1/

Get a cup of coffee.

In this thread, I'll help you understand the relationships between *investing* and *inflation*.

Get a cup of coffee.

In this thread, I'll help you understand the relationships between *investing* and *inflation*.

2/

In his 2011 letter to Berkshire shareholders, Warren Buffett made an important observation.

He said that the purpose of investing is not just to grow *money*, but to grow *after tax purchasing power*.

In his 2011 letter to Berkshire shareholders, Warren Buffett made an important observation.

He said that the purpose of investing is not just to grow *money*, but to grow *after tax purchasing power*.

3/

This means:

Investments should not be evaluated simply in *nominal* terms -- how much they grow our money.

They should be evaluated in *real* terms -- taking into account both taxes and inflation.

This means:

Investments should not be evaluated simply in *nominal* terms -- how much they grow our money.

They should be evaluated in *real* terms -- taking into account both taxes and inflation.

4/

Let's take an example.

Suppose we invested $100K in a stock 5 years ago.

And suppose the stock doubled in these 5 years.

So now, our position is worth $200K.

This is a *nominal* annualized return of about 14.87%.

Let's take an example.

Suppose we invested $100K in a stock 5 years ago.

And suppose the stock doubled in these 5 years.

So now, our position is worth $200K.

This is a *nominal* annualized return of about 14.87%.

5/

Suppose we now sell the stock.

When we sell, we have to pay *capital gains tax* on our $100K profit.

Let's say our tax rate is 20%.

So we'll pay $20K in taxes.

After that, we'll have $200K - $20K = $180K left over.

Suppose we now sell the stock.

When we sell, we have to pay *capital gains tax* on our $100K profit.

Let's say our tax rate is 20%.

So we'll pay $20K in taxes.

After that, we'll have $200K - $20K = $180K left over.

6/

But as Buffett said, that's not all. We should also consider *inflation*.

Let's say, over the last 5 years, inflation was about 5% per year.

That means, we need $1*(1.05^5) = $1.28 today to buy the same goods and services that $1 would have bought us 5 years ago.

But as Buffett said, that's not all. We should also consider *inflation*.

Let's say, over the last 5 years, inflation was about 5% per year.

That means, we need $1*(1.05^5) = $1.28 today to buy the same goods and services that $1 would have bought us 5 years ago.

7/

So, the $180K we have today is equivalent to about $180K/1.28 = $141K in "5 years ago" money.

So, in *constant dollar* terms, we've grown $100K into ~$141K over 5 years.

This is a *real* annualized return of only ~7.12% -- much worse than our *nominal* ~14.87%.

So, the $180K we have today is equivalent to about $180K/1.28 = $141K in "5 years ago" money.

So, in *constant dollar* terms, we've grown $100K into ~$141K over 5 years.

This is a *real* annualized return of only ~7.12% -- much worse than our *nominal* ~14.87%.

8/

Also note: capital gains tax reduced our gains by $20K. But *inflation* further reduced them by about $180K - $141K = $39K.

So, the impact of inflation was almost *twice* as bad as capital gains tax.

In his 2011 letter, Buffett called this the "invisible inflation tax".

Also note: capital gains tax reduced our gains by $20K. But *inflation* further reduced them by about $180K - $141K = $39K.

So, the impact of inflation was almost *twice* as bad as capital gains tax.

In his 2011 letter, Buffett called this the "invisible inflation tax".

9/

But inflation was only 5%.

Capital gains tax was 20%.

And yet, inflation had the bigger impact. Why?

There are 2 reasons.

But inflation was only 5%.

Capital gains tax was 20%.

And yet, inflation had the bigger impact. Why?

There are 2 reasons.

10/

First, inflation *compounds* year over year, whereas capital gains tax is paid *just once* -- at the end when the stock is sold.

Second, inflation erodes the *entire capital* (principal + profits), whereas capital gains tax is levied *only on the profits*.

First, inflation *compounds* year over year, whereas capital gains tax is paid *just once* -- at the end when the stock is sold.

