Rightmove (RMV) is one of the decade’s top-returning stocks.

Investors have generated a +1,500% total return!

Studying the Super Stocks of the past helps us spot future Super Stocks today.

Here’s a thread on what made RMV a network effect monster 👇

macro-ops.com/super-stock-ca…

Investors have generated a +1,500% total return!

Studying the Super Stocks of the past helps us spot future Super Stocks today.

Here’s a thread on what made RMV a network effect monster 👇

macro-ops.com/super-stock-ca…

2/ Biz Description & IPO

RMV is a property portal in the UK. They allow RE agents, homeowners & homebuilders to list their home for sale on their website (think Zillow).

Before IPO, RMV offered initial shares to its customers (RE agents and developers).

That’s confidence.

RMV is a property portal in the UK. They allow RE agents, homeowners & homebuilders to list their home for sale on their website (think Zillow).

Before IPO, RMV offered initial shares to its customers (RE agents and developers).

That’s confidence.

3/ Owning Their Market

In 2004 RMV was the largest property list site in the UK.

They commanded 79% market share in total pageviews.

24/25 top RE agents listed homes ONLY on RMV

25/25 top UK home dev. Listed on RMV

82% of UK homebuyers that bought on the internet used RMV

In 2004 RMV was the largest property list site in the UK.

They commanded 79% market share in total pageviews.

24/25 top RE agents listed homes ONLY on RMV

25/25 top UK home dev. Listed on RMV

82% of UK homebuyers that bought on the internet used RMV

4/ The Power of Network Effects

It’s a classic network effect model:

- More home listings = more site visits

- More people encourage agents to list on RMV.

- Seeing the buying, home devs list on RMV.

This reinforces that network. Soon, an impenetrable ecosystem is born.

It’s a classic network effect model:

- More home listings = more site visits

- More people encourage agents to list on RMV.

- Seeing the buying, home devs list on RMV.

This reinforces that network. Soon, an impenetrable ecosystem is born.

