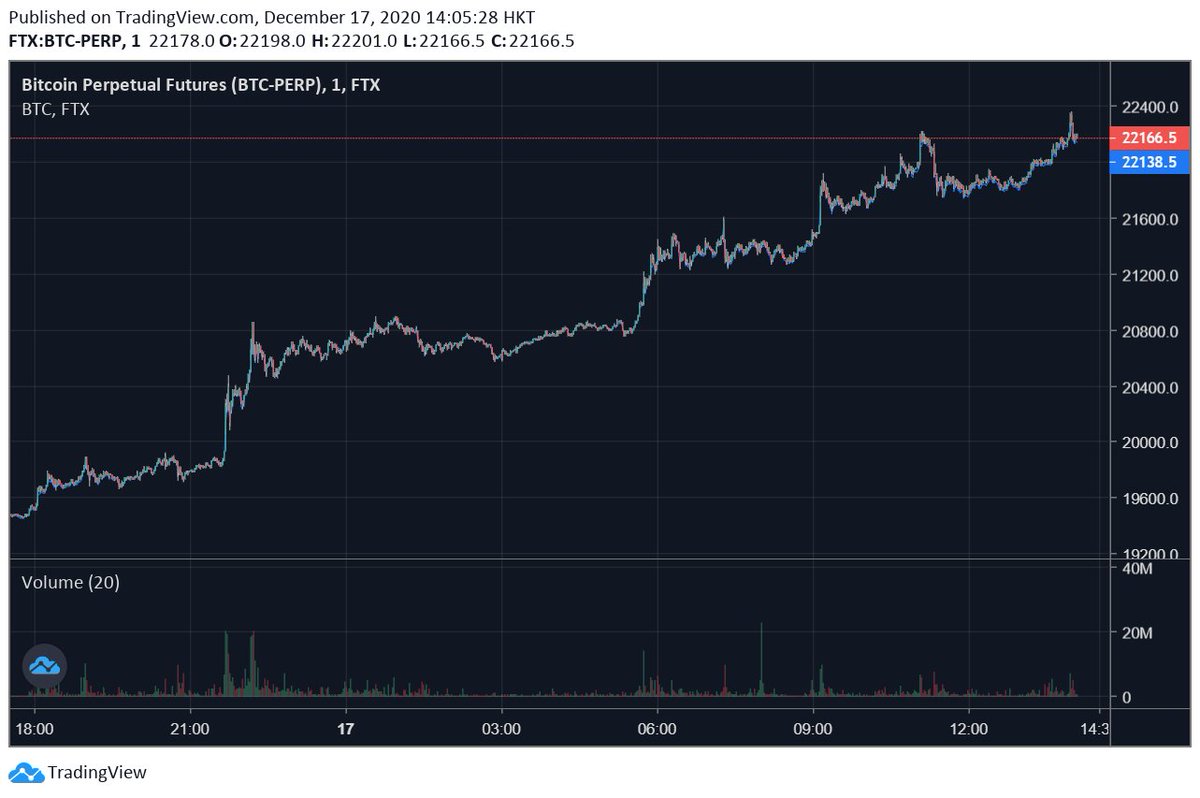

Many close calls later, BTC finally managed to break through $20k -- and it BLEW through it, barely slowing down til $22k. What was different this time?

A thread about man vs. machine.

A thread about man vs. machine.

https://twitter.com/AlamedaTrabucco/status/1265369446824075265?s=20

As has been pointed out, I've been adamant that the rallies in the past month or so have been heavily fueled by rampant liquidations on both BitMEX and Binance. And they have! But they were also fueled by organic buying among U.S. investors, as has been a popular narrative.

If anything, the narratives surrounding various U.S. funds and other companies buying BTC have gotten *stronger* in the past week or two than they were around Thanksgiving. More and more funds have announced their crypto holdings or plans to acquire them.

