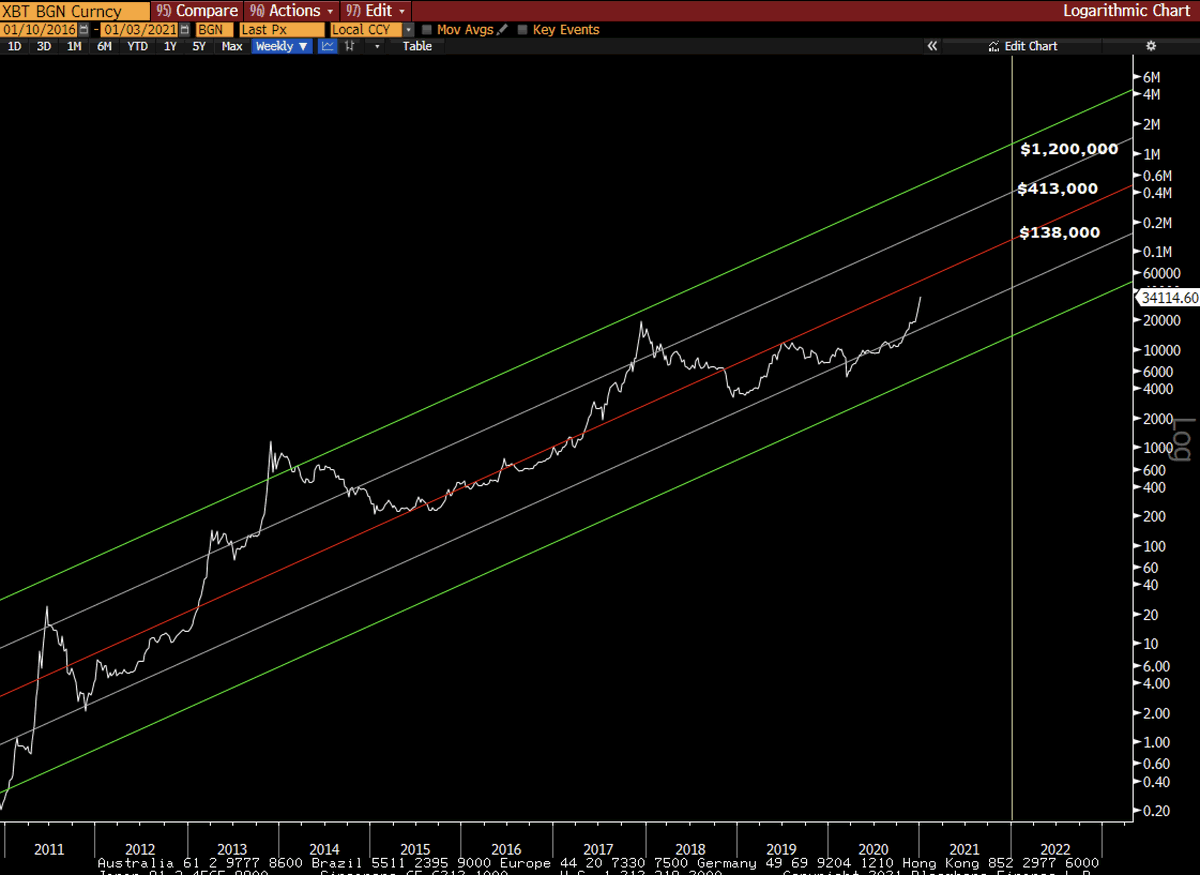

While everyone seems to celebrate every single new BTC high, let me remind you of where we are going...

Nothing is a Law of Nature but the log-regression trend since inception makes sense to me contextually.

I think the risk is people UNDERSHOOT in their price targets. 1/

Nothing is a Law of Nature but the log-regression trend since inception makes sense to me contextually.

I think the risk is people UNDERSHOOT in their price targets. 1/

The Halving runs tend to get between 1 and 2 standard deviations overbought versus trend, and it occurs usually around 18 months.

This would give a rough price target between $400k and $1.2m by end of 2021 (not an exact science, but context).

This would give a rough price target between $400k and $1.2m by end of 2021 (not an exact science, but context).

It also ALWAYS climbs a wall of fear - in 2017 it was forks (they threw me off the trend back then). This time it feels like regulation and Tether/stable coins will create the wall of fear that the market climbs, throwing weak hands off.

At every point people will tell you its insanity, it's due a correction, it's over bought, bad news is about to come out. And they are right.

But the Bitcoin Super Massive Black Hole don't care.

It is going from here to somewhere up there and how it gets there is irrelevant.

But the Bitcoin Super Massive Black Hole don't care.

It is going from here to somewhere up there and how it gets there is irrelevant.

But we can guess how long it takes to get there and that makes it HUGELY attractive as we have a decent probabilistic outcome from both price and time, its just path we don't know...

I still down own enough...but have no cash currently to buy more and don't want leverage.

I still down own enough...but have no cash currently to buy more and don't want leverage.

• • •

Missing some Tweet in this thread? You can try to

force a refresh