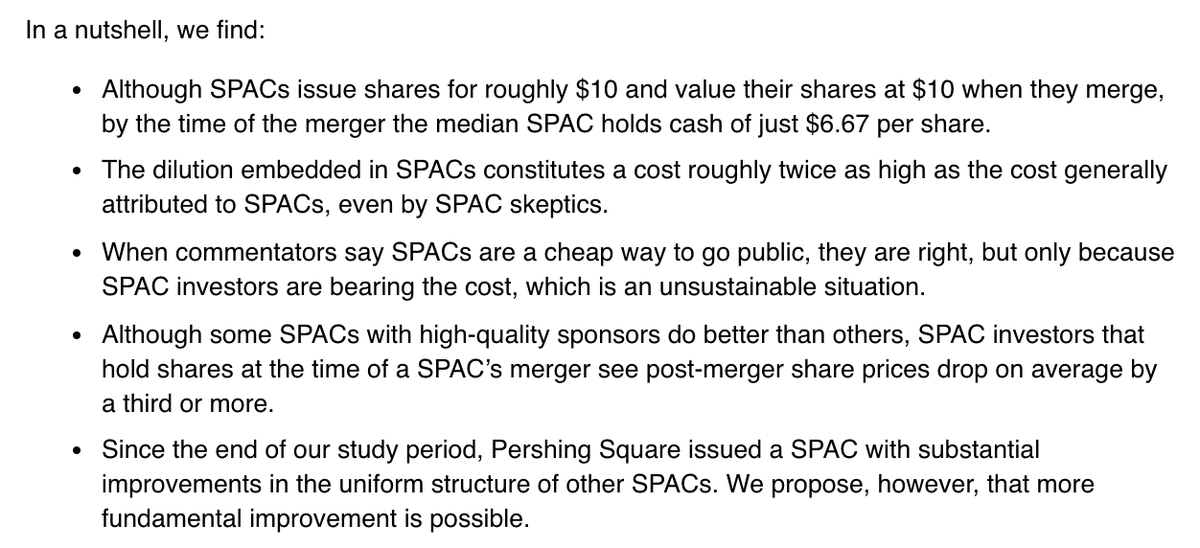

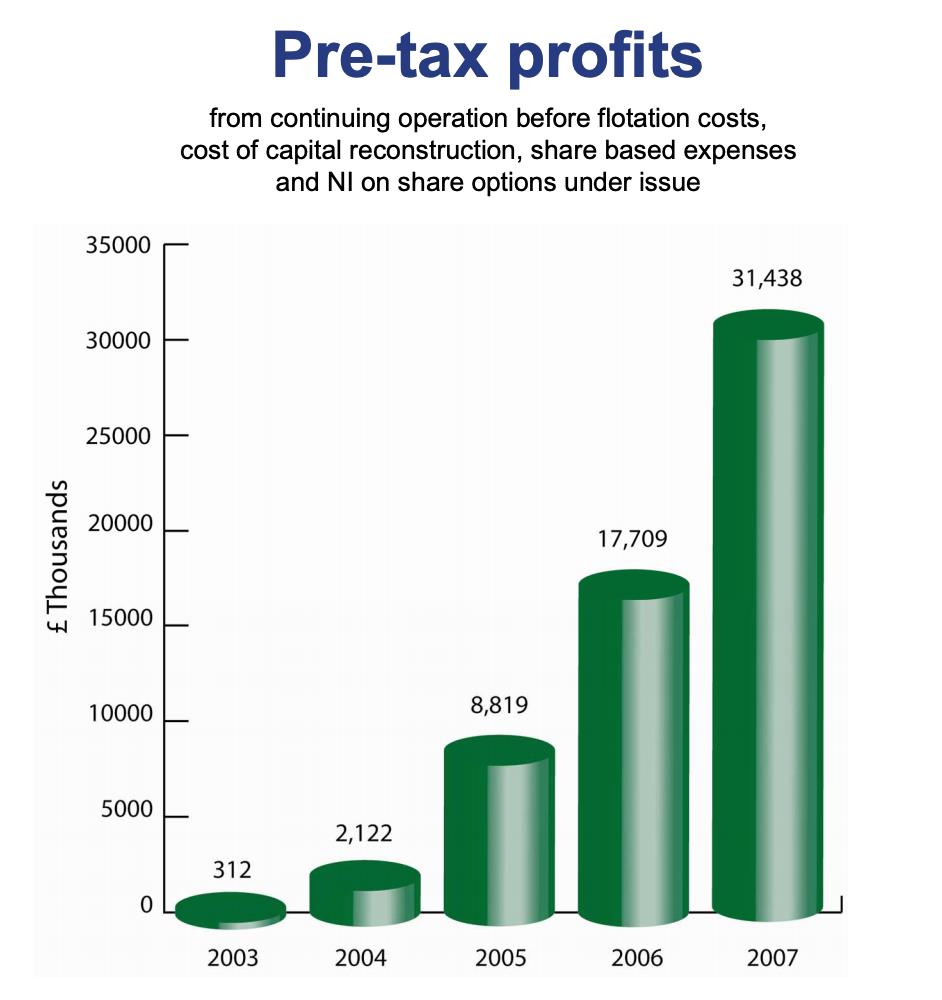

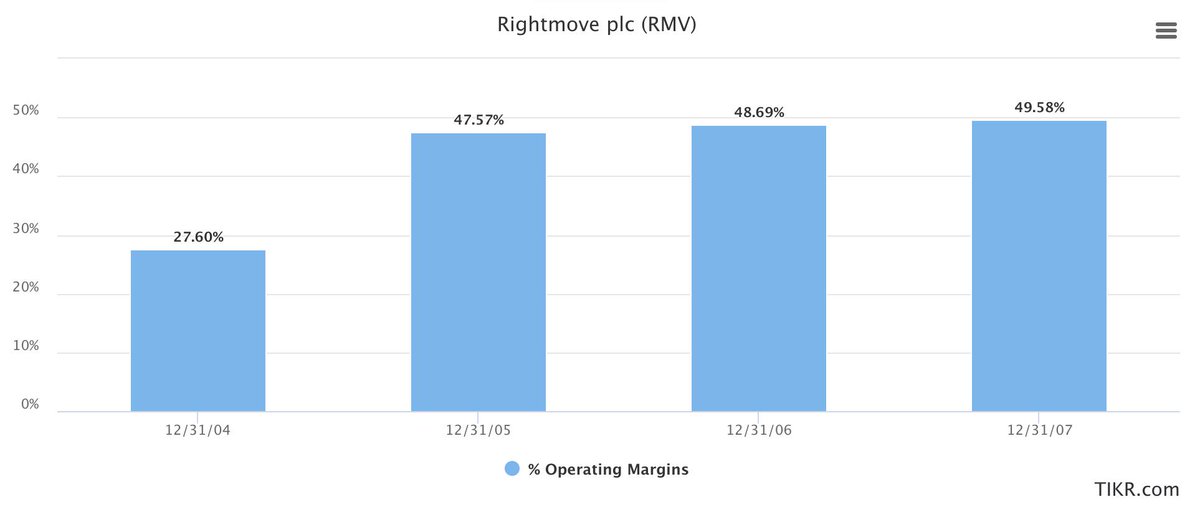

5/ Narrative To Numbers

RMV displayed EARLY & HIGH rev growth in its first 3 years:

- 98%

- 85%

- 69%

In total, they grew revs from 17.6M in ‘04 to 113M in ‘07 (540%!).

At the same time, they expanded operating margins from 27% to 53%.

By 2007, RMV traded for 21x EBIT.

RMV displayed EARLY & HIGH rev growth in its first 3 years:

- 98%

- 85%

- 69%

In total, they grew revs from 17.6M in ‘04 to 113M in ‘07 (540%!).

At the same time, they expanded operating margins from 27% to 53%.

By 2007, RMV traded for 21x EBIT.

6/ Early Sentiment

I’m always interested in early sentiment on a super stock.

Here’s a good summary of the RMV sentiment around its IPO:

- Expensive price

- Good brand name

- Popular biz

2 things analysts got wrong:

1. RMV wasn't expensive

2. Popular = network effects

I’m always interested in early sentiment on a super stock.

Here’s a good summary of the RMV sentiment around its IPO:

- Expensive price

- Good brand name

- Popular biz

2 things analysts got wrong:

