This is a take. The thread is worth reading for the take.

I expect it overstates things.

Couple of problems.

1) while vanna can drive moves, I expect it is more gamma curvature and density than vol (in real trader terms, vanna of one-week options is meaningless).

I expect it overstates things.

Couple of problems.

1) while vanna can drive moves, I expect it is more gamma curvature and density than vol (in real trader terms, vanna of one-week options is meaningless).

https://twitter.com/SqueezeMetrics/status/1339434562548604929

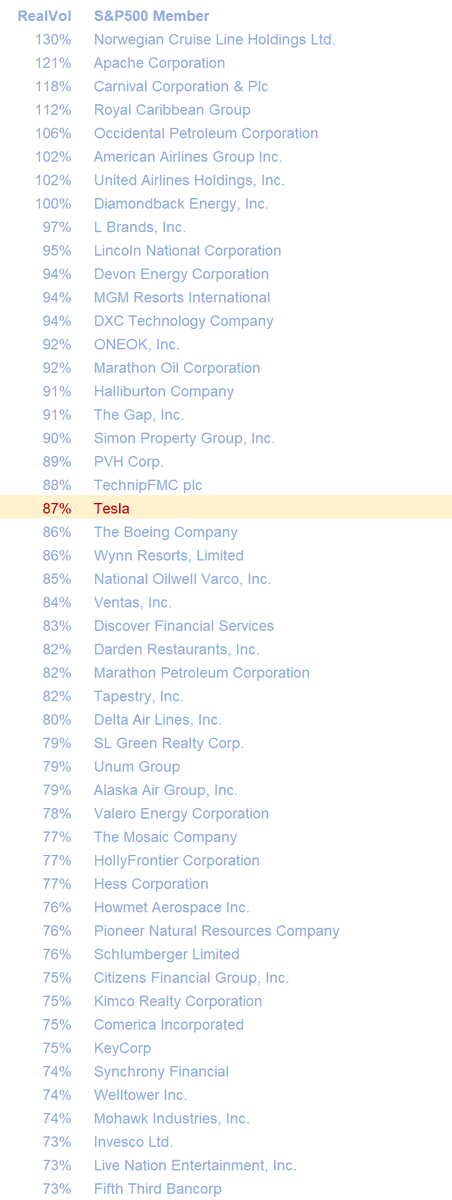

2) if this were the case, it would be the case for other stocks too, but TSLA did not have the highest realized volatility of S&P500 (or S&P+TSLA) for the 52wks to 13Nov announcement. It's #21. Sure airlines and oilcos and cruise companies were on the list. But banks are too.

3) What really drives that number - volatility - over time is volume, and volume is best understood by how much of a company's float is traded every day.

Every time someone buys/sells S&P500 and dealers/arbitrageurs have to buy/sell the shares, increasing intra-correlation

Every time someone buys/sells S&P500 and dealers/arbitrageurs have to buy/sell the shares, increasing intra-correlation

3) cont) between members, they buy and sell the same percentage of float for all members. If a group of people net buy $10bn of S&P500 they will buy roughly 0.032% of the float of Apple. And of every other member of S&P. Same number. That's how float weight indices work.

So...

So...

if a stock trades 10% of float per day as Tesla does (9.8% average from 14Nov19 to 13Nov20), the OTHER 9.77% of float traded per day is non-index people.

And those people are the people punting stock around.

And those people are the people punting stock around.

Obviously, it is not the case that the average holder of the stock holds it for only 10 days, but yes there are a bunch of people who swing it back and forth quite aggressively. And that happens. AMD has been a high ADV/Float number for years. And volatility and options follow.

