Thread on how easy it is to get tricked into haemorrhaging money from your bank account after an online purchase – and why financial regulators seem to be behind the curve on this.🧵💸💻

Forgive the personal story, but I think it's relevant...1/

Forgive the personal story, but I think it's relevant...1/

I’m pretty careful with my money online - regularly checking my pension, combing my online bank statement for suspicious transactions, pruning unwanted subscriptions etc...2/

I’d describe this as financial hygiene – and would advise everyone to do it.

Yet it’s not always enough.

While looking through a list of transactions on my online account before Xmas I noticed a £15 payment to something called "WLY*COMPLETESAVE.CO.UK" ...3/

Yet it’s not always enough.

While looking through a list of transactions on my online account before Xmas I noticed a £15 payment to something called "WLY*COMPLETESAVE.CO.UK" ...3/

By chance I knew for certain I’d not bought anything on that particular day, so I investigated further.

I downloaded my entire statement for the year and discovered I’d made a payment to this entity for the

same amount every month for 14 months, so £210 in total...4/

I downloaded my entire statement for the year and discovered I’d made a payment to this entity for the

same amount every month for 14 months, so £210 in total...4/

I did an online search & found a club called Complete Savings (@completesave), that offers cashback on online purchases in return for £15 a month membership fees.

This is not, to put it mildly, the kind of scheme I would ever knowingly sign up to....5/

This is not, to put it mildly, the kind of scheme I would ever knowingly sign up to....5/

I phoned the company and they told me that I’d “joined” when I’d booked some rail tickets on the Trainline website @thetrainline in November 2019.

I’d zero recollection of doing so....6/

I’d zero recollection of doing so....6/

It turns out that this is a long-running ruse by Complete Savings and its parent company Webloyalty @WebloyaltyUK

See here:

theguardian.com/money/2020/jan…

And here which.co.uk/news/2017/10/b…: 7/

See here:

theguardian.com/money/2020/jan…

And here which.co.uk/news/2017/10/b…: 7/

The headline offer on a retailer’s website is for the opportunity to get cash back after an online transaction, but the monthly charge and the indefinite club membership is in the small print...8/

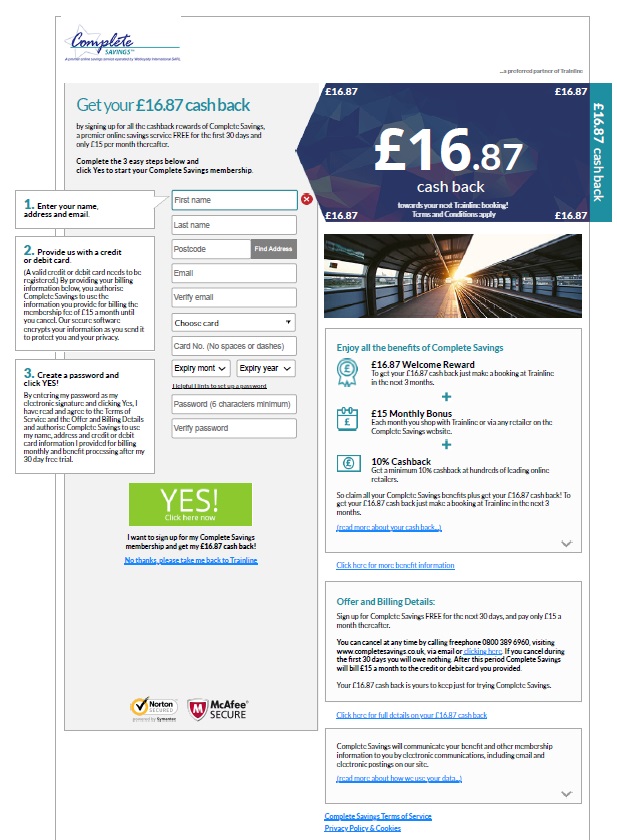

Here’s the form Complete Savings's complaints department sent to me, saying I must have filled it in, so judge for yourself whether what's going on is adequately signposted (bearing in mind that you’re funneled to it via the secure payment zone of another firm's website)...9?