1. RMV wasn't expensive

2. Popular = network effects

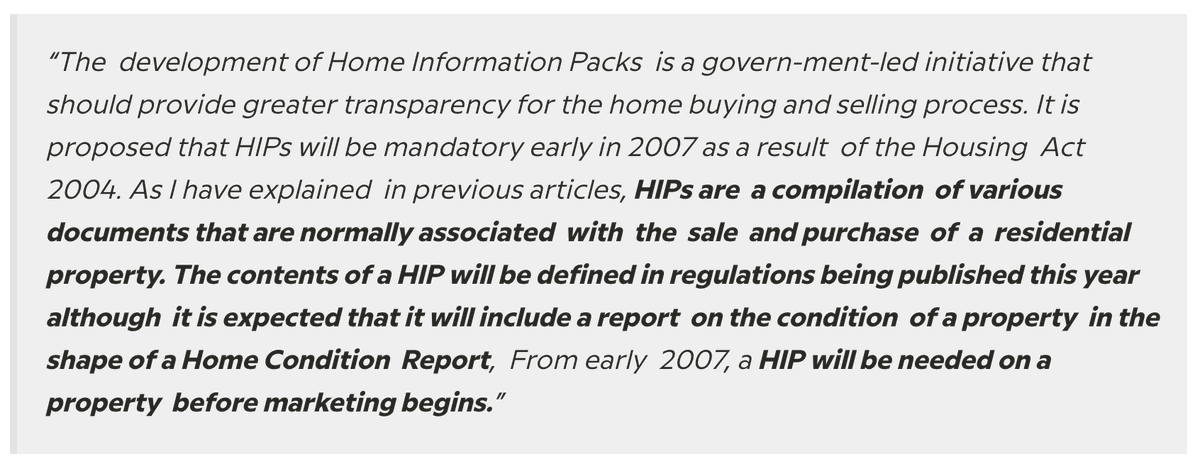

7/ First Mover Advantage

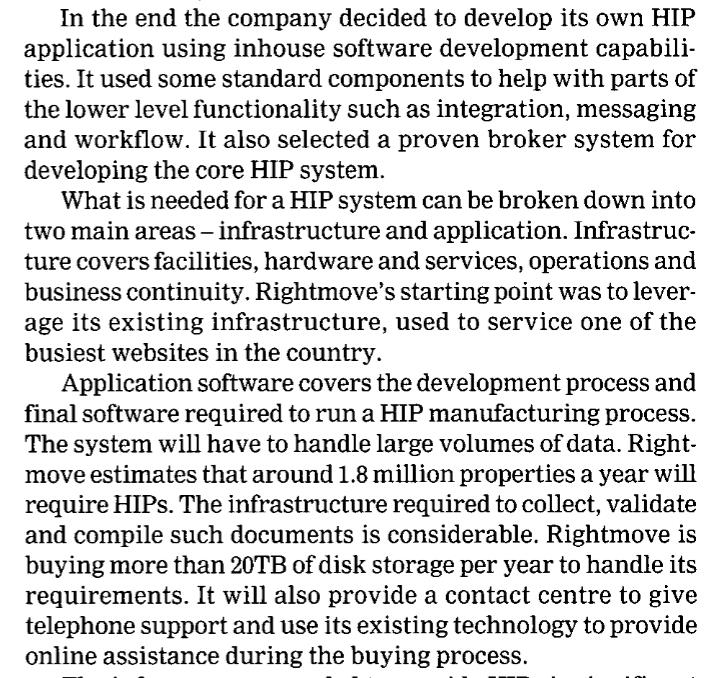

RMV moved first during the UK’s Home Information Packs (HIPs) legislation.

They made an in-house HIP portal so customers could store HIP-mandated documents on the RMV website.

Second, RMV funded the HIP for customers until the house sold.

RMV moved first during the UK’s Home Information Packs (HIPs) legislation.

They made an in-house HIP portal so customers could store HIP-mandated documents on the RMV website.

Second, RMV funded the HIP for customers until the house sold.

8/ HIP Ramifications

RMV’s moves on the HIP news set the standard for competitors. They established a “rule of law” for the RE listing industry.

It cost RMV $8.5M to make in-house HIP tech.

They could’ve outsourced, but it would’ve reduced customer experience.

RMV’s moves on the HIP news set the standard for competitors. They established a “rule of law” for the RE listing industry.

It cost RMV $8.5M to make in-house HIP tech.

They could’ve outsourced, but it would’ve reduced customer experience.

