Ok, looks like I need to explain this tweet...

https://twitter.com/RaoulGMI/status/1347316138062053376

Its just a thought but...

Let's say there is a $100bn of institutional money ready to come into BTC in the next 6 months and $XX bn retail.

Crypto is impossible to buy for some and hard(ish) for others.

Let's say there is a $100bn of institutional money ready to come into BTC in the next 6 months and $XX bn retail.

Crypto is impossible to buy for some and hard(ish) for others.

Then imagine an equity is launched that is worth $60bn on the grey market. If you are a fund manager, then why not just own Coinbase to get exposure? Easy.

No, it ain't bitcoin, but it will move sort of like it and you don't have to beg your investment committee or trustees.

No, it ain't bitcoin, but it will move sort of like it and you don't have to beg your investment committee or trustees.

Retail - well, they can now just buy on Schwab in 3 seconds.

BTC exposure without the pain of new accounts, fear over hacks and all the other FUD.

So, rational choice - buy Coinbase, regardless of whether good or bad as a company... Its BTC for Dummies.

BTC exposure without the pain of new accounts, fear over hacks and all the other FUD.

So, rational choice - buy Coinbase, regardless of whether good or bad as a company... Its BTC for Dummies.

Job done. Boxes ticked. Move on. Get rich. (well, last part might work or not)

Sadly, it soaks up $60bn of demand (or more) for BTC. Others who hate the bearer asset custody model will switch to rest their minds and also integrate into their prime brokerages or RIA accounts.

Sadly, it soaks up $60bn of demand (or more) for BTC. Others who hate the bearer asset custody model will switch to rest their minds and also integrate into their prime brokerages or RIA accounts.

That absorbs a lot of future demand. Maybe a few months worth and the institutional buying slows down... market corrects.

All perfectly normal and reasonable.

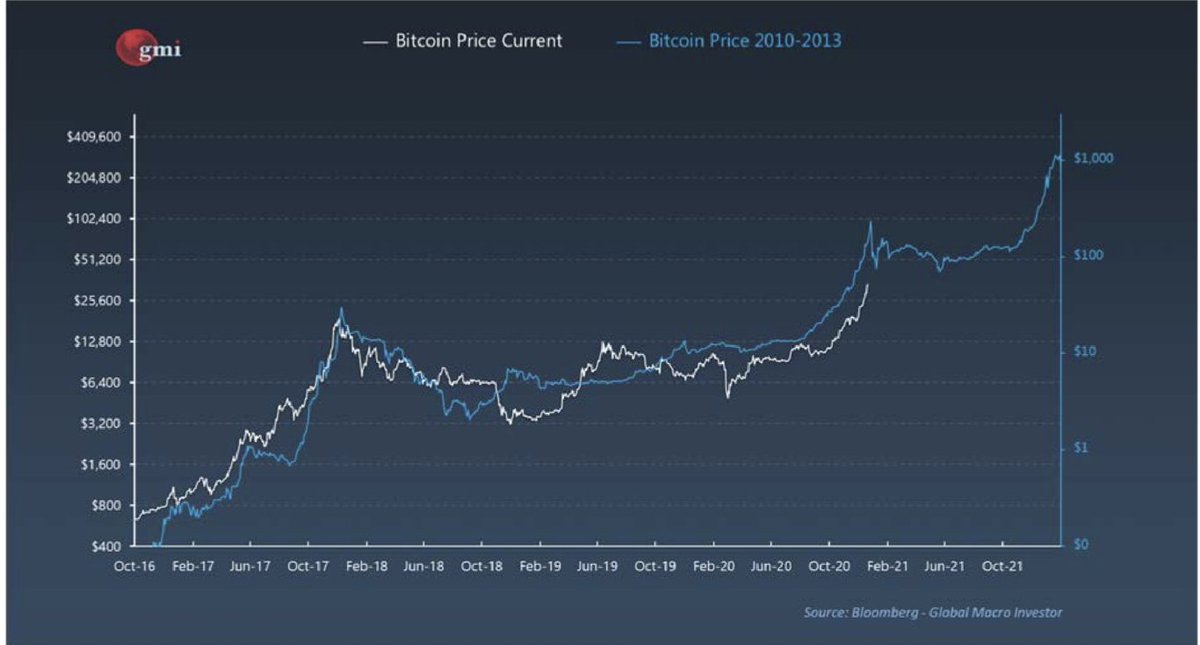

..Then it goes to the moon. See 2013 for details.

Who knows... but worth thinking about.

All perfectly normal and reasonable.

..Then it goes to the moon. See 2013 for details.

Who knows... but worth thinking about.

• • •

Missing some Tweet in this thread? You can try to

force a refresh