1/ A quick thread highlighting some of my favorite papers of the year, picking just one paper per month based upon when they were published!

(Warning: There will be a quant skew to this)

(Warning: There will be a quant skew to this)

2/ JANUARY

@vol_christopher's The Allegory of the Hawk and the Serpent: How to Grow and Protect Wealth for 100 Years

artemiscm.docsend.com/view/taygkbn

@vol_christopher's The Allegory of the Hawk and the Serpent: How to Grow and Protect Wealth for 100 Years

artemiscm.docsend.com/view/taygkbn

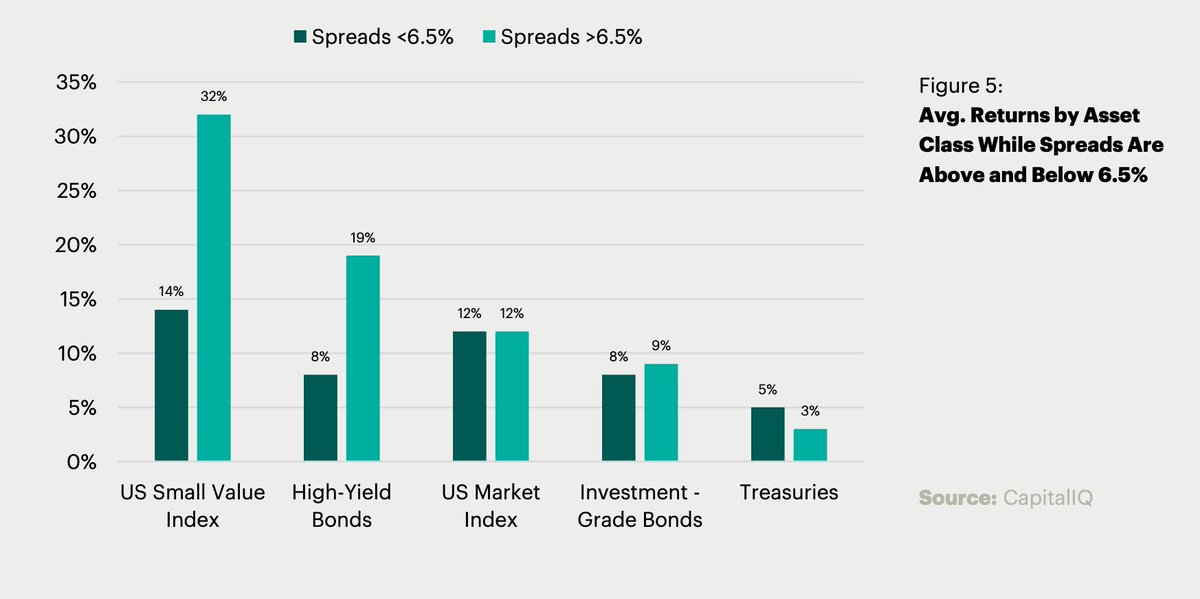

2/ FEBRUARY

@verdadcap's Crisis Investing: How to Maximize Returns During Market Panics

static1.squarespace.com/static/5db0a1c…

@verdadcap's Crisis Investing: How to Maximize Returns During Market Panics

static1.squarespace.com/static/5db0a1c…

3/ MARCH

Everything on Twitter.

Twitter was an astoundingly good resource for information and data during March.

Everything on Twitter.

Twitter was an astoundingly good resource for information and data during March.

