The Spanish flu of 1919 serves as a roadmap for the current macro environment.

Thread 👇👇👇

Thread 👇👇👇

Similar to today, the outbreak of the pandemic severely limited the industrial capacity of the economy and led to a major supply shock in raw materials.

Commodities became rare assets and, despite still muted aggregate demand, inflationary forces started to accelerate again.

Commodities became rare assets and, despite still muted aggregate demand, inflationary forces started to accelerate again.

To note, the rise of wholesale prices became a global phenomenon.

Grocery stores began hoarding inventories to sell at higher prices, forcing governments to intervene and criminalize these actions to avoid an even larger hit to the consumer.

Grocery stores began hoarding inventories to sell at higher prices, forcing governments to intervene and criminalize these actions to avoid an even larger hit to the consumer.

The cost of living surged and prompted major labor union protests on the streets demanding higher wages and salaries only exacerbating the problem.

Inflation surged above 20% in 1920 and the Dow Jones Industrial Average began a decline of 47% from peak to trough from 1920 to 1921 while the world emerged from the pandemic.

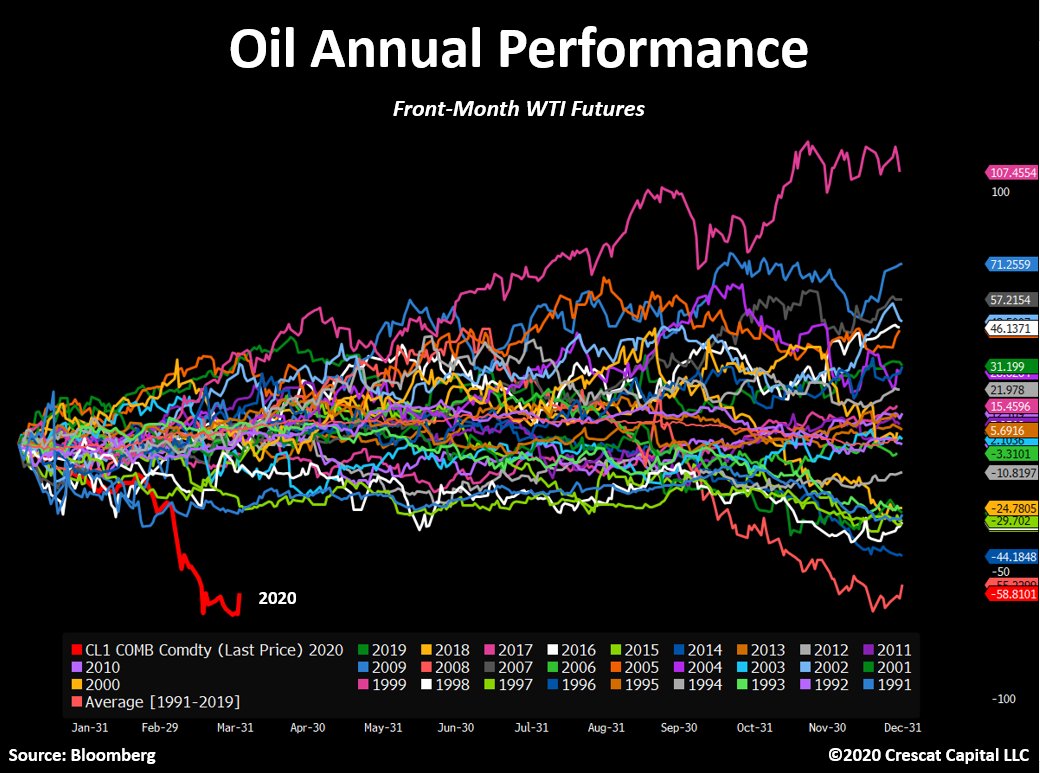

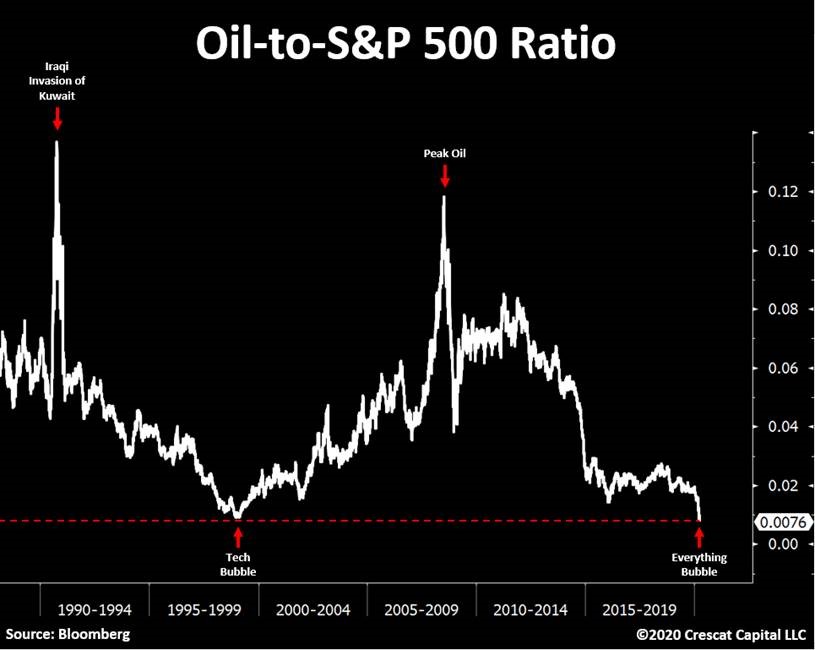

The global economy is at risk of commodity supply shock inflation, something we have not experienced since the 1970s.

We have had a long streak of under investments in exploration, production and infrastructure across virtually all commodities.

We have had a long streak of under investments in exploration, production and infrastructure across virtually all commodities.

As I pointed out recently, the Bloomberg commodity index already broke out.

Inflation expectation look to be next.

Inflation expectation look to be next.

Yes, the aging demographics problem and significant technological advancements are deflationary tailwinds…

But in our view, the key reason why consumer prices have not gone higher is due to a long-standing period of depressed commodity prices.

This trend is about to change.

But in our view, the key reason why consumer prices have not gone higher is due to a long-standing period of depressed commodity prices.

This trend is about to change.

Meanwhile, the Fed is crippled.

Monetary policy has become a funding mechanism through massive purchases of Treasuries to suppress interest rates.

It enables the US government to run a large fiscal deficit.

Monetary policy has become a funding mechanism through massive purchases of Treasuries to suppress interest rates.

It enables the US government to run a large fiscal deficit.

With the Fed being forced to run hot, inflation expectations should continue to rise faster than nominal rates.

Therefore, real yields keep falling.

Another important macro driver for precious metals.

Therefore, real yields keep falling.

Another important macro driver for precious metals.

Now, let’s talk gold/silver miners.

That’s one of the best ways to be exposed to this opportunity.

That’s one of the best ways to be exposed to this opportunity.

Credit availability completely dried up among mining companies over the last decade.

They were all forced to buckle up and apply strict capital controls to financially survive during that period.

They were all forced to buckle up and apply strict capital controls to financially survive during that period.

Investors demanded significant reductions in debt and equity issuances while miners had to effectively tighten up operational costs, cut back investment, and prioritize the quality of their balance sheet assets.

The last times this industry acted in a similarly conservative fashion, metal prices were at historically low-price levels.

This time we are seeing corporate discipline with gold prices remaining near all-time highs.

This time we are seeing corporate discipline with gold prices remaining near all-time highs.

As a result, major producers have surprisingly swung into being cash flow machines.

That’s only the beginning.

Another important point:

Gold/silver producers are also about to face a supply cliff problem in the next years.

That’s only the beginning.

Another important point:

Gold/silver producers are also about to face a supply cliff problem in the next years.

- No new gold discoveries of over 2mm oz in the last 3 years

- Declining exploration budget since 2011

- Shrinking overall CAPEX in the last decade

Meanwhile, gold is near all-time highs.

- Declining exploration budget since 2011

- Shrinking overall CAPEX in the last decade

Meanwhile, gold is near all-time highs.

The good news is:

With cleaner balance sheets & and now making turning into profitable businesses, miners are getting cashed up to make new acquisitions.

That means….

High quality exploration projects are likely to get massively bid up in this next part of the process.

With cleaner balance sheets & and now making turning into profitable businesses, miners are getting cashed up to make new acquisitions.

That means….

High quality exploration projects are likely to get massively bid up in this next part of the process.

We discuss this opportunity in our latest letter.

Please take some time to read it:

crescat.net/december-resea…

Merry Christmas again and greetings from Brazil .

Cheers

Please take some time to read it:

crescat.net/december-resea…

Merry Christmas again and greetings from Brazil .

Cheers

• • •

Missing some Tweet in this thread? You can try to

force a refresh