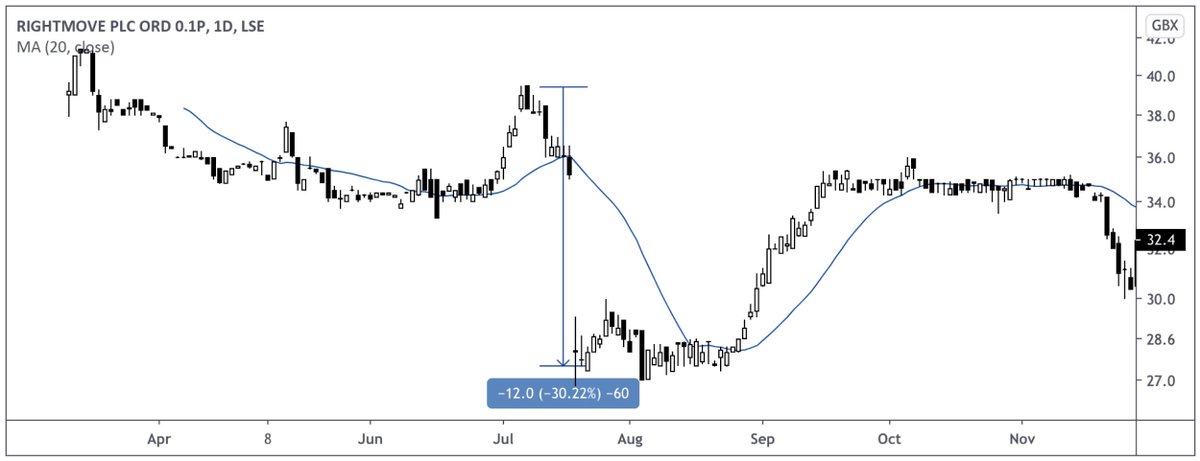

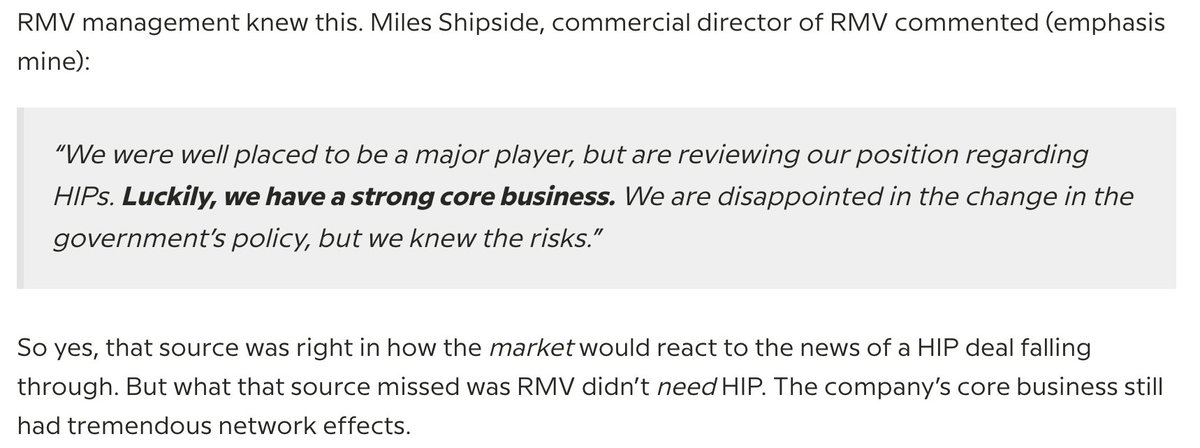

9/ Rely on Core Business, Not Catalysts

The UK govt halted HIP program. RMV’s $8.5M investment was worthless.

The stock dropped 20% on the news and down 30% that week.

Yet the core biz was growing 60% w/ expanding operating margins.

Terminally, it's core biz that matters

The UK govt halted HIP program. RMV’s $8.5M investment was worthless.

The stock dropped 20% on the news and down 30% that week.

Yet the core biz was growing 60% w/ expanding operating margins.

