Mithril Cash now has over $400 million in total value locked just three hours after its launch.

This includes over $200 million worth of stables and dozens of millions in YFI, CRV, and more.

Let's take a look at the second-order effects of the launch of this Basis Cash fork. 👇

This includes over $200 million worth of stables and dozens of millions in YFI, CRV, and more.

Let's take a look at the second-order effects of the launch of this Basis Cash fork. 👇

Quick intro: Mithril Cash (MIC) is a Basis Cash fork that can be farmed by depositing stablecoins, some blue chips, MITH, or CREAM.

Reason for the latter two being, Mithril Cash is coming courtesy of @machibigbrother, founder of Mihril and Cream.

Reason for the latter two being, Mithril Cash is coming courtesy of @machibigbrother, founder of Mihril and Cream.

Disclaimer: While the contracts are similar to the Basis Cash contracts, Mithril Cash is unaudited.

Ape at your own risk.

Ape at your own risk.

#1) Curve volumes have risen.

Although not a notable outlier (yet), Curve has done $170 million worth of volume over the past 24 hours.

This is above the ~$80 million daily average of the past month.

Although not a notable outlier (yet), Curve has done $170 million worth of volume over the past 24 hours.

This is above the ~$80 million daily average of the past month.

#2) Aave v1 yields for sUSD have shot higher to 105% annualized as pool utilization is basically at 100%.

Out of the "regular" stablecoins in the Mithril system, sUSD has the highest yield.

sUSD also currently trades for $1.06, above the normal price of $1.00-1.02.

Out of the "regular" stablecoins in the Mithril system, sUSD has the highest yield.

sUSD also currently trades for $1.06, above the normal price of $1.00-1.02.

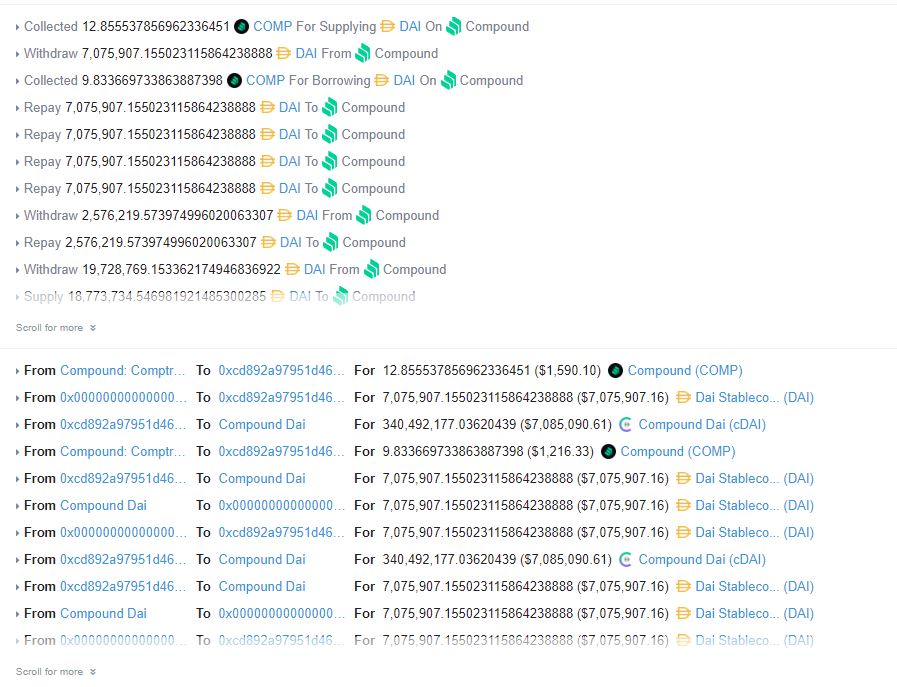

#3) By a similar token, CREAM yields on governance tokens are up big time.

It costs:

- 720% to borrow COMP

- 282% to borrow LINK

- 830% to borrow CREAM

- 1,000% to borrow CRV

- 650% to borrow AAVE

It costs:

- 720% to borrow COMP

- 282% to borrow LINK

- 830% to borrow CREAM

- 1,000% to borrow CRV

- 650% to borrow AAVE

#4) DeFi coins are shooting higher, similar to what YAM did in August.

CRV, AAVE, and COMP have rallied by 27%, 9.5%, 5.7%, respectively, since the launch of Mithril Cash.

Interesting YFI and SUSHI are down. May show the market is relatively overexposed to these 2.

CRV, AAVE, and COMP have rallied by 27%, 9.5%, 5.7%, respectively, since the launch of Mithril Cash.

Interesting YFI and SUSHI are down. May show the market is relatively overexposed to these 2.

• • •

Missing some Tweet in this thread? You can try to

force a refresh