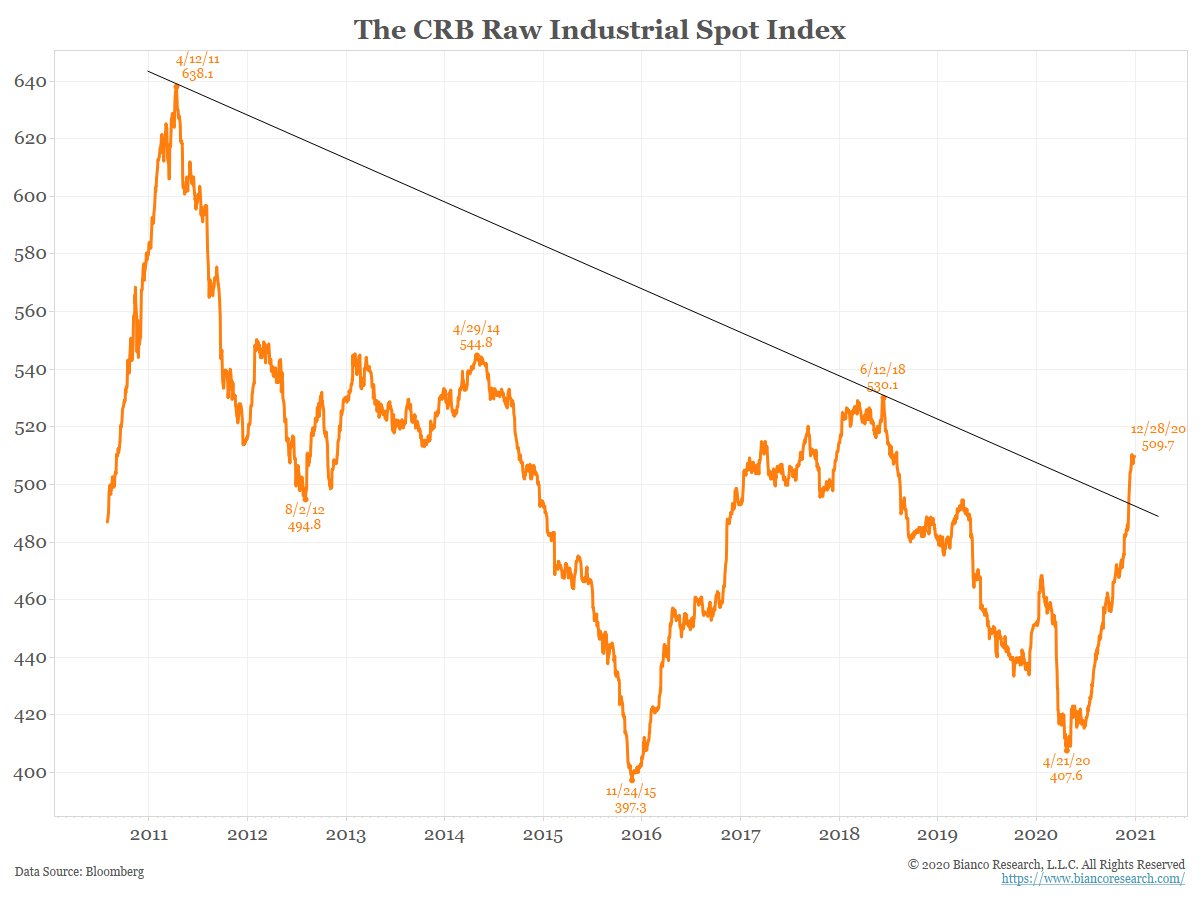

CRB Raw Industrial Spot up 25% since April.

It is made up of largely non-fut traded commods, so should not be subject to speculative money flows

Hides, tallow, copper scrap, lead scrap, steel scrap, zinc, tin, burlap, cotton, print cloth, wool tops, rosin, and rubber.

(1/6)

It is made up of largely non-fut traded commods, so should not be subject to speculative money flows

Hides, tallow, copper scrap, lead scrap, steel scrap, zinc, tin, burlap, cotton, print cloth, wool tops, rosin, and rubber.

