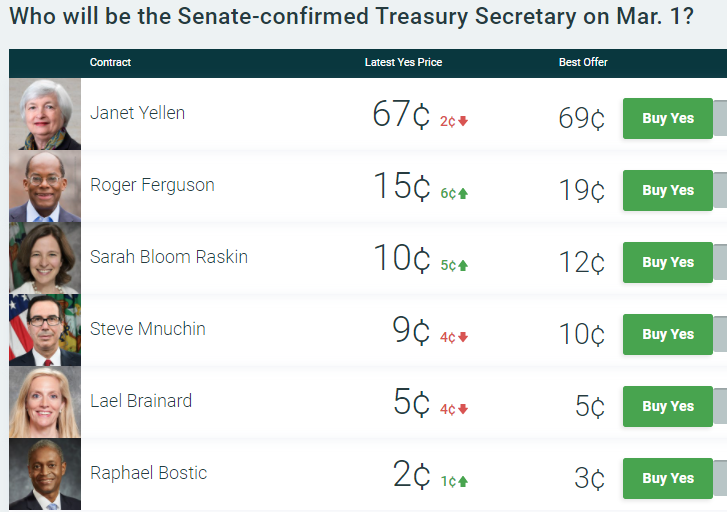

Earlier, I posted this on Twitter and, predictably, all the conversation is about Mnuchin at 9%. Why?

(1/7)

(1/7)

Remember that the limit for an account is $850. So, if you are dead sure that Mnuchin will not be the TreasSec on March 1, then deposit $850 and in an account and get an $80 profit on March 1.

This is not why people bet on @PredictIt. They want to speculate!

(2/7)

This is not why people bet on @PredictIt. They want to speculate!

(2/7)

So, some bettors think it makes more sense to buy Mnuchin at 9% and "hope" the Trump lawsuits or something else come along and pops this contract to 18%. Double your money!!

(3/7)

(3/7)

Again, this is not about Mnuchin going to 100% and staying as TreasSec, it about his contract popping 50% to 100% in short order, over a sure 10% in four months (March 1) on $850 total account limit.

(4/7)

(4/7)

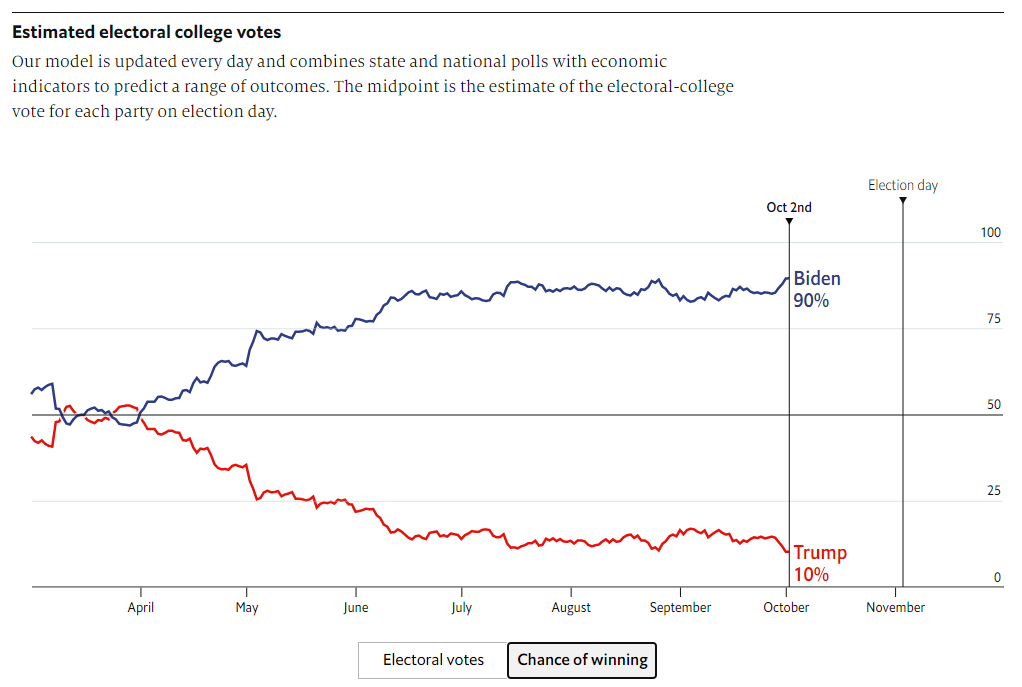

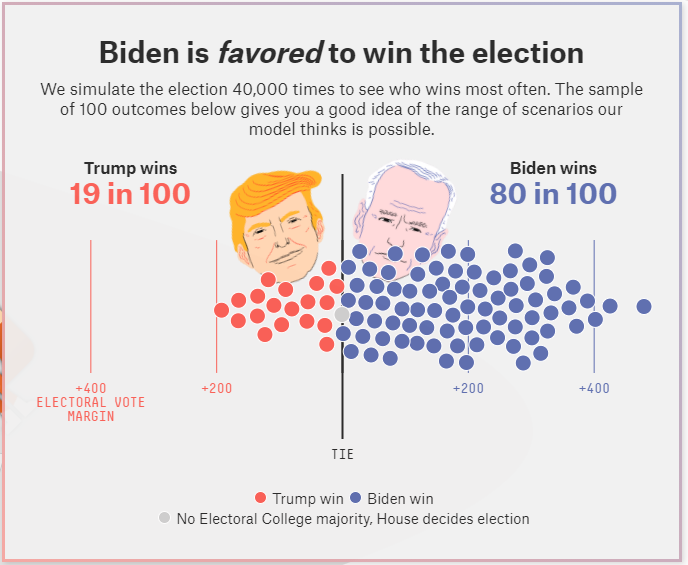

Ditto the state betting that Trump has a 10% chance of winning GA or PA or AZ. They bet is not Trump overturns the election. The speculative bet is some court ruling or evidence emerges that pops these contracts to 20% to 25%, and walk away with a good profit.

(5/7)

(5/7)

Restated, the $850 limit means a lack of arbitrage. So, view anything between 90% and 98% as functionally the same as 99% (or 10% to 2% as functional the same as 1%).

(6/7)

(6/7)

Or go full @NateSilver538 and purposely elect to not understand this so you can call these contracts "dumb" (Note, who needs Nate Silver when these "dumb" markets can replace him)

(7/7)

(7/7)

• • •

Missing some Tweet in this thread? You can try to

force a refresh