The latest flash loan attack?

An account funded by one ETH from Tornado Cash executed a contract that flash swapped $180m from Uniswap and flash borrowed $51m from dYdX.

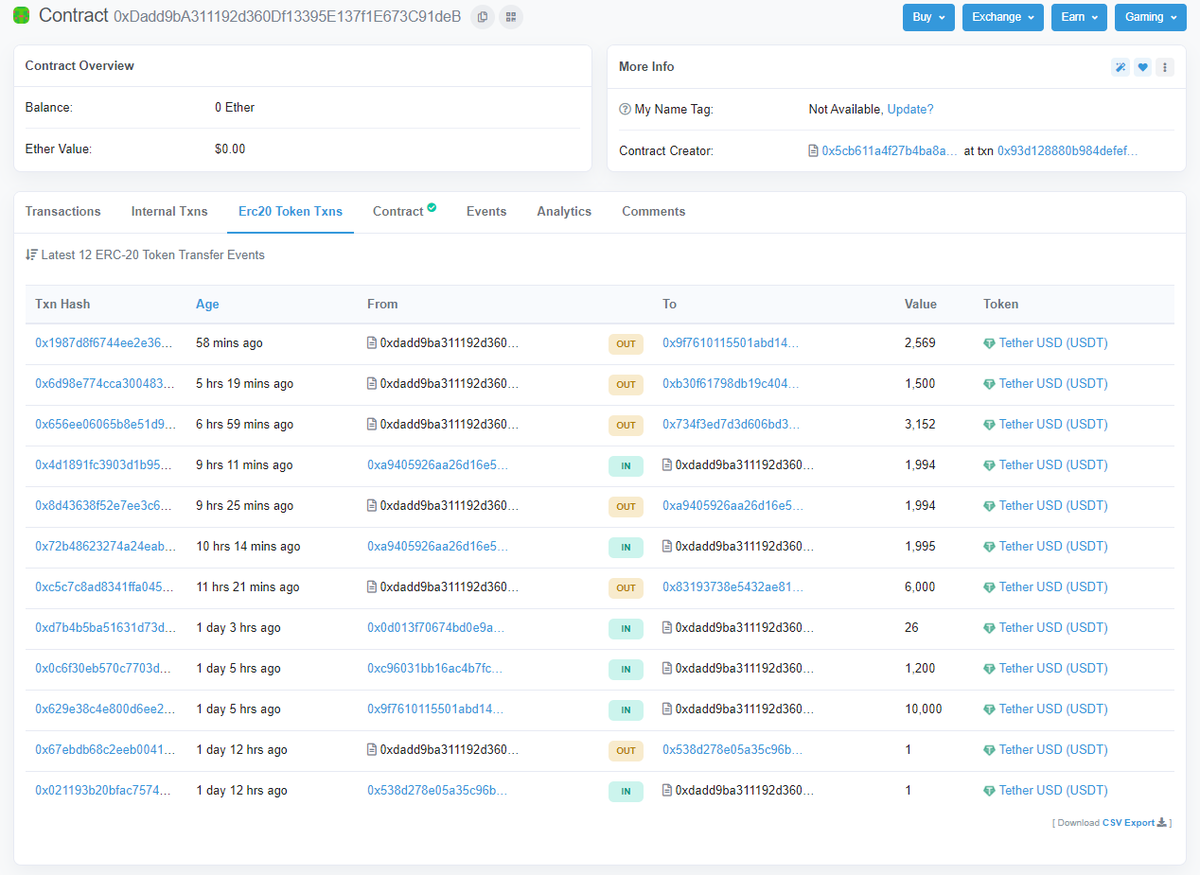

USDC and DAI vaults of Warp, the protocol affected, are empty.