Terminally, it's core biz that matters

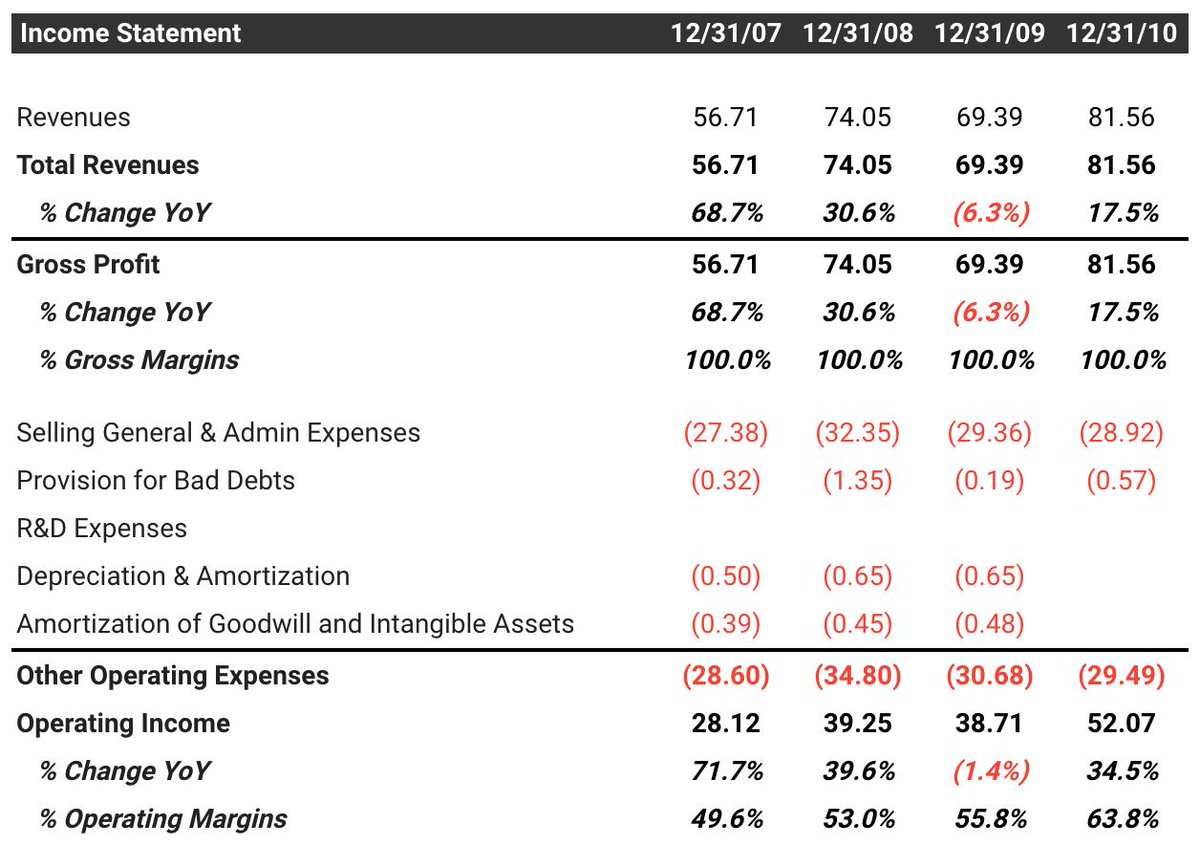

10/ The Housing Crisis

08-09 was a bad time for housing.

Without looking at financials, you’d expect RMV to post lower revs, profits & margins.

That wasn’t the case. Revs shrunk 6% in ‘09 while op. margins expanded to 56%. How?

- 100% GM

- Scalable SG&A

- No debt & low D&A

08-09 was a bad time for housing.

Without looking at financials, you’d expect RMV to post lower revs, profits & margins.

That wasn’t the case. Revs shrunk 6% in ‘09 while op. margins expanded to 56%. How?

- 100% GM

- Scalable SG&A

- No debt & low D&A

11/ Share Price =/ Biz Value

Knowing the above, we’d expect a slight (if any) decrease in RMV’s stock price.

But what we got was a 75% peak-t0-trough drawdown from 07-09.

While the stock crashed, the biz grew rev $13M, OI $10M, and expanded margins 800bps

EfFiCiEnT mArKeTs?

Knowing the above, we’d expect a slight (if any) decrease in RMV’s stock price.

But what we got was a 75% peak-t0-trough drawdown from 07-09.

While the stock crashed, the biz grew rev $13M, OI $10M, and expanded margins 800bps

EfFiCiEnT mArKeTs?

12/ Potential Screens To Find RMV

Here’s a stock screener that would’ve picked up RMV during 2004-2005:

- Revenue Growth YoY: 25% or Greater

- Operating Margin: 20% or Greater

- Current Ratio: 1.5x or Greater

- Market Capitalization: $1B or Less

Get to hunting for RMVs!

Here’s a stock screener that would’ve picked up RMV during 2004-2005:

- Revenue Growth YoY: 25% or Greater

- Operating Margin: 20% or Greater

- Current Ratio: 1.5x or Greater

- Market Capitalization: $1B or Less

Get to hunting for RMVs!

13/ Reviewing The Thesis

Like most Super Stocks, the bull case rested on a few variables:

- Expand users & RE agents on the platform

- Incentivize home developers to list on the platform

- Maintain low SG&A expenses

Thesis was simple and biz model powerful. RMV was a monster!

Like most Super Stocks, the bull case rested on a few variables:

- Expand users & RE agents on the platform

- Incentivize home developers to list on the platform

- Maintain low SG&A expenses

Thesis was simple and biz model powerful. RMV was a monster!

• • •

Missing some Tweet in this thread? You can try to

force a refresh