#Spreading +ive vibes via My #StressBusters🕺

#Screening #Investing #Educating

No paid services!

17 subscribers

How to get URL link on X (Twitter) App

I use @Trendlyne for Insider buying Alerts. It is easy to do this.

I use @Trendlyne for Insider buying Alerts. It is easy to do this.

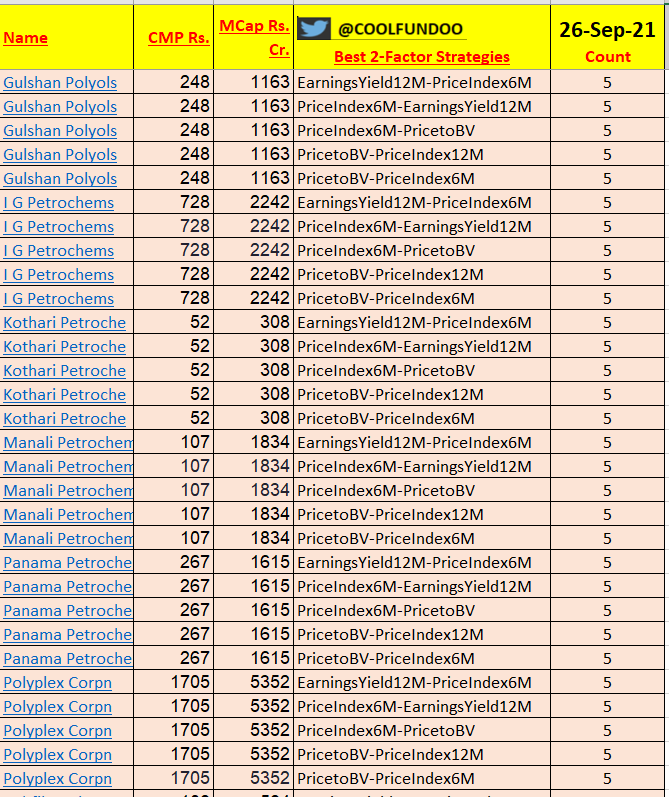

Common stocks in all 5 Best 2-Factor Strategies !

Common stocks in all 5 Best 2-Factor Strategies !

