0/ [PUBLIC RELEASE] The Bitcoin Bull Case: 2021 & Beyond

After 1,081 days of waiting, #Bitcoin recently reached a new ATH. So what’s next?

We’re making our latest report public to provide the $BTC community with ammo 👇

delphidigital.io/reports/the-bi…

After 1,081 days of waiting, #Bitcoin recently reached a new ATH. So what’s next?

We’re making our latest report public to provide the $BTC community with ammo 👇

delphidigital.io/reports/the-bi…

1/ It's packed w/ on-chain data, market cycle forecasts, key trading trends, and macro market analysis (thread below):

🔸 UTXO Analysis

🔸 Market Cycle Patterns & Forecasts

🔸 Supply Shortage & Exchange Balances

🔸 Price Breakout & Momentum

🔸 Correlations, Sentiment, Volatility

🔸 UTXO Analysis

🔸 Market Cycle Patterns & Forecasts

🔸 Supply Shortage & Exchange Balances

🔸 Price Breakout & Momentum

🔸 Correlations, Sentiment, Volatility

2/ Forecasting Market Cycles

In our inaugural #Bitcoin report (Dec ‘18) we analyzed historical holder activity to predict a $BTC price bottom by 1Q19.

$BTC hit a cycle low 5 days later, setting up its 2019 surge.

In our inaugural #Bitcoin report (Dec ‘18) we analyzed historical holder activity to predict a $BTC price bottom by 1Q19.

$BTC hit a cycle low 5 days later, setting up its 2019 surge.

https://twitter.com/Delphi_Digital/status/1083396022771027971?s=20

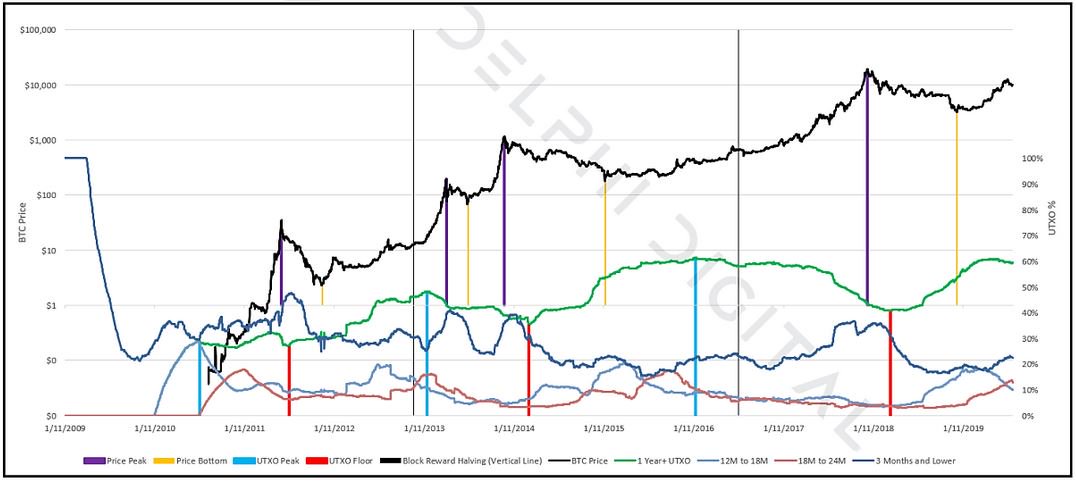

3/ Where are we now? Leveraging UTXO analysis with on-chain data helps us answer that.

$BTC works in well-defined patterns. The chart below reveals a pattern:

🔵 UTXO Peak

🟢 BTC Price ATH

🟡 UTXO Floor

🔴 BTC Price Max Drawdown

Blue, green, yellow, red.

$BTC works in well-defined patterns. The chart below reveals a pattern:

🔵 UTXO Peak

🟢 BTC Price ATH

🟡 UTXO Floor

🔴 BTC Price Max Drawdown

Blue, green, yellow, red.

4/ LT holders accumulate through the bear market & a new UTXO Peak (🔵) is reached.

As the % supply inactive for +1yr rolls over, $BTC tends to strengthen, eventually breaking to a new ATH (🟢).

As the % supply inactive for +1yr rolls over, $BTC tends to strengthen, eventually breaking to a new ATH (🟢).

