AXTEL INDUSTRIES #Thread

Presenting my study for educational purpose 👇

@Atulsingh_asan - I know you have studied #Axtel in very detail your additional points/thought process/comments will be great addition to this effort !

1

Presenting my study for educational purpose 👇

@Atulsingh_asan - I know you have studied #Axtel in very detail your additional points/thought process/comments will be great addition to this effort !

1

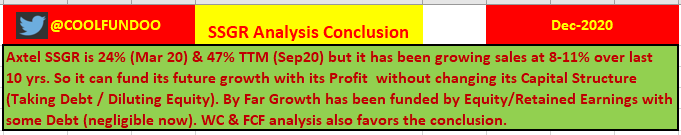

SSGR Analysis !

It gives +ive vibes for future growth. Further the Working Capital management & it's Free Cash Flow further strengthen the view.

SSGR (24%) > Current & Historical Sales Growth

2

It gives +ive vibes for future growth. Further the Working Capital management & it's Free Cash Flow further strengthen the view.

SSGR (24%) > Current & Historical Sales Growth

2

#AXTEL Retained Earnings vs Market Cap vs EPS Growth

In last 10 yrs ->

📌For every Rs 1 Retained by Axtel it has generated 17x of Market Cap (Big Boost for shareholders)👍👌

📌EPS Growth has been 7% higher than RE growth 👍

3

In last 10 yrs ->

📌For every Rs 1 Retained by Axtel it has generated 17x of Market Cap (Big Boost for shareholders)👍👌

📌EPS Growth has been 7% higher than RE growth 👍

3

📌Last 10yrs (incl TTM) in Nutshell (Screenshot) ->

Paying handsome dividend for last 3 yrs.

Remarkable improvement in Receivable Days & NPM.

4

Paying handsome dividend for last 3 yrs.

Remarkable improvement in Receivable Days & NPM.

4

OPM has considerably improved 13% to 23%.👌

Last 5yr Sales Growth has picked up. Though as per management due to Lock down they couldn't ship orders in Mar 20 but still their Recent Sales growth is 23%.👌

Profit growth 👌

5

Last 5yr Sales Growth has picked up. Though as per management due to Lock down they couldn't ship orders in Mar 20 but still their Recent Sales growth is 23%.👌

Profit growth 👌

5

Though #Axtel is in Machinery Manufacturing & supplying but doesn't seem much Capital Intensive.

Last 10yrs

Generated 66 Cr CFO

36 Cr Capex

13 Cr dividend Paid.

FCF of 30 Cr

6

Last 10yrs

Generated 66 Cr CFO

36 Cr Capex

13 Cr dividend Paid.

FCF of 30 Cr

6

Overall Management Compensation seems higher than normally allowed. Future Profit incr with same pace might make them compliant in a yr or two.

Only related party transaction which I found little dicey was Rs 42 lakh Fees paid to a company belonging to Promoter's brother.

7

Only related party transaction which I found little dicey was Rs 42 lakh Fees paid to a company belonging to Promoter's brother.

