Huge opportunity there + I'm sure as hell not calling $7.5t an upper bound for bitcoin. #Bitcoin could also be base money. It could replace the $32 trillion that's tied up in offshore banking. We could even see some of the $BTC smart contract platforms gain traction and...

5/

... watch it grow it in new directions. But for now, the $BTC narrative is store of value. And for now, the closest analogue gold.

So how big are derivatives?

Derivatives gross value: $11 trillion

Derivatives notional value: $500 trillion-$1 quadrillion+

... watch it grow it in new directions. But for now, the $BTC narrative is store of value. And for now, the closest analogue gold.

So how big are derivatives?

Derivatives gross value: $11 trillion

Derivatives notional value: $500 trillion-$1 quadrillion+

6/

Gross value of derivatives is 42% bigger than store of value (gold). Notional value's a bit of a joke, but I do believe blockchain-based derivatives will dwarf traditional derivatives. That's because of the mind-bending marketplaces that are popping up

Gross value of derivatives is 42% bigger than store of value (gold). Notional value's a bit of a joke, but I do believe blockchain-based derivatives will dwarf traditional derivatives. That's because of the mind-bending marketplaces that are popping up

7/

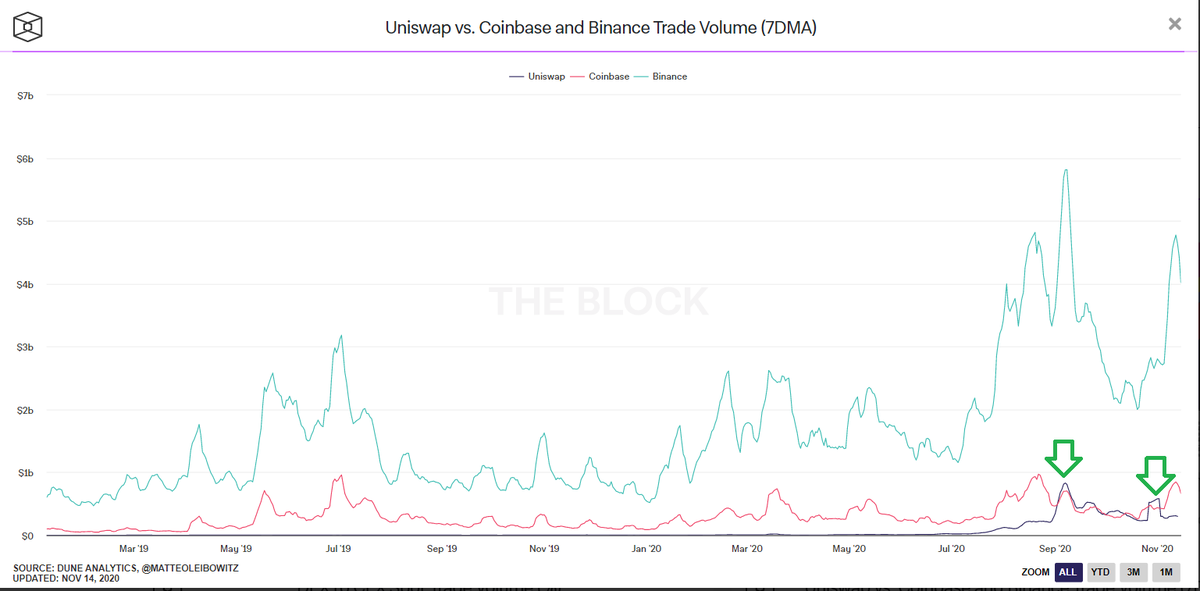

You don't nec need a counterparty. Much like AMMs are disrupting centralized exchanges, on-chains options, perps, futures, will disrupt centralized derivatives markets

You don't nec need a counterparty. Much like AMMs are disrupting centralized exchanges, on-chains options, perps, futures, will disrupt centralized derivatives markets

8/

Even more exciting is the fact that these new derivatives will be composable. We ain't seen nothing yet. And it all begs the question, how much do you have allocated to store of value? How much do you have allocated to decentralized derivatives? And why?

Even more exciting is the fact that these new derivatives will be composable. We ain't seen nothing yet. And it all begs the question, how much do you have allocated to store of value? How much do you have allocated to decentralized derivatives? And why?

• • •

Missing some Tweet in this thread? You can try to

force a refresh