5/ Profit taking ensues as LT holders sell into buying pressure from new market participants, which weighs on price and brings us to a new UTXO floor (🟡).

Once the UTXO Floor is in, ST holders w. weaker hands capitulate, leading LT holders to once again start accumulating.

Once the UTXO Floor is in, ST holders w. weaker hands capitulate, leading LT holders to once again start accumulating.

6/ In the table below, we demonstrate how important identifying the UTXO Peak is (measured by the max Supply Last Active 1+Years Ago) by showing BTC returns at various intervals following its occurrence.

So what can we expect for the 4th cycle? Read the report to find out 👀

So what can we expect for the 4th cycle? Read the report to find out 👀

7/ Strong Hands Dominate 💪

Miners are starting to hold onto more of their BTC earnings, reversing a trend that picked up steam after the 3rd halving in May.

$BTC supply held on exchange is down 20% since it reached an ATH in Feb, further strengthening the HODL philosophy.

Miners are starting to hold onto more of their BTC earnings, reversing a trend that picked up steam after the 3rd halving in May.

$BTC supply held on exchange is down 20% since it reached an ATH in Feb, further strengthening the HODL philosophy.

8/ Gobbling Up Supply

PayPal & CashApp users now account for so much volume they're buying up the entire supply of newly issued BTC on their own.

Institutional demand is also becoming increasingly evident alongside retail interest; GBTC now holds 546k+ $BTC or ~2.9% of circ. s.

PayPal & CashApp users now account for so much volume they're buying up the entire supply of newly issued BTC on their own.

Institutional demand is also becoming increasingly evident alongside retail interest; GBTC now holds 546k+ $BTC or ~2.9% of circ. s.

9/ Interest & Financialization Picking Up

In addition, the popularity of Bitcoin derivatives - notably futures - is accelerating.

Bitcoin futures volume is coming off its best month to-date.

Institutions aren’t sitting on a hill off in the distance; some are already here.

In addition, the popularity of Bitcoin derivatives - notably futures - is accelerating.

Bitcoin futures volume is coming off its best month to-date.

Institutions aren’t sitting on a hill off in the distance; some are already here.

10/ The Biggest Bulls: Corporate America

$MSTR and $SQ may seem like one-off events to some but their implications have immense consequences.

Bitcoin is now part of the corporate treasury conversation...and it’s a BIG conversation.

Slowly, then all at once.

$MSTR and $SQ may seem like one-off events to some but their implications have immense consequences.

Bitcoin is now part of the corporate treasury conversation...and it’s a BIG conversation.

Slowly, then all at once.

11/ #Bitcoin Breakout

Watching for an upside breakout above $20k on strong volume to confirm BTC's next leg higher.

Important note: when BTC hit a new ATH in early '17, it sold off, recovered, retested, and corrected another ~25% before continuing its uptrend.

Patience is key.

Watching for an upside breakout above $20k on strong volume to confirm BTC's next leg higher.

Important note: when BTC hit a new ATH in early '17, it sold off, recovered, retested, and corrected another ~25% before continuing its uptrend.

Patience is key.

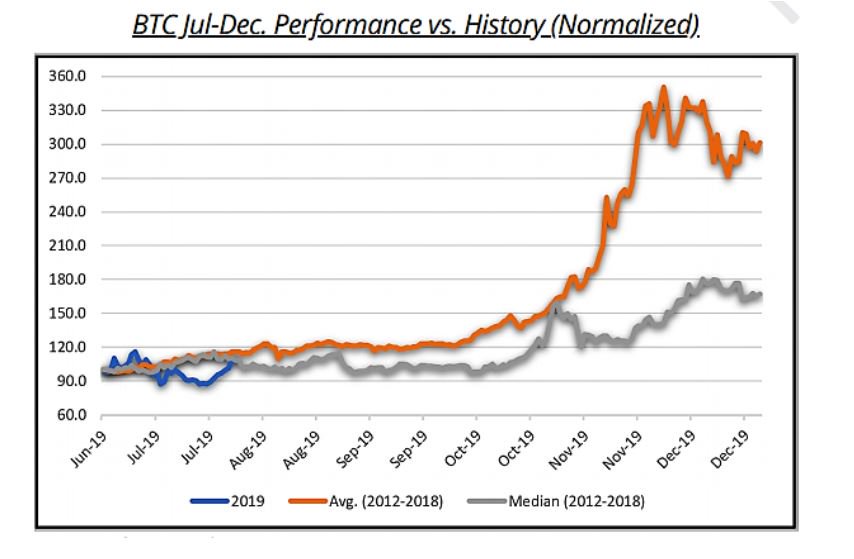

12/ Right on Track

In addition, if we compare BTC’s current cycle to the one prior, the world’s largest crypto asset appears to be right on track; though imperfect, the similarities between cycles is striking.