7/ JULY

Contagious Margin Calls: How COVID-19 Threatened Global Stock Market Liquidity

papers.ssrn.com/sol3/papers.cf…

Contagious Margin Calls: How COVID-19 Threatened Global Stock Market Liquidity

papers.ssrn.com/sol3/papers.cf…

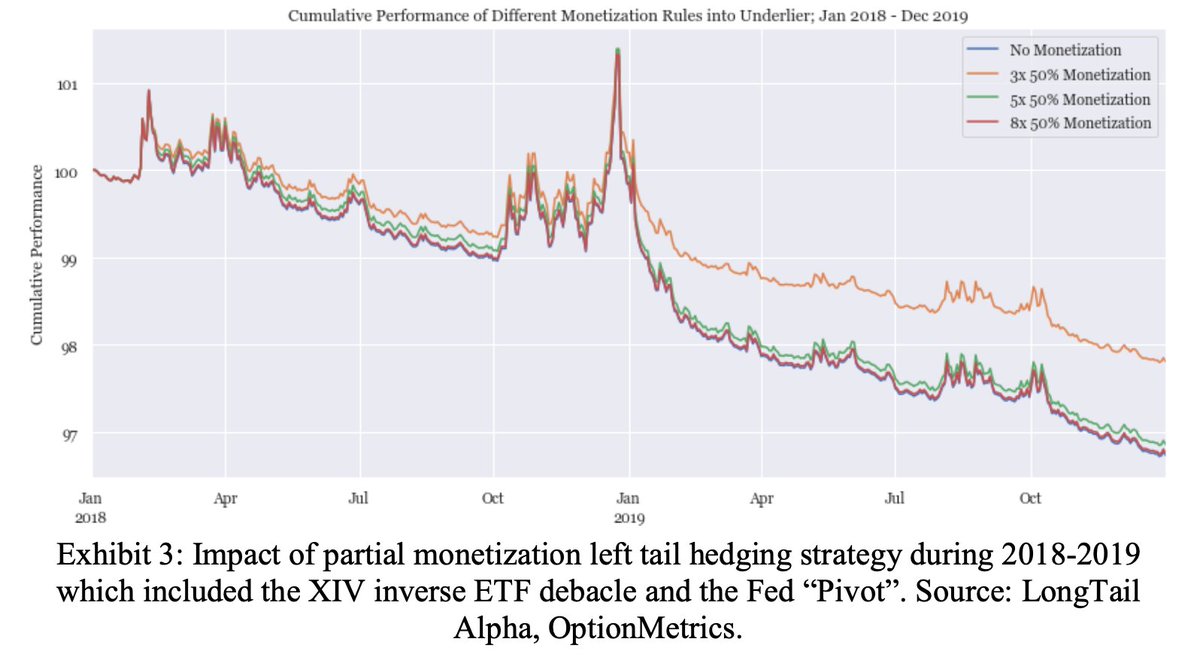

8/ AUGUST

@longtailalpha's Monetization Matters: Active Tail Risk Management and The Great Virus Crisis

papers.ssrn.com/sol3/papers.cf…

@longtailalpha's Monetization Matters: Active Tail Risk Management and The Great Virus Crisis

papers.ssrn.com/sol3/papers.cf…

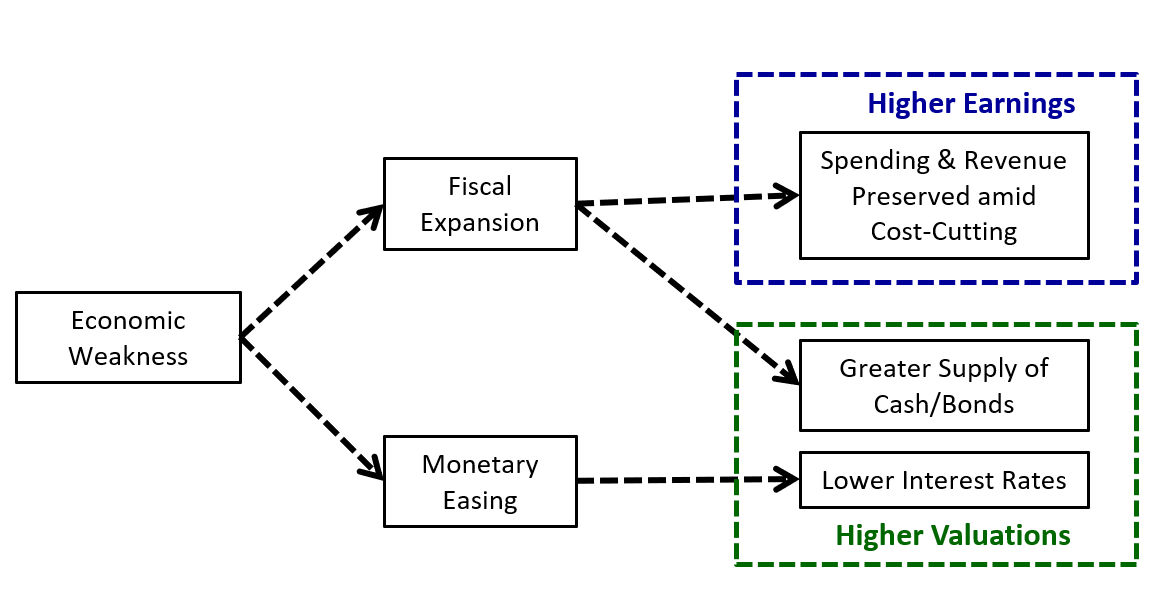

9/ SEPTEMBER

@Jesse_Livermore's Upside-Down Markets: Profits, Inflation, and Equity Valuation in Fiscal Policy Regimes

