By far, one of the most interesting Ethereum addresses I've seen is @0x_b1.

It's quite an interesting social experiment as well - a $300m whale starting a Twitter account for fun. Check their bio.

Let's break down the address and see what they are doing with their capital. 👇

It's quite an interesting social experiment as well - a $300m whale starting a Twitter account for fun. Check their bio.

Let's break down the address and see what they are doing with their capital. 👇

0xb1 was created in mid-August, amid the food farming craze.

The address is active every day of the week and consistently makes transactions between 12:00 UTC and 6:00 UTC (sleeps between 7-11).

Likely U.S. based individual or team based on this history.

h/t @nansen_ai

The address is active every day of the week and consistently makes transactions between 12:00 UTC and 6:00 UTC (sleeps between 7-11).

Likely U.S. based individual or team based on this history.

h/t @nansen_ai

0xb1 is a yield farming beast, to say the least.

It's industrial farming at its best - hundreds of transactions, swapping in and out of the latest yield farms on Ethereum.

Fun fact: the address has spent $111,000 in ether on transaction fees since its inception. Ow.

It's industrial farming at its best - hundreds of transactions, swapping in and out of the latest yield farms on Ethereum.

Fun fact: the address has spent $111,000 in ether on transaction fees since its inception. Ow.

According to @DeBankDeFi, the address has a current net worth of $280 million, with $381 million in assets or staked assets and $101 million in debt.

Not too sure if this is 100% accurate, as there may be some new farms that it may not capture or represent properly.

Not too sure if this is 100% accurate, as there may be some new farms that it may not capture or represent properly.

99% of this capital is active in yield farms.

Out of the ~$280 million, only ~$250k is naked.

The address has $150 million worth of ETH and WBTC collateral deposited in Compound, which is being used to borrow $80 million worth of stablecoins.

C-ratio scares me a bit.

Out of the ~$280 million, only ~$250k is naked.

The address has $150 million worth of ETH and WBTC collateral deposited in Compound, which is being used to borrow $80 million worth of stablecoins.

C-ratio scares me a bit.

An additional $38 million is supplied to Aave, most of which is in Chainlink.

Borrowing Ethereum, MANA (for DG farming), SNX, and a few other tokens.

Health factor of 1.34...

December's LINK wick ($12 -> $8) could put this at risk.

Borrowing Ethereum, MANA (for DG farming), SNX, and a few other tokens.

Health factor of 1.34...

December's LINK wick ($12 -> $8) could put this at risk.

The address also has $4m deposited in Aave v2 (health factor of 1.35) and $1.6m in Cream (500% c-ratio).

One interesting bit about 0xb1's Cream balance is the use of ESD as collateral.

Cool to see that new collateral type being used.

One interesting bit about 0xb1's Cream balance is the use of ESD as collateral.

Cool to see that new collateral type being used.

Now, where are all these borrowed assets being put to work?

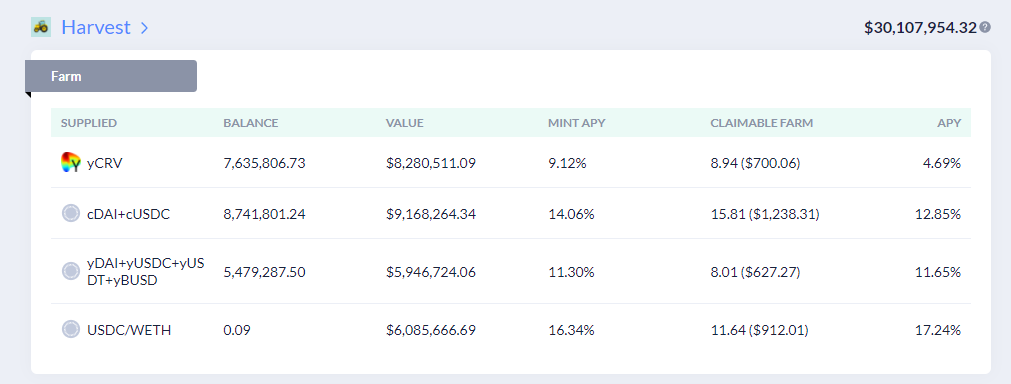

A large portion is in BadgerDAO ($47 million) and Harvest ($30 million).

This address appears to be long BADGER, with $400,000 in BADGER staked, and $1m in BADGER Uniswap LP pools.

A large portion is in BadgerDAO ($47 million) and Harvest ($30 million).

This address appears to be long BADGER, with $400,000 in BADGER staked, and $1m in BADGER Uniswap LP pools.

0xb1 has $26m in ETH deposited in @AlphaFinanceLab's no-IL ibETH pool. Making a cool $2.6m at current interest levels.

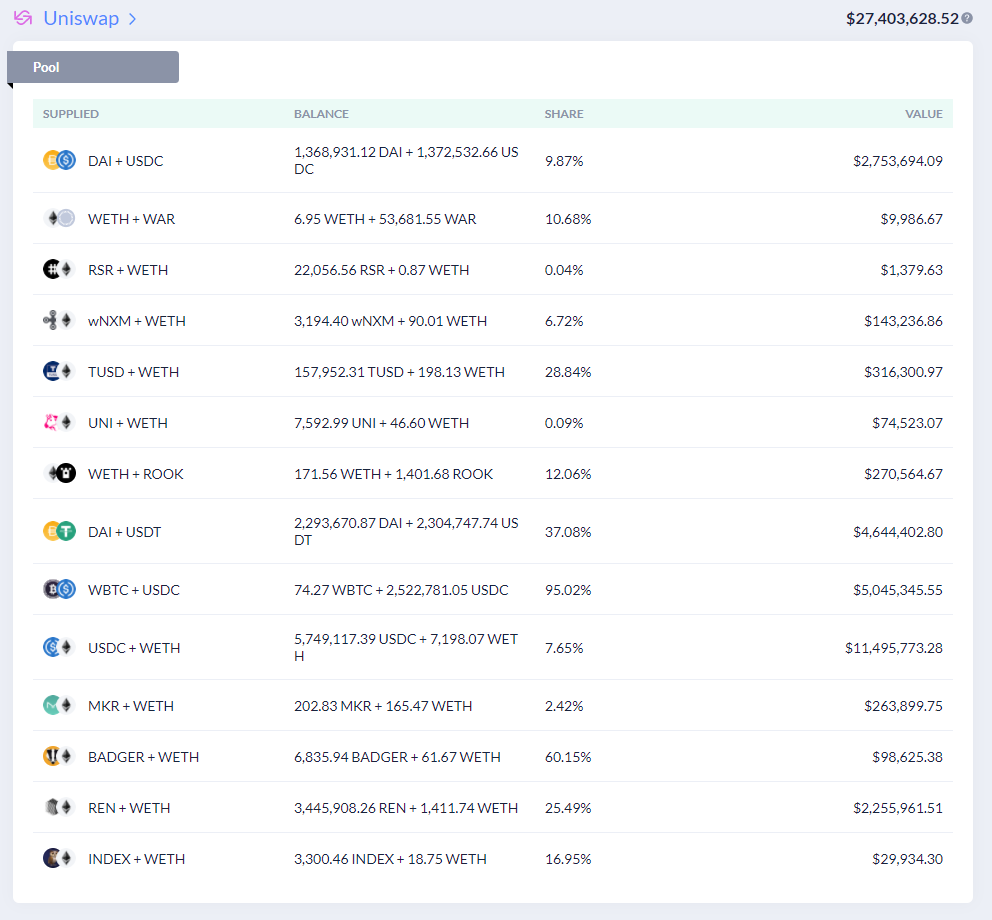

Another $27.5m in Uniswap, mostly in USDC-ETH.

Also $10 million in SushiSwap's Onsen program.

Another $27.5m in Uniswap, mostly in USDC-ETH.

Also $10 million in SushiSwap's Onsen program.

The Alpha Chef is also pretty big on Empty Set Dollar and Dynamic Set Dollar.

$2.7 million in ESD-USDC LP and $550k in the DAO.

$500k in DSD-USDC LP.

No coupons as far as I can tell.

$2.7 million in ESD-USDC LP and $550k in the DAO.

$500k in DSD-USDC LP.

No coupons as far as I can tell.

0xb1 has had a few mishaps.

The address holds 3,908,343 GRAIN—the claim token for the @harvest_finance attack. This can be sold for $260,000 assuming no Uniswap slippage.

This means the address lost $3.9 million in the Harvest attack, just over 10% of the total stolen amount.

The address holds 3,908,343 GRAIN—the claim token for the @harvest_finance attack. This can be sold for $260,000 assuming no Uniswap slippage.

This means the address lost $3.9 million in the Harvest attack, just over 10% of the total stolen amount.