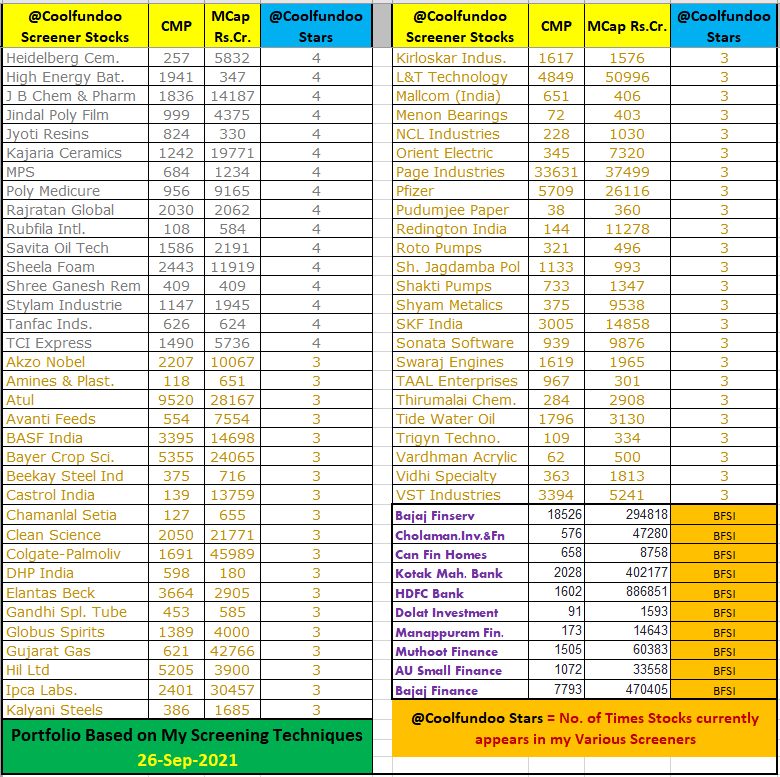

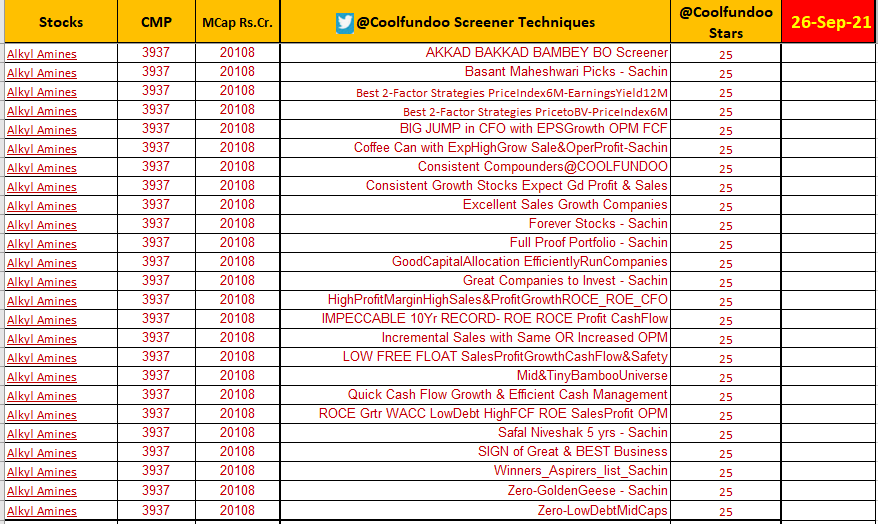

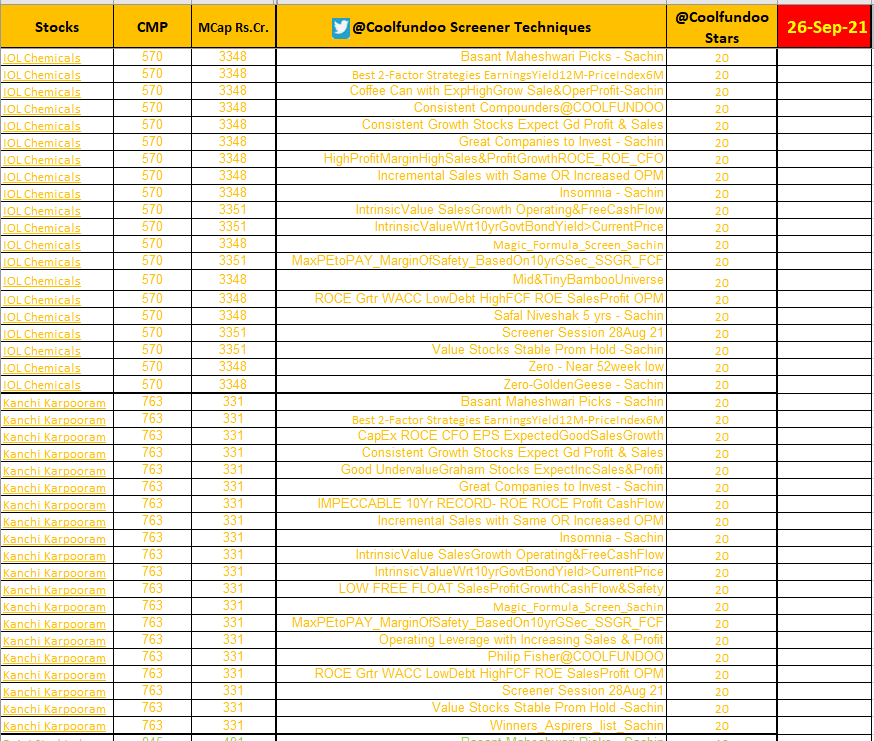

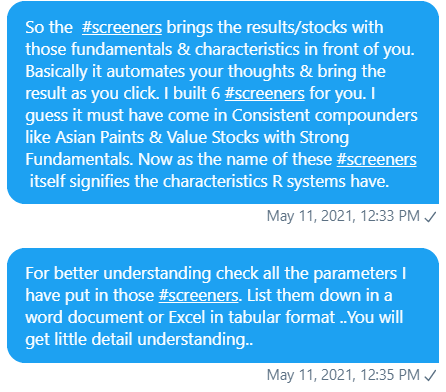

Stocks & Screening Technique Methodologies !