In addition, if we compare BTC’s current cycle to the one prior, the world’s largest crypto asset appears to be right on track; though imperfect, the similarities between cycles is striking.

13/ Momentum Strengthens

BTC's weekly RSI >85 for the 7th time; in every instance but one $BTC was higher 12M later.

Meanwhile, BTC's monthly RSI also just broke >70; we saw a similar event at the end of '16, setting up bitcoin’s '17 bull run.

November = ATH monthly close.

BTC's weekly RSI >85 for the 7th time; in every instance but one $BTC was higher 12M later.

Meanwhile, BTC's monthly RSI also just broke >70; we saw a similar event at the end of '16, setting up bitcoin’s '17 bull run.

November = ATH monthly close.

14/ Starting Points Matter

Safe to say bitcoin's publicity-to-market-value ratio is among the highest of any asset in existence today.

Note: Global M2 has increased >$11 trillion since end of March.

$BTC tripled over same period yet still only represents ~0.4% of global M2.

Safe to say bitcoin's publicity-to-market-value ratio is among the highest of any asset in existence today.

Note: Global M2 has increased >$11 trillion since end of March.

$BTC tripled over same period yet still only represents ~0.4% of global M2.

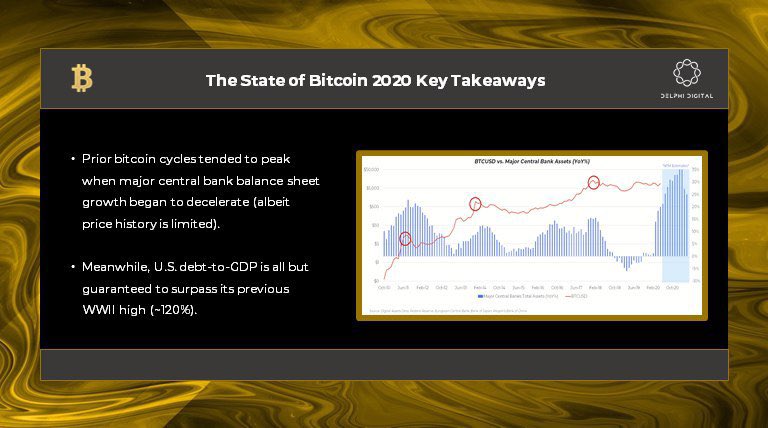

15/ "Goldilocks" Backdrop

The “goldilocks” environment for $BTC is characterized by easing finl. conditions, acceleration in monetary growth, declining market volatility, weaker USD, & lower real rates.

Anchored nominals + higher inflation exp can drive real rates even lower.

The “goldilocks” environment for $BTC is characterized by easing finl. conditions, acceleration in monetary growth, declining market volatility, weaker USD, & lower real rates.

Anchored nominals + higher inflation exp can drive real rates even lower.

16/ This is not your 2017 Bitcoin.

Mass retail speculation and viral memes have been swapped for family offices and world-class macro investors.

Investment professionals sit at a crossroad: lean in & embrace or dismiss & hope all these big names have it wrong...

Mass retail speculation and viral memes have been swapped for family offices and world-class macro investors.

Investment professionals sit at a crossroad: lean in & embrace or dismiss & hope all these big names have it wrong...

17/ If you enjoyed this summary thread, then you'll definitely want to check out the full report.

If you have any questions, please don't hesitate to reach out. If you aren't already, become a Delphi Member today for access to the best crypto content!

delphidigital.io/reports/the-bi…

If you have any questions, please don't hesitate to reach out. If you aren't already, become a Delphi Member today for access to the best crypto content!

delphidigital.io/reports/the-bi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh