One 🤡's ELI5 on $WHITE @WhiteheartDeFi

Wtf is Whiteheart?

(art via @crypto_caviar)

<commence thread 👇>

Wtf is Whiteheart?

(art via @crypto_caviar)

<commence thread 👇>

First, you have to understand $HEGIC

It's facing dilution, but I'm long-term bullish

See the thread below on why... or read the tldr below

It's facing dilution, but I'm long-term bullish

See the thread below on why... or read the tldr below

https://twitter.com/redphonecrypto/status/1332747713797099526

tldr = $HEGIC isn't your typical options platform...

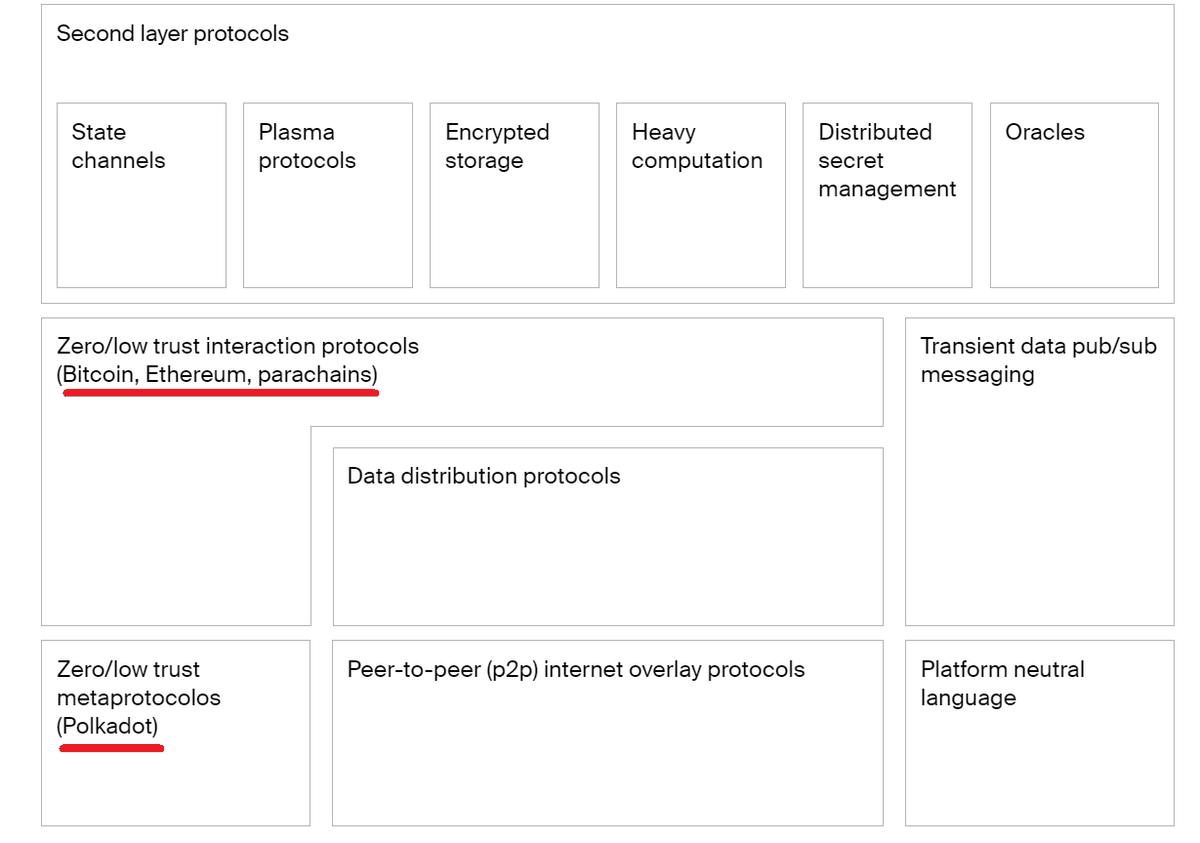

it's an options protocol, which take options from something that trades on CLOB-y centralized exchanges and turns them into the fabled "money legoes" Ethereans love

it's an options protocol, which take options from something that trades on CLOB-y centralized exchanges and turns them into the fabled "money legoes" Ethereans love

Once you lego-ize options, you can begin to use them in ways that are hard to conceive of now

Imo too many people look at $HEGIC like it’s a decentralized competitor to something like Deribit

But what is Deribit??