osam.com/Commentary/ups…

@Jesse_Livermore's Upside-Down Markets: Profits, Inflation, and Equity Valuation in Fiscal Policy Regimes

osam.com/Commentary/ups…

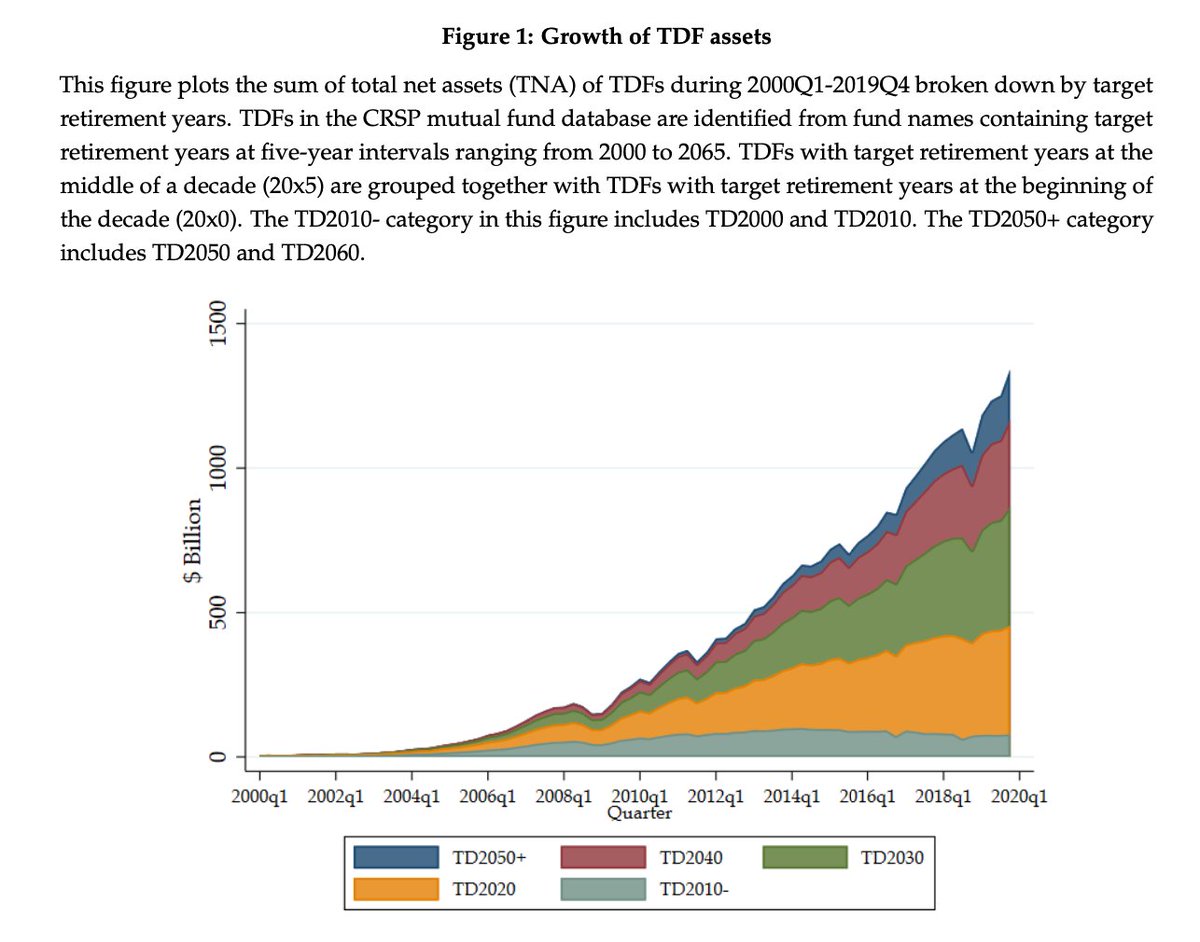

10/ OCTOBER

Retail Financial Innovation and Stock Market Dynamics: The Case of Target Date Funds

nber.org/papers/w28028

Retail Financial Innovation and Stock Market Dynamics: The Case of Target Date Funds

nber.org/papers/w28028

12/ DECEMBER

Still reading...

So what great articles and papers did I miss?

Still reading...

So what great articles and papers did I miss?

• • •

Missing some Tweet in this thread? You can try to

force a refresh