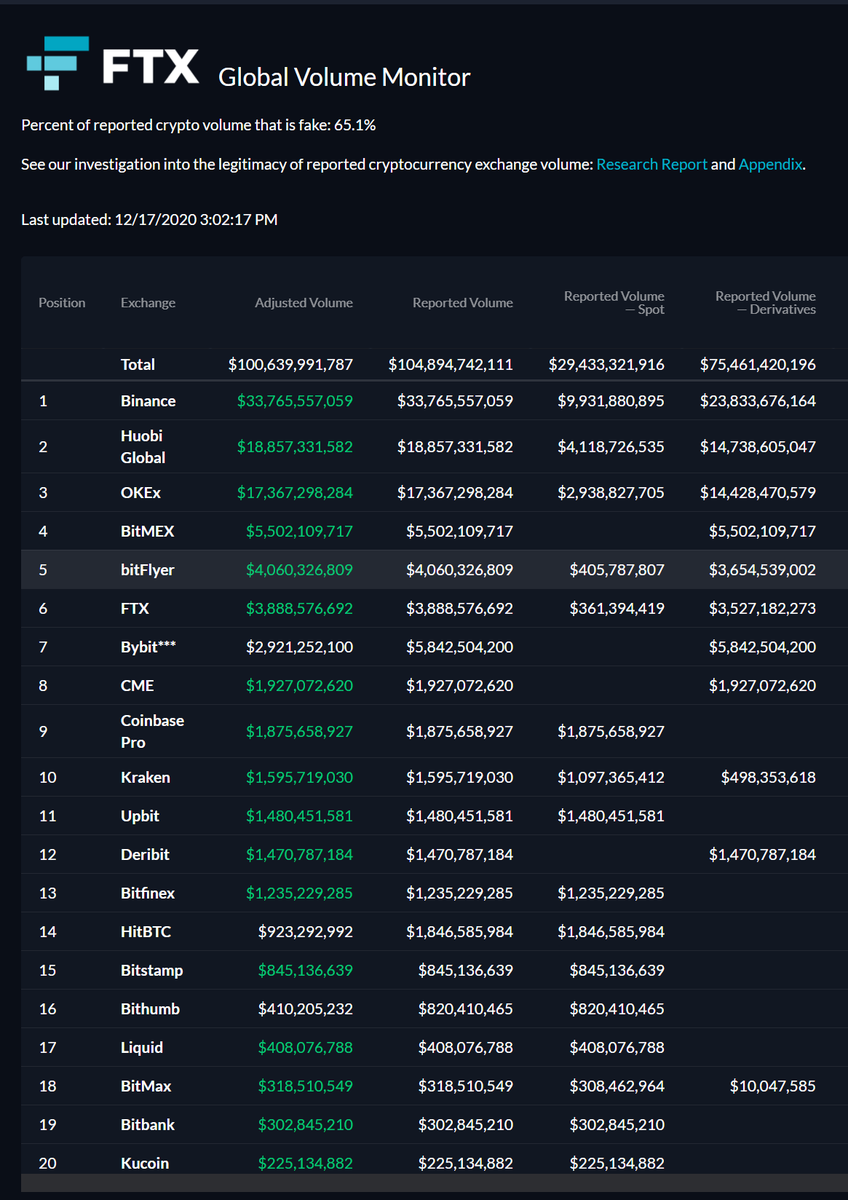

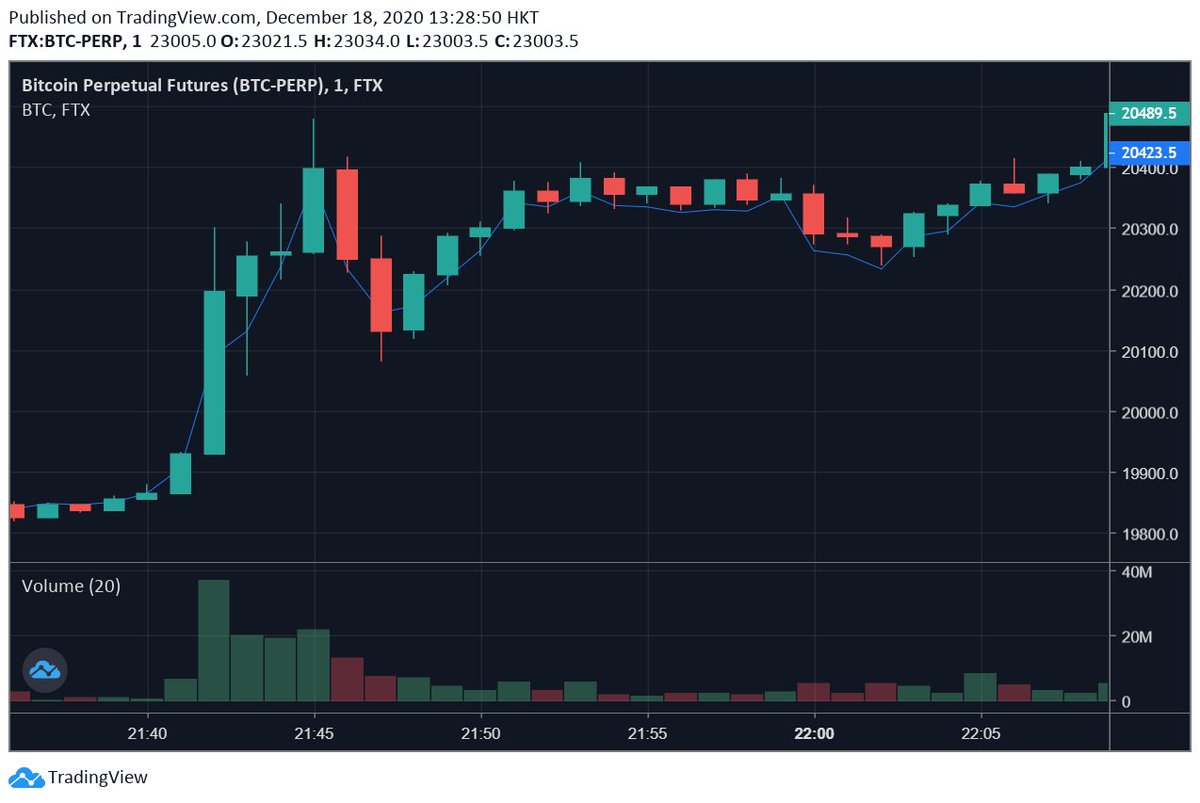

And direct signs of all this exist. Take a look at FTX's volume monitor: U.S. trading hubs like Coinbase having more volume than normal *is* a signal that U.S. customers are doing *something*, and when BTC is going up ...

(Coinbase even crashed from "heightened activity :P).

(Coinbase even crashed from "heightened activity :P).

The DOW recently announced their new crypto indices, CME is listing ETH futures, Microstrategy putting $650M into BTC, GBTC AUM continuing to balloon, these all point in the same direction, and that direction is a resounding "up" for the crypto markets.

So, the institutional BTC buying is both more intense and more "robust" -- it's *everywhere*, not just a few firms.

But something else was different, too. Note in the volume monitor, Coinbase's volume is higher than usual -- but it's also really low globally.

But something else was different, too. Note in the volume monitor, Coinbase's volume is higher than usual -- but it's also really low globally.

Derivatives markets (outside the U.S.) still, of course, have the *vast* majority of volume -- they have leverage, so they almost have to. This was true in the last run-ups too -- but just "futures" isn't enough to tell the whole story.

The previous run-ups were dominated by aggressive buyers in a few markets with really high leverage -- Binance and BitMEX perps, mostly. This time, those were in the mix -- heavily! -- but not quite as heavily as some other products.

