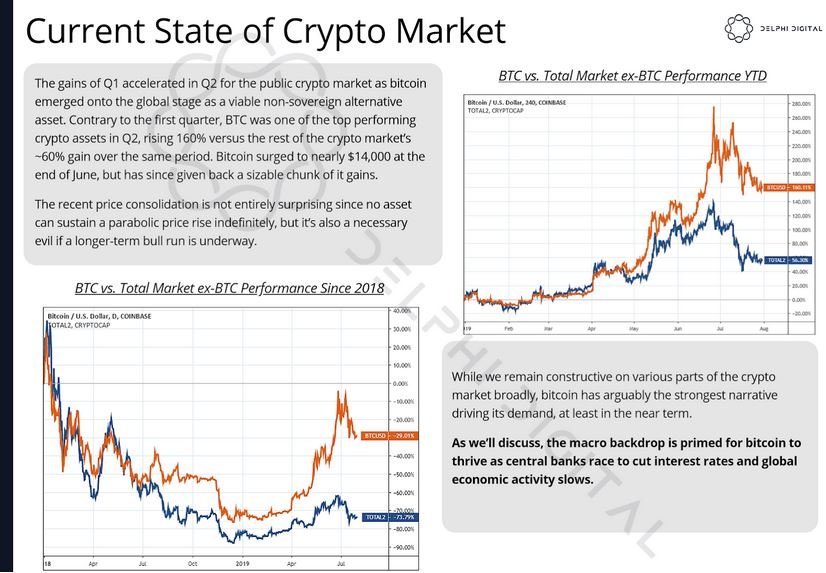

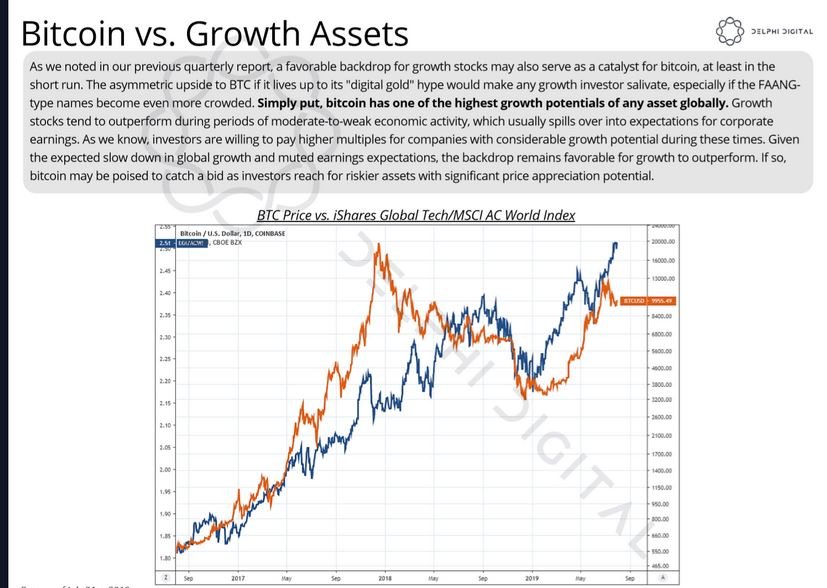

Our team just released our Quarterly Macro Outlook, which digs deep into the key drivers behind Bitcoin’s long-term value proposition as a non-sovereign, digitally native store of value. Quick summary thread: delphidigital.io/research

forbes.com/sites/ktorpey/…

You can view the entire report as well as get access to our Member's Portal by signing up for either of our subscriptions here: delphidigital.io/research