As promised!

We all know one reason banks are doing well since the beginning of the Covid crisis is that so much has been swept under the rug with guarantees and moratoriums.

So it’s great to actually have a look at what is hidden under that carpet! Thanks, EBA.

We all know one reason banks are doing well since the beginning of the Covid crisis is that so much has been swept under the rug with guarantees and moratoriums.

So it’s great to actually have a look at what is hidden under that carpet! Thanks, EBA.

https://twitter.com/jeuasommenulle/status/1329843254934777857

Let’s start with the basics: the numbers, in % of loan book. And the differences in the EU are huge.

THE GOLDEN CARPET AWARD GOES TO CYPRUS

(And it's not even close even if Portugal, Hungary or a few others are really worrying.)

THE GOLDEN CARPET AWARD GOES TO CYPRUS

(And it's not even close even if Portugal, Hungary or a few others are really worrying.)

But one should be careful: EBA moratorium are not the only measures, some banks took measures that were not “EBA compliant”. Is this significant? Well, in some countries it’s up to 40% of all Covid measures.

So, if you add up both types of measures, it slightly changes the picture & some countries with low EBA moratorium appear (a little bit) less sexy. But don’t get overexcited, the usual suspects still appear horrible.

The EBA also looked at how moratorium split between household, CRE, SME, etc. Here’s the chart summarizing everything.

(70% of household debt in Cyprus... yiiikes.)

(70% of household debt in Cyprus... yiiikes.)

You can’t really see anything on that chart? Yeah, I thought so. So here are the salient points.

1st – There are 75% more moratoriums on SMEs than on larger Corps.

This is important because, if you remember an earlier thread I made, banks did not provision correctly on SMEs. So that’s really your big risk zone.

This is important because, if you remember an earlier thread I made, banks did not provision correctly on SMEs. So that’s really your big risk zone.

In some countries, this ratio (SME/Corp) is even bigger (170% in Italy or Ireland), 200% in the Netherlands.

Also, interestingly, there is a strong correlation between Corp and SME moratorium (yeah, I know, expected.)

Logically, when one sees that kind of scatter plot, the next question is: what about the outliers?

Who has « too much » or « not enough » moratorium? Here they are for you.

Two hot zones: Italie & Ireland (also Hungary, but you probably don’t care, not many listed banks there)

Who has « too much » or « not enough » moratorium? Here they are for you.

Two hot zones: Italie & Ireland (also Hungary, but you probably don’t care, not many listed banks there)

2nd important fact: there are 50% more moratorium on Corps than on households.

This is significant, but clearly not the same across countries.

Spain is where there are huge household moratoriums. I believe they are less risky ones.

This is significant, but clearly not the same across countries.

Spain is where there are huge household moratoriums. I believe they are less risky ones.

What about sectors? We all know Covid is hitting different sectors differently, but what do the numbers show? And more importantly, is it very different from the early assumptions made, for example, in the ECB’s FSR?

Hotels & Food, Entertainment or real estate behave exactly as expected (i.e. poorly) but the good surprises come from Manufacturing & retail/wholesale. This is good news for Manuf heavy countries (e.g. Italy). The bad surprises are Education" & Health. Odd.

A key aspect of all this is when will we remove the carpet with all the shit under it? i.e. when do the moratoriums expire?

We have some useful data that allows me to compute the share of post-2020 expiry per country.

We have some useful data that allows me to compute the share of post-2020 expiry per country.

Overall, 86% is expiring in 2020… so clarity should be delivered soon, but in some countries, you’ll have to wait longer…much longer sometimes! This is bad for Portugal. (I wouldn’t worry about SE & their 0.000001% cost of risk…)

There are only three countries with a weighted average life over 0.6: Sweden (1.13), Finland (0.83), and Portugal (0.64). But as you can see from this chart, the first two have low numbers anyway and there are 3 countries with big, looooong carpets.

(Unfortunately, I should point out that this chart is not entirely accurate as it does not take into account recent extension measures (e.g. Spain or… Portugal !) so it’s slightly worse than it appears.)

What we all want to know, obviously, is how much of those moratoria will turn into NPL. That’s really a difficult question. We have some numbers from some banks regarding expired moratorium, with low NPL, but it’s hard to say if there is some bias there or not.

It could be, e.g. that only “good banks” are reporting numbers or that only good debtors are exiting from moratoriums, while others extend with various schemes...

We have some info on this in the new EBA data: we get the share of loans under a moratorium that are NPLs: 2.5%.

That might look low, but is it really? Remember that normally, moratorium schemes were only open to non-NPL!!

That might look low, but is it really? Remember that normally, moratorium schemes were only open to non-NPL!!

