(1) So let me try to write something down on #options, more specifically #LEAPs (Long-term options).

Options?

Options give you the 𝗿𝗶𝗴𝗵𝘁 to buy (call) or sell (put) an underlying asset (= stock/ETF) at a fixed price (= strike price) up to a spec. date (= exp. date).

Options?

Options give you the 𝗿𝗶𝗴𝗵𝘁 to buy (call) or sell (put) an underlying asset (= stock/ETF) at a fixed price (= strike price) up to a spec. date (= exp. date).

(2) Premium.

Ofc. options aren't free. You'll have to pay a premium for this right. Important to keep in mind is the multiplier, which often equals to 100 (every option covers 100 of the underlying shares).

𝗣𝗿𝗶𝗰𝗲 𝗽𝗲𝗿 𝗼𝗽𝘁𝗶𝗼𝗻 = 𝗽𝗿𝗲𝗺𝗶𝘂𝗺 * 𝟭𝟬𝟬 (+ 𝗰𝗼𝘀𝘁𝘀)

Ofc. options aren't free. You'll have to pay a premium for this right. Important to keep in mind is the multiplier, which often equals to 100 (every option covers 100 of the underlying shares).

𝗣𝗿𝗶𝗰𝗲 𝗽𝗲𝗿 𝗼𝗽𝘁𝗶𝗼𝗻 = 𝗽𝗿𝗲𝗺𝗶𝘂𝗺 * 𝟭𝟬𝟬 (+ 𝗰𝗼𝘀𝘁𝘀)

(3) Pricing

Options pricing is determined by the four greeks (separate thread in the future). Important to take into account is that options will be more expensive if:

1. Your expiration date if further out (#theta).

2. The closer the strike price lies near the asset (#delta)

Options pricing is determined by the four greeks (separate thread in the future). Important to take into account is that options will be more expensive if:

1. Your expiration date if further out (#theta).

2. The closer the strike price lies near the asset (#delta)

(4)

3. The volatility of the underlying stock is high (#vega).

The latter is an important driver, responsible for the rather cheap #LEAPs on majors today. As an example the pricing history of AG (=𝑠𝑡𝑜𝑐𝑘) JUL 2021 (= 𝑒𝑥𝑝. 𝑑𝑎𝑡𝑒 ) 12 (=𝑠𝑡𝑟𝑖𝑘𝑒 ) CALL (=𝑏𝑢𝑙𝑙)

3. The volatility of the underlying stock is high (#vega).

The latter is an important driver, responsible for the rather cheap #LEAPs on majors today. As an example the pricing history of AG (=𝑠𝑡𝑜𝑐𝑘) JUL 2021 (= 𝑒𝑥𝑝. 𝑑𝑎𝑡𝑒 ) 12 (=𝑠𝑡𝑟𝑖𝑘𝑒 ) CALL (=𝑏𝑢𝑙𝑙)

(5) Option premiums on most majors have fallen, partly due to a limited amount of time decay, but mainly due to the fact that the underlying asset ($AG) traded more stable (thus decreasing the underlying volatility and vega component).

(6) E.G. $AG: as the underlying stock didn't break lower lows, while as the option as such did. On Monday (30.11.2020), the implied volatility (foreseen by this option) even dropped below the historical volatility. Meaning the market assumes $AG won't leave this trading range.

(7) What & why?

Due to the lengthy consolidation in #miners, options premium came down significantly (mainly due to the decreasing vega component). The latter makes options relatively cheap for a developing $bull market.

Due to the lengthy consolidation in #miners, options premium came down significantly (mainly due to the decreasing vega component). The latter makes options relatively cheap for a developing $bull market.

(8) Why would anyone buy an option?

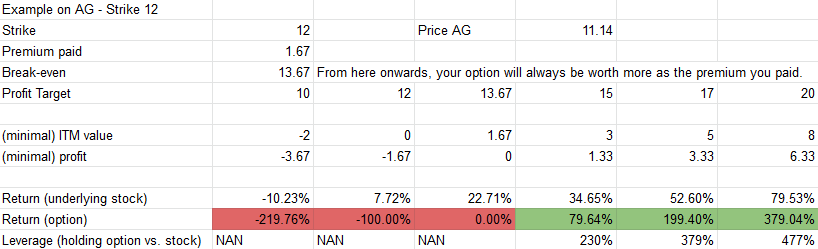

If you're bullish on the long-term outlook of an asset, an option can provide leverage in comparison to holding the underlying asset itself (example given below).

For the AG JUL 21 12 CALL, you'll pay:

1.67 * 100 (+cost) = $ 167 USD

If you're bullish on the long-term outlook of an asset, an option can provide leverage in comparison to holding the underlying asset itself (example given below).

For the AG JUL 21 12 CALL, you'll pay:

1.67 * 100 (+cost) = $ 167 USD

(9) 𝐇𝐨𝐰𝐞𝐯𝐞𝐫, it is very important to understand that with options, it is possible to 𝐥𝐨𝐨𝐬𝐞 your 𝐞𝐧𝐭𝐢𝐫𝐞 investment (e.g. on the JUL 21 12 CALL, $AG)

Important to notice is that if $AG doesn't break 13.67 (break even) by exp., this option will be in the red.

Important to notice is that if $AG doesn't break 13.67 (break even) by exp., this option will be in the red.

(10) Please beware that in the given example, I'm using option premiums in my calculations. The initial price you'll pay (and the return you'll get) has to be multiplied by the multiplier (most often 100).

(11) Take-homes:

* Don't overpay on the premium, especially with regard to vega. Buying options on stocks that had a 100% run on one day rarely pays off well.

* To be profitable, you have to be right on both the profit target (which determines the strike) and time (exp. date).

* Don't overpay on the premium, especially with regard to vega. Buying options on stocks that had a 100% run on one day rarely pays off well.

* To be profitable, you have to be right on both the profit target (which determines the strike) and time (exp. date).

(12) Of course this is just a thread to inform everyone out there in the #preciousmetals on $option. (No investment advice ;))

Thanks to @BuyingMyFreedom, who motivated me to write down this little thread on options.

I'll try to increase my #mintwit contributions as well. $UAG

Thanks to @BuyingMyFreedom, who motivated me to write down this little thread on options.

I'll try to increase my #mintwit contributions as well. $UAG

CORRECTED:

Let me correct that example, you can never loose more as your initial investment (so you'll max. loss of course is -100%). This error slipped in, since I'm just doing some mathematical calculations here!

Let me correct that example, you can never loose more as your initial investment (so you'll max. loss of course is -100%). This error slipped in, since I'm just doing some mathematical calculations here!

• • •

Missing some Tweet in this thread? You can try to

force a refresh