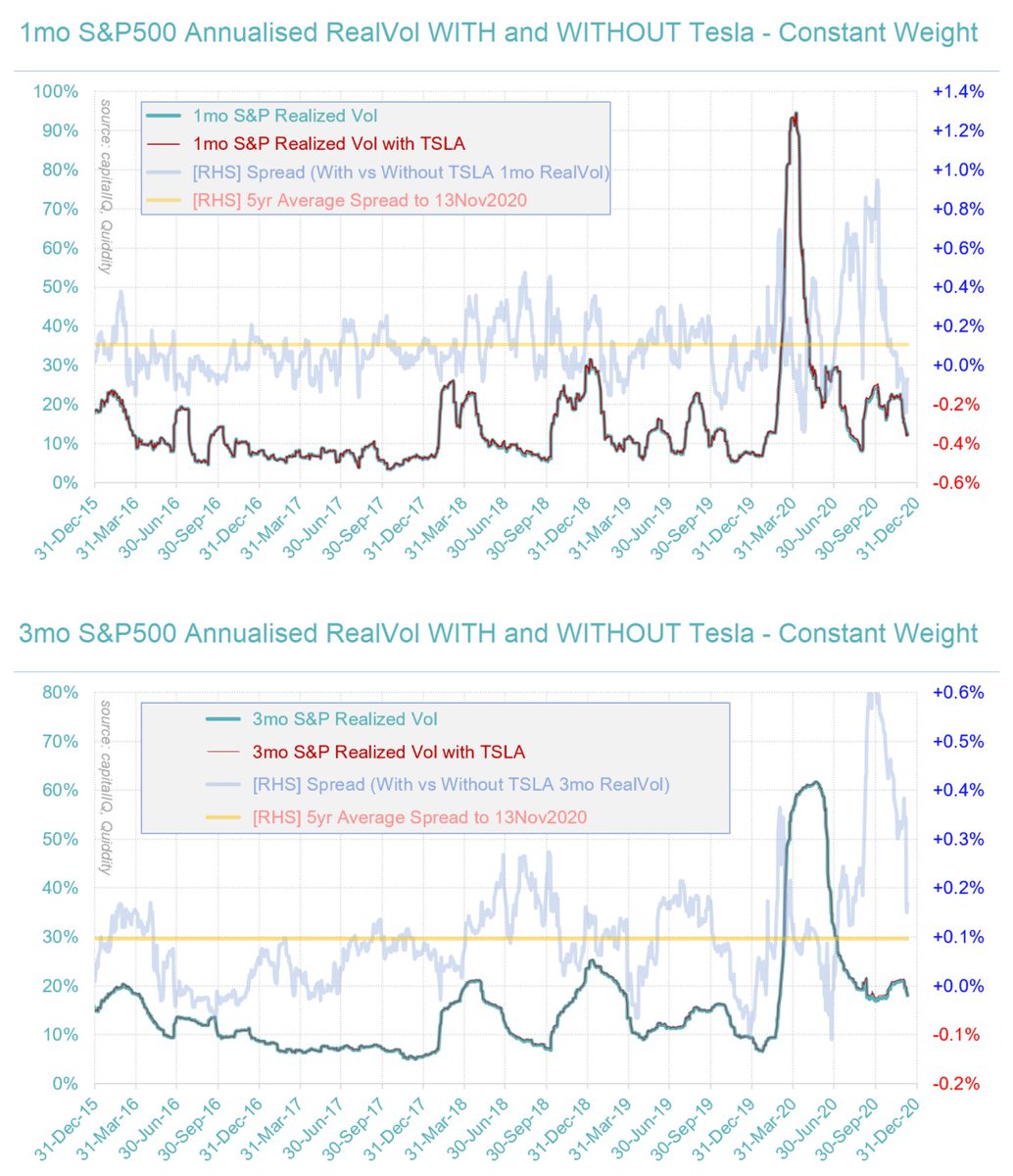

4) If you reconstruct S&P to include Tesla over the past five years at a constant 1.5% weight, it does not change S&P realized volatility much at all (see charts below), which means yes, slight adjustments will be made, but the only thing which will NECESSARILY drive TSLA to

greater intracorrelation to S&P is lower excess volume.

There is a question of causality/reflexivity. Excess vanna/gamma causes excess delta to trade causing excess ADV/Float. But if people punt, the stock will move, others will pay for the YOLO options, and hedgers get offside.

There is a question of causality/reflexivity. Excess vanna/gamma causes excess delta to trade causing excess ADV/Float. But if people punt, the stock will move, others will pay for the YOLO options, and hedgers get offside.

There is nothing within the mechanism of options, S&P flows, intracorrel/dispersion trading, etc, which REQUIRES Tesla see its excess volume/float and high vol to drop post-inclusion.

Real World Float will actually drop ~20% on the inclusion. This too is not pure - increased

Real World Float will actually drop ~20% on the inclusion. This too is not pure - increased

index holding allows for greater borrowability meaning more shorts are possible (and every short creates a new long), but real delta1 shorts are constrained by dollars of risk appetite (notional x volatility x expected return), not % of float, so it'll be a thing to watch.

5) Implied vol of TSLA could fall. But it doesn't have to, as per above. Implied vol will fall when realized vol falls. And realvol doesn't HAVE TO fall to the 40s. Ever.

However, I do agree the stock can fall, and can fall sharply. And it can do so because demand for upside

However, I do agree the stock can fall, and can fall sharply. And it can do so because demand for upside

could fall off a cliff because "the event" is now gone. Traders who decide not to buy the next dip will be psychically rewarded if it drops further from that decision not to BTD. And as it falls, if YOLO call buying disappears, dealers will play less. And others will play less.

However, this is Behavioral Trading 101 - not the result of changes to the "massive volatility complex, which is a terrifying web of arbitrage and pseudo-arbitrage relationships", which by itself could not overcome other demand for TSLA options exposure (TSLA options OI

outpunches its implied S&P weight by an enormous amount (similar to how its ADV/float outpunches the average). Pros trading S&P500 dispersion will have it a bit easier than before as liquid options will trade on a greater portion of S&P than before, but it isn't them who will

force the mass of others to change their behavior.

They have to do that all by themselves.

They have to do that all by themselves.

I should caveat that bit on vanna. Most YOLO call buyers don't buy 1wk 30% OTM options. They buy the sweet spot of "throwaway premium" and moneyness which at sub 100% vol will be 3-10% OTM. At that price, even if you lift vol, and delta goes up (vanna), the real problem is still

gamma (and auto-correlated gamma).

At 5 trading days and 60 vol, a 108 call will be 50cts with a 15 delta. At 61 vol, BS delta moves up 0.5%. But at 60 vol, a 1% move on the stock moves delta 3-4pts, and a 1stdev move on the open will get you to a very high 20s delta.

At 5 trading days and 60 vol, a 108 call will be 50cts with a 15 delta. At 61 vol, BS delta moves up 0.5%. But at 60 vol, a 1% move on the stock moves delta 3-4pts, and a 1stdev move on the open will get you to a very high 20s delta.

So if RHers have bought $20bn notional of said calls, hedgers hv to buy $3bn of stock by lunch. And that pushes the stock up further.

If more YOLOers then come in to buy YOLO calls and the risk mgr is on the phone asking about your short gamma, desk trader raises offer

If more YOLOers then come in to buy YOLO calls and the risk mgr is on the phone asking about your short gamma, desk trader raises offer

to 65 vol, which adds another 1.5% of delta if you are 2mins after the open, but almost all that additional delta (from 60 to 65 vol) will have decayed by day end.

So yes vanna exists, but I expect the positive correlation in TSLA's case is more correlation than causation.

So yes vanna exists, but I expect the positive correlation in TSLA's case is more correlation than causation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh