"This paradox is absolutely central to the working of all financial markets... The more bullish things are, the more bearish they are." ~ Percival's "The Way of the Dollar"

Markets are paradoxical & circular. Understanding its many circular relationships is crucial.... /1

Markets are paradoxical & circular. Understanding its many circular relationships is crucial.... /1

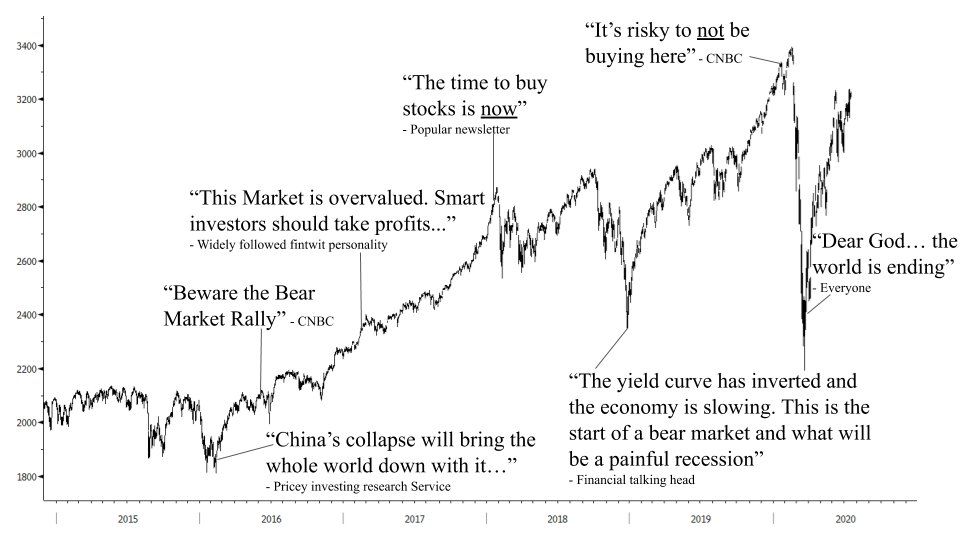

2/ ...to groking its true nature. The price-sentiment relationship is one of these. Prices rise=sentiment follows=positioning adapts=criticality is reached = prices reverse = sentiment follows, ad infinum...