(1/6)

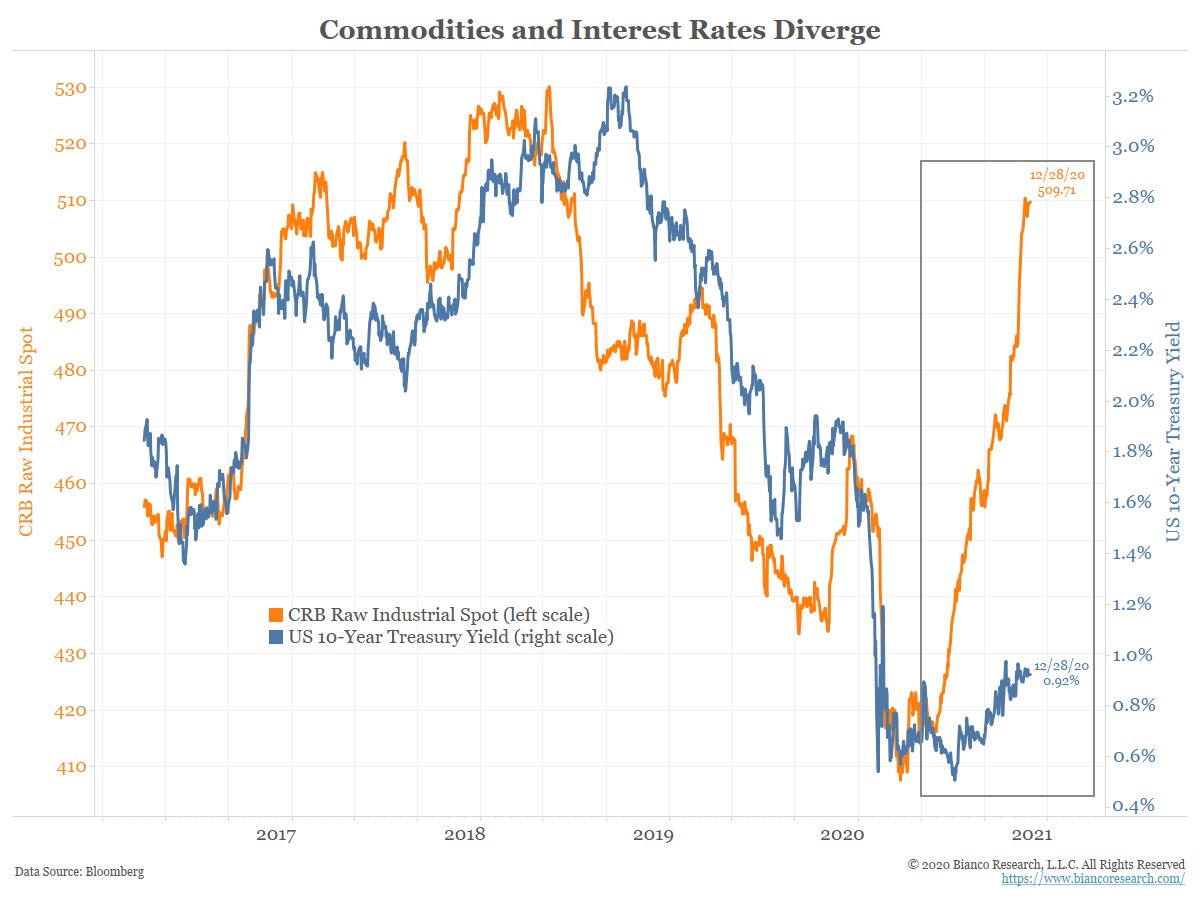

Typically this is good coincident indciator with interest rates. But now is diverging in a big way.

(2/6)

(2/6)