Stocks & Screening Technique Methodologies !

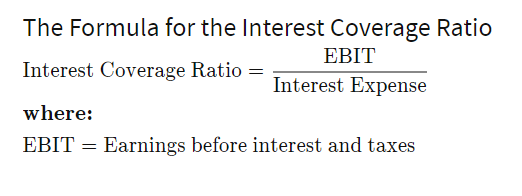

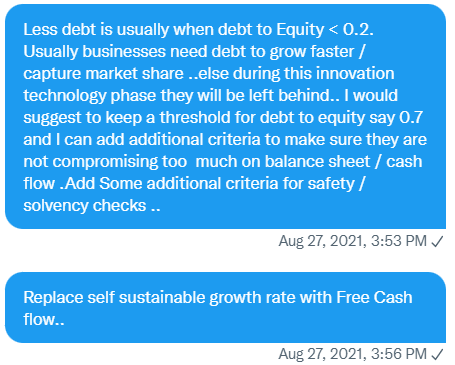

How much Debt ? Should we only invest in low debt companies ?

How much Debt ? Should we only invest in low debt companies ?

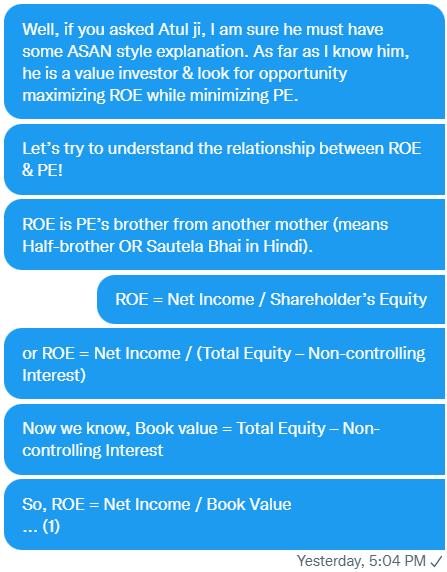

ROE is PE's brother from another mother / Half-brother (Sautela Bhai)

ROE is PE's brother from another mother / Half-brother (Sautela Bhai)

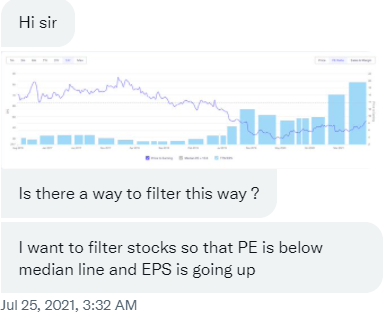

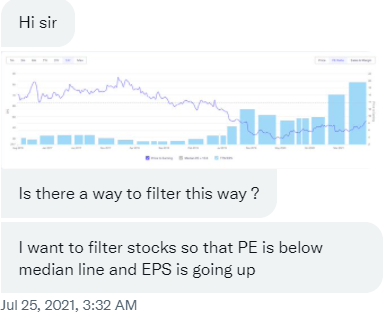

You can use this #thread of mine to learn how to use EPS formula quarterly YoY ->

You can use this #thread of mine to learn how to use EPS formula quarterly YoY ->https://twitter.com/Coolfundoo/status/1416053404061913092?s=20

Stocks & Screening Technique Methodologies !

Stocks & Screening Technique Methodologies !

Steps to be taken !

Steps to be taken !

Stocks & Screening Technique Methodologies !

Stocks & Screening Technique Methodologies !

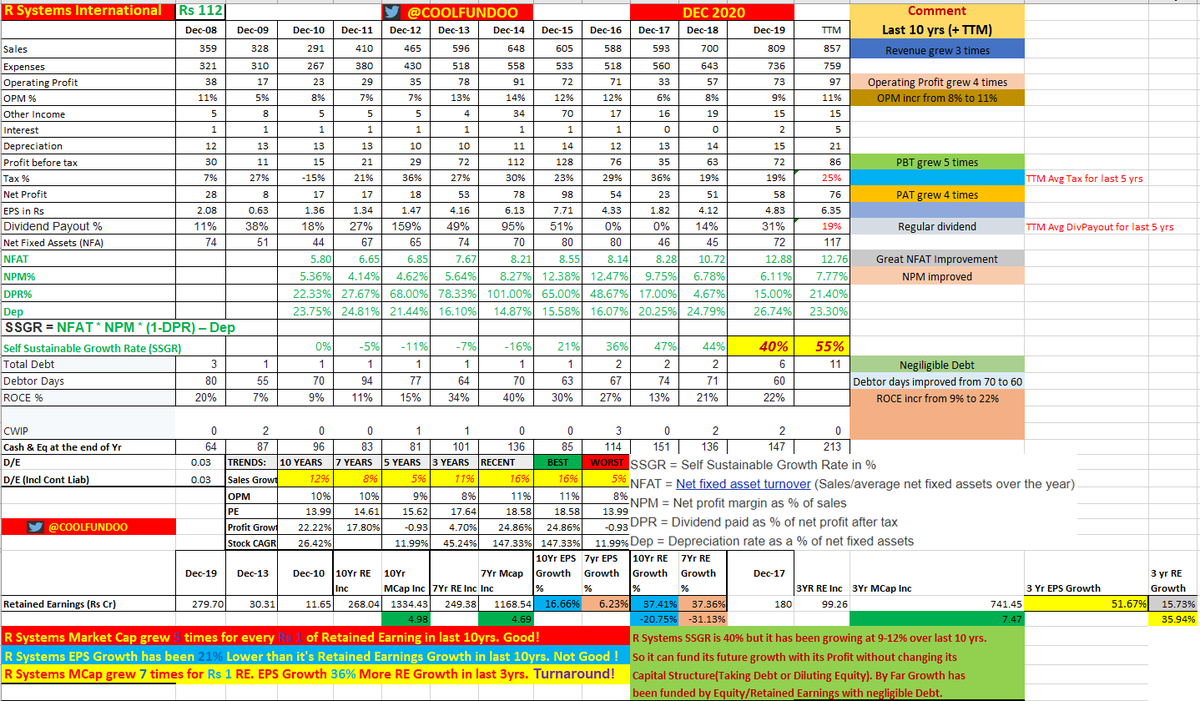

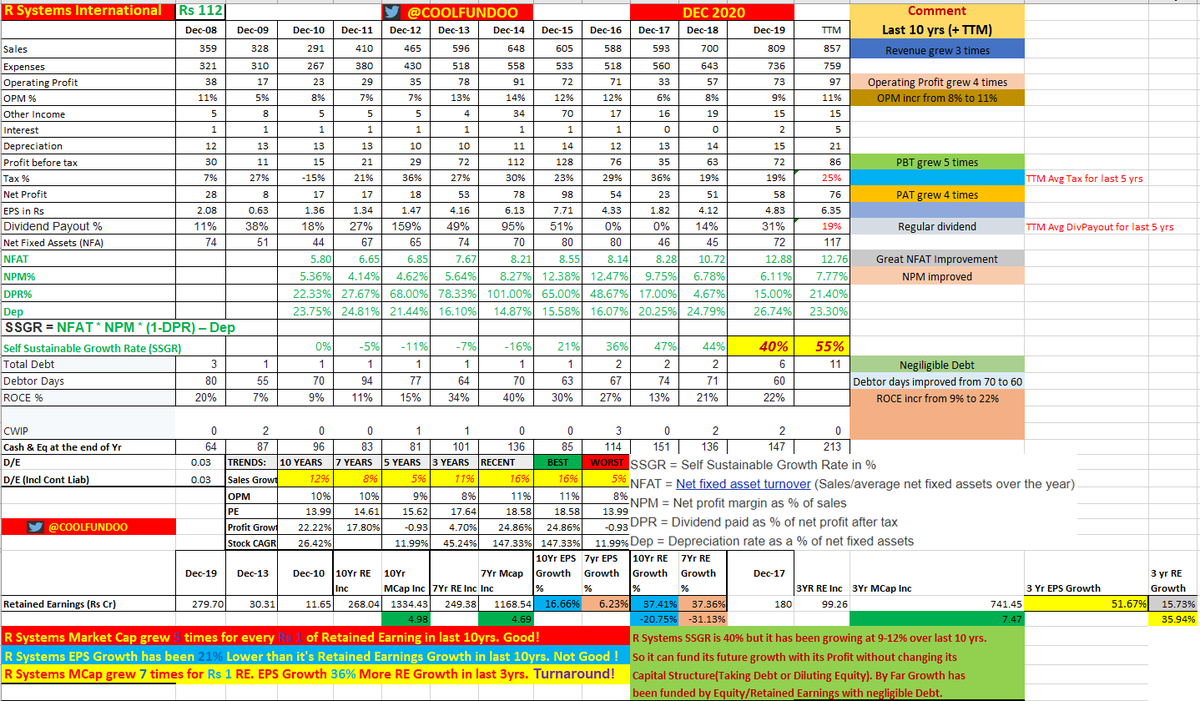

R Systems International incorporated in 1993 as a consulting firm in California, US.

R Systems International incorporated in 1993 as a consulting firm in California, US.

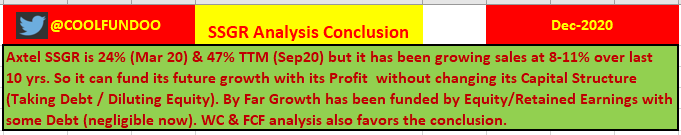

SSGR Analysis !

SSGR Analysis !

📌Magic formula =Good Stocks At Attractive Prices

