Grant and his guests always give you a ton to ponder. Agree with pretty much everything they discuss. 1 long energy. 2 #DCEP is a massive threat to podcasts.apple.com/us/podcast/the…

Btc and 99% of the folks trading crypto have no concept of what is going on in china.( china is responsible for 65% of btc hash power)

@EconguyRosie post a few days ago that being —ve on btc is like calling your first born ugly and the visceral reaction being similar to tech investors in 99 or housing investors in 06 is

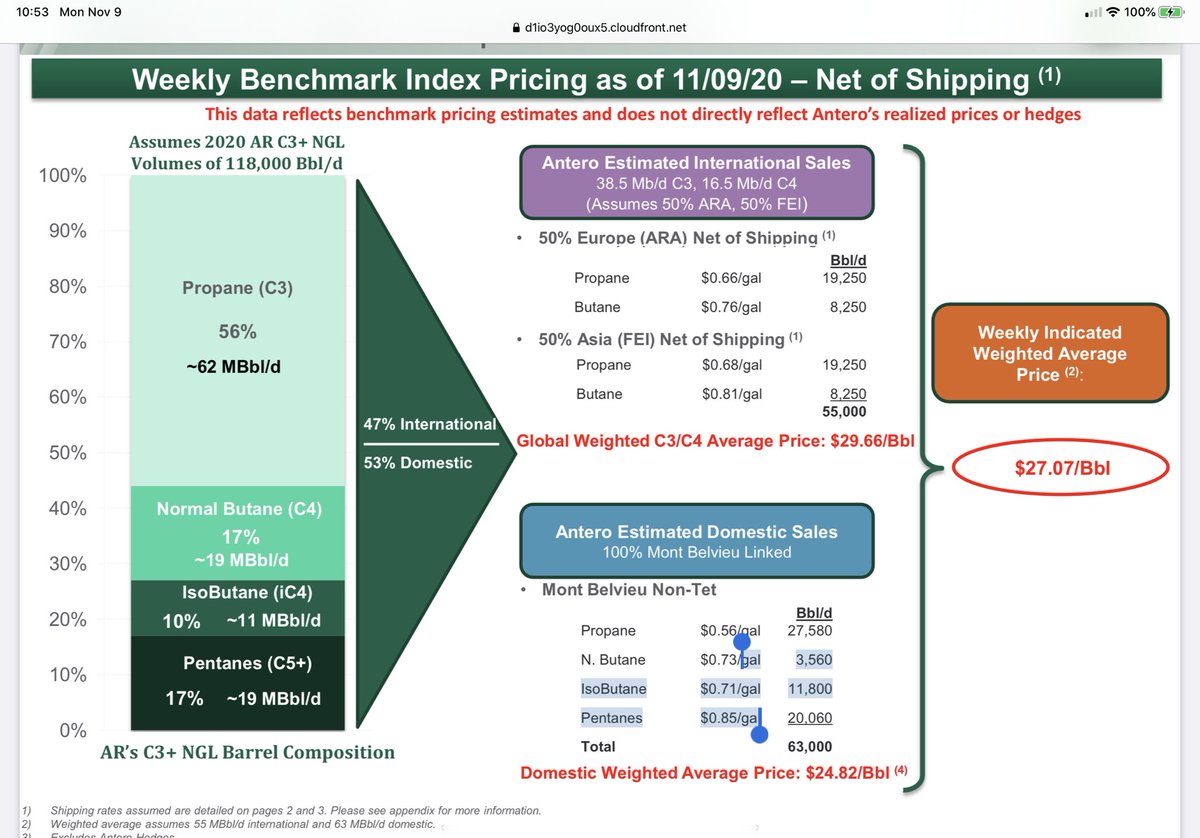

Interesting. Given this left tail risk glad I’m invested in stuff the Chinese can’t just will away like uranium or energy.

• • •

Missing some Tweet in this thread? You can try to

force a refresh