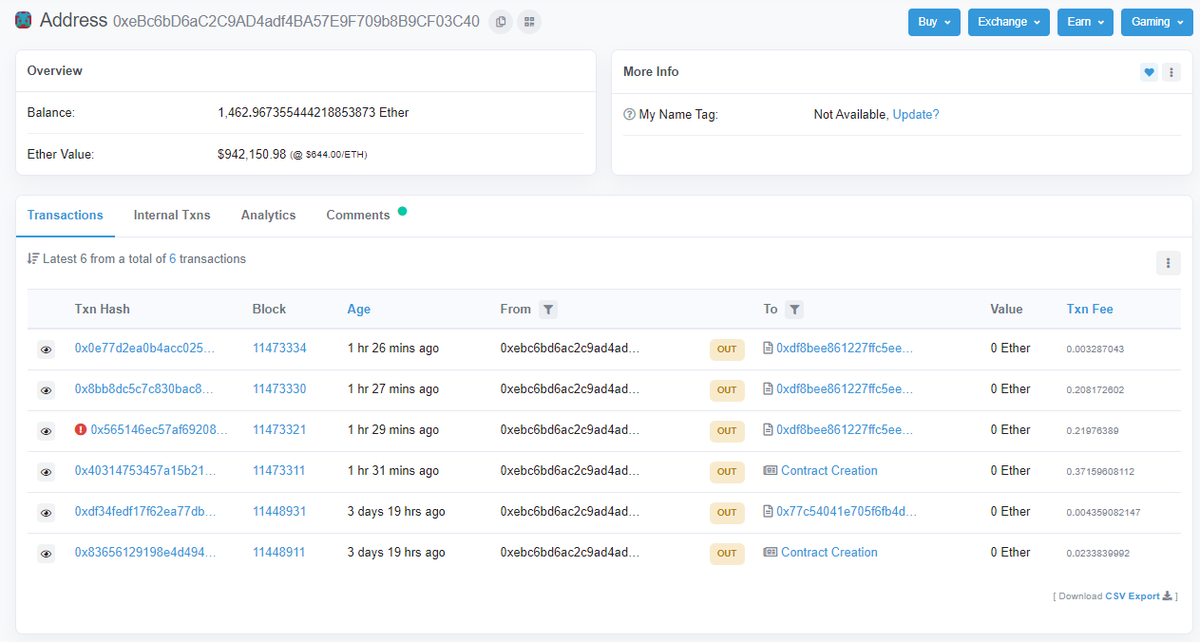

$1m in ETH is in an EOA.

h/t @CryptoCatVC

An account funded by one ETH from Tornado Cash executed a contract that flash swapped $180m from Uniswap and flash borrowed $51m from dYdX.

USDC and DAI vaults of Warp, the protocol affected, are empty.

$1m in ETH is in an EOA.

h/t @CryptoCatVC

What I immediately find interesting here is that it appears that much of the attacker's bounty went to fees.

There was 3.85m DAI and 3.92m USDC in the Warp contracts.

The attacker (seemingly) left with $1 million in ethereum (1,462 ETH).

There was 3.85m DAI and 3.92m USDC in the Warp contracts.

The attacker (seemingly) left with $1 million in ethereum (1,462 ETH).

Warp Finance is a protocol that is creating a money market for LP tokens.

Aave does have a Uniswap LP money market but thus far, it has yet to gain traction.

With LP yield farming programs, this may be an increasingly important market gap to fill.

Aave does have a Uniswap LP money market but thus far, it has yet to gain traction.

With LP yield farming programs, this may be an increasingly important market gap to fill.

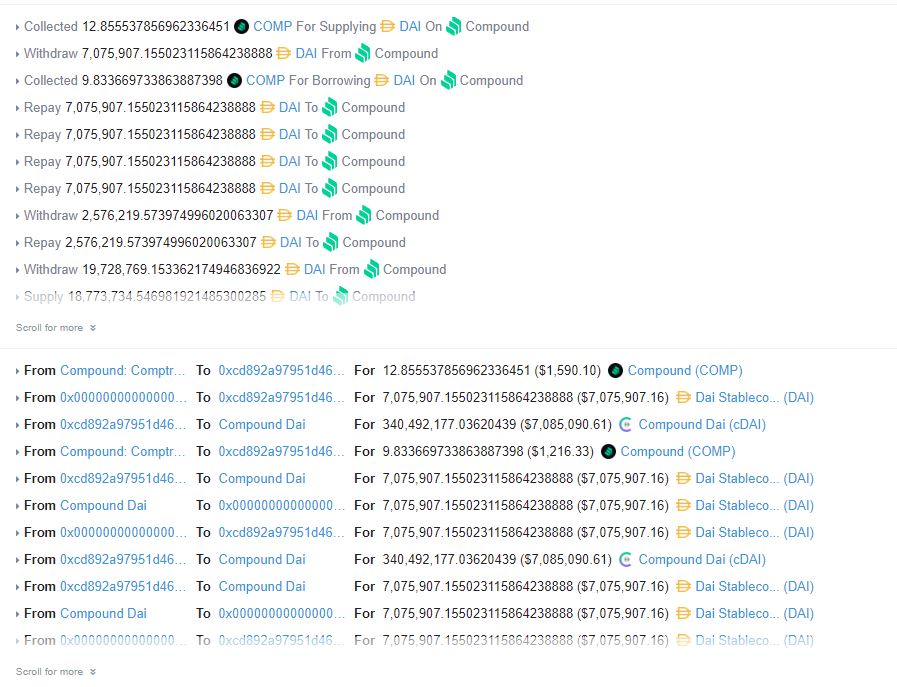

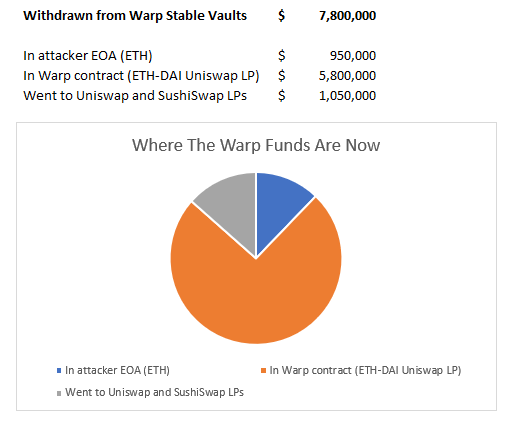

Circling back to my point about fees,

Rough back of the napkin math indicates that yes, much of the funds are uncoverable at this point (distributed to Uniswap and Sushiswap LPs).

$800m in AMM volume for this transaction = $2.4m in fees

Then slippage on top of that?

Rough back of the napkin math indicates that yes, much of the funds are uncoverable at this point (distributed to Uniswap and Sushiswap LPs).

$800m in AMM volume for this transaction = $2.4m in fees

Then slippage on top of that?

I guess the attacker would likely have made away with more if the second phase of the UNI distribution was live as there would have been less slippage on the flash swaps.

The attacker pumped dozens of millions through Uniswap pairs that are relatively illiquid now compared to b4

The attacker pumped dozens of millions through Uniswap pairs that are relatively illiquid now compared to b4

Interesting...

The account was funded from a Tornado Cash mix three days ago.

3 days ago, they deployed an unverified contract, tried to execute something, then went quiet for three days.

The account was funded from a Tornado Cash mix three days ago.

3 days ago, they deployed an unverified contract, tried to execute something, then went quiet for three days.

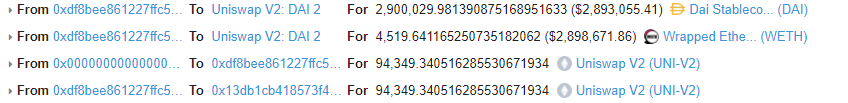

Pardon me, it appears that I missed the part where the attacker minted $6m worth of Uniswap DAI-ETH LP shares.

The LP shares are STILL IN THE Warp contract (0x13db1CB418573f4c3A2ea36486F0E421bC0D2427).

So not fully rekt?

The LP shares are STILL IN THE Warp contract (0x13db1CB418573f4c3A2ea36486F0E421bC0D2427).

So not fully rekt?

Rough estimate of where we're at right now.

The biggest question right now is if the attacker owns the ETH-DAI LP collateral in the Warp contract.

The biggest question right now is if the attacker owns the ETH-DAI LP collateral in the Warp contract.

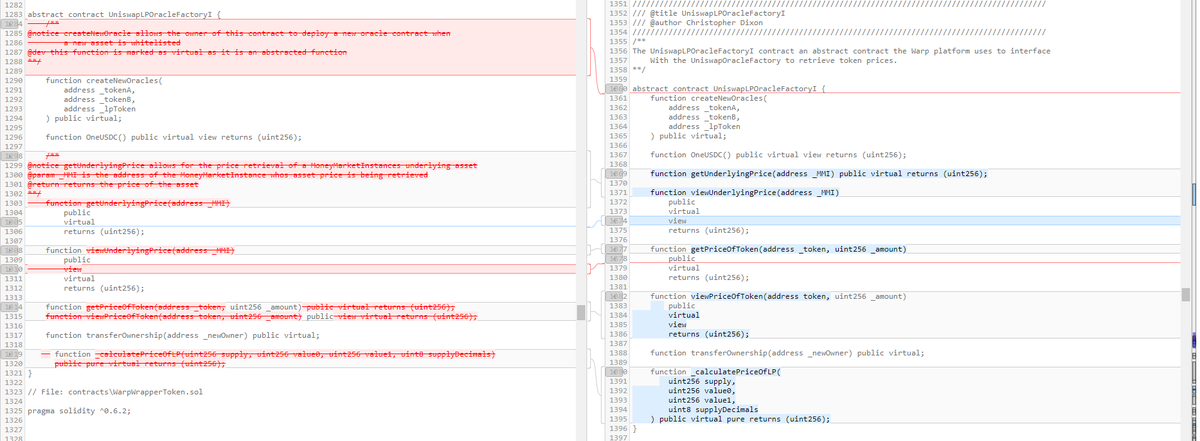

This attack comes two days after Warp began a migration from its v1 to v2.

Here's a Mergely between the v1 USDC vault (left) and the v2 USDC vault (right):

editor.mergely.com/BPzu44WH/

One of the only changed parts of code is this part:

Here's a Mergely between the v1 USDC vault (left) and the v2 USDC vault (right):

editor.mergely.com/BPzu44WH/

One of the only changed parts of code is this part:

@emilianobonassi is there anything here?

I wonder if these are related at all:

Account gets funded three days ago, deploys unverified contract, executes something but fails.

v2 launched two days ago.

Today, account deploys another contract, executes something but succeeds.

Account gets funded three days ago, deploys unverified contract, executes something but fails.

v2 launched two days ago.

Today, account deploys another contract, executes something but succeeds.

https://twitter.com/n2ckchong/status/1339720629050720256

Confirmed - the attacker still owns the collateral in the contract.

Interesting why they haven't withdrawn it.

Interesting why they haven't withdrawn it.

https://twitter.com/brockjelmore/status/1339732996027371520

There's a plan in place to recover the funds.

Hoping for the best for those affected 👍

Hoping for the best for those affected 👍

https://twitter.com/warpfinance/status/1339751976695947266

• • •

Missing some Tweet in this thread? You can try to

force a refresh