📌Magic formula =Good Stocks At Attractive Prices

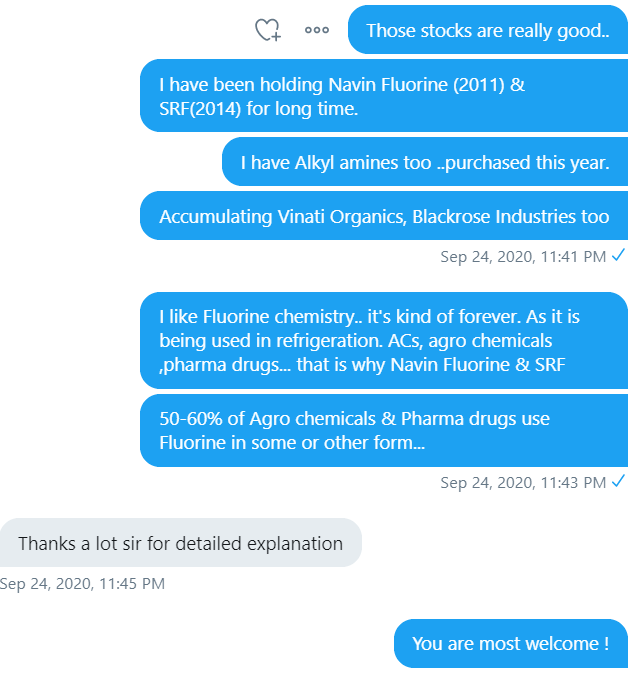

Me-> Chemical Businesses !

Me-> Chemical Businesses !

STRATEGY No. 1

STRATEGY No. 1https://twitter.com/Coolfundoo/status/1286820339469688832?s=20

📌Free Float = Public Float(DII+FII+ MF+ Corporate+HNI+Retail)

📌Free Float = Public Float(DII+FII+ MF+ Corporate+HNI+Retail)