7

📌Some Figures which Impressed me

(Avg Last 5yrs)->

Cash Conv Cycle 77

Sales vs Receivables 29

ROCE 24%

ROE 19%

Small Other Income compared to PAT

8

(Avg Last 5yrs)->

Cash Conv Cycle 77

Sales vs Receivables 29

ROCE 24%

ROE 19%

Small Other Income compared to PAT

8

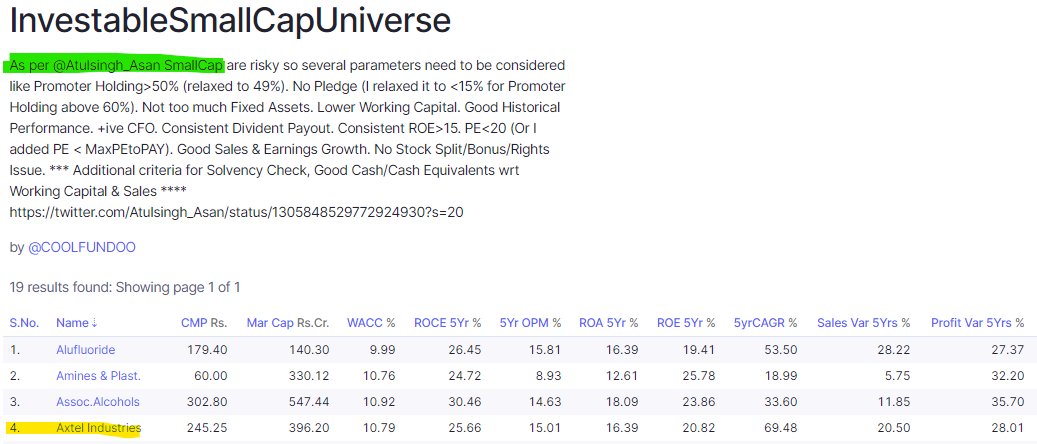

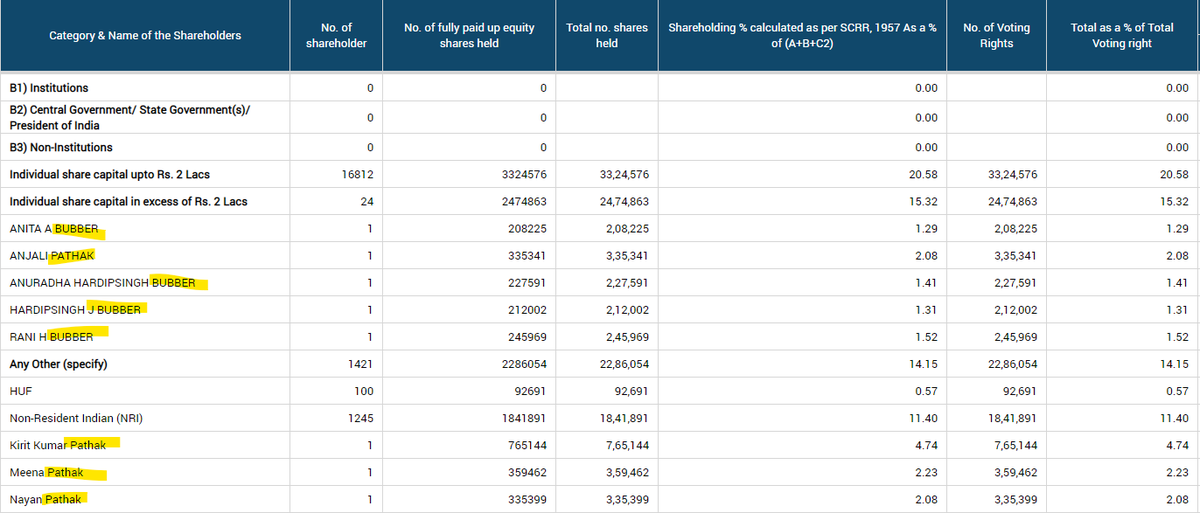

Promoter Holding is 49.95%. Though it seems low but if you notice public shareholdings there are relatives of promoters (Babbars & Pathak) holding 16% share.

📌So there is very only 14% shares left as free float (which actually available for trading).

9

📌So there is very only 14% shares left as free float (which actually available for trading).

9

Hold your thought from above👆

Check #Axtel Total no. of Equity shares = 1.2 Cr

Promoter holding 49.5%

Promoter relatives in Public 16%

Free Float -> 61 lakh

📌Hence only 61 lakh shares available for trading so small interest from few investors can move price crazily !

10

Check #Axtel Total no. of Equity shares = 1.2 Cr

Promoter holding 49.5%

Promoter relatives in Public 16%

Free Float -> 61 lakh

📌Hence only 61 lakh shares available for trading so small interest from few investors can move price crazily !

10

#Axtel has generated 30Cr of FCF in last 10yr on CFO of 66Cr.

FCF has been fluctuating (see red & green)

It has Cash of 6.5 Cr

Cash flow to Capex has been Impressive 👌

11

FCF has been fluctuating (see red & green)

It has Cash of 6.5 Cr

Cash flow to Capex has been Impressive 👌

11

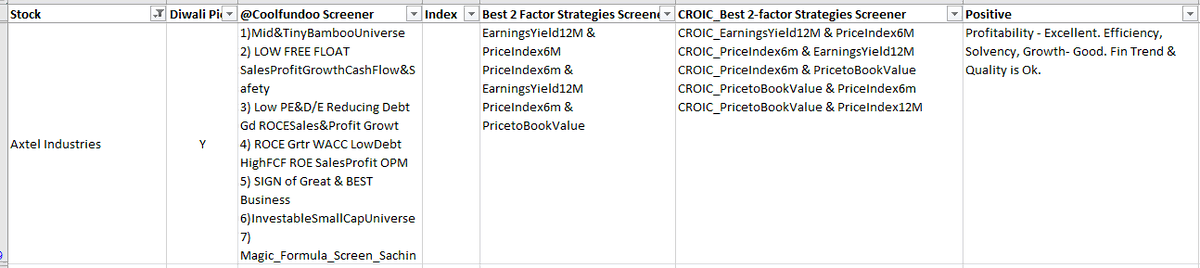

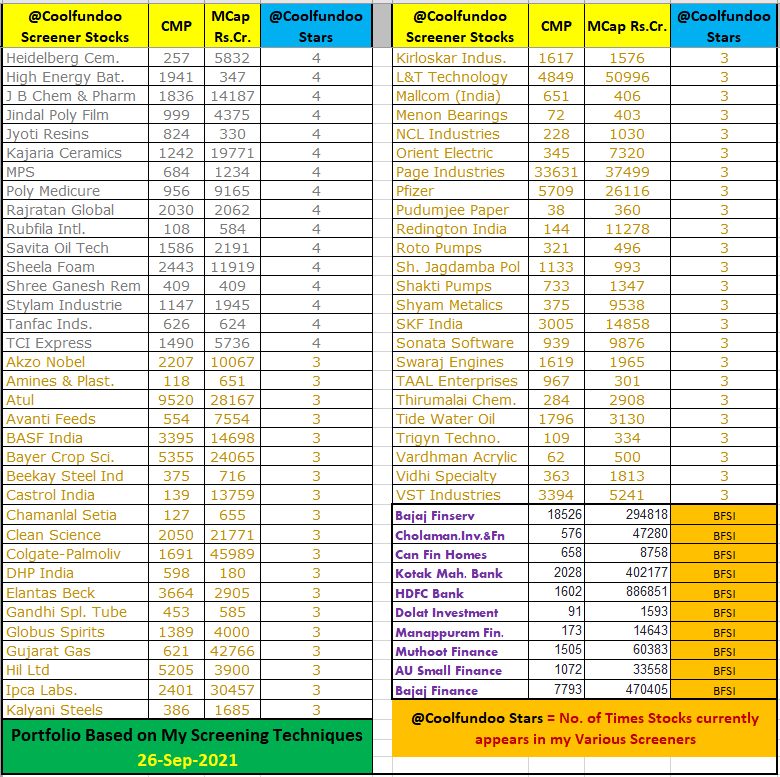

If I summarize #Axtel Fundamentals in layman terminology ->

Profitability -> Excellent.

Efficiency, Solvency, Growth-> Good.

Quality is Ok.

Fin Trend is turning Very +ive.

12

Profitability -> Excellent.

Efficiency, Solvency, Growth-> Good.

Quality is Ok.

Fin Trend is turning Very +ive.

12

#Axtel manufactures various Machineries & Equipments for the clients in Food Processing industry like

Continuous Fryers

Big Bag Filling Pasta Machines

Vacuum Gravity Separators

Universal Mills with Plate Beaters

Continuous Khoa Making Machines

13

Continuous Fryers

Big Bag Filling Pasta Machines

Vacuum Gravity Separators

Universal Mills with Plate Beaters

Continuous Khoa Making Machines

13

Axtel has mainly 3 divisions -

Snacks, Spices, Confectionary. Apart from packaging it does everything.

Space is mostly dominated by European & American manufacturers like Buhler, Rockwell, SPX, Russell Finex etc

📌Axtel has cost advantage against them.

14

Snacks, Spices, Confectionary. Apart from packaging it does everything.

Space is mostly dominated by European & American manufacturers like Buhler, Rockwell, SPX, Russell Finex etc

📌Axtel has cost advantage against them.

14

Sales 81% in India, 19% Export.

Clients like

Cadbury

Nestle(India,Thailand,Bangladesh,Sri Lanka,Russia, Malaysia,Morocco,Vietnam,Phillipines)

Godrej Industries

Britannia

GSK Cons Hlth

CCL Products

Mondelez(India, Singapore, Vietnam)

15

Clients like

Cadbury

Nestle(India,Thailand,Bangladesh,Sri Lanka,Russia, Malaysia,Morocco,Vietnam,Phillipines)

Godrej Industries

Britannia

GSK Cons Hlth

CCL Products

Mondelez(India, Singapore, Vietnam)

15

In Ist Tweet 👆 above you will notice I have highlighted FY15 was disaster for #Axtel as a large order from a major client was cancelled.

Client Concentration is still little risk but after that setback they have been continuously diversifying in other FMCG.

16

Client Concentration is still little risk but after that setback they have been continuously diversifying in other FMCG.

16

No long term contract is another thing to watch out. For Example, Nestle contract is for 1 yr & gets renewed every year.

They don't have Intellectual Property rights on their design so need to continuous maintain their Quality standards to win more contracts.

17

They don't have Intellectual Property rights on their design so need to continuous maintain their Quality standards to win more contracts.

17

Conclusion->

I feel it has potential to grow as its clients in food processing industry doing Capex which results in orders for #Axtel. Good quality & low cost advantage helping it to gain reputed clients.

Financial Trend is coming on track. Corp Gov needs some improvement.

18

I feel it has potential to grow as its clients in food processing industry doing Capex which results in orders for #Axtel. Good quality & low cost advantage helping it to gain reputed clients.

Financial Trend is coming on track. Corp Gov needs some improvement.

18

#Axtel in my Magic_Formula_Screen_Sachin #screener

25

https://twitter.com/Coolfundoo/status/1325684764255408129?s=20

25

Correction #Axtel Total no. of Equity shares = 1.62 Cr not 1.2 Cr. Rest is correct !

