Another 1.0 million people applied for UI last week, including 712,000 people who applied for regular state UI and 289,000 who applied for Pandemic Unemployment Assistance (PUA). 1/

After two weeks of increases, the 1.0 million who applied for UI last week was a welcome decline of 105,000 from the prior week. 2/

But, last week was the 37th straight week total initial claims were greater than the worst week of the Great Recession (GR). If you restrict to regular state claims (b/c we didn’t have PUA in the GR), initial claims are still nearly three times where they were a year ago. 3/

Most states provide 26 weeks of regular benefits, and this crisis has gone on much longer than that, which means many workers have exhausted their regular state UI benefits. In the most recent data, continuing claims for regular state UI dropped by 569,000. 4/

FOR NOW, after an individual exhausts regular state benefits, they can move onto Pandemic Emergency Unemployment Compensation (PEUC), which is an additional 13 weeks of regular state UI. 5/

In the latest data available for PEUC, the week ending Nov 14, PEUC rose by just 60,000, offsetting about 40% of the 148,000 decline in continuing claims for regular state benefits for the same week. 6/

Why didn’t PEUC rise more? Many of the roughly 2 million people who were on UI before the recession began, or who are in states w/ less than 26 weeks of regular state benefits, are now exhausting PEUC. More than 1.5 million workers had exhausted PEUC by the end of Oct. 7/

In some states, if workers exhaust PEUC, they can get on yet another program, Extended Benefits (EB). In the latest data, 681,000 workers were on EB. That’s far less than half of those who have exhausted PEUC. Most are left with nothing. 8/

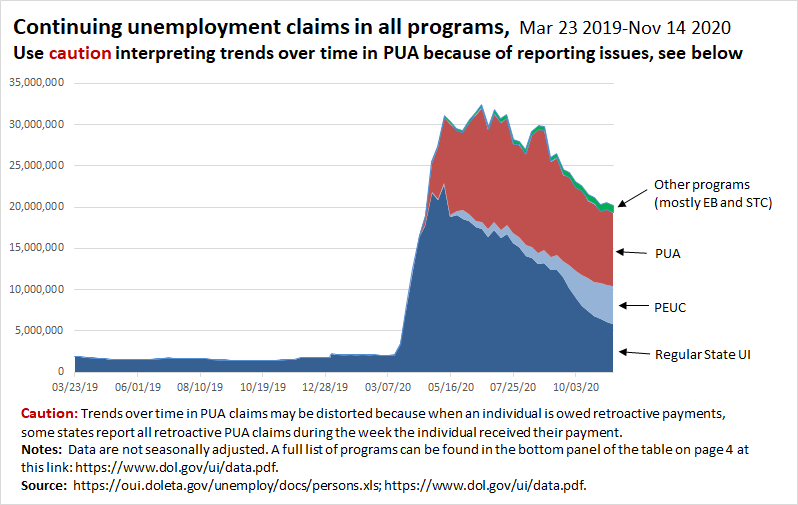

This chart shows continuing claims in all programs over time (the latest data for this are for Nov 14). Continuing claims are still more than 18 million above where they were a year ago, even with the exhaustions we’ve seen so far. 9/

Republicans in the Senate allowed the across-the-board $600 increase in weekly UI benefits to expire at the end of July. Last week was the 18th week of unemployment in this pandemic for which recipients did not receive the extra payment. 10/

And w/o congressional action, PUA & PEUC will expire on Dec 26. Millions of workers are depending on these programs (DOL reports 13.4 mil in the latest data). When they expire, millions of these workers & their families will be financially devastated. 11/

@pelhamprog and @ENPancotti find that 12 million workers will lose PUA or PEUC benefits when they expire on Dec 26—on top of the 4.4 million who will have exhausted them before then. And only 2.9 million will then be eligible for EB. 12/

https://twitter.com/ENPancotti/status/1329047409691930624

That means a total of 13.5 million workers (12.0 million + 4.4 million – 2.9 million) will have lost CARES Act benefits by the end of the year with nothing to fill in the gap. 13/

The House passed a $3 trillion relief package in May, then a $2.2 trillion relief package in October, and yesterday Pelosi and Schumer announced they backed a $908 billion bipartisan bill as a basis for negotiations. 14/

So far, throughout all that, McConnell has blocked meaningful additional COVID relief—knowing full well that millions will see their benefits disappear on Dec 26 if he doesn’t act. The cruelty is beyond belief. 15/

Further, UI is great economic stimulus. As @eliselgould and @joshbivens_DC show, reinstating and extending pandemic UI provisions would create or save more than FIVE MILLION jobs. 16/ epi.org/blog/reinstati…

Blocking stimulus is also exacerbating racial inequality. Due to the impact of historic & current systemic racism, Black and Latinx workers have seen more job loss in this pandemic, and have less wealth to fall back on. Stimulus is about racial justice. 17/

And of course, people haven’t just lost their jobs. Millions of workers and their family members have lost employer-provided health insurance due to job loss in the coronavirus downturn. 18/

To get the economy back on track in a reasonable timeframe, we need policymakers to pass roughly $3 trillion in fiscal support now, with the first $2 trillion hitting the economy between now and mid-2022. 19/ epi.org/publication/pr… @joshbivens_DC

Another thing: A recent GAO report documented key problems with UI data since COVID hit. This is important—we need to know exactly what happened to muck up the data in this crisis so we can make the investments to ensure we'll have good data next time. 20/ gao.gov/reports/GAO-21…

The GAO report also sheds light on the underpayment of PUA (and gives the common sense recommendation that where underpayment occurred, states should recalculate benefits and make up the difference). 21/

And here's this tweet thread in a blog post for your pandemic pleasure reading. n/ epi.org/blog/one-milli…

• • •

Missing some Tweet in this thread? You can try to

force a refresh