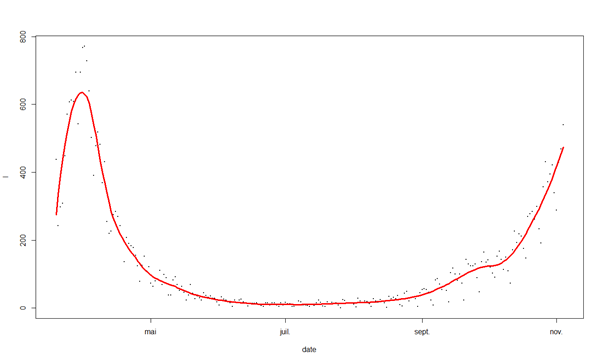

So what we have there are loans that went from good loans to NPL in 3 months. That’s fast. If you annualise, it almost looks like there is a 10% default rate on moratorium loans. But, again, the country dispersion is HUGE.

Greece only accounts for more than *20%* of *all EU* NPL under moratorium!

Worse, if I annualize the default rates for each country this is what I get. Those are big numbers. Greek banks, for example, say that 20% is realistic (compared to my 58%).

Worse, if I annualize the default rates for each country this is what I get. Those are big numbers. Greek banks, for example, say that 20% is realistic (compared to my 58%).

I suspect this is because somehow banks put under moratorium some loans that were already NPLs. I am not sure exactly how this is possible – I need to dig deeper into this – but at least you can have an idea of relative ranks of moratorium default rates.

Are those NPL with moratorium adequately provisioned? The coverage ratios below suggest that those NPL are more unlikely to pays loans than actual defaulted loans (which makes sense if there’s nothing to pay anyway, you can't really default!)

But does it really make sense? When payment will come due again, they will be quick to migrate to the defaulted loans category.

If you look e.g. at Italy or Portugal, 30% coverage ratios for UTP loans is fair…but the past NPL crisis showed that this is where problems come from. The slow migration from UTP to defaulted loans creates never-ending quarterly provisions – which is what the SSM tried to stop.

So I suggest you watch this space carefully, because if nothing is done, we’ll probably get the same slow-dripping problem we had some years ago.

Now that we kive under IFRS9 rules, we also have Stage 2 loans, i.e. loans that have seen credit risk deteriorate. How you book those Stage 2 loans is a fascinating topic, worth many threads, but let’s keep our focus.

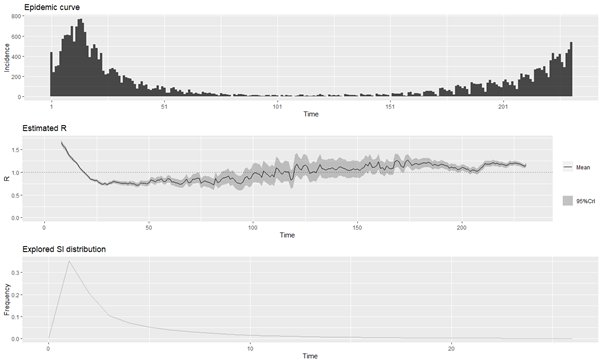

The EBA points out something weird. There is a strong link between the % of stage 2 loans and the % of Stage 2 loans under moratorium. You might think this is logical (moratorium are riskier) but actually, it does not make any sense.

There could be a link between % of moratorium and % of moratorium Stage 2 loans but there isn’t (R^2 = 1%) or % of Stage 2 loans and % of moratorium (if everyone applied more or less the same % of Stage 2 to moratorium loans) but there isn’t (R^2 = 11%).

The more I think about it, the more I believe this shows how different banks have different models and criteria to determine when a loan is in Stage 2. Highly “sensitive” banks book Stage 2 loans very quickly, and this applies to moratorium too.

Banks with models that basically say all is good until very late in the downgrading process, will do it both for a moratorium and a non-moratorium loan. Of course, I’ve always suspected it, but this is the first time I actually see clear evidence of it.

The (bad) outliers to this regression are Cyprus, Italy, Ireland, and Portugal. I would be most worried when both the absolute number of S2 loans is low (so models are not sensitive enough) AND it’s an outlier in the regression.

The EBA also had a look at guaranteed loans. From an analyst’s point of view, it’s slightly less interesting because the outcome is simpler. But let me make a few points.

Corporate loans are 95% of guaranteed loans and France + Spain is more than 83% of the EU total. It’s also significant in Portugal (2.1% of the loan book) or Italy (1.2%) but elsewhere this is negligible.

We also get sector by sector data which allows me to compute the “total aid” received by each sector and nuance a bit the analysis based on moratoriums only.

Retail & wholesale trade or construction received more help than moratoriums only suggest and real estate received less. But both manufacturing and transport continue to appear good – or rather less bad than expected.

I'll make one last point on something I think could be very important in a few years' time. The data shows something totally unreal: out of a sample of 67 banks, 5 already have 10%+ NPLs on guaranteed loans.

This is in 3 months since the data is as of June 30th, 2020. 6 banks have NPL% between 2% and 5%.

There is NO WAY this 10% has been achieved without the banks knowing a big chunk was going into NPL.

There is NO WAY this 10% has been achieved without the banks knowing a big chunk was going into NPL.

And honestly, good luck with getting your money back from the government, because it will have a good case to argue the guarantee is void, IN MY OPINION.

Enjoy your week and stay safe!

Enjoy your week and stay safe!

• • •

Missing some Tweet in this thread? You can try to

force a refresh