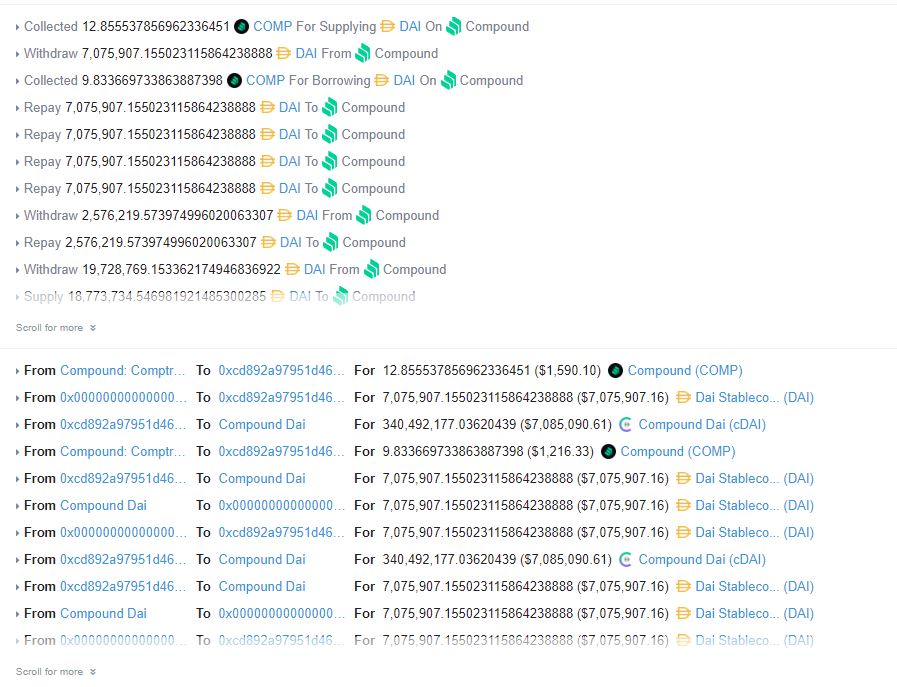

Another mishap was the Compound DAI liquidation event in November.

DAI/USDC spiked to 1.3 late November, causing the oracle to print an extremely high price, liquidating Compound DAI borrowers.

I think the address lost $1.4 million in the liquidation of its position.

DAI/USDC spiked to 1.3 late November, causing the oracle to print an extremely high price, liquidating Compound DAI borrowers.

I think the address lost $1.4 million in the liquidation of its position.

To be fair, this doesn't seem to be a massive concern for 0xb1.

The address earns somewhere in the range of ~$200,000-400,000 each day in yield.

The address earns somewhere in the range of ~$200,000-400,000 each day in yield.

What's most interesting IMO is 0xb1 is becoming an activist investor—or at least an activist farmer.

I'm keeping an eye on @0x_b1. Such a fascinating address - cool that they have a Twitter account as well.

I'm keeping an eye on @0x_b1. Such a fascinating address - cool that they have a Twitter account as well.

https://twitter.com/0x_b1/status/1343934926983483393

Missed a few farms - will add them now:

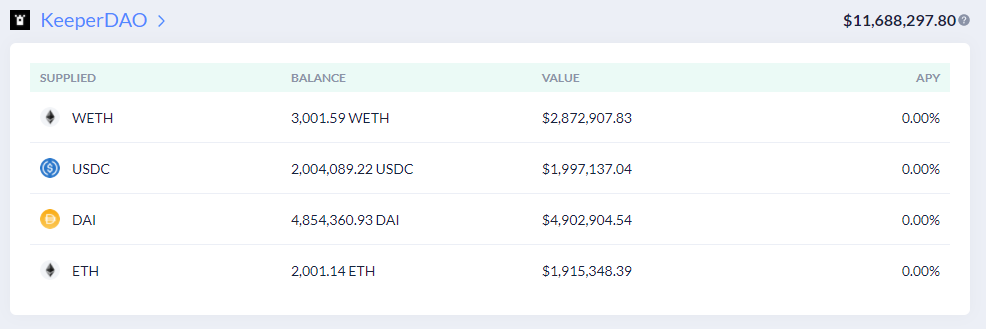

$11.68m in KeeperDAO. 0xb1 appears to be fundamentally bullish on ROOK.

$7.1 million worth of liquidity provided to DODO. Mostly USDC provided, some YFI, WBTC, and ETH.

$11.68m in KeeperDAO. 0xb1 appears to be fundamentally bullish on ROOK.

$7.1 million worth of liquidity provided to DODO. Mostly USDC provided, some YFI, WBTC, and ETH.

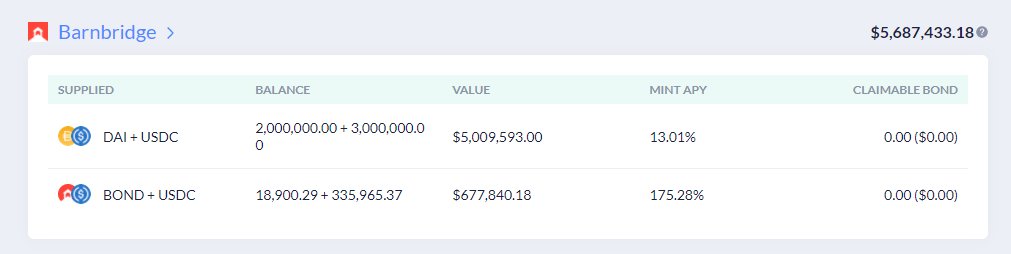

$5.6 million in BarnBridge. Largely skewed toward the stablecoin Pool 1 as opposed to the Uniswap LP Pool 2.

$10 million in Mithril Cash. No pool 2

$10 million in Mithril Cash. No pool 2

A few million worth of liquidity in @YFLinkio.

300 $SFI in the epoch 3 rSFI pool. They have yet to claim their funds.

300 $SFI in the epoch 3 rSFI pool. They have yet to claim their funds.

• • •

Missing some Tweet in this thread? You can try to

force a refresh