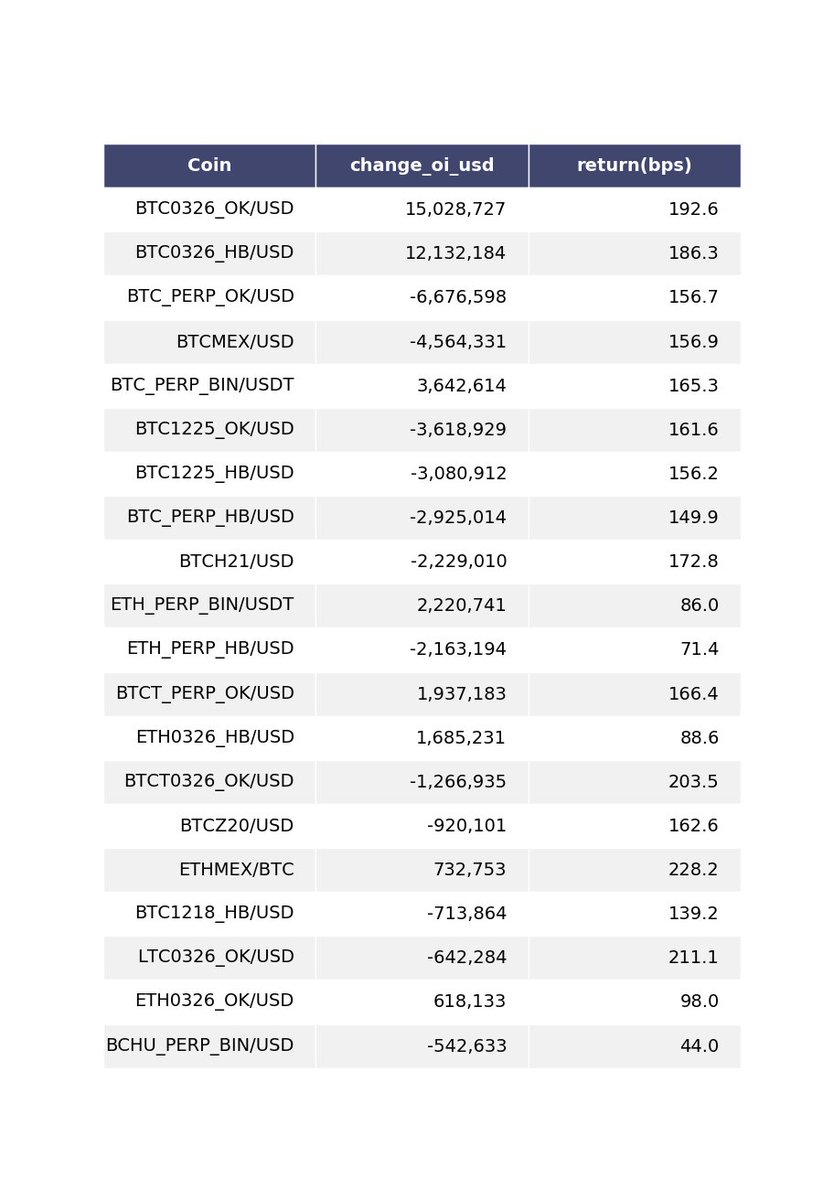

Here's a report one of Alameda's traders made that runs every hour and tells us about the products with the biggest OI changes, as well as their price moves. In the hour from the biggest moves right before BTC hit $20k, the biggest inflows were actually in ... March quarterlies?

And the returns column indicates that the premium on those quarterlies went up a TON more than other products' did -- these were AGGRESSIVE buyers, and they were buying a ton. This was the pattern for most of these inflows -- less BitMEX/Binance perps, more quarterlies/spot.

A big difference? These products (spot and the OK/HB quarterlies) tend to have way less leverage (possible or realized, as the case may be) -- the positions get held for more time, and buyers in them tend to indicate "I'm buying to hold" more than "I'm buying to scalp."

And they get liquidated less, too -- so these buys weren't apt to get undone as easily as 100x levered-long Binance perps would on the first draw-down. All this is to say: this rally was driven by more "organic" buying, in both spot and derivatives markets.

