It appears that 1inch's governance token is right on the horizon.

1inch is the leading Ethereum-based decentralized exchange aggregator. Since its launch, it has done $7.6 billion in volume.

Here's a thread on what we know so far. 👇

1inch is the leading Ethereum-based decentralized exchange aggregator. Since its launch, it has done $7.6 billion in volume.

Here's a thread on what we know so far. 👇

First off, some context:

1inch is a decentralized exchange aggregator that routes liquidity through a number of exchanges to find the optimal prices.

This is often useful for larger traders, who may need to spread their buys or sells across exchanges to minimize slippage.

1inch is a decentralized exchange aggregator that routes liquidity through a number of exchanges to find the optimal prices.

This is often useful for larger traders, who may need to spread their buys or sells across exchanges to minimize slippage.

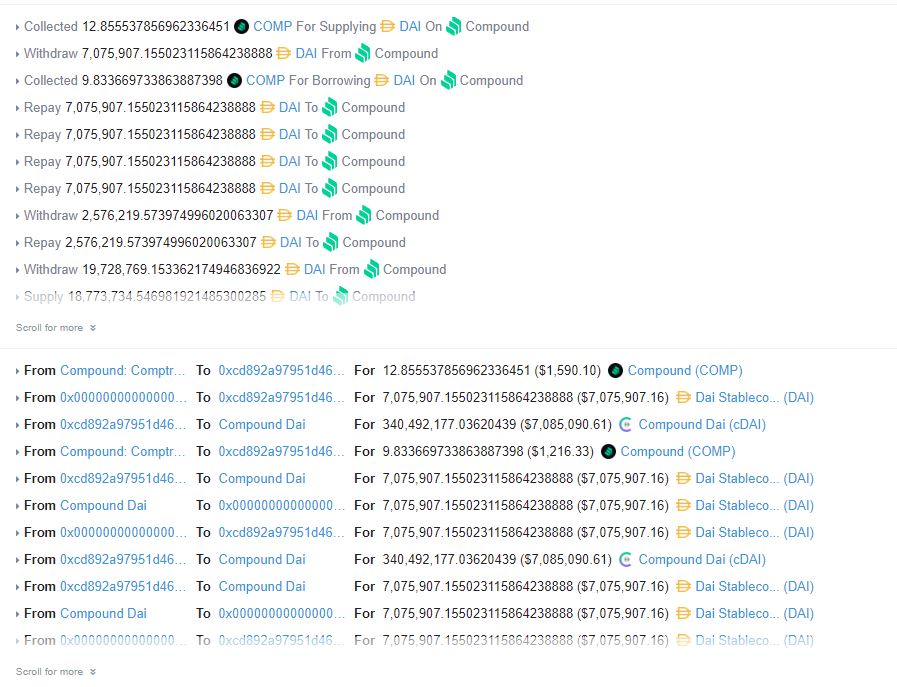

e.g. Here is Three Arrows swapping 4,000,000 USDT for 4,001,307 TUSD via 1inch v2 around four weeks ago.

1inch does have quite a bit of traction, even though you may not hear about it sometimes.

Stats:

- $7.6b in total volume

- $272m in seven-day volume

- $36.5m in seven-day volume

h/t @DuneAnalytics for the stats

Stats:

- $7.6b in total volume

- $272m in seven-day volume

- $36.5m in seven-day volume

h/t @DuneAnalytics for the stats

Yesterday, some sleuths spotted a contract on Ethereum pertaining to a "1inch" token.

The contract address: 0x111111111117dc0aa78b770fa6a738034120c302

Contained in the contract is this bit of ASCII art.

The contract address: 0x111111111117dc0aa78b770fa6a738034120c302

Contained in the contract is this bit of ASCII art.

Today, we are seeing reports of users getting notifications to claim 1INCH.

Degenomics here got this notification, though got an error on MetaMask when he attempted to claim it.

So that appears to be the official it's just that claims are not live yet.

Degenomics here got this notification, though got an error on MetaMask when he attempted to claim it.

So that appears to be the official it's just that claims are not live yet.

https://twitter.com/degenomix/status/1342232168487997440

The timing makes sense:

At the start of December, 1inch announced it had closed a $12m round that involved ParaFi, Pantera, and other top funds in the space.

Uniswap closed its Series A six weeks before it launched its token.

At the start of December, 1inch announced it had closed a $12m round that involved ParaFi, Pantera, and other top funds in the space.

Uniswap closed its Series A six weeks before it launched its token.

Now, token economics.

Degenomics (tweet above) claims to *not have LPed* on Mooniswap, 1inch's CFMM AMM.

That suggests that all historical users may be getting a pro-rata retroactive distribution, maybe based on volume.

Check this update on the token from 1inch:

Degenomics (tweet above) claims to *not have LPed* on Mooniswap, 1inch's CFMM AMM.

That suggests that all historical users may be getting a pro-rata retroactive distribution, maybe based on volume.

Check this update on the token from 1inch:

@FrankResearcher just found that it appears that Mooniswap liquidity providers will be earning 1INCH with a new liquidity mining program.

Early LPs should also earn 1INCH, based on the image in the tweet before this.

Early LPs should also earn 1INCH, based on the image in the tweet before this.

https://twitter.com/FrankResearcher/status/1342246481844183040

Found this a bit funny.

The address that deployed the 1INCH token contract got one ETH from Tornado 30 hours ago.

The address that deployed the 1INCH token contract got one ETH from Tornado 30 hours ago.

Ownership of the Mooniswap farming contracts seems to have been passed to this address:

0x5E89f8d81C74E311458277EA1Be3d3247c7cd7D1

Address holds 1,500,000 1INCH and 707 DAI that someone sent there accidentally (RIP).

0x5E89f8d81C74E311458277EA1Be3d3247c7cd7D1

Address holds 1,500,000 1INCH and 707 DAI that someone sent there accidentally (RIP).

I'm trying to think about how to play this.

Long $CHI?

Long $CHI?

Some big brains found this link:

governance.1inch.exchange/v1.0/distribut… *input ETH address here*

If you're included in the airdrop distro, the link should give you a merkle proof.

governance.1inch.exchange/v1.0/distribut… *input ETH address here*

If you're included in the airdrop distro, the link should give you a merkle proof.

First merkle claim.

31,010 1INCH to 0x68a17B587CAF4f9329f0e372e3A78D23A46De6b5

etherscan.io/tx/0xa93bd3f64…

31,010 1INCH to 0x68a17B587CAF4f9329f0e372e3A78D23A46De6b5

etherscan.io/tx/0xa93bd3f64…

Official ann:

"All wallets ... will receive 1INCH as long as they meet one of the following conditions: at least one trade before September, 15, OR at least 4 trades in total OR trades for a total of at least $20."

Yield programs for 1INCH-DAI, -ETH, -WBTC, -USDC, -USDT, -YFI

"All wallets ... will receive 1INCH as long as they meet one of the following conditions: at least one trade before September, 15, OR at least 4 trades in total OR trades for a total of at least $20."

Yield programs for 1INCH-DAI, -ETH, -WBTC, -USDC, -USDT, -YFI

early LPs are making bank.

There's basically no liquidity at all on Mooniswap or Uniswap.

There's basically no liquidity at all on Mooniswap or Uniswap.

PSA: if you want to buy 1INCH, make sure you're buying the right token:

0x111111111117dc0aa78b770fa6a738034120c302

Fake Uniswap market seen below.

0x111111111117dc0aa78b770fa6a738034120c302

Fake Uniswap market seen below.

• • •

Missing some Tweet in this thread? You can try to

force a refresh