Imo too many people look at $HEGIC like it’s a decentralized competitor to something like Deribit

But what is Deribit??

It’s a pro-fucking-level options exchange for full-time traders... many of whom wear slacks and shoes made of alligator skin even when they're wfh during a pandemic

Those same people hear about $HEGIC and they pop an adderall and get out their calcs and do their back of the napkins and they think, wut, these hegic options are more expensive than more Deribit options... this project is doomed

Clown pushback:

First, option prices on $HEGIC will fall over time

Second, consider even crypto natives who trade on $UNI several times a week. Many of them (myself included) look at Deribit and say wtf is all this??

First, option prices on $HEGIC will fall over time

Second, consider even crypto natives who trade on $UNI several times a week. Many of them (myself included) look at Deribit and say wtf is all this??

It really is a specialized skill. And I don't have a month to create a test account and learn how to play this game... but I sure AF see the power of options

Enter $HEGIC

What if Hegic isn’t trying to be a pro-fucking-level options exchange?

Enter $HEGIC

What if Hegic isn’t trying to be a pro-fucking-level options exchange?

What if it’s trying to bring the sorts of tools bankers and #tradfi use... the ones they have a complete and utter monopoly on... to people who wear Nikes?

See, one of my perpetual arguments is that most people in the space still underestimate the power of AMMs.

See, one of my perpetual arguments is that most people in the space still underestimate the power of AMMs.

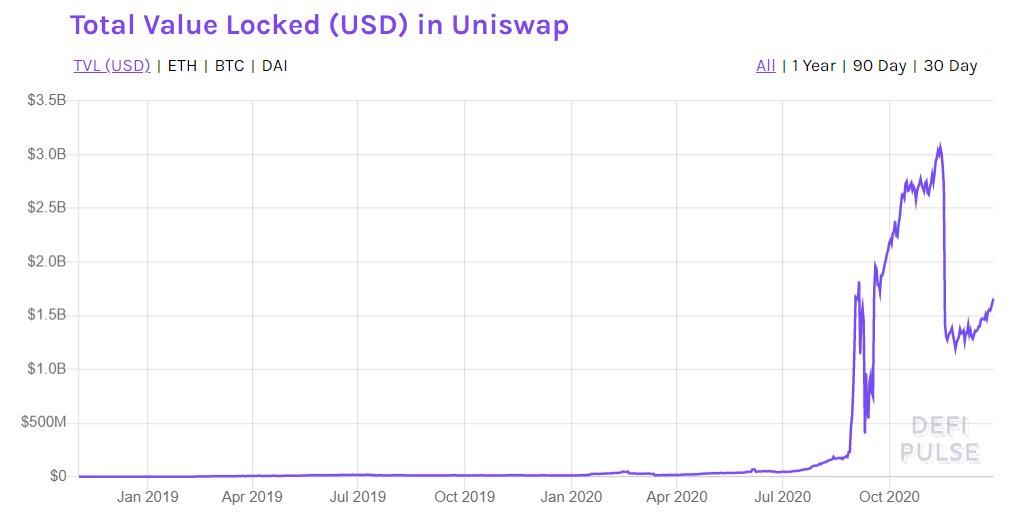

They complain about the slippage and the high prices. Meanwhile, the market answers with this...

@defipulse

@defipulse

AMMs simplify trading by 10x. And they're creating money legoes like a mf'ing plastic factory

AMMs are always on, and they're KYC-free

They're revolutionizing trading

AMMs are always on, and they're KYC-free

They're revolutionizing trading

$HEGIC is doing something similar for options. In fact, I think of it as an AMM in a way... only instead of people pooling specific options, they pool capital that can be used to generate options

Once you have the ability to print any option at any time, you can start composing them into surprisingly elegant little packages that do mind-blowing things

Enter @WhiteheartDeFi

It's a protocol for integrating $HEGIC options into a trading platform

Enter @WhiteheartDeFi

It's a protocol for integrating $HEGIC options into a trading platform

It will allow perhaps the simplest way to buy an option that's ever been created

The walkthrough on whiteheart.finance tells the story better than I can

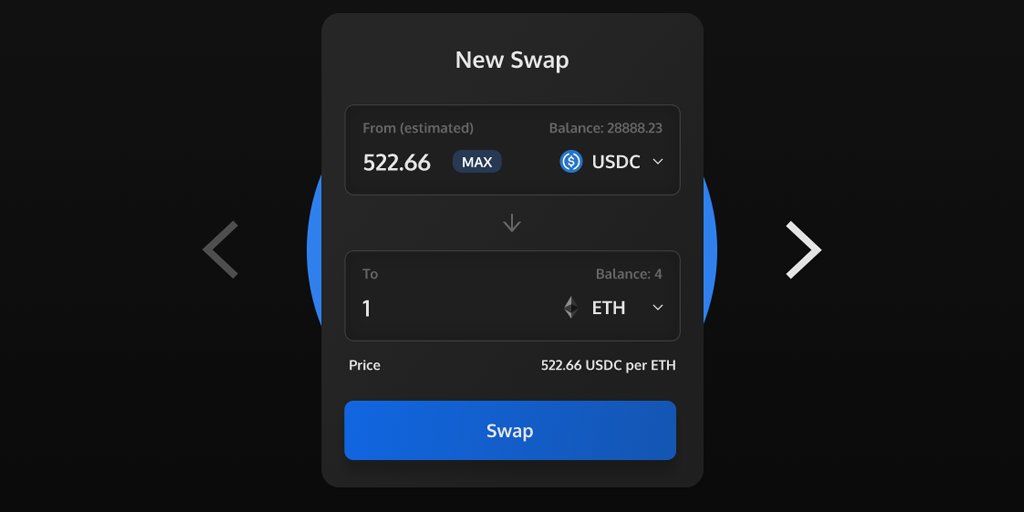

1. Buy ETH or WBTC on Uniswap as you usually do it using Whiteheart’s interfaces

The walkthrough on whiteheart.finance tells the story better than I can

1. Buy ETH or WBTC on Uniswap as you usually do it using Whiteheart’s interfaces

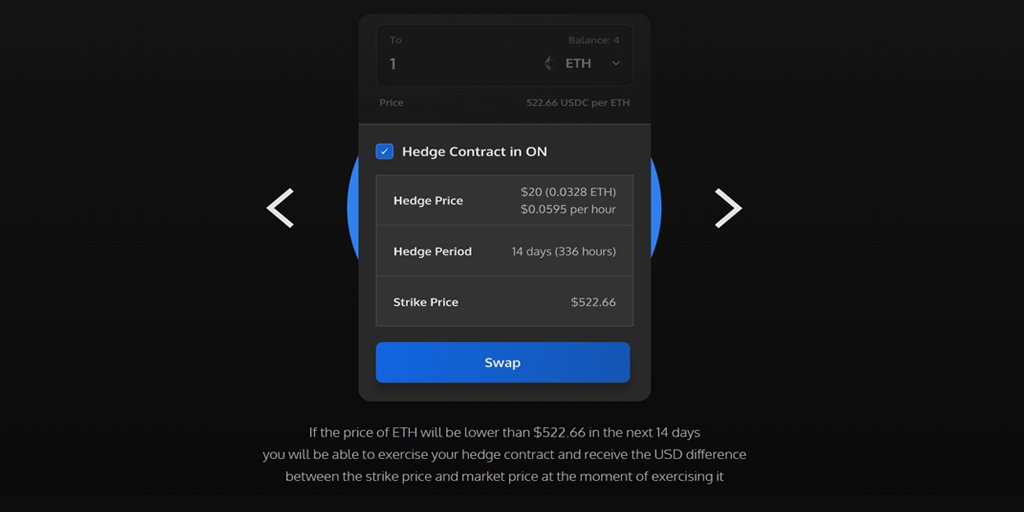

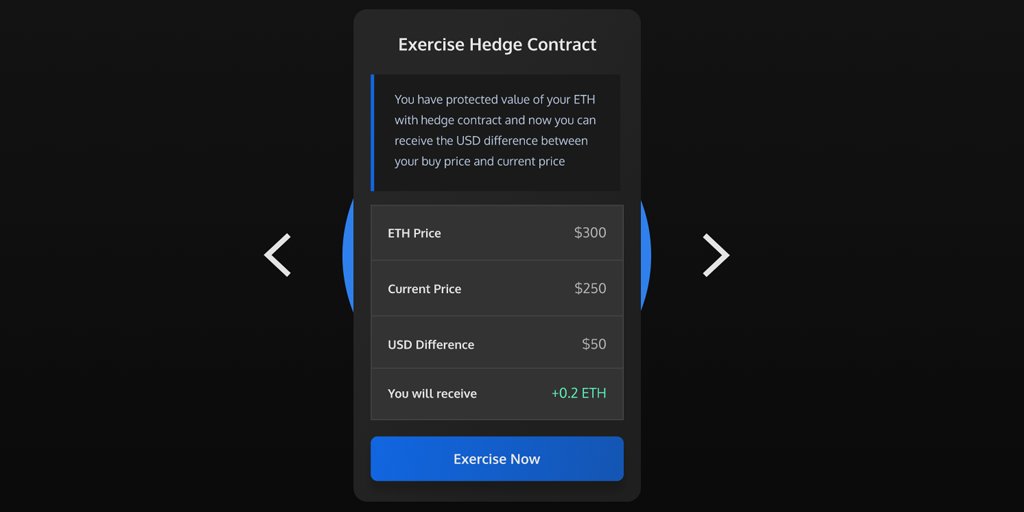

2. Each time you buy ETH or WBTC an option (a hedge contract) can automatically protect the value of your ETH or WBTC buy (thanks to an at-the-money put option)

3. That means the value of your ETH or WBTC will be protected from ANY USD losses over the next 14 days

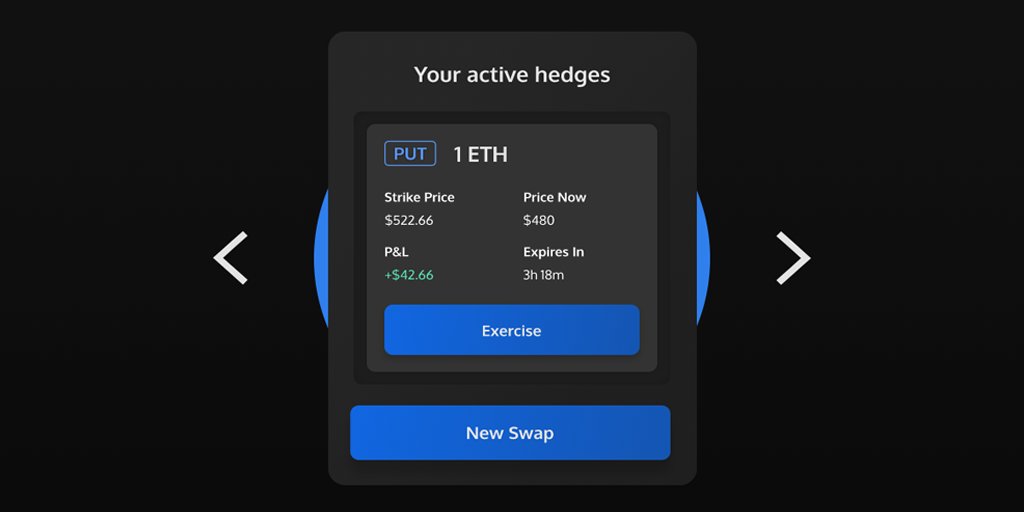

4. If the price of ETH or WBTC falls, and you "lose money" on your trade... you're not really losing money because you can cash in your option and receive the USD difference between your buy price and current price

5. You'll get the net USD difference in ETH or WBTC sent to your Ethereum address, and you'll be able to use these funds to make a new trade

Basically, you pay a slight premium on your trade to be guaranteed you won't lose money over the next two weeks. Only upside. And it only takes seconds

@0mllwntrmt3 compares it to FDIC insurance on a bank deposit. But it's all decentralized and KYC free.

@0mllwntrmt3 compares it to FDIC insurance on a bank deposit. But it's all decentralized and KYC free.

It's democratizing options. It's taking them from the alligator shoes and giving them to the Nikes

Will it work?

Hell if I know. @WhiteheartDeFi is an experiment. It's a risky one. But it's a glimpse of the power behind $HEGIC

Will it work?

Hell if I know. @WhiteheartDeFi is an experiment. It's a risky one. But it's a glimpse of the power behind $HEGIC

And I envision a crazy future for it... what if it's expanded to any token on Uniswap?

What if it's integrated into a big AMM like $SUSHI?

Or an aggregator like $1INCH?

What if it's pushed crosschain and used on something like $RUNE's @thorchain_org?

What if it's integrated into a big AMM like $SUSHI?

Or an aggregator like $1INCH?

What if it's pushed crosschain and used on something like $RUNE's @thorchain_org?

Who tf knows, but it's got my attention, and I'm willing to roll the 🎲

🤡 out

🤡 out

• • •

Missing some Tweet in this thread? You can try to

force a refresh