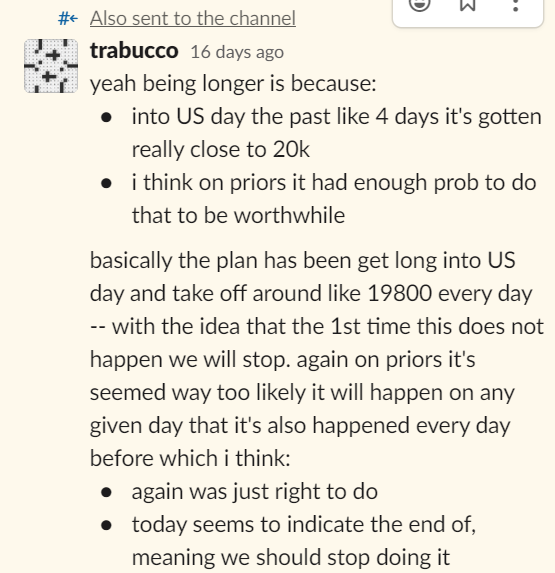

If you're just running a study on the past few weeks, you might come to the conclusion that selling near $20k is just an incredible trade -- we ran this study and came to that conclusion a few times! Here's a post I made in our "delta-force" channel on Slack:

You could imagine studies which nail things like "if it's these products leading do X near $20k, if these do Y" -- but there were like, 5 data points, and that's just not enough to optimize this. It's enough to think selling $19900 makes sense on average -- not much else.

So all our fancy data analysis wasn't going to be enough -- to really nail predicting what happened when BTC *did* break through $20k, you'd need human intuition -- noticing what I said about re: quarterlies being different, guessing that meant the inflows were "stickier."

Alameda did know things were different during the run-up, but I'll admit we didn't *nail* this -- we still thought that there'd be $20k resistance even though the U.S. / sticky inflows were definitely there. And, actually, there was a TON of $20k (and just above) selling ...

... but not enough to counter-act all the liquidations that happened as BTC crossed the $20k threshold :P (I didn't say they *didn't* happen). Indeed, remember all the levered-up shorts that got opened on Binance and BitMEX during the fall after the last $20k test?

