Diminishing Marginal Returns

The productivity of our debt is collapsing and that is creating a major problem.

The problem is here now, and not in the future.

Here is why:

1)

The productivity of our debt is collapsing and that is creating a major problem.

The problem is here now, and not in the future.

Here is why:

1)

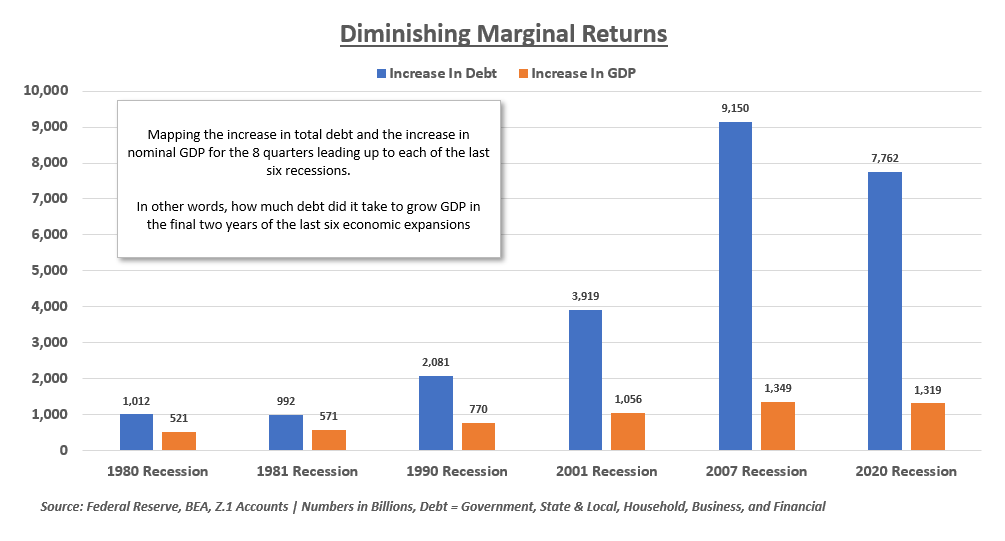

Charted below is the increase in total debt and the increase in nominal GDP in the 8 quarters before each of the last six recessions.

In other words, how much did debt increase, and how much did GDP increase in the final two years of each economic expansion?

2)

In other words, how much did debt increase, and how much did GDP increase in the final two years of each economic expansion?

2)

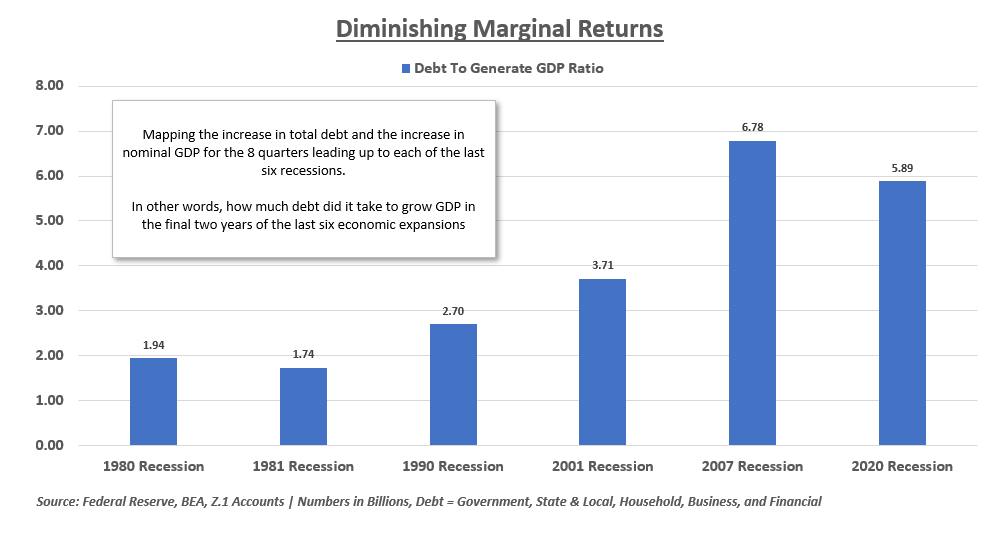

Graphed another way, leading up to the 1980 recession it took about 1.94 dollars of debt to boost GDP by 1 dollar.

Leading up to the COVID recession saw debt increase nearly 6 dollars for each 1 dollar of GDP growth.

4)

Leading up to the COVID recession saw debt increase nearly 6 dollars for each 1 dollar of GDP growth.

4)

Flipping the ratio shows the decline in the utility of debt.

We are only generating about 15-20 cents of growth for each dollar of debt.

This becomes a larger problem when we think about "growth rates" instead of nominal dollars.

5)

We are only generating about 15-20 cents of growth for each dollar of debt.

This becomes a larger problem when we think about "growth rates" instead of nominal dollars.

5)

Before the 2007 recession, it took about $9T of debt to increase GDP by $1.3T. Or, it took about $9T of debt to increase nominal GDP by 4.9%/year in those two years.

The same $1.3T increase in nGDP only translated to a 3.2% growth rate per year leading up to 2020.

6)

The same $1.3T increase in nGDP only translated to a 3.2% growth rate per year leading up to 2020.

6)

In other words, $9T of debt got us ~5% nominal growth in 2005-2007 and only ~3% in 2018-2020.

The problem is here now because we know it will take about $10T of new debt to increase GDP by $1.5T.

That would only be an increase in growth of 3% nominal per year.

7)

The problem is here now because we know it will take about $10T of new debt to increase GDP by $1.5T.

That would only be an increase in growth of 3% nominal per year.

7)

As we continue to press down on this diminishing marginal returns curve, we will find ourselves using 8-10 units of debt for each dollar of growth, each dollar that generates a lower "growth rate" on a higher base.

8)

8)

With any political division, Congress will not be able to authorize the spending needed to increase GDP by the same ~3% per year as the numbers are simply getting too large.

$10T in total debt growth won't even get us 3% nominal.

9)

$10T in total debt growth won't even get us 3% nominal.

9)

If we have just 2% inflation then $10T in new debt will only lead to about 1% real growth.

At this stage of the game, no amount of government spending will translate to an increase in the standard of living (real GDP per capita).

The nonlinear decline continues.

10/10

At this stage of the game, no amount of government spending will translate to an increase in the standard of living (real GDP per capita).

The nonlinear decline continues.

10/10

• • •

Missing some Tweet in this thread? You can try to

force a refresh