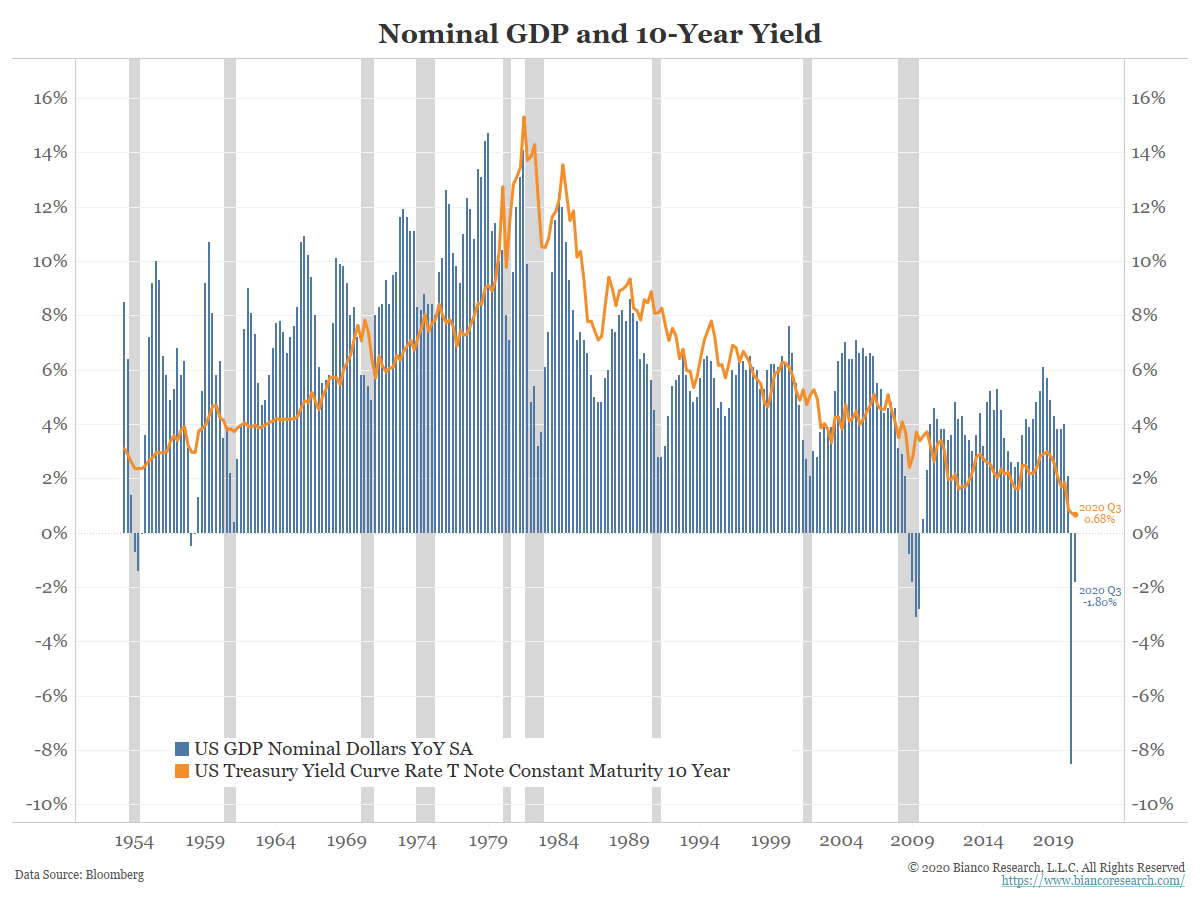

What does rising raw industrials mean? The simplest answer is NOMINAL economic growth is accelerating.

Nom Growth = Real Growth Plus Inflation

The last 25 yrs have seen nominal growth led by an increase in the real growth. These have become interchangeable terms to many.

(3/6)

Nom Growth = Real Growth Plus Inflation

The last 25 yrs have seen nominal growth led by an increase in the real growth. These have become interchangeable terms to many.

(3/6)

All things being equal, rates should closely align with the level and trend of expected NOMINAL GDP (real growth plus inflation).

Below shows rates to nom GDP growth over the last 12 mos. While this is not EXPECTED GDP, it shows the loose relationship between the two.

(4/6)

Below shows rates to nom GDP growth over the last 12 mos. While this is not EXPECTED GDP, it shows the loose relationship between the two.

(4/6)

The reason rates are rising matters.

Rising rates from real growth, positive for risk assets. The Fed’s suppression of rates would be tolerated/ supported by markets.

Rising rates from inflation is not good for risk markets. Purchasing power reduced, hurts risk assets.

(5/6)

Rising rates from real growth, positive for risk assets. The Fed’s suppression of rates would be tolerated/ supported by markets.

Rising rates from inflation is not good for risk markets. Purchasing power reduced, hurts risk assets.

(5/6)

Rising commods, like the Raw Industrial Spot Index, means NOMINAL growth is expected to rise in 2021. The only question is whether NOMINAL growth will rise because of real growth or inflation. Our bet is it will be more about inflation and become evident as 2021 unfolds.

(6/6)

(6/6)

• • •

Missing some Tweet in this thread? You can try to

force a refresh