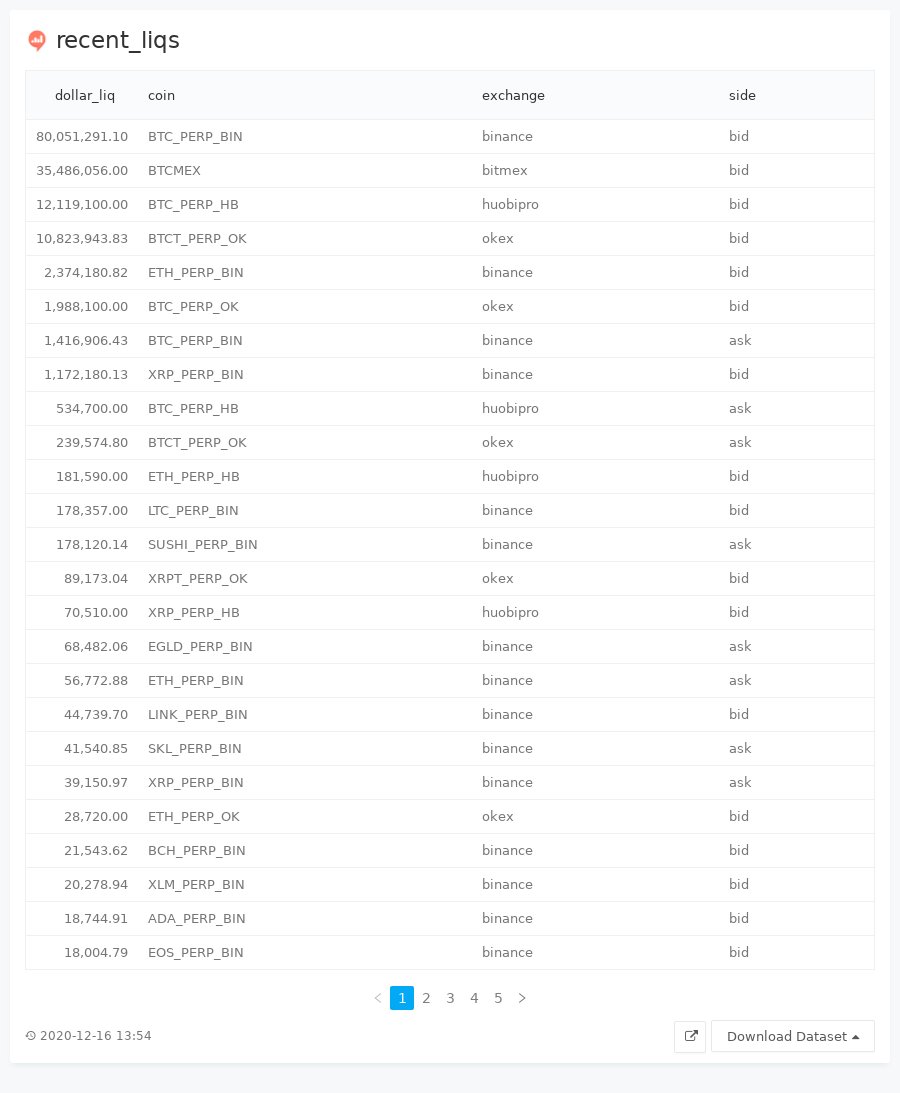

Yeah: they got "rekt." TONS of liquidations during the rally above $20k, which is what allowed BTC to push through all the legitimate selling pressure. Here's another report Alameda uses to keep track of those sorts of things in aggregate (we also have loud alerts):

An interesting thing about these: liquidations by definition are *closing* someone's positions. But OIs did *not* go down by enough when these happened, and premia did *not* go up enough. This meant there was a LOT of selling -- about half as much as got liquidated.

With around half as many shorts getting liquidated? Probably the post-pop reversion here goes down a LOT more -- back down to 19700 or something? Unclear, liquidity got low. But back down for sure, at least temporarily (we now know people probably buy it back up :P).

What followed here was an exercise in favoring human intuition over a computer's studies -- what would the markets do in a new paradigm where waiting to pass the ATH wasn't a factor? Well, the new paradigm looked a lot like the old one in some ways ...

Liquidity was LOW (still sorta is, but that's changing). This meant that big orders had a LOT of impact, and as that impact (plus natural buying pressure) accrues, it compounds, as more shorts got liquidated. Sounds familiar!

https://twitter.com/AlamedaTrabucco/status/1332036760939896832?s=20

A case study in how low liquidity got: BitMEX's ETH/BTC quanto perp is pretty liquid, usually -- it can absorb orders of several mil without much issue. When a $15M or so liquidation popped up? It was on the book for minutes! Stepping up and up and up.

(There's actually a cool trade there -- the bid gets richer and richer, and if you can buy ETH on other markets as it slowly steps up, which is sometimes possible if you're crafty, you can buy before all its impact and then sell the BitMEX bid rich, locking in fast profit.)

So, betting on momentum seemed likely still pretty good -- and it *really* has been! Our strategy sorta became "buy whenever we're near levels where we predict shorts might get liquidated" and that's gone quite well. But it is different, because there was no "top."

And, we *knew* there was real, organic selling interest somewhere. Ended up materializing a few times under $24k so far, and the low liquidity + new longs getting opened meant it was pretty possible for a HUGE draw-down -- so the momentum bets have been of a different nature.

Also, alts have been behaving with haphazard betas, and not having so consistent liquidations as they did in the last alt run-up -- it's because a lot of shorts already got liquidated last time, but it highlights another difference / way intuition needs to dominate strategy here.

But, something like recognizing XRP did GREAT during the last U.S.-driven BTC run-up might lead a human to think it might do that again -- even with just the one data point. And that intuition might lead you to put on some good deltas, if you timed it right!

So, what next? Who knows! This is pretty uncharted territory -- low liquidity, new price levels, new products dominating, maybe more U.S. stuff but is it over-impacted? Will alts catch up more robustly? Which? Sadly for us, studies probably gonna keep coming up short.

Alameda's doing a lot of *thinking* about what we should be doing on all but the shortest timescales, and a lot of it is gut-based (also news-based, staring at orders-based, and similar). I'm sure you're all doing the same -- may the best humans (or very impressive machines) win!

And for reference, I used this graph because I started writing this last night and got too tired :P

• • •

Missing some Tweet in this thread? You can try to

force a refresh