1/

Part 2

Zimbabwe Remittances

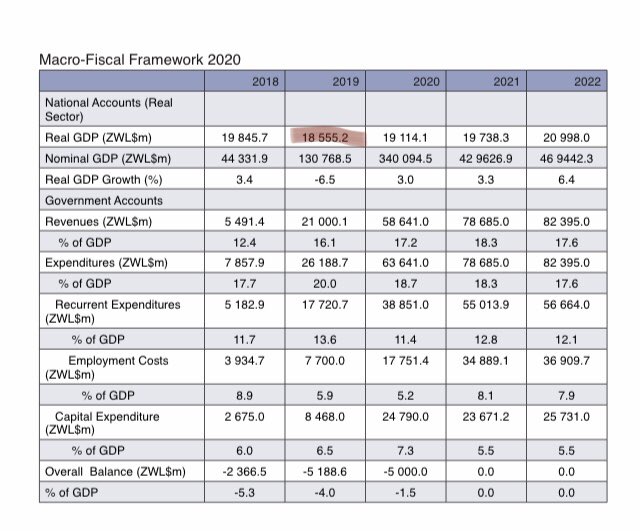

According to the World Bank/IMF data remittances into Zim averaged US$1.8bn annually over the last decade. This translates to between 10-14% of GDP.

Remittances over the decade were equivalent (on average)to 60% of GOZ tax revenues (US$3bn).

Part 2

Zimbabwe Remittances

According to the World Bank/IMF data remittances into Zim averaged US$1.8bn annually over the last decade. This translates to between 10-14% of GDP.

Remittances over the decade were equivalent (on average)to 60% of GOZ tax revenues (US$3bn).

2/

Over the same period FDI was US$400m p.a

Humanitarian aid was US$500m p.a

Total bank deposits during Dollarisation were US$4bn. Private sector credit was US$3.8bn.

The absolute annual remittances of US$1.8bn & as a % of GDP show how pivotal & influential a variable it is.

Over the same period FDI was US$400m p.a

Humanitarian aid was US$500m p.a

Total bank deposits during Dollarisation were US$4bn. Private sector credit was US$3.8bn.

The absolute annual remittances of US$1.8bn & as a % of GDP show how pivotal & influential a variable it is.

3/

The US$1.8bn is unencumbered when it enters Zim. By unencumbered, it means free money without any requisite strings attached to it. For example Zim exports US$5bn, of which 80% is cost& expenses. 20% profit is unencumbered.

The US$1.8bn is unencumbered when it enters Zim. By unencumbered, it means free money without any requisite strings attached to it. For example Zim exports US$5bn, of which 80% is cost& expenses. 20% profit is unencumbered.

4/

The WB defines remittances as formal & informal cash transfers plus goods coming from abroad into country.

US$1.8bn doesn’t include goods. A cursory study attests to goods movement from Botswana & SA into Zim funded by the diaspora.

It also doesn’t include diaspora tourism

The WB defines remittances as formal & informal cash transfers plus goods coming from abroad into country.

US$1.8bn doesn’t include goods. A cursory study attests to goods movement from Botswana & SA into Zim funded by the diaspora.

It also doesn’t include diaspora tourism

5/

Remittances significantly supplement & anchor consumption. Zim is a household consumption led economy. Remittances play three roles;

(1) As welfare cash/goods stipend as one sees in more developed nations.

(2) As supplementary income

(3) As a source for investment and savings

Remittances significantly supplement & anchor consumption. Zim is a household consumption led economy. Remittances play three roles;

(1) As welfare cash/goods stipend as one sees in more developed nations.

(2) As supplementary income

(3) As a source for investment and savings

6/

A definition of a welfare state is by Susser, “a state committed to providing its people with a wide range of social services – health care, unemployment insurance, social security, old age benefits”.

In Zim the state is incapacitated, the burden falls on diaspora.

A definition of a welfare state is by Susser, “a state committed to providing its people with a wide range of social services – health care, unemployment insurance, social security, old age benefits”.

In Zim the state is incapacitated, the burden falls on diaspora.

7/

In SA the state provides social services to 17m people ranging from 300-1000ZAR in support.

60-80% of Zim remittances seem to be of such “altruistic” nature as welfare stipend. By sending goods & cash worth US$50, millions of poor households survive

In SA the state provides social services to 17m people ranging from 300-1000ZAR in support.

60-80% of Zim remittances seem to be of such “altruistic” nature as welfare stipend. By sending goods & cash worth US$50, millions of poor households survive

8/

A lot of Zim academia has focused on the impact of remittances on the poor & vulnerable households.

One such study by Maziva (2012)et al in Tshloloshlo is instructive. 75% of the households have someone in the SA sending money. 72% claim the money is NOT excess to necessity.