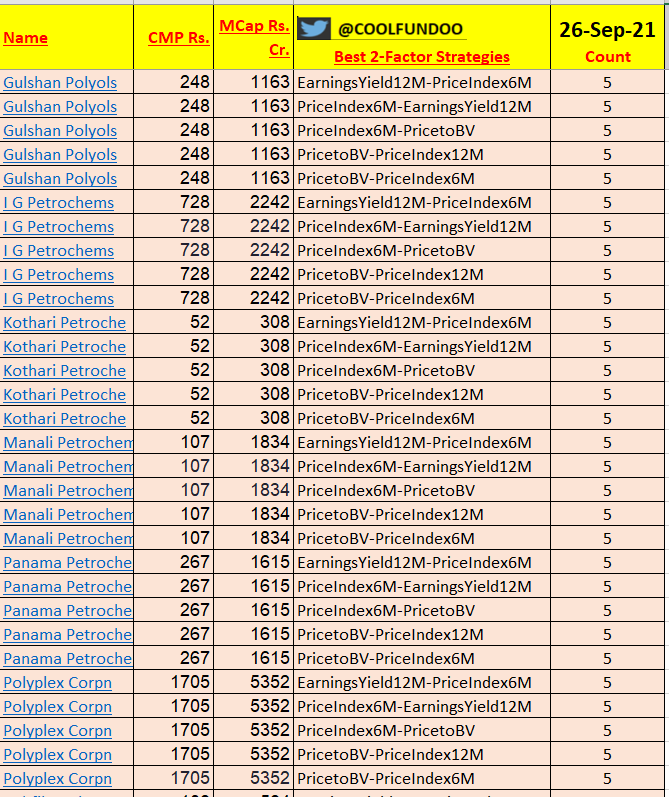

#Axtel in my BEST 2-FACTOR STRATEGIES #screener

26

https://twitter.com/Coolfundoo/status/1328233201580576770?s=20

26

#Axtel Credit Rating(June 20)

LongTerm(12Cr)-CARE BBB; Stable/ CARE A3+

ShortTerm(8Cr)-CARE A3+

📌Key Strength

Moderate scale Comfortable profit margins

Comfortable capital structure & debt coverage indicators

Experienced promoters operational track record reputed clientele

27

LongTerm(12Cr)-CARE BBB; Stable/ CARE A3+

ShortTerm(8Cr)-CARE A3+

📌Key Strength

Moderate scale Comfortable profit margins

Comfortable capital structure & debt coverage indicators

Experienced promoters operational track record reputed clientele

27

#axtel

📌Key Weaknesses

No Price Contracts for Raw material supply

📌Customer Concentration-Top 5 customers contribute 52% in FY19 far better than 74% in FY18

(Diversification happening)

Adequate Liquidity

No major COVID impact. Receiving Regular Orders & Timely Payments

28

📌Key Weaknesses

No Price Contracts for Raw material supply

📌Customer Concentration-Top 5 customers contribute 52% in FY19 far better than 74% in FY18

(Diversification happening)

Adequate Liquidity

No major COVID impact. Receiving Regular Orders & Timely Payments

28

#Axtel (dvanced Extrufoil Technology and Exports Ltd)

Kirit Kumar Pathak - holds 4.74% stake as a Public Shareholder.

He invested in Q4 2016 & didn't sell a single share yet.

Currently Non-Executive Director in Axtel & was Chairman from 01/2008–04/2016.

@Atulsingh_asan

29

Kirit Kumar Pathak - holds 4.74% stake as a Public Shareholder.

He invested in Q4 2016 & didn't sell a single share yet.

Currently Non-Executive Director in Axtel & was Chairman from 01/2008–04/2016.

@Atulsingh_asan

29

Kirit Kumar Pathak is his brother-in-law of Mr Ajay Naishad Desai (Executive Director) Promoter and is reputed name in spices (Patak's) in UK.

He is also on board of Nilons pickles which is served in railway canteens.

@Atulsingh_asan

Info Courtesy @jusdoitmt 🙏

30

He is also on board of Nilons pickles which is served in railway canteens.

@Atulsingh_asan

Info Courtesy @jusdoitmt 🙏

30

Just a rough estimate of Expected Price for #Axtel based on Avg of EPS (last 3yrs) & Avg of EPS (last 3yrs+TTM) & Current PE (20.2), assuming it would be able to maintain the PE ->

Mar 23 Rs 476

Mar 25 Rs 897

Not a recommendation just an estimated calculation.

32

Mar 23 Rs 476

Mar 25 Rs 897

Not a recommendation just an estimated calculation.

32

• • •

Missing some Tweet in this thread? You can try to

force a refresh