869,000 people filed for unemployment benefits last week (regular state programs, not seasonally adjusted). Another 398,000 filed for Pandemic Unemployment Assistance, which will expire after this week if the president doesn't sign the new relief package.

nytimes.com/live/2020/12/2…

nytimes.com/live/2020/12/2…

Both regular state claims and PUA were down from the week before but remain above their early November level.

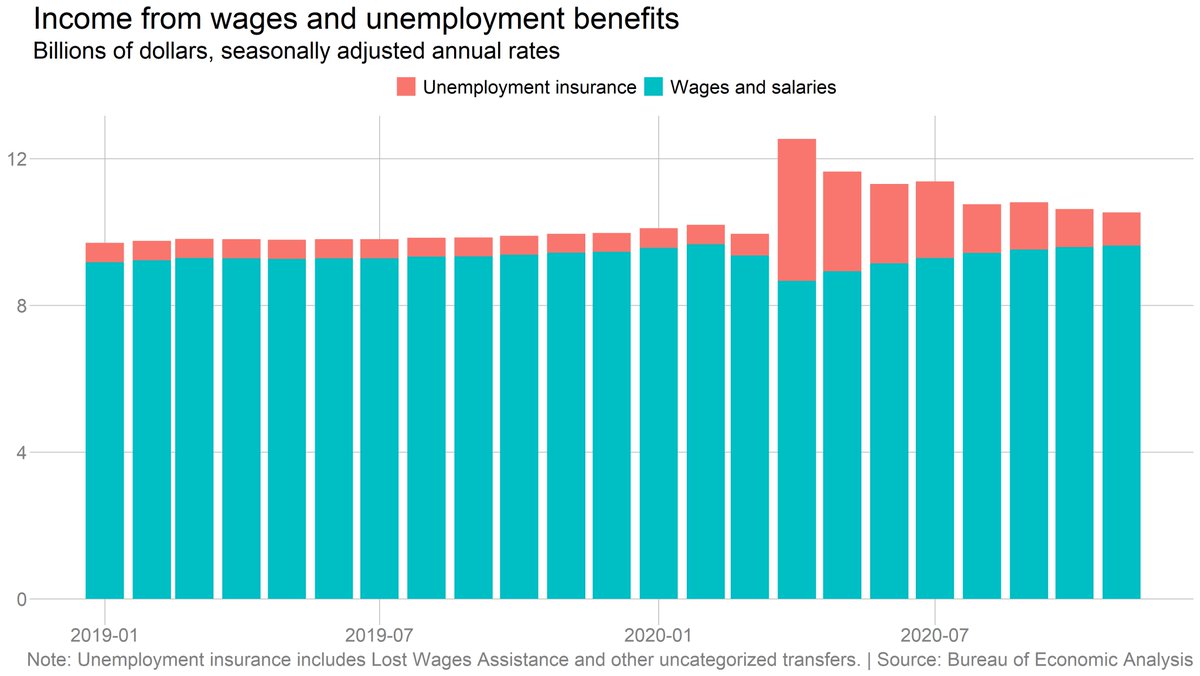

Meanwhile personal income fell for the second straight month in November, and consumer spending fell for the first time since the spring.

(Corrected date in chart.)

(Corrected date in chart.)

The impact of declining government support is clear here. Wage and salary income was up in November, but income was down because of shrinking government aid, including unemployment benefits.

Total savings were down again but are still well above pre-pandemic levels. But we don't have current data on how it's distributed -- wealthy households are probably sitting on a lot of cash right now.

The split between spending on goods vs services has been a hallmark of the pandemic. Goods spending fell last month but remains above prepandemic levels. More concerningly, services was down slightly too.

Interesting to think about what today's data implies for Q4. If real spending is flat in December, consumption would be up 1.1% (4.3% annualized) in Q4, down 2.2% from Q4 2019.

If we get another 0.4% decline, then Q4 would be up 0.9% q/q (3.7% annualized) and down 2.3% y/y.

If we get another 0.4% decline, then Q4 would be up 0.9% q/q (3.7% annualized) and down 2.3% y/y.

• • •

Missing some Tweet in this thread? You can try to

force a refresh