A lot of Zim academia has focused on the impact of remittances on the poor & vulnerable households.

One such study by Maziva (2012)et al in Tshloloshlo is instructive. 75% of the households have someone in the SA sending money. 72% claim the money is NOT excess to necessity.

9/ Bracking & Sachikonye (2007) believed that 50% of Zimbabweans receive some for assistance from the diaspora. Most of which was supporting the basic welfare needs of families back home. This includes, groceries, medicine, school fees, clothing.

10/

Another study Dzingirayi et al (2015) looked at migration patterns in Hurungwe, Chivi & Gwanda. These are small scale agriculture & artisanal mining hinterlands.

Local economic circumstances play a major role in migration plus what is curiously termed “rite of passage”.

Another study Dzingirayi et al (2015) looked at migration patterns in Hurungwe, Chivi & Gwanda. These are small scale agriculture & artisanal mining hinterlands.

Local economic circumstances play a major role in migration plus what is curiously termed “rite of passage”.

11/

Dendere (2018)focuses on the impact of remittances on local politics. As the economy worsens many migrate & inturn provide a welfare to those that remain. In her conclusion, that is how Zanu PF survives. While the general economy plummets, family welfare is not as desperate.

Dendere (2018)focuses on the impact of remittances on local politics. As the economy worsens many migrate & inturn provide a welfare to those that remain. In her conclusion, that is how Zanu PF survives. While the general economy plummets, family welfare is not as desperate.

12/

It is instructive that humanitarian aid is now significantly dwarfed as the Diaspora provides the last line of defense, even in formal channels towards poverty reduction. What would happen if these remittances stop? International aid has become woefully insufficient.

It is instructive that humanitarian aid is now significantly dwarfed as the Diaspora provides the last line of defense, even in formal channels towards poverty reduction. What would happen if these remittances stop? International aid has become woefully insufficient.

13/

Therein lies the threat. Remittances anchor Zim livelihoods & in this decade (2021-2030) will see them rise above GOZ tax revenues. In 2019 tax revenue was US$2.5bn & US$2bn in 2020. This means production continues to decline & economy becomes purely reliant on diaspora

Therein lies the threat. Remittances anchor Zim livelihoods & in this decade (2021-2030) will see them rise above GOZ tax revenues. In 2019 tax revenue was US$2.5bn & US$2bn in 2020. This means production continues to decline & economy becomes purely reliant on diaspora

14/

If local production is dwindling ( that’s what negative growth means), Remittances move away from cash to goods & worse the cash goes back abroad to buy basic food. Presently most households buy groceries downtown mostly imported products in USD.

If local production is dwindling ( that’s what negative growth means), Remittances move away from cash to goods & worse the cash goes back abroad to buy basic food. Presently most households buy groceries downtown mostly imported products in USD.

15/

As local economic policies favour agriculture & mining, even though these sectors are low contributors to GDP there is a rise in remittances going back abroad in 2 ways;

(1) Buying cheaper imported product,

(2) Rich locals moving savings abroad through remittances barter

As local economic policies favour agriculture & mining, even though these sectors are low contributors to GDP there is a rise in remittances going back abroad in 2 ways;

(1) Buying cheaper imported product,

(2) Rich locals moving savings abroad through remittances barter

16/

There is evidence of this when one looks at countries with the highest remittances to GDP ratio. Haiti, Tonga, Nepal are poor countries with high remittances.

Production & productive people move abroad.

They send family welfare support which ends up buying cheaper imports

There is evidence of this when one looks at countries with the highest remittances to GDP ratio. Haiti, Tonga, Nepal are poor countries with high remittances.

Production & productive people move abroad.

They send family welfare support which ends up buying cheaper imports

17/

In Part 2, the goal was to build on the idea & evidence of Zim being a household consumption led economy (60%) & remittances being a critical anchor of this. Averaging unencumbered US$1.8bn annually over the last decade

In Part 2, the goal was to build on the idea & evidence of Zim being a household consumption led economy (60%) & remittances being a critical anchor of this. Averaging unencumbered US$1.8bn annually over the last decade

18/

Studies show 60-80% of Zim remittance as basic family welfare support.

Because of lopsided economic policy remittances in Zim end up abroad.

GOZ policies favour FDI & AID yet not much effort has been done for remittance policy. Albeit remittances dwarfing both.

Studies show 60-80% of Zim remittance as basic family welfare support.

Because of lopsided economic policy remittances in Zim end up abroad.

GOZ policies favour FDI & AID yet not much effort has been done for remittance policy. Albeit remittances dwarfing both.

• • •

Missing some Tweet in this thread? You can try to

force a refresh