Second, inflation erodes the *entire capital* (principal + profits), whereas capital gains tax is levied *only on the profits*.

11/

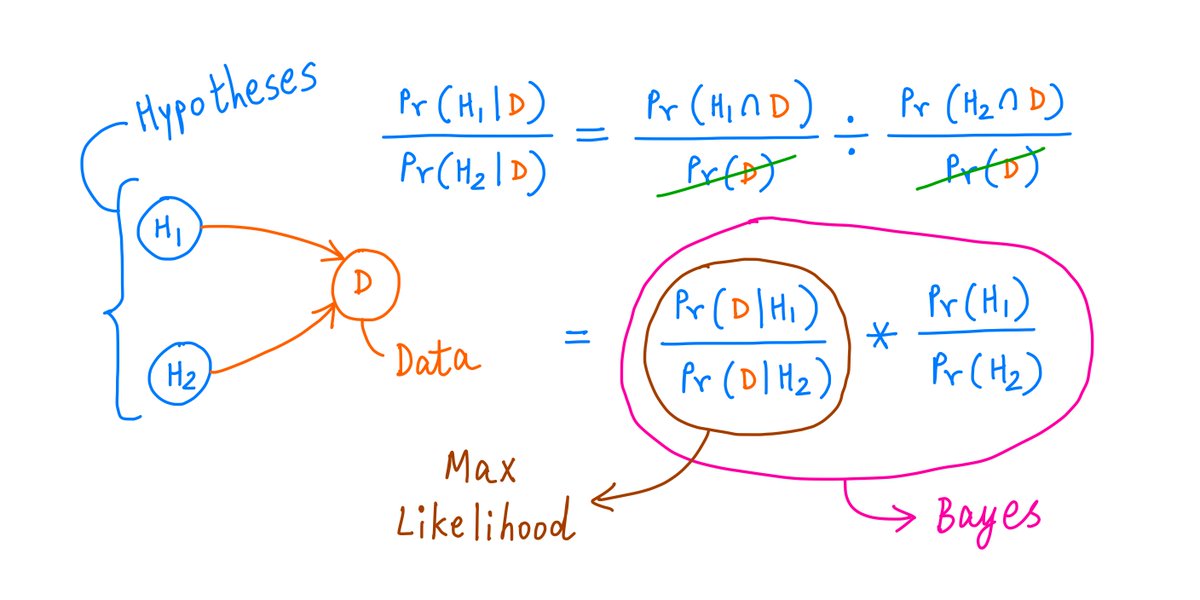

Here's a formula to calculate the *real* annualized return -- accounting for both inflation and taxes -- from the *nominal* annualized return of an investment:

Here's a formula to calculate the *real* annualized return -- accounting for both inflation and taxes -- from the *nominal* annualized return of an investment:

12/

Carrying this one step further:

The same principles also apply when a company *reinvests* its earnings back into its own business -- instead of distributing these earnings to shareholders as dividends.

Carrying this one step further:

The same principles also apply when a company *reinvests* its earnings back into its own business -- instead of distributing these earnings to shareholders as dividends.

13/

The reason why companies retain earnings: they believe that for every dollar retained and reinvested back into growing the business, they will *eventually* be able to distribute more than $1 of value to shareholders.

The reason why companies retain earnings: they believe that for every dollar retained and reinvested back into growing the business, they will *eventually* be able to distribute more than $1 of value to shareholders.

14/

For example, let's say a company we own earned $1 this year (after tax).

The company could, of course, distribute this $1 to us as a dividend. If the company did this, we'd pay, say, $0.20 in income taxes and be left with $0.80 of "purchasing power".

For example, let's say a company we own earned $1 this year (after tax).

The company could, of course, distribute this $1 to us as a dividend. If the company did this, we'd pay, say, $0.20 in income taxes and be left with $0.80 of "purchasing power".

15/

But instead of this dividend, let's say the company retained this $1 and used it to buy an asset.

Let's say this asset will last 10 years, and will generate $0.30 of cash in each of those 10 years. That's a pre-tax return (IRR) of ~27.32%.

For more:

But instead of this dividend, let's say the company retained this $1 and used it to buy an asset.

Let's say this asset will last 10 years, and will generate $0.30 of cash in each of those 10 years. That's a pre-tax return (IRR) of ~27.32%.

For more:

https://twitter.com/10kdiver/status/1284536987861446657

16/

The company can claim a $0.10 per year depreciation charge for this $1 asset over the next 10 years.

So, its pre-tax income from this asset will be $0.30 - $0.10 = $0.20.

For more:

The company can claim a $0.10 per year depreciation charge for this $1 asset over the next 10 years.

So, its pre-tax income from this asset will be $0.30 - $0.10 = $0.20.

For more:

https://twitter.com/10kdiver/status/1320058796572438528

17/

Let's say the company pays a 25% tax on this $0.20 of pre-tax income. That's a $0.05 tax bill.

This leaves $0.30 - $0.05 = $0.25 in operating cash flows -- every year for the next 10 years.

Suppose the company distributes all these cash flows to us as dividends.

Let's say the company pays a 25% tax on this $0.20 of pre-tax income. That's a $0.05 tax bill.

This leaves $0.30 - $0.05 = $0.25 in operating cash flows -- every year for the next 10 years.

Suppose the company distributes all these cash flows to us as dividends.

18/

Of course, we then have to pay our 20% income tax on these dividends, netting us $0.20 each year over the next 10 years.

See, we have 2 layers of taxation -- one at the corporate level and one at the shareholder level!

Of course, we then have to pay our 20% income tax on these dividends, netting us $0.20 each year over the next 10 years.

See, we have 2 layers of taxation -- one at the corporate level and one at the shareholder level!

19/

Also, unfortunately, we have 5% inflation.

So, the first $0.20 will only be worth $0.20/1.05 = ~$0.19 in today's dollars, the second $0.20 only $0.20/(1.05^2) = ~$0.18, and so on -- up to the tenth and final $0.20 that will be worth only $0.20/(1.05^10) = ~$0.12.

Also, unfortunately, we have 5% inflation.

So, the first $0.20 will only be worth $0.20/1.05 = ~$0.19 in today's dollars, the second $0.20 only $0.20/(1.05^2) = ~$0.18, and so on -- up to the tenth and final $0.20 that will be worth only $0.20/(1.05^10) = ~$0.12.

20/

So, in *real* terms, we gave up $0.80 of purchasing power when the company decided to retain the original $1 instead of paying us a dividend.

But in return, we get this sequence of diminishing inflation-adjusted $0.20 payouts for 10 years.

So, in *real* terms, we gave up $0.80 of purchasing power when the company decided to retain the original $1 instead of paying us a dividend.

But in return, we get this sequence of diminishing inflation-adjusted $0.20 payouts for 10 years.

21/

Therefore, our *real* return from $1 of earnings retained by the company -- considering both the purchasing power given up and that obtained in exchange -- works out to about ~15.63%.

Therefore, our *real* return from $1 of earnings retained by the company -- considering both the purchasing power given up and that obtained in exchange -- works out to about ~15.63%.

22/

This ~15.63% in our hands is, of course, much lower than the ~27.32% originally earned by the company on the asset.

But that's what 2 layers of taxation combined with inflation can do.

This ~15.63% in our hands is, of course, much lower than the ~27.32% originally earned by the company on the asset.

But that's what 2 layers of taxation combined with inflation can do.

23/

Key lesson: it's vitally important to account for both taxes and inflation while analyzing investment returns -- from both stock purchases/sales and dividends/retained earnings.

What counts is the preservation and growth of *real* purchasing power, not *nominal* dollars.

Key lesson: it's vitally important to account for both taxes and inflation while analyzing investment returns -- from both stock purchases/sales and dividends/retained earnings.

What counts is the preservation and growth of *real* purchasing power, not *nominal* dollars.

24/

I also want to mention why I used 5% for inflation in the examples above -- when it's no secret that the Fed aims to keep it at ~2%.

The reason has to do with the way inflation is measured -- Consumer Price Index or CPI.

I also want to mention why I used 5% for inflation in the examples above -- when it's no secret that the Fed aims to keep it at ~2%.

The reason has to do with the way inflation is measured -- Consumer Price Index or CPI.

25/

Our actual costs of living tend to rise a bit faster than CPI.

This is because CPI relies on assumptions like "substitution": if a product becomes pricey, CPI assumes that we'll substitute it with a cheaper product, which we may be unwilling to do.

Our actual costs of living tend to rise a bit faster than CPI.

This is because CPI relies on assumptions like "substitution": if a product becomes pricey, CPI assumes that we'll substitute it with a cheaper product, which we may be unwilling to do.

26/

Also, CPI adjusts for "quality".

For example, cars have become more expensive over time. But they've also improved in safety, fuel efficiency, and performance.

Also, CPI adjusts for "quality".

For example, cars have become more expensive over time. But they've also improved in safety, fuel efficiency, and performance.

27/

So, CPI tries to only reflect *part* of a car's price increase -- the part that's due to general inflation.

The rest of the price increase is attributed to product improvements -- and excluded from CPI.

So, CPI tries to only reflect *part* of a car's price increase -- the part that's due to general inflation.

The rest of the price increase is attributed to product improvements -- and excluded from CPI.

28/

But of course, when we buy a new car, we're hit by the *full* price increase -- not just the part that's reflected in CPI.

Also, over time, we all experience "lifestyle creep" -- we consume more goods and services over time. This is not reflected in CPI.

But of course, when we buy a new car, we're hit by the *full* price increase -- not just the part that's reflected in CPI.

Also, over time, we all experience "lifestyle creep" -- we consume more goods and services over time. This is not reflected in CPI.

29/

For all these reasons, it's a good idea to be *conservative* with inflation assumptions.

If our portfolio can deliver growth in purchasing power even at 5% inflation, then we're likely to do even better if inflation turns out to be only 2%.

But the reverse isn't true.

For all these reasons, it's a good idea to be *conservative* with inflation assumptions.

If our portfolio can deliver growth in purchasing power even at 5% inflation, then we're likely to do even better if inflation turns out to be only 2%.

But the reverse isn't true.

30/

In addition to Buffett's 2011 letter above, I also recommend reading his 1980 letter.

This was written when inflation was rampant in the US (close to 15% per year). And as always, Buffett's thoughts are clear-headed and beautifully expressed.

Link: berkshirehathaway.com/letters/1980.h…

In addition to Buffett's 2011 letter above, I also recommend reading his 1980 letter.

This was written when inflation was rampant in the US (close to 15% per year). And as always, Buffett's thoughts are clear-headed and beautifully expressed.

Link: berkshirehathaway.com/letters/1980.h…

31/

Also, thanks to @rationalwalk and @RudyHavenstein, I stumbled upon this comic book about inflation -- created by the Federal Reserve Bank of New York. It's a super fun read!

Link: ia600307.us.archive.org/26/items/gov.f…

Also, thanks to @rationalwalk and @RudyHavenstein, I stumbled upon this comic book about inflation -- created by the Federal Reserve Bank of New York. It's a super fun read!

Link: ia600307.us.archive.org/26/items/gov.f…

32/

Finally, my friend @SahilBloom has also created a very nice thread explaining the basics of inflation:

Finally, my friend @SahilBloom has also created a very nice thread explaining the basics of inflation:

https://twitter.com/SahilBloom/status/1293590227064217603?s=20

33/

If you're still with me, thank you!

It's the season of gratitude -- and I feel especially blessed to have readers like you.

Have a great Thanksgiving weekend!

/End

If you're still with me, thank you!

It's the season of gratitude -- and I feel especially blessed to have readers like you.

Have a great Thanksgiving weekend!

/End

• • •

Missing some Tweet in this thread? You can try to

force a refresh