Every trend sows the seed for its end. Trend + reversion = sine waves

Every trend sows the seed for its end. Trend + reversion = sine waves

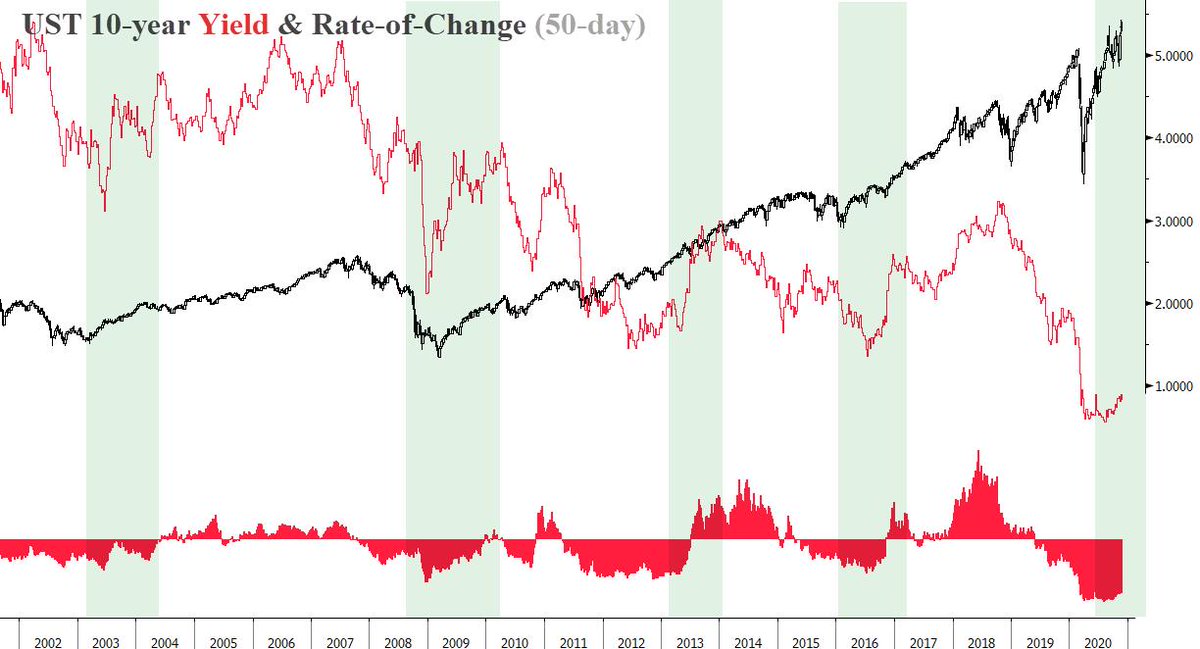

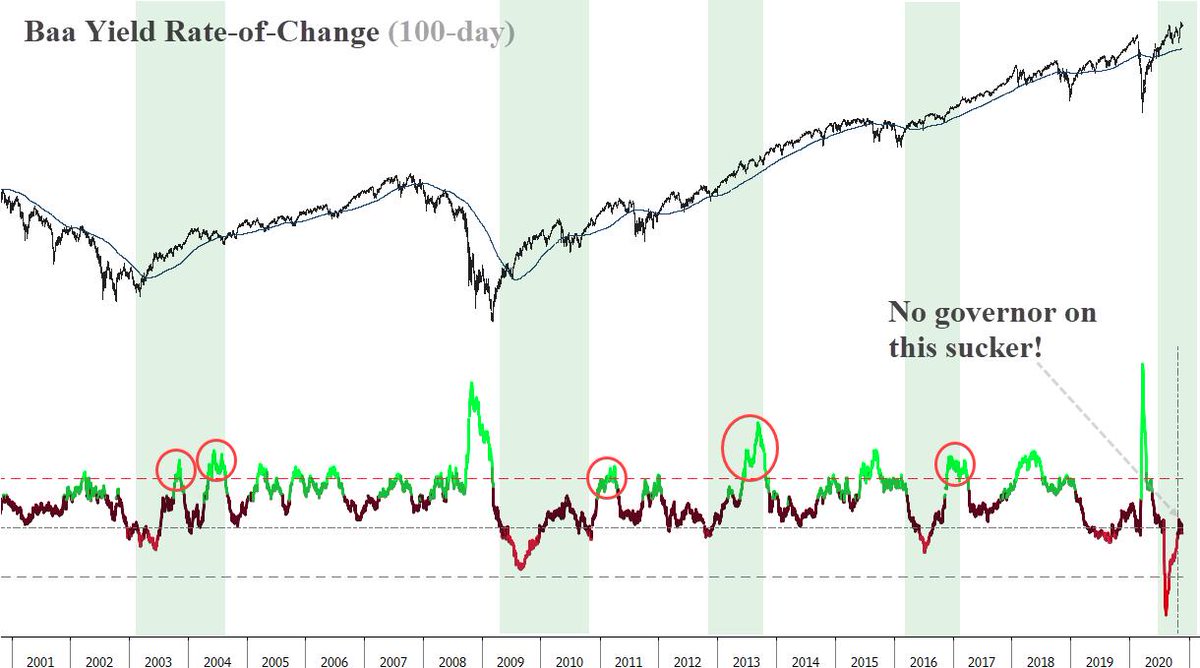

3/ Another critically important circular relationship is that between stocks & bonds.

No financial asset exists w/in a vacuum. The game of markets & the act of valuation is one of relative comparisons. Stocks and bonds compete for flows...

No financial asset exists w/in a vacuum. The game of markets & the act of valuation is one of relative comparisons. Stocks and bonds compete for flows...

4/ Rising prices=improving sentiment=more flows into risk assets (stocks)/ out of safe assets=falling bonds (higher yields). Until... yields rise to a point where bonds again become attractive on a relative basis and the flows reverse = stocks fall = bonds rise (yields fall)...

5/ There's fundamental reasons for this (discounting rate & valuations, easing/tightening of fin-conditions, etc...) as well as a chicken & egg aspect, is it sentiment that drives price or vice-versa? Do rising stocks push bonds lower or vice versa? Mrkts= paradoxical & circular

6/ Understanding this, we can think of yields as a type of governor on stocks & risk-taking in general. It's the Yang to the equity market's Yin as Percival puts it. Yields generally keep risk-taking in check by preventing stocks from running too far too fast...

7/ This is a good thing as the circular stock-bond relationship actually extends trends by creating frequent volatility. Thru a constant back & forth, it prevents over-positioning. When this relationship fails, we get yield suppression, & participants get out over their skis...

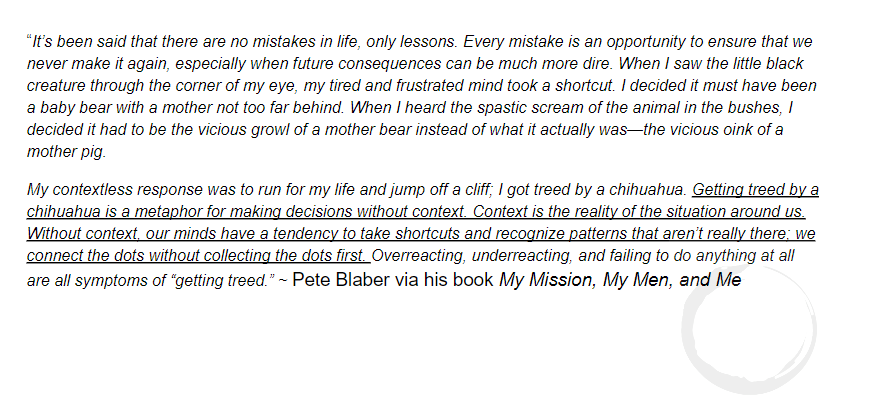

8/ And this creates critical states (fragility) that can lead to larger phase shifts, a reversal of trend.

This is what's happening now. A global safe asset shortage + Fed policy + stimulus has led to increasing risk-taking while keeping yields low... macro-ops.com/the-most-impor…

This is what's happening now. A global safe asset shortage + Fed policy + stimulus has led to increasing risk-taking while keeping yields low... macro-ops.com/the-most-impor…

9/ Effectively, the market is driving w/out a governor. No governor means no speed limit, no countervailing force on risk/sentiment, and rising asset prices.

This fact is obvious in the charts. Current Intermarket action is that of a strong reflation/rotation recovery regime.

This fact is obvious in the charts. Current Intermarket action is that of a strong reflation/rotation recovery regime.

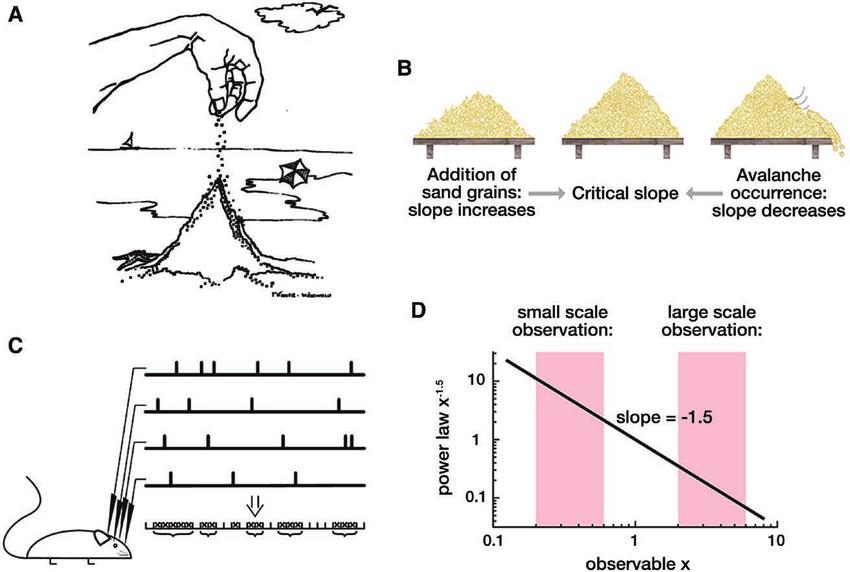

10/ But look at yields... The vertical green zones mark similar past reflation recovery regimes. Compare the rise in yields during past regimes to that of today.

Typically the 10yr yield would be over 100bps higher by now and Baa yields would have spiked...

Typically the 10yr yield would be over 100bps higher by now and Baa yields would have spiked...

11/ Thus putting the pinch on risk-taking. That's obviously not the case this time around.

This is why sentiment indicators have been giving plenty of false signals over the last couple of months. Keeping many smart traders on the sidelines. W/out an effective governor...

This is why sentiment indicators have been giving plenty of false signals over the last couple of months. Keeping many smart traders on the sidelines. W/out an effective governor...

12/ the next de facto countervailing force becomes positioning, which lags sentiment. & it can boil longer when yields are pinned down. And that's where we are today. We've transitioned to a mrkt with increasingly low population diversity=trend fragility

https://twitter.com/MacroOps/status/1276209036254478336

13/ This is likely to go on a bit longer but eventually the market will reach a point when positioning reaches an extreme & "there's no one left to buy". While margin debt has risen a lot this year, it can rise a LOT more. 99' & 07' are perfect examples of where things could go

14/ Institutional money has carried big cash positions since the March low and have been terribly underperforming the market. Career risk is real and we're likely to see continued chasing into year's end, with managers drawing down their cash which is showing in latest BofA GFS.

15/ That's just my two cents. You can read more here macro-ops.com/a-broken-gover…

I'll be looking at SQN, our TL Score, and the tape to help signal when a turn is near.

Stay safe and keep your head on a swivel! / fin

I'll be looking at SQN, our TL Score, and the tape to help signal when a turn is near.

Stay safe and keep your head on a swivel! / fin

• • •

Missing some Tweet in this thread? You can try to

force a refresh