It’s all legal.

But is it ethical?

And should well-known retailers like Trainline be partnering with an organisation like this?...10/

But is it ethical?

And should well-known retailers like Trainline be partnering with an organisation like this?...10/

Bear in mind Webloyalty’s own US parent company, Affinion, paid $30m to numerous American states in 2013 to settle a probe into its sales and billing practices...11/

wsj.com/articles/SB100…

wsj.com/articles/SB100…

Bear in mind too that in 2009 a number of UK retailers such as B&Q and Asda severed partnerships with Webloyalty after complaints from customers that were similar to mine (they never thought they were signing up to an expensive monthly club)...12/

independent.co.uk/news/business/…

independent.co.uk/news/business/…

After successfully securing a commitment from Webloyalty to refund all my money, I contacted Trainline to tell them what happened and ask whether they too would sever ties with this company and stop it using their website to pick up new unwitting “members”...13/

There are, I was told, no plans to do review the partnership.

Readers can draw their own conclusions about whether Trainline is a safe space online....14/

Readers can draw their own conclusions about whether Trainline is a safe space online....14/

Complete Savings refused to tell me which other online retailers it has partnerships with, but the many furious reviews of the service on Trustpilot suggests major companies such as Morrisons and WHSmith...15/

uk.trustpilot.com/review/www.com…

uk.trustpilot.com/review/complet…

uk.trustpilot.com/review/www.com…

uk.trustpilot.com/review/complet…

Are there any larger lessons here?

I believe there are.

Why, despite my keeping a regular eye on my online account, didn’t I spot the payments on my bank statement sooner?...16/

I believe there are.

Why, despite my keeping a regular eye on my online account, didn’t I spot the payments on my bank statement sooner?...16/

The answer is that there’s been an explosion of relatively small contactless transactions on my account this year due to the retreat from cash by retailers during the pandemic.

Identifying a relatively small outgoing nowadays is much harder in the morass of payments data...17/

Identifying a relatively small outgoing nowadays is much harder in the morass of payments data...17/

If contactless is the future, as seems probable, this threatens to make it harder for people to be alert to unexpected withdrawals....18/

Also - and very importantly - an increasing number of firms take regular payments from accounts not through direct debits or standing orders but through “continuous payment authorities”...19/

moneysavingexpert.com/banking/recurr…

moneysavingexpert.com/banking/recurr…

These are NOT listed alongside a customer's ordinary direct debits and standing orders by their banks making them much harder for even an assiduous statement reader (like me) to monitor...20/

This is a vulnerability that, it seems to me, financial regulators need to be alive to.

But who regulates Complete Savings/Webloyalty/Affinion? 21/

But who regulates Complete Savings/Webloyalty/Affinion? 21/

Not the Financial Conduct Authority @TheFCA , which told me :

"Subscription/cashback services for retailers would fall outside our remit and this means that our rules don’t apply to these firms and their business falls outside our jurisdiction"...22/

"Subscription/cashback services for retailers would fall outside our remit and this means that our rules don’t apply to these firms and their business falls outside our jurisdiction"...22/

So I imagine many of you will be breaking out the world’s smallest violin at this point.🎻

Perhaps you think if I did not immediately notice £15 leaving my account each month I’m well-off enough not to have anything useful to say to people who are financially struggling...23/

Perhaps you think if I did not immediately notice £15 leaving my account each month I’m well-off enough not to have anything useful to say to people who are financially struggling...23/

And I’ll happily take all that on the chin.

But I honestly don’t think it’s unreasonable to conclude that if it can happen to me it can happen to anyone....24/

But I honestly don’t think it’s unreasonable to conclude that if it can happen to me it can happen to anyone....24/

And if you’re still murmuring “caveat emptor” to yourself, just imagine your granny venturing online to buy train tickets or do some online shopping in a world populated by companies like Webloyalty.

More here for @IndyVoices:

independent.co.uk/voices/interne…

ENDS/

More here for @IndyVoices:

independent.co.uk/voices/interne…

ENDS/

• • •

Missing some